- As market sentiment becomes cautious, XRP and ETH are competing fiercely to attract capital from Bitcoin.

- XRP has the potential to carve out its own asset class distinct from BTC by 2025.

The resilience of cryptocurrency markets is being tested once again as the FOMC concludes 2024 with a “speculative” twist. The third and final interest rate cut of the year in just four months has sparked a sharp sell-off in Bitcoin (BTC). A long red candlestick erased five days of gains, pulling BTC price below the critical $100,000 level.

But this may be just the beginning. The Fed said,circumspect” The position implied that Trump’s conservative policies could lead to higher inflation in the coming months.

Investors did not take this news well. As the market fell, some altcoins took double-digit hits, but top coins held firm, suggesting the potential for a strong rebound.

Here’s the interesting part: Ripple (XRP) emerged as the big winner as it rode the “Trump pump.” Does this give XRP an edge in the battle against Bitcoin and Ethereum?

The game is on!

Currently, XRP is experiencing a surge in selling in several sectors. Metrics. It is clear that XRP is not immune to market turmoil. In fact, XRP’s current price is $2.30 (at the time of writing), with the $3 mark moving further and further away.

But not all is lost. December started off strong for XRP. The coin posted four green candles in a row, each registering a gain of nearly 15%, before closing near $2.80, a level it hasn’t reached in three years. So distributing XRP tokens seemed like a smart move.

On the other hand, Ethereum’s daily chart shows much greater volatility, with an impressive rebound after the plunge.

Each “drop” from mid-November to mid-December seemed strategically timed, followed by a strong recovery. This means that when ETH supply increases, aggressive action is taken quickly. accumulation.

Now, XRP and ETH are in a fierce race to break the key resistance level. Competition is fierce. However, the winner will be a company that can remain strong despite uncertainty based on solid fundamentals. So which will break first: $3 for XRP or $4,000 for Ethereum? Or will Bitcoin take the spotlight instead?

Should you dig into the “dip” of XRP or ETH?

Over the past 24 hours, the cryptocurrency market has been rocked as a variety of factors have combined to trigger an unstable chain reaction. In particular, small individual investors have been hit hardest.

In these circumstances, it’s clear that FOMO may not return in the next few days. Instead, investors are rushing to adjust their portfolios to recoup losses. Now the burden seems to be on the big players with a lot of money.

Here’s what’s interesting: The recent decline has brought both XRP and ETH closer to important support levels. If the big players start accumulating at this price range, a local bottom could begin. This could spark a rebound and inspire confidence among smaller investors.

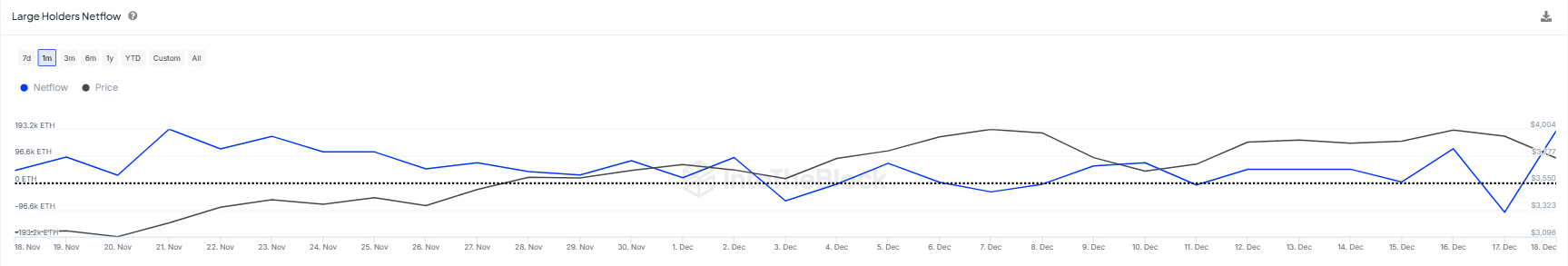

For ETH, whales have shown much more strategy compared to XRP. They have been taking advantage of this decline by scooping up ETH at a discount before cashing it out at a premium when they see the $4K mark.

Source: IntoTheBlock

now, whale If ETH accumulates again, the price will likely test $3.9K next, but caution is advised.

However, attention has shifted to Bitcoin, which has recently seen a strong rally, taking it back to $101,000, a bullish signal for the market.

Nonetheless, the recent Bitcoin crash has provided altcoins with a golden opportunity to shine. Despite whales and institutions taking advantage of the downturn, a BTC retail surge is unlikely to occur in the near future.

So while ETH continues to suffer from endless loops, XRP has several factors supporting its growth, including historical performance, whale support, SEC developments, and the RLUSD stablecoin initiative.

Read Ripple (XRP) Price Prediction 2024-2025

As a result, XRP’s potential to carve out a separate asset class from BTC by 2025 is a unique advantage. This is something Ethereum failed to achieve from the beginning.

If XRP succeeds in this, it could be in a prime position to benefit from Bitcoin’s volatility over the next year.