- Ethereum’s funding rate indicates a potential rebound for ETH.

- ETH is down 16.48% over the past 7 days.

Ethereum (ETH) has been under strong downward pressure since hitting $4,109. As a result, the altcoin price fell 16.48% last week, falling to its lowest point of $3,095.

Despite the recent decline, Ethereum appears likely to return to $3,300. This is because Ethereum’s funding rate has cooled after suffering two rejections at $4,000.

Ethereum futures market cooled after $4,000 rejection.

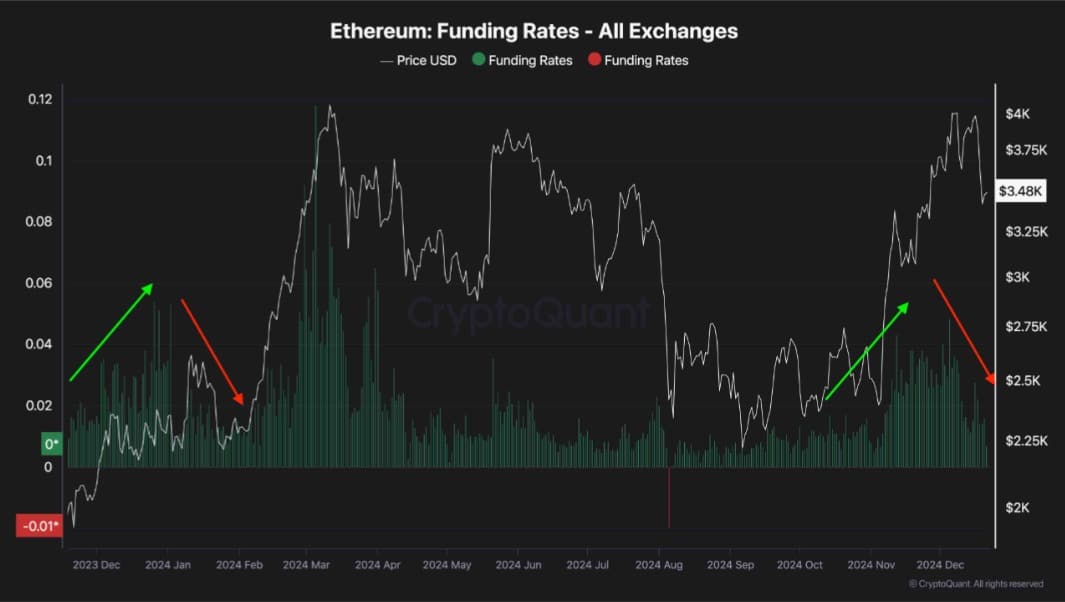

Ethereum’s failure to regain $4,000 resistance has led to massive liquidations in the futures market, according to CryptoQuant.

Source: CryptoQuant

This caused a massive market crash as ETH hit record lows. ETH’s funding rate surged last week, but with the altcoin unable to sustain above $4,000, the funding rate has returned to healthy levels. This level is very suitable for a bullish trend.

The resulting cooling effect could therefore pave the way for a more sustainable rally in the coming weeks.

Historically, this pattern occurred in January 2024, when futures markets cooled due to lower funding rates, causing ETH to rally significantly.

During this rally, Ethereum rallied from $2,169 to $4,091. This historical precedent indicates that the current market reset could mark the start of another bullish phase.

What the ETH Chart Suggests

Ethereum has experienced strong downward pressure over the past week, but prevailing market conditions point towards a recovery.

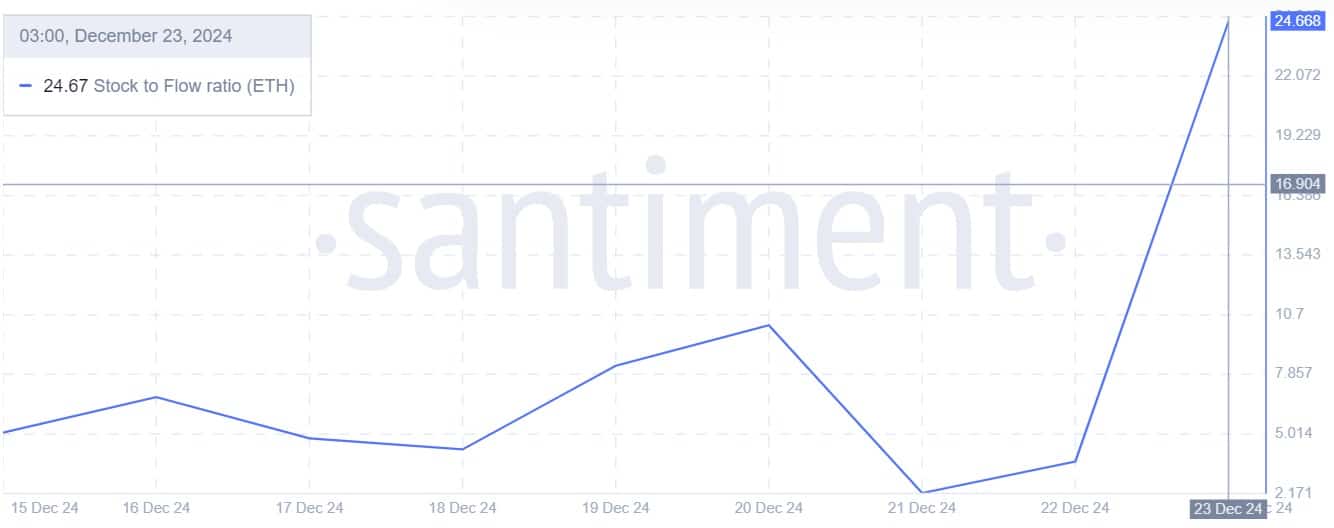

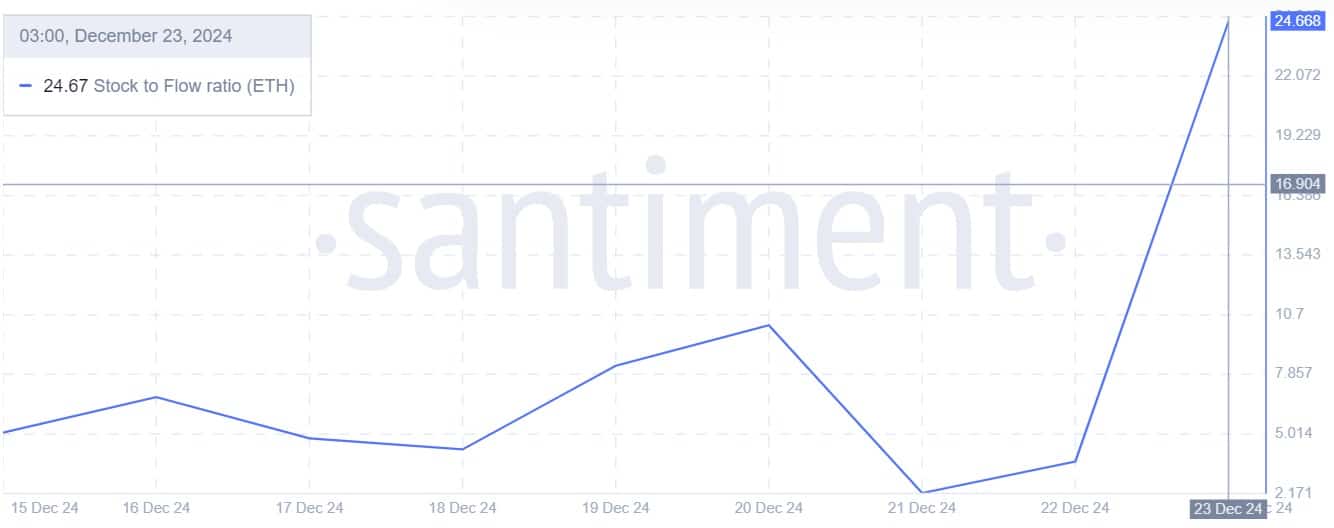

Source: Santiment

First of all, Ethereum’s stock-to-flow ratio jumped from 2.19 to 24.67 last week. A rising SFR means that ETH is becoming more scarce as large holders accumulate more.

As a result, altcoins have become more scarce. As demand increases, prices rise through supply shortages.

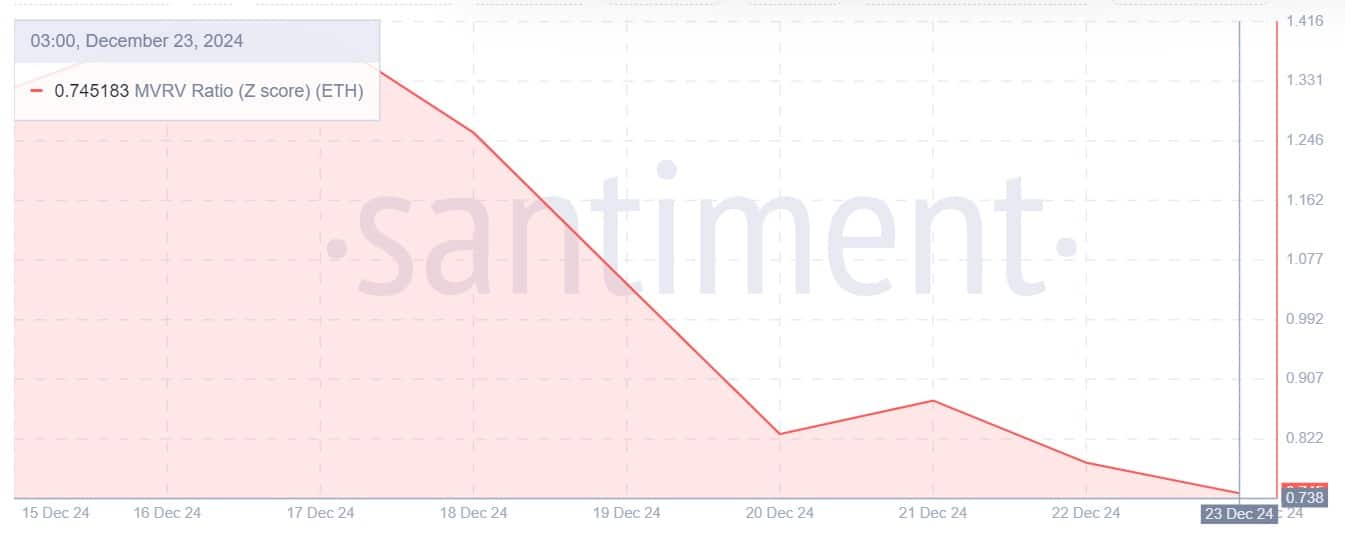

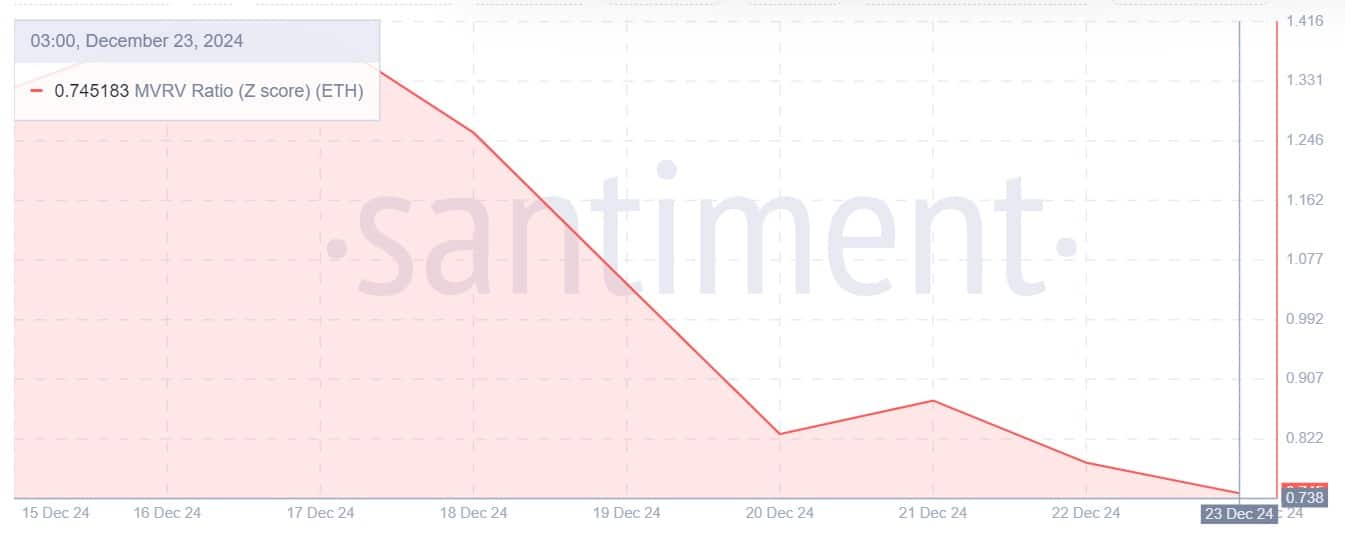

Source: Santiment

Additionally, the Ethereum MVRV Z-score ratio decreased to 0.745 last week. When the MVRV score reaches such a low level, it is a sign that ETH is currently undervalued, providing a good signal for accumulation among long-term holders.

This trend was seen last week as whales turned around to buy the dip. Increasing accumulation typically creates higher buying pressure, which in turn creates upward pressure on prices due to high demand.

Source: Santiment

Lastly, the Bitmex base rate for Ethereum has surged from -0.22 to 0.07 over the past few days. When this ratio turns positive, it reflects optimism in the futures market as traders expect prices to rise after a decline.

What are the chances of a comeback?

As observed above, the futures market is bullish and we expect the ETH price to recover. Likewise, spot demand for Ethereum continues to grow, creating healthy conditions for price growth.

Read Ethereum (ETH) Price Prediction for 2024-25

As the market is bullish, ETH may recover from the $3300 drop and regain higher resistance. If these conditions hold, ETH will regain the $3700 resistance.

A move here could strengthen Ethereum and move it towards $3900. However, if the bears remain strong and the bulls fail to retake the market, ETH will fall to $3,160.