- LUNC will burn 19.67 million tokens daily to support recovery and burn 394 billion tokens to reduce 5.5T supply.

- LUNC price stabilizes near $0.00011 due to reduced market activity, cautious trading, and mixed momentum.

Terra Luna Classic (LUNC) The ecosystem continued its aggressive token burn strategy, recording a daily total of 19,674,564 tokens burned on December 22, 2024.

According to data from LUNC Burn TrackerThis consists of 7,265,976 tokens burned from wallets and an additional 12,408,588 tokens burned through the on-chain mechanism.

LUNC burned over 394 billion tokens, reducing the supply of the 5.5 trillion tokens in circulation.

These burn plans are critical to Terra Luna Classic’s recovery plan. We aim to support price stability and future growth.

Price stability amid market volatility

The price of LUNC rose 1.82% over the last 24 hours to trade at $0.0001123, with a 24-hour trading volume of $37.21 Million.

However, the token has been under pressure, recording a decline of 12.31% over the past seven days. The market capitalization is estimated at approximately $618.43 million.

In the last 24 hours, the price of LUNC fluctuated between $0.0001054 and $0.0001135. The wider 7-day range extended from $0.00009174 to $0.0001344.

LUNC is attempting to stabilize near the $0.0001100 support level, with immediate resistance observed around $0.0001200.

Technical indicators show mixed momentum

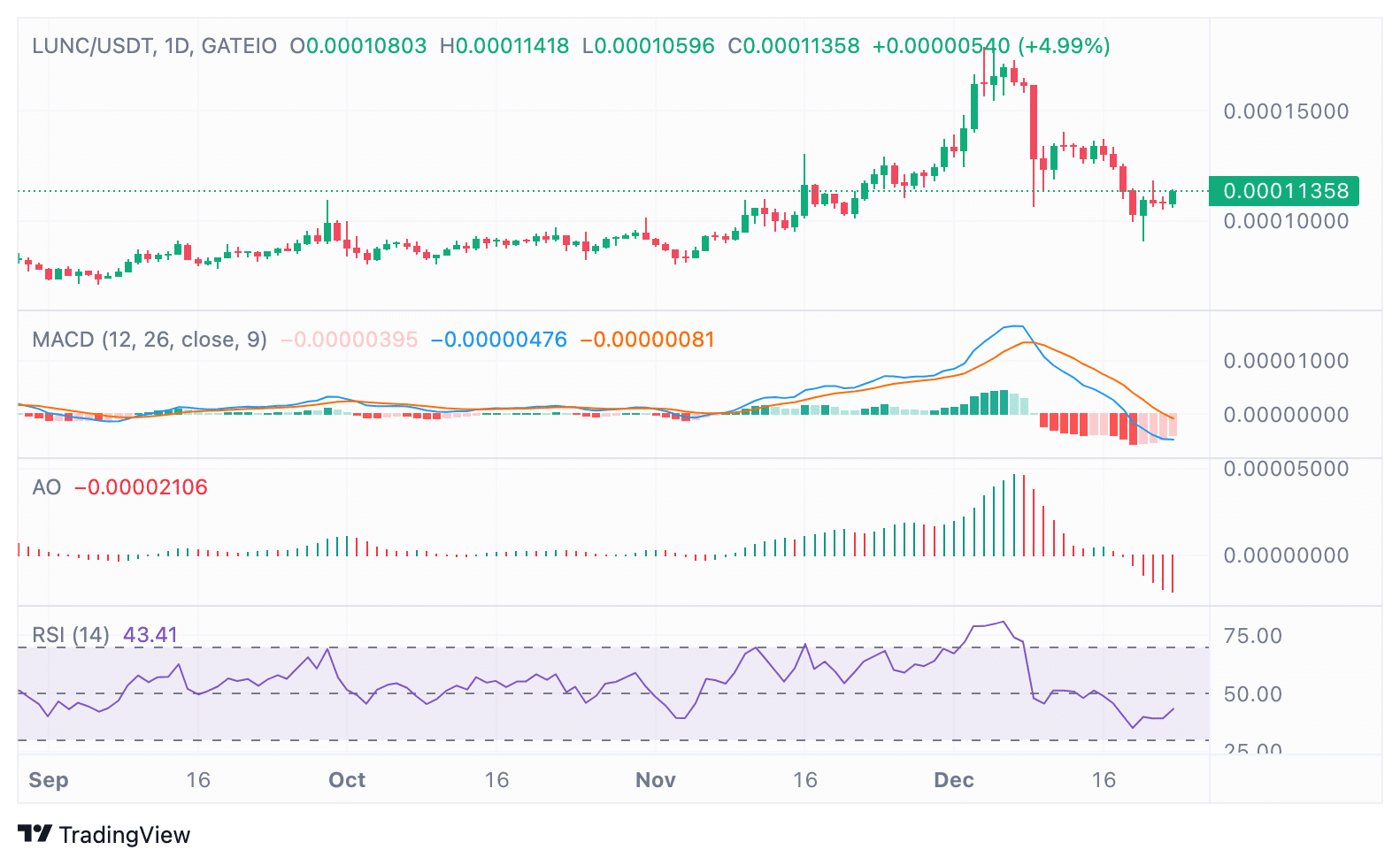

Technical indicators on the LUNC/USDT daily chart suggest mixed momentum. Moving Average Convergence Divergence (MACD) has indicated a bearish crossover, but a fading red histogram bar indicates that the bearish pressure is waning.

Likewise, the Awesome Oscillator (AO) reflects waning selling pressure, suggesting a possible reversal if the indicator moves above the neutral zone.

Source: TradingView

The relative strength index (RSI) recorded 43.41, recovering from oversold territory.

A sustained break above the 50 level could indicate further bullish momentum, with key levels to watch remaining at $0.0001000 for a decline and $0.0001200-$0.0001250 for an advance.

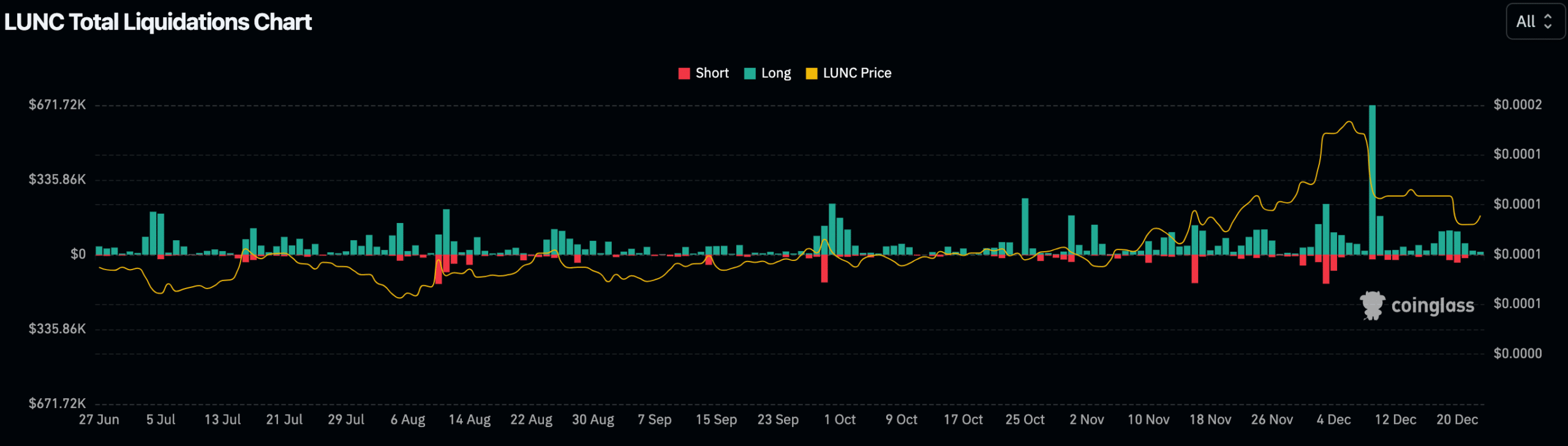

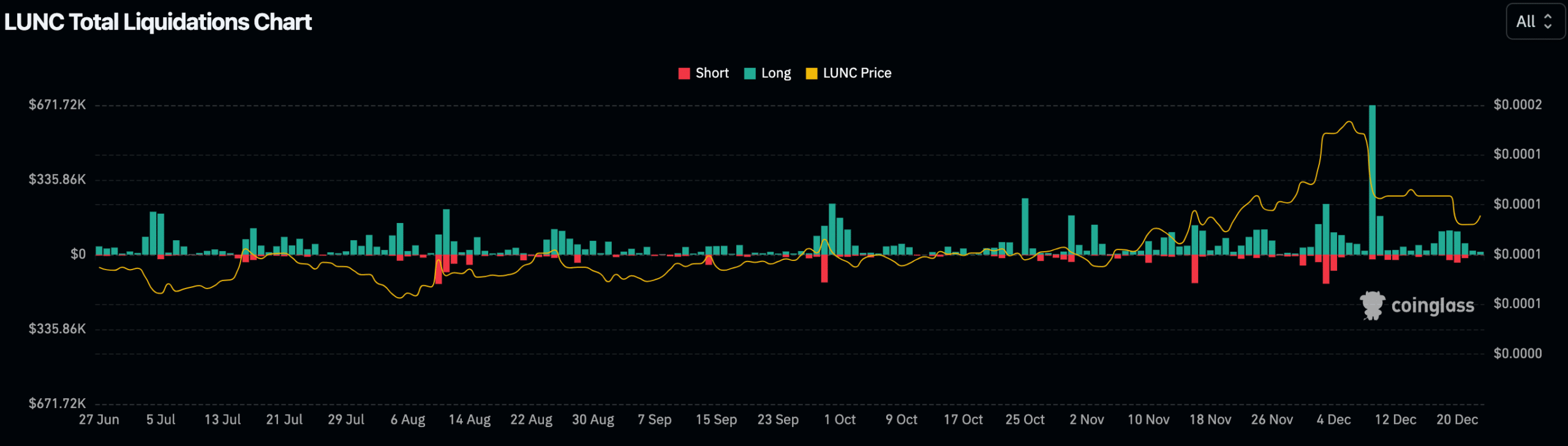

Derivatives and clearing data indicate cautious sentiment.

LUNC Derivatives data showed a decrease in activity, with trading volume down 15.35% and open interest down 4.57%. Despite the downtrend, the 24-hour long/short ratio is 1.0255, somewhat favoring long positions.

In particular, OKX traders showed a stronger bullish sentiment with a long/short ratio of 1.26.

According to liquidation data, $12.63K of long positions were liquidated, while $1.27K of short positions were liquidated. This indicates higher bullish leverage in the market.

Source: Coinglass

Is your portfolio green? check it out LUNC Profit Calculator

The surge in liquidation activity coincides with price volatility, further highlighting cautious sentiments among traders.