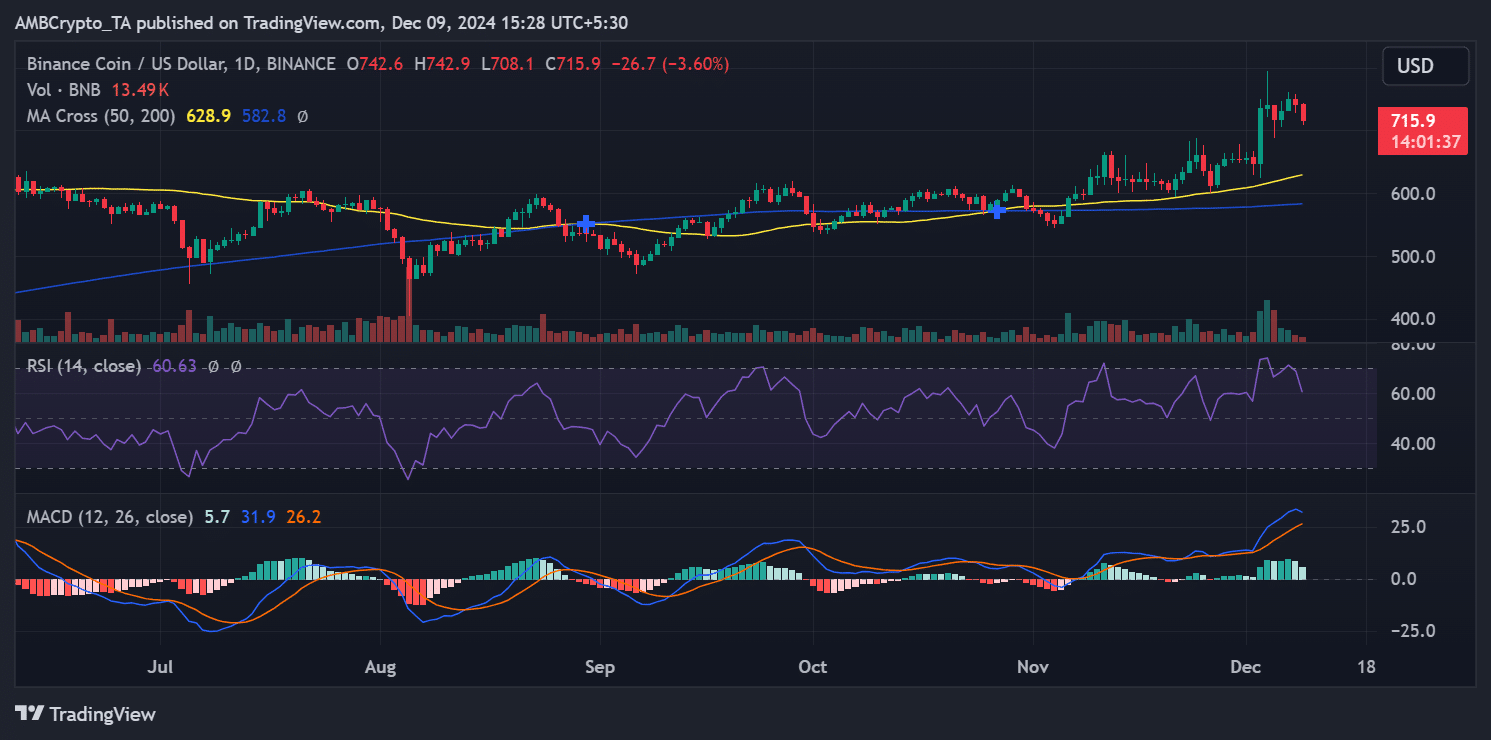

- BNB was trading around $715.9 at the time of press.

- Increased on-chain activity and social sentiment have strengthened the bullish outlook for BNB.

Binance Coin (BNB) It continues to see impressive growth, recently reaching an all-time high of $794.

This surge, driven by increased trading volume and stronger on-chain activity, reflects growing confidence in the ecosystem.

With strong technical indicators and optimistic social sentiment, BNB shows potential for further upward momentum despite minor consolidation risks.

BNB: Price and trading activity are increasing

BNBBinance’s native token, , has seen notable growth throughout 2024, with a series of upward trends towards the end of the year.

After hitting an all-time high just four days ago, the price hovered around $715.9 at press time. This rally has led to an increase in trading volume, which is a sign of increased investor interest. CryptoQuant.

The 30-day moving average of BNB trading volume has been steadily increasing since mid-2023, with values recently reaching historical highs.

This surge reflects continued enthusiasm and growing confidence in Binance and its ecosystem.

Technical indicators such as RSI of 60.63 suggest that the token is slightly overbought but has room for further growth. MACD remains strong, increasing optimism among traders.

Source: TradingView

On-chain volume and social sentiment

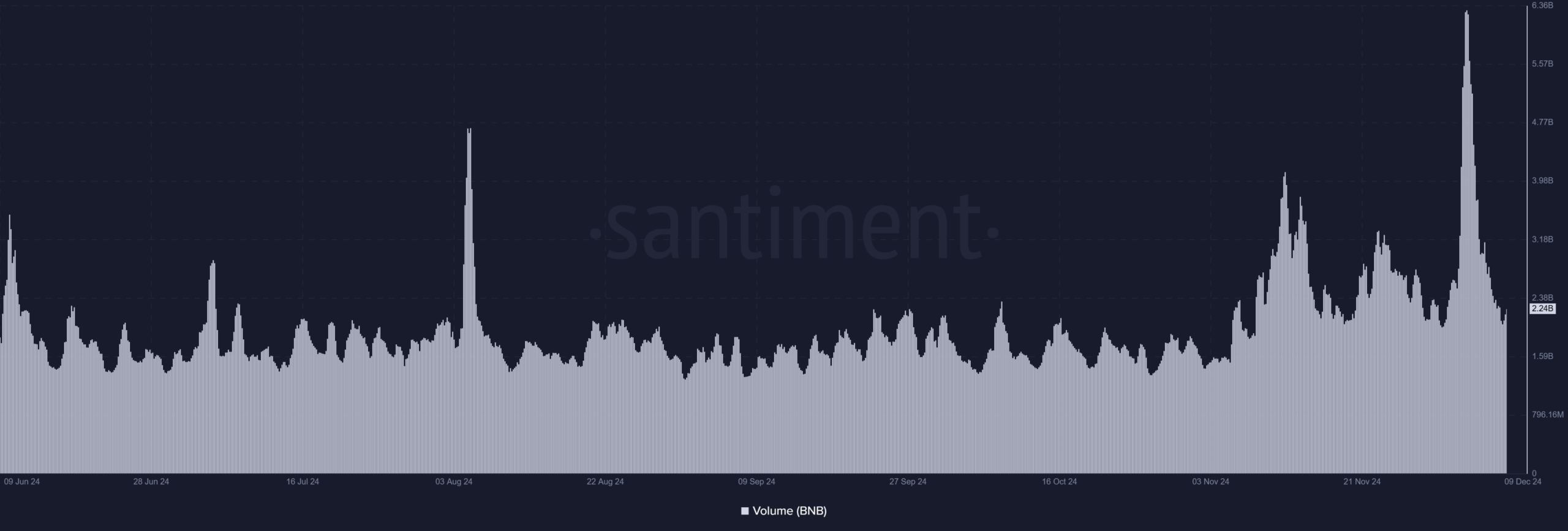

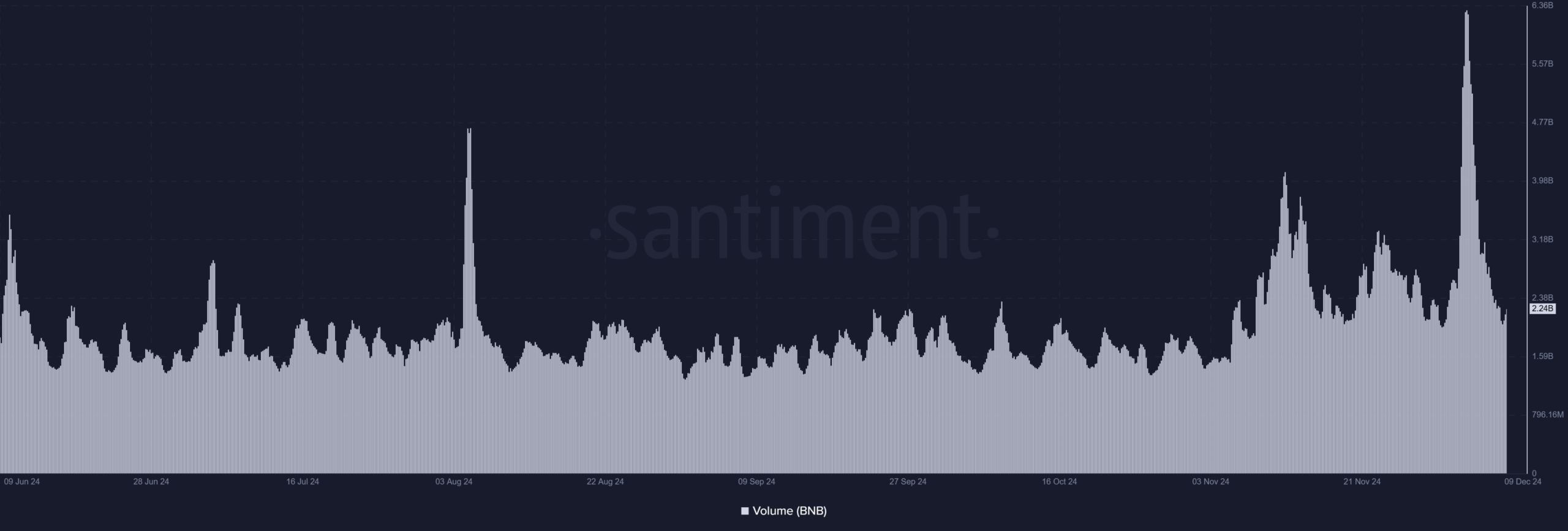

On-chain data shows a rapid increase. BNB Trading activity. Analysis shows that when the price surged to ATH, trading volume surged to over $6 billion.

The surge in trading volume signals a significant increase in activity across the Binance blockchain and is consistent with the broader market recovery and recent price gains. At the time of this writing, it was worth about $2.24 billion.

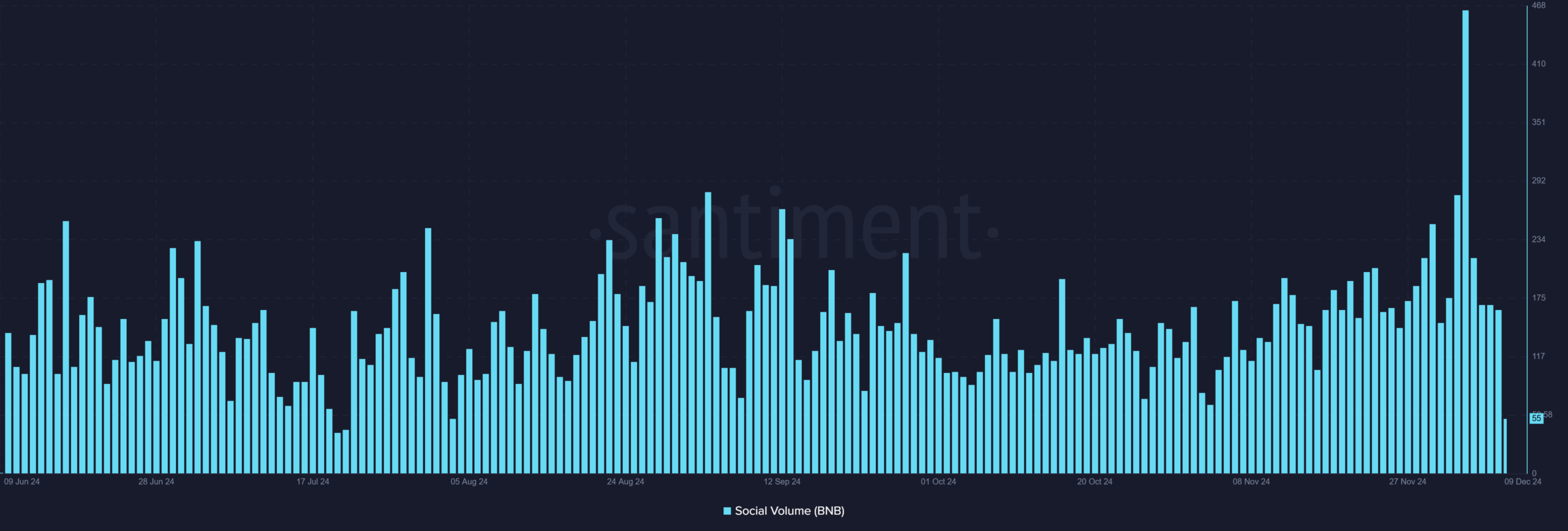

Source: Santiment

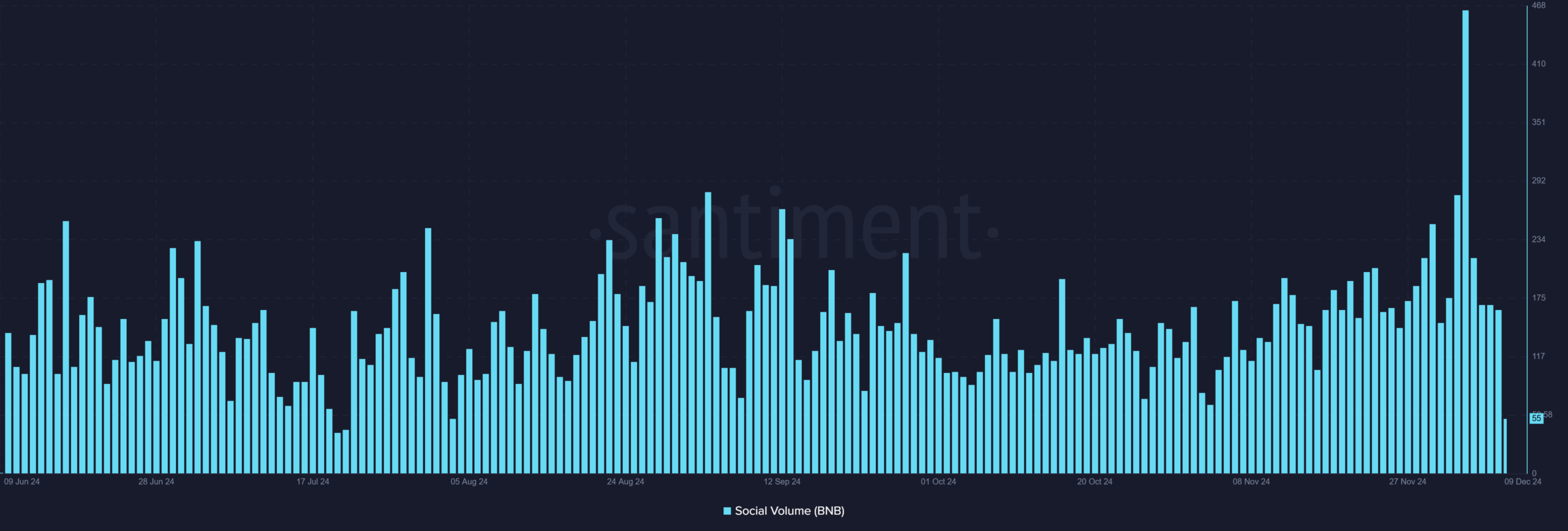

Additionally, AMBCrypto’s social sentiment analysis, as measured by Santiment, reflected growing interest in BNB. Social Volume soared to 465, the highest level of the year.

Historically, these surges in social engagement have preceded or coincided with major price movements, reinforcing BNB’s current bullish narrative.

Source: Santiment

What to Expect from Binance

that Binance Analysis of price and volume trends suggests that BNB’s current momentum indicates that its bullish trajectory is likely to continue.

A steadily increasing 30-day moving average of volume and a recent surge in on-chain activity suggest continued interest from traders and investors alike.

Historically, this trend has been a precursor to mass gatherings, especially when accompanied by strong social engagement.

However, BNB’s RSI remains near overbought territory at 60.63, indicating a possible near-term correction or consolidation phase.

This allows new investors to enter the market before another potential surge occurs.

MACD’s bullish crossover supports the possibility of further price upside if volume remains consistent.

Read Binance Coin (BNB) price prediction for 2024-2025

If current trading activity and sentiment continue, BNB could soon target new highs. Key levels to watch include resistance near $750 and support in the $680 range.

Breaking the resistance line could strengthen BNB’s upward momentum, while holding the support line signals strong market confidence.