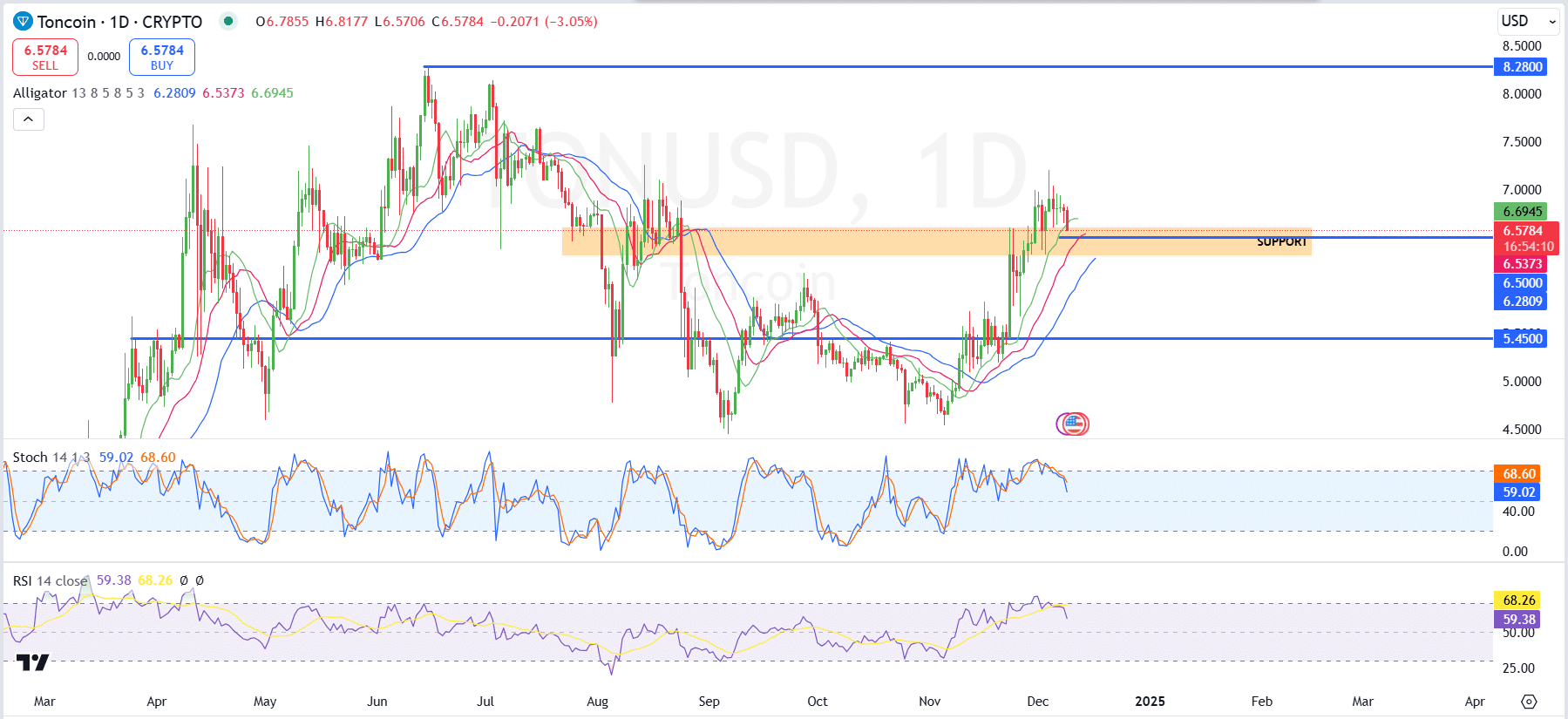

- Toncoin price prediction looks optimistic after retesting the $6.50 support level.

- Momentum is at risk as Toncoin network activity declines. New addresses decrease by 16.33%.

The cryptocurrency market had an explosive November. Toncoin (TON) surged 50% and turned $6.50 resistance into firm support. December was strong, with a 14% increase in the first week.

However, these gains were erased by a retracement to retest the support level.

Over the past seven days, TON has fallen 1.01%, trading within a daily range of $6.59 to $6.82. Will altcoins regain their bullish momentum, or is the market preparing for further consolidation?

Toncoin price prediction as 2025 approaches

Toncoin At press time, it was trading at $6.58 and has experienced a daily decline of 3.54%. The main support level is $6.50, an important level as it reversed from the previous resistance level and provided a basis for recovery.

The Alligator indicator showed consolidation, with the fast moving average flattening out near the current price.

Momentum indicators, including the Stochastic RSI at 59.02, indicate that there may be downward pressure. Meanwhile, the 14-day RSI is 59.38, reflecting weakening bearish momentum.

To continue its strength, TON needs to break above $7.2 and target $7.5, which is a key step towards revisiting its all-time high of $8.24.

Conversely, a violation below $6.50 could trigger a decline to $6.28 and deeper support at $5.45. These levels will be important to monitor as 2025 approaches.

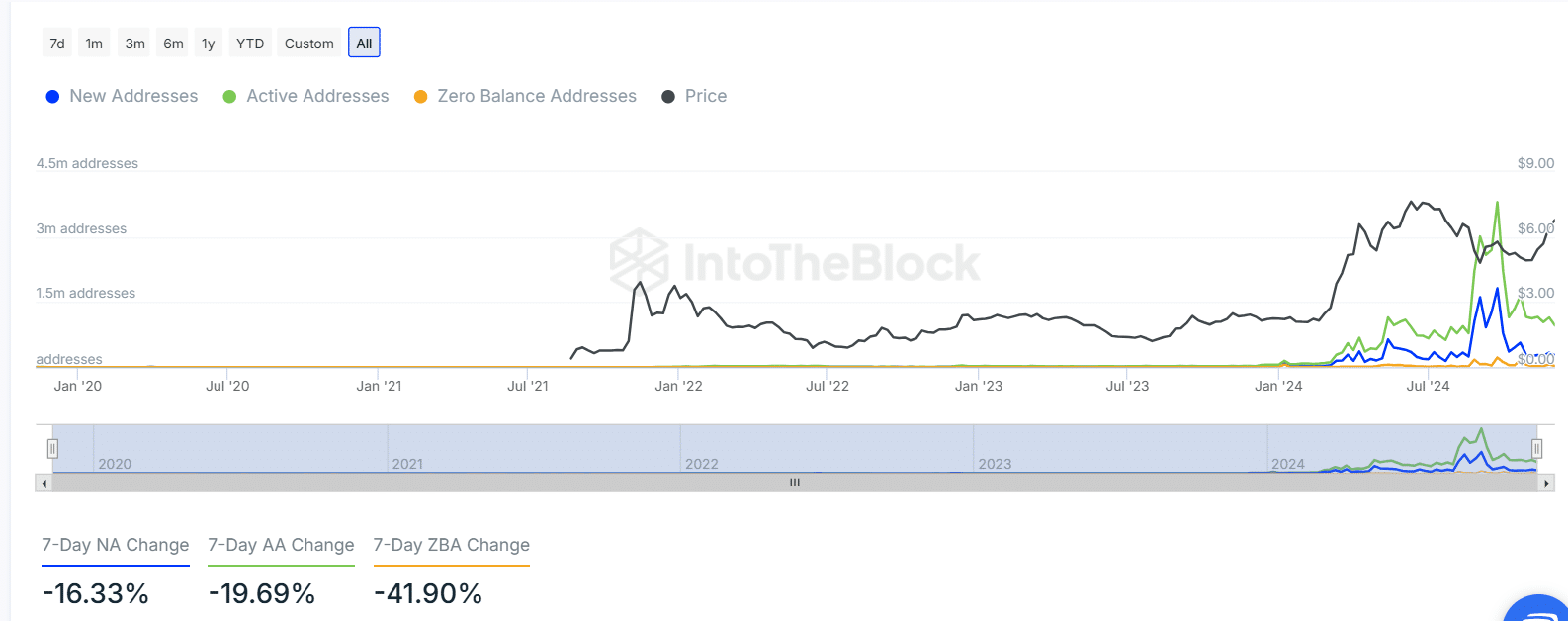

Network activity will fuel TON’s rebound

Network activity for ton New addresses decreased by 16.33% and active addresses decreased by 19.69%.

The decline in zero balance addresses (41.90% decline) highlighted the decline in participation across the blockchain. This activity is related to recent price consolidation and market sentiment.

Source: IntoTheBlock

Active addresses tend to follow price movements, highlighting the link between network participation and market trends.

The current decline in network activity is a sign of reduced interest, reflecting a broader market retracement. A renewed focus on network growth will be key to fueling a potential rebound.

To regain momentum, TON will need increased network activity along with supportive price action. Improved participation could foster new bullish momentum for the ecosystem.

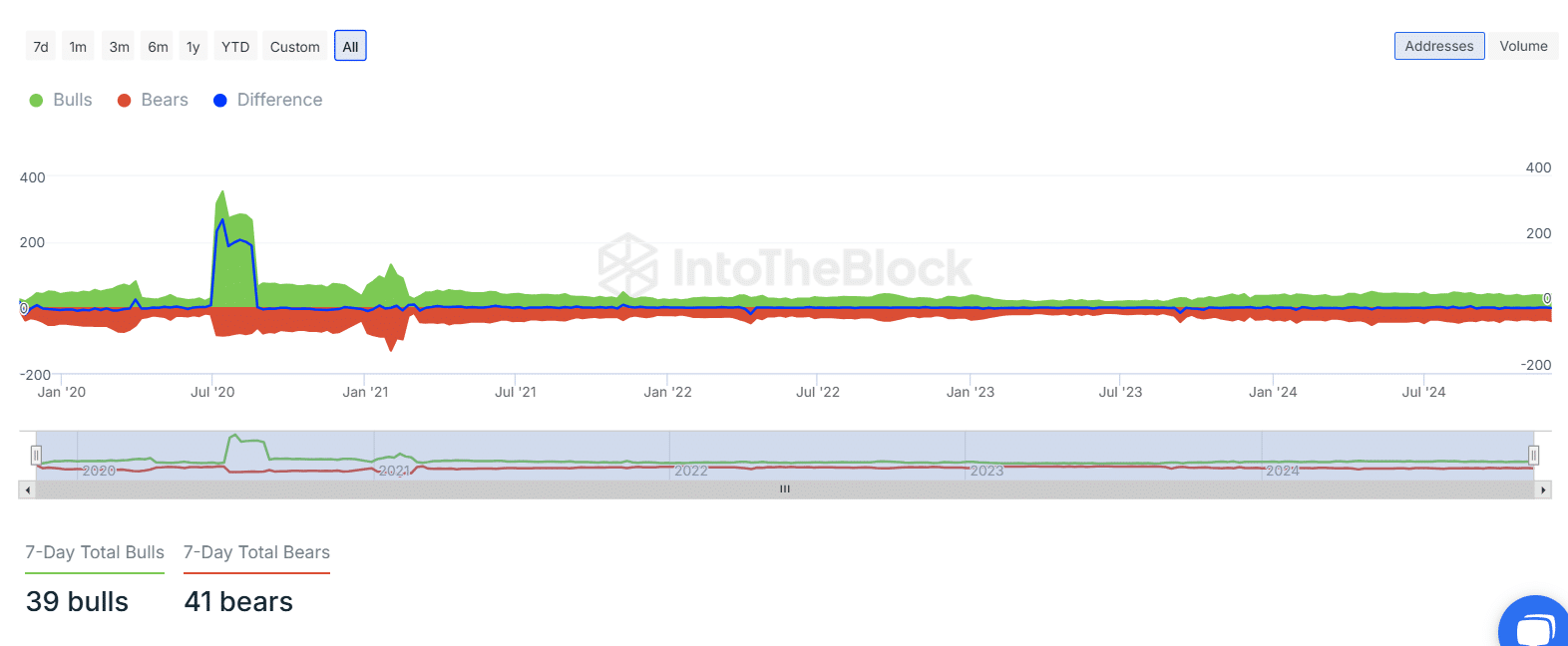

A slight bearish bias prevails

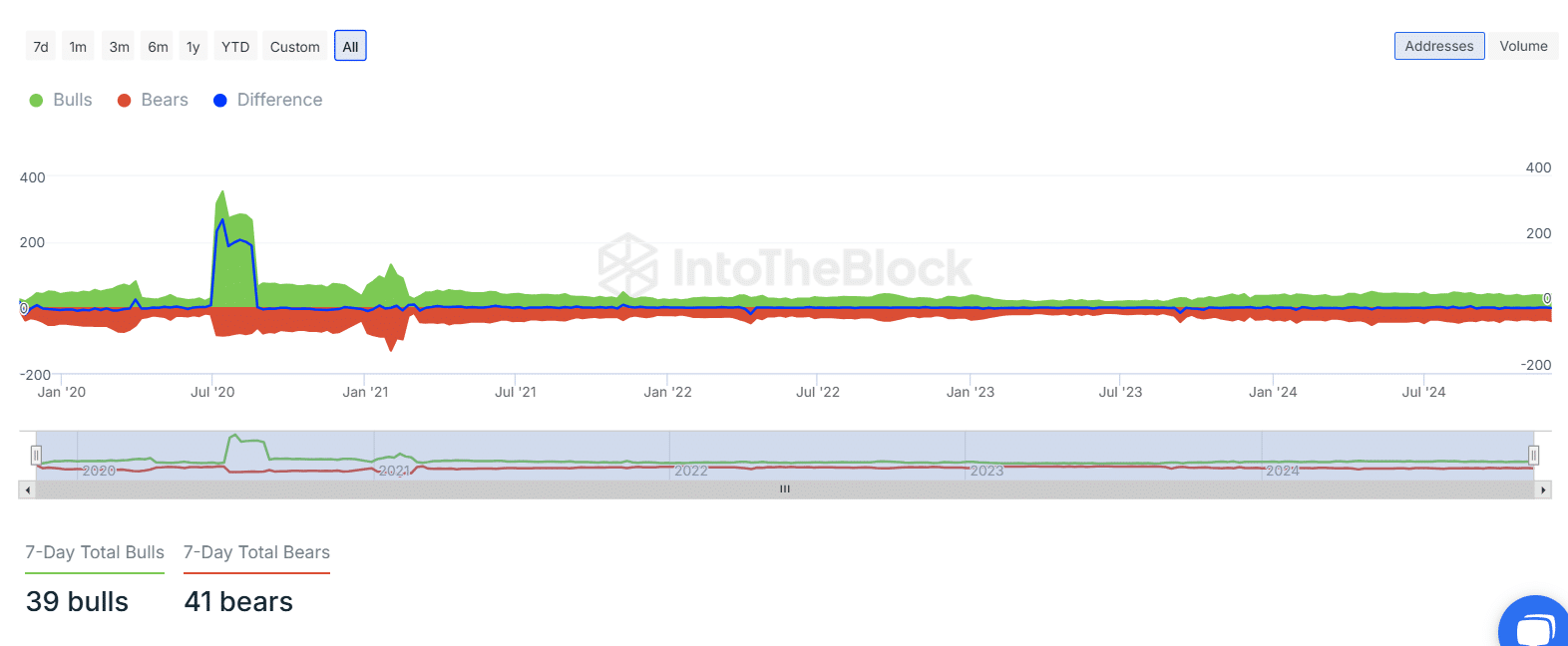

Toncoin sentiment was slightly bearish last week. A market has appeared The difference between bulls and bears is close to neutral. This indicates a consolidated market preparing for its next move.

Source: IntoTheBlock

Read Toncoin (TON) price prediction for 2024-2025

Historical data shows a strong bullish edge in 2020 and a bearish trend in 2022, suggesting that sentiment shifts occur cyclically.

The current balance shows that the market could break either way depending on the broader momentum.