- ADA’s $0.88 support level remains pivotal as technical indicators hint at a potential rebound.

- Market sentiment is indecisive, but a break above $0.88 could spark bullish momentum.

Cardano (ADA) As we continue to face volatile market conditions, traders are anxious about its future trajectory. At press time, ADA was trading at $0.8811, down 1.12% in the last 24 hours.

This decline highlights the importance of key indicators and skill levels in shaping your next move.

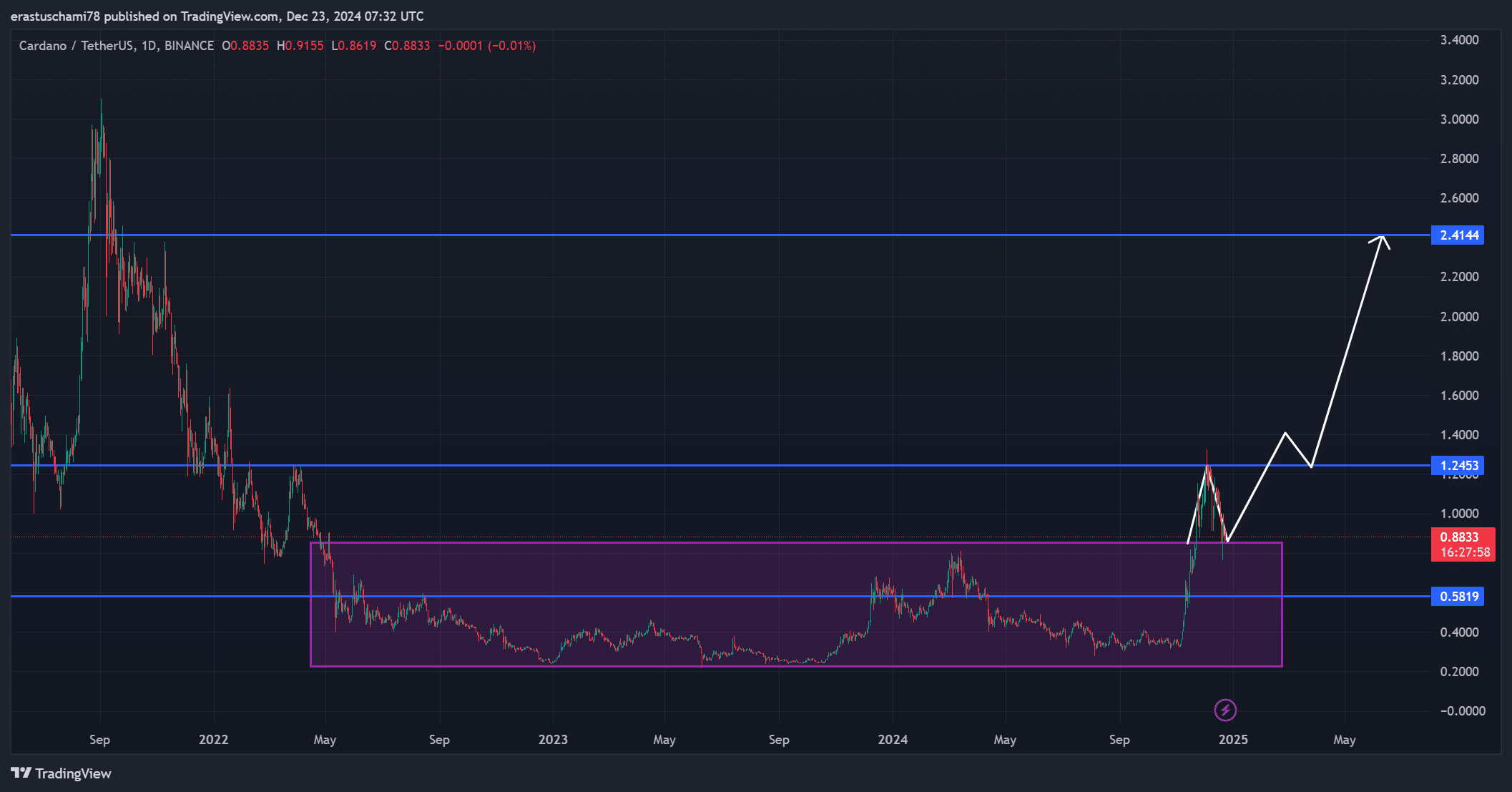

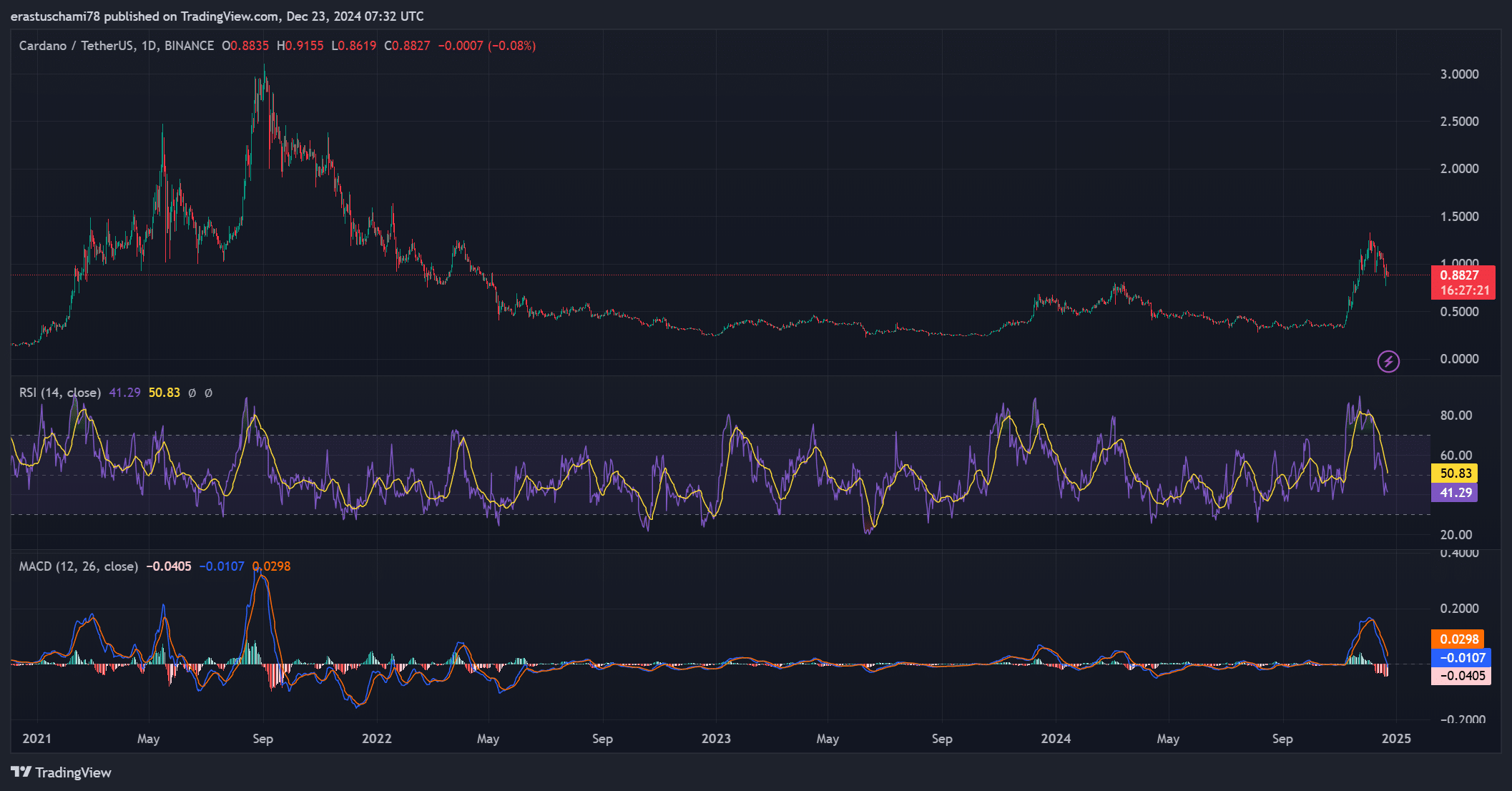

ADA Price Action Analysis

Cardano’s price shows a significant interplay between consolidation and breakout phases. After spending most of 2023 within a range of $0.58 to $0.88, ADA surged as high as $1.25 earlier this year, only to face this resistance.

Now back near $0.88, this level acts as an important support area. If ADA holds at this level, it could recover towards $1.25 and eventually target $2.41 if momentum builds.

However, failure to hold this level could lead to a retreat to the $0.58 range. Therefore, ADA’s ability to maintain support at $0.88 will be pivotal for price direction.

Source: TradingView

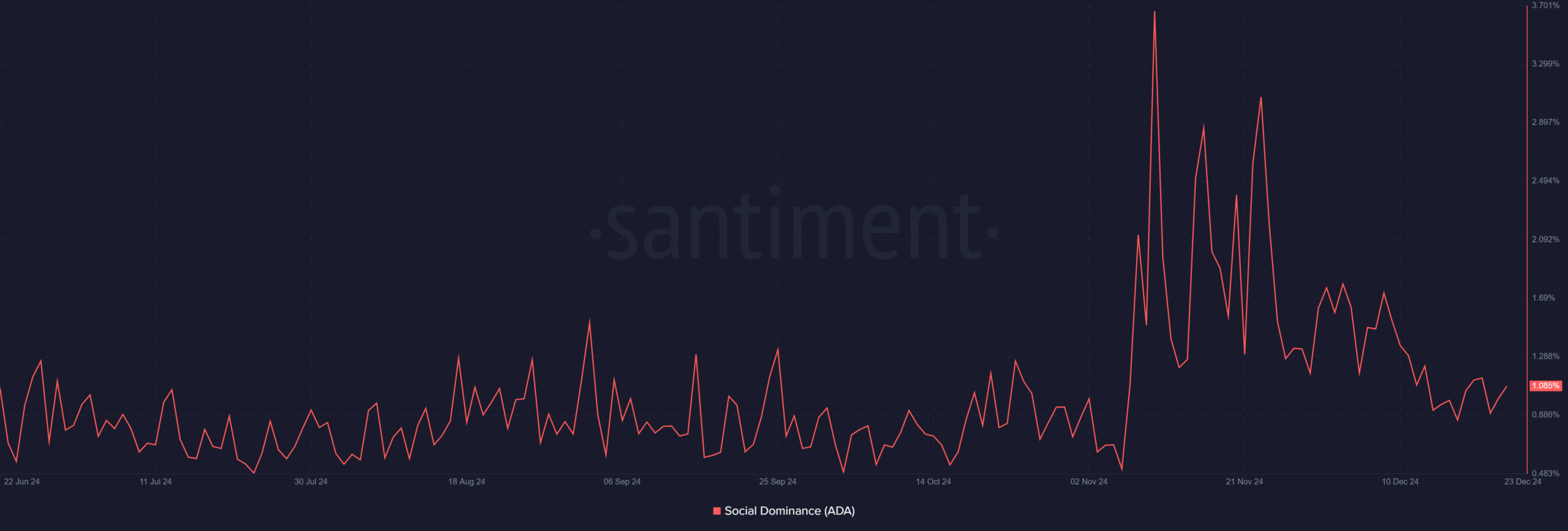

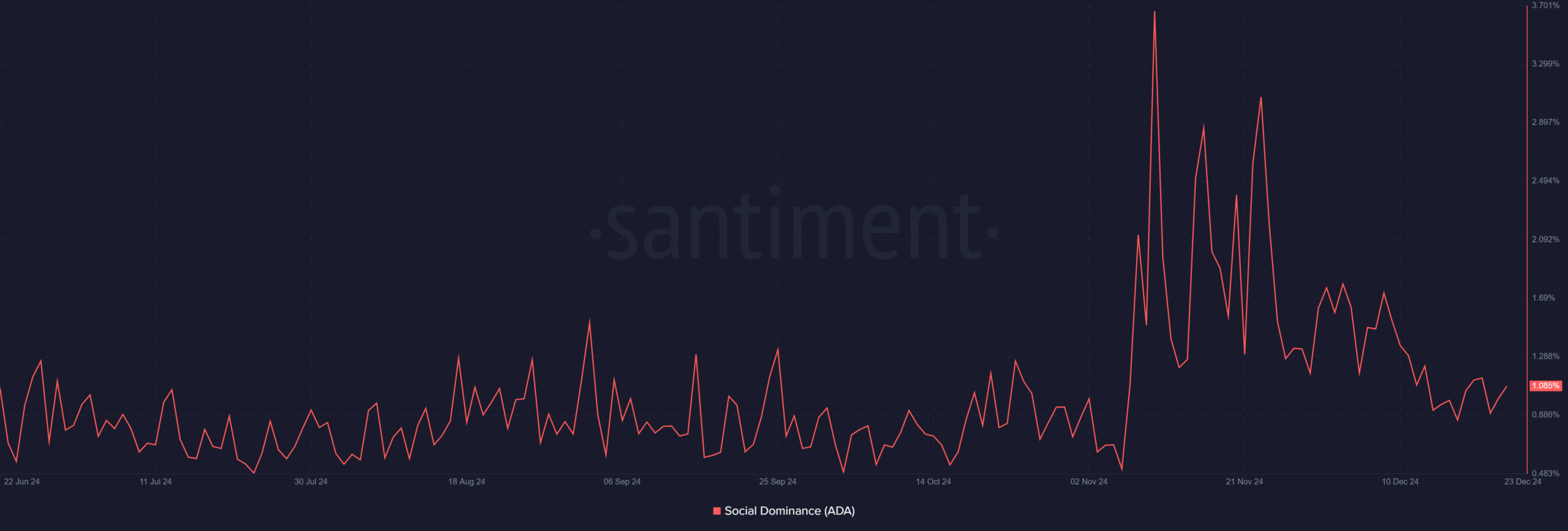

ADA’s social indicator analysis

ADA’s social dominance rose slightly to 1.08%. Although it is not a huge increase, it reflects the growing interest and discussion about Cardano in the cryptocurrency community.

Historically, high social engagement has often been associated with price fluctuations. Additionally, consistent social dominance signals that investor confidence has been restored and can further benefit price action.

Source: Santiment

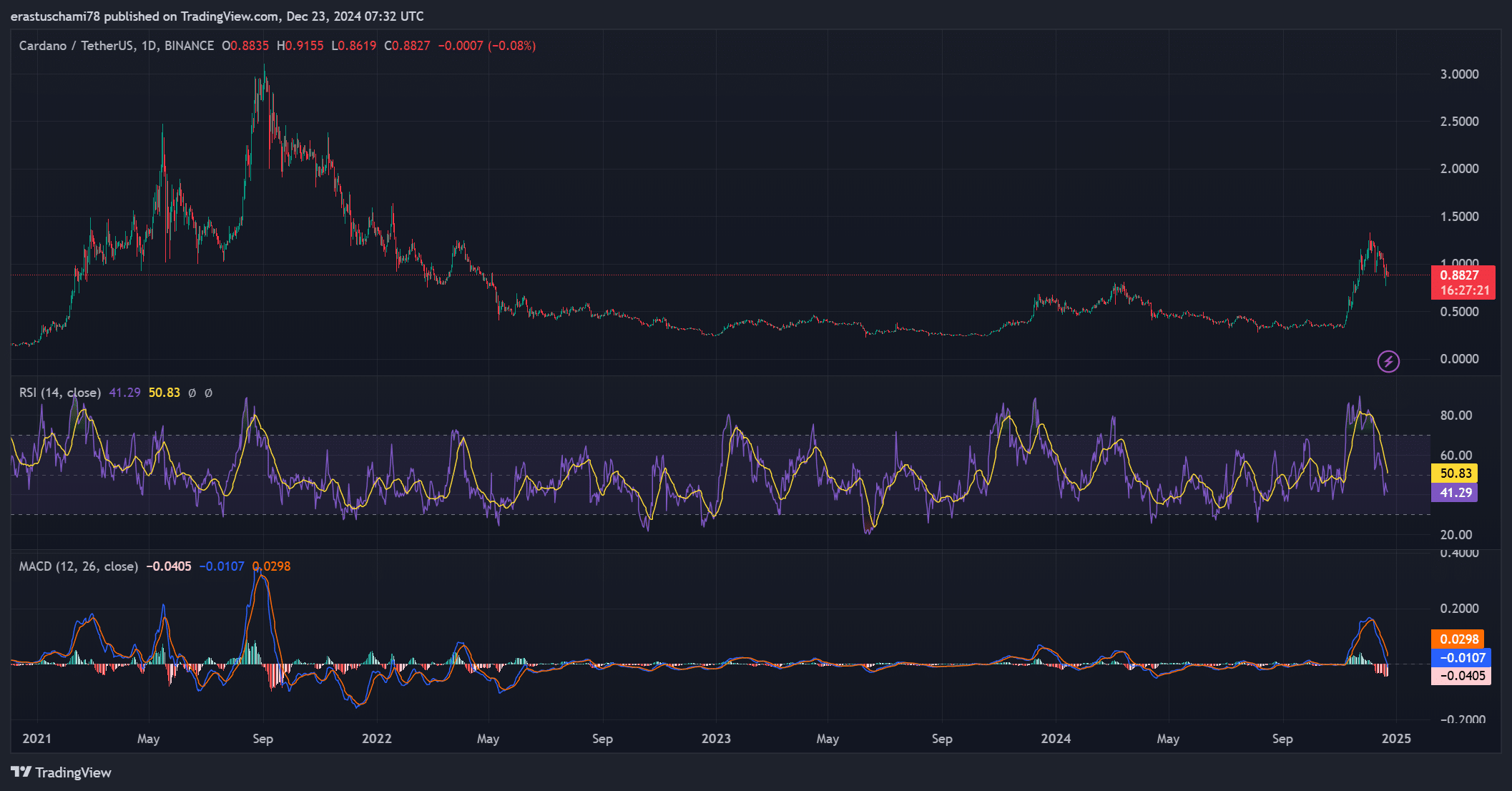

Technical indicators suggest a possible reversal.

RSI is currently at 41.29, indicating that ADA is approaching oversold territory. This indicator often signals an imminent price rebound as selling pressure eases and buyers regain control.

Meanwhile, MACD is showing bearish momentum, but the histogram suggests that the bearish trend may be weakening. A possible crossover of the MACD line could further confirm the shift to bullish sentiment. Therefore, it is essential to monitor these indicators closely.

Source: TradingView

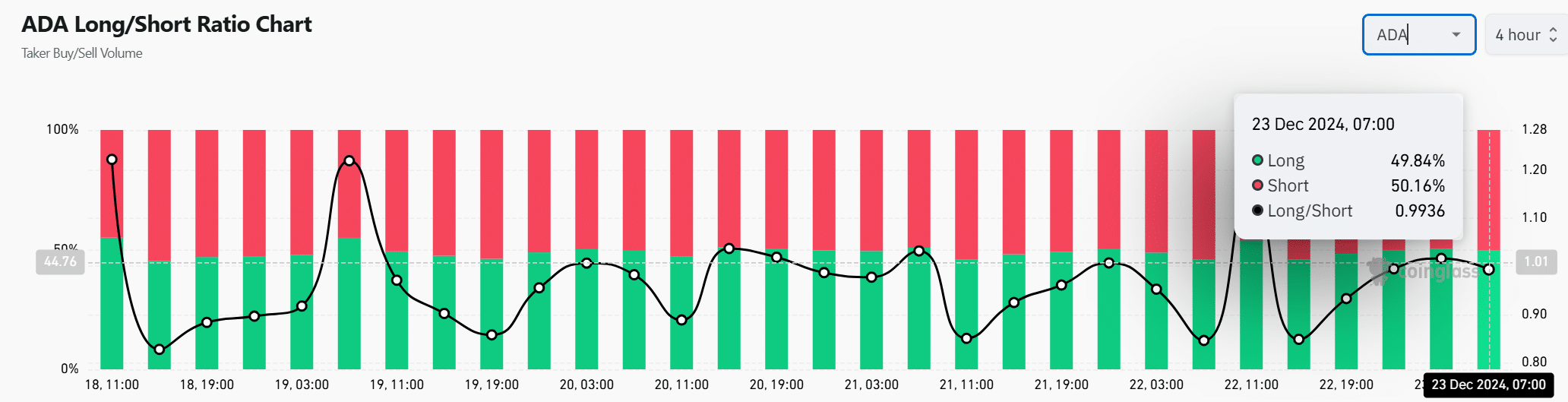

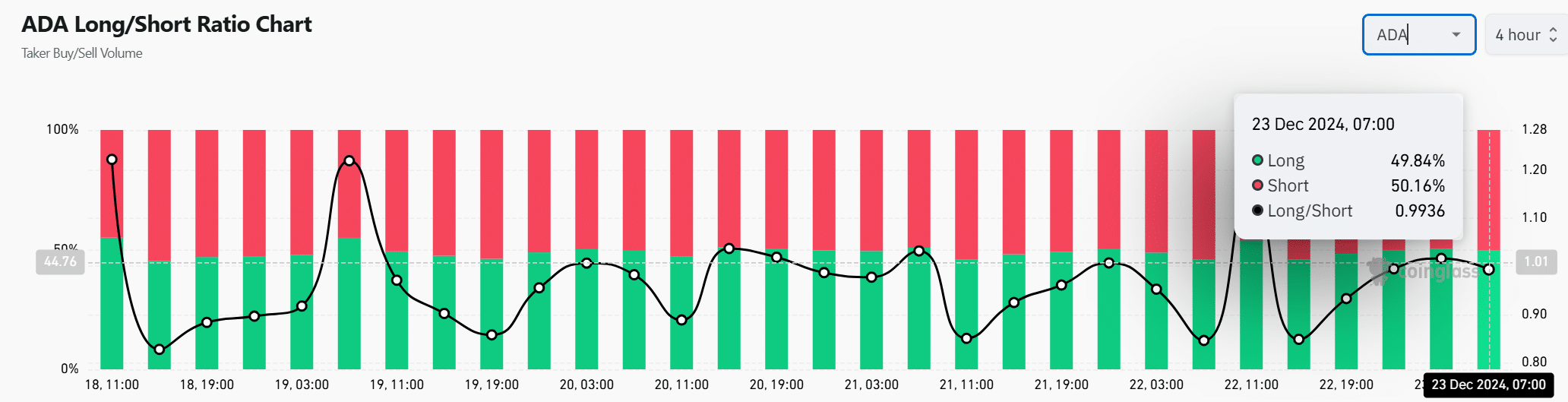

ADA Long/Short Ratio and Market Sentiment

ADA’s long/short ratio is 0.9936, with short positions slightly ahead of long positions at 50.16%. This nearly even distribution reflects market indecisiveness.

However, a break above $0.88 could result in increased long positions as traders anticipate a bullish breakout. Conversely, failure to maintain support could strengthen bearish sentiment.

Source: Coinglass

Read Cardano (ADA) Price Prediction for 2023-24

ADA’s future depends on its ability to maintain the $0.88 support level. If so, a rebound to $1.25 is likely, with the possibility of reaching $2.41 in the coming months. However, a breakout could retest $0.58, delaying a bullish recovery.

Cardano is currently at a critical stage where patience and key level monitoring are essential.