- TD Sequential issues a rare buy signal, suggesting a possible breakout for Solana towards $250 resistance.

- Solana’s TVL grew to $8.312 billion as strong fundamentals and upbeat derivative indicators fueled market excitement.

Solana (SUN) It traded on a rebound from the recent correction. $190.04 It was close to a critical support area at press time.

The cryptocurrency has seen a price increase of 4.91% in the last 24 hours, despite registering a decline of 11.43% over the past 7 days.

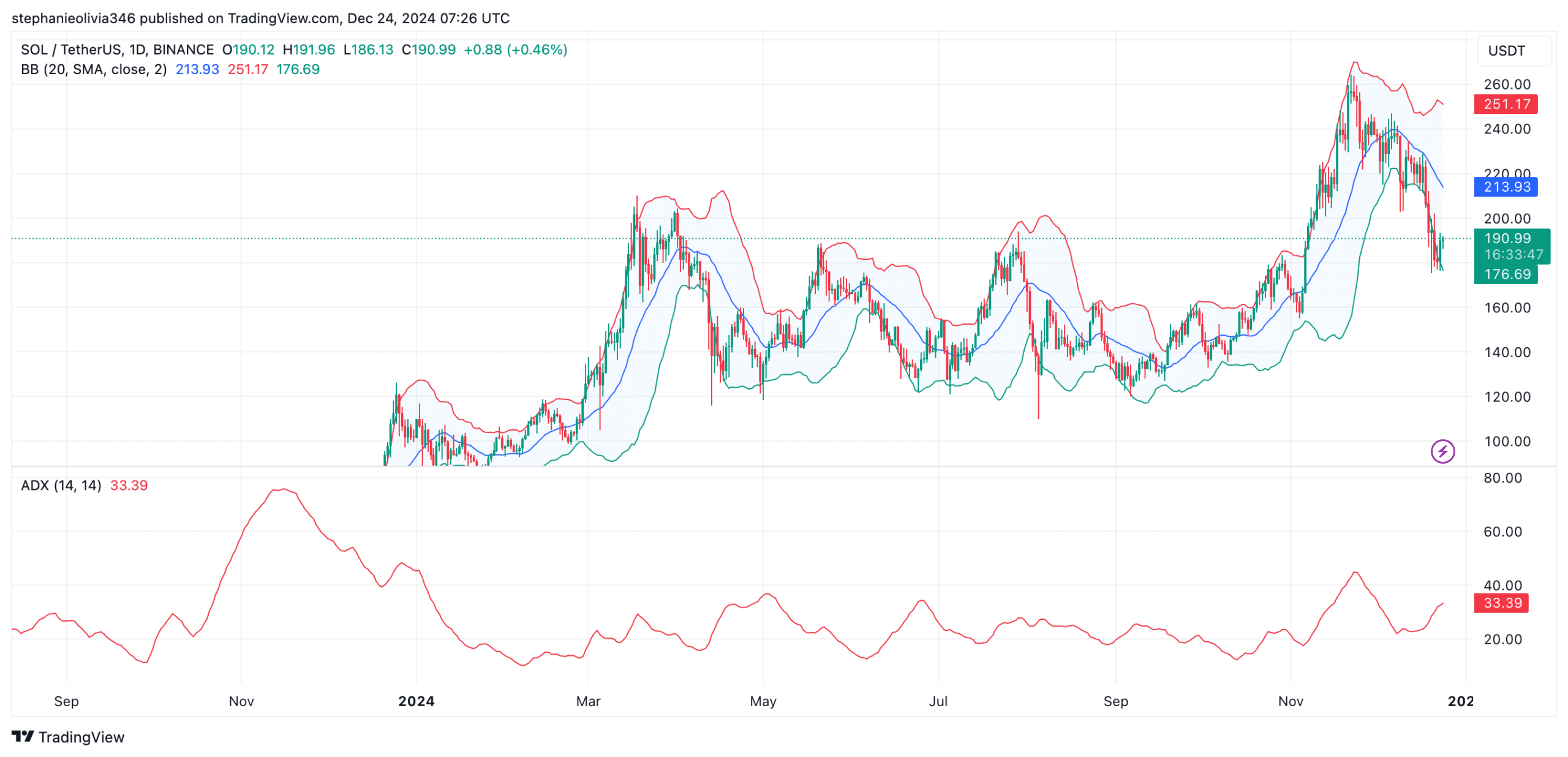

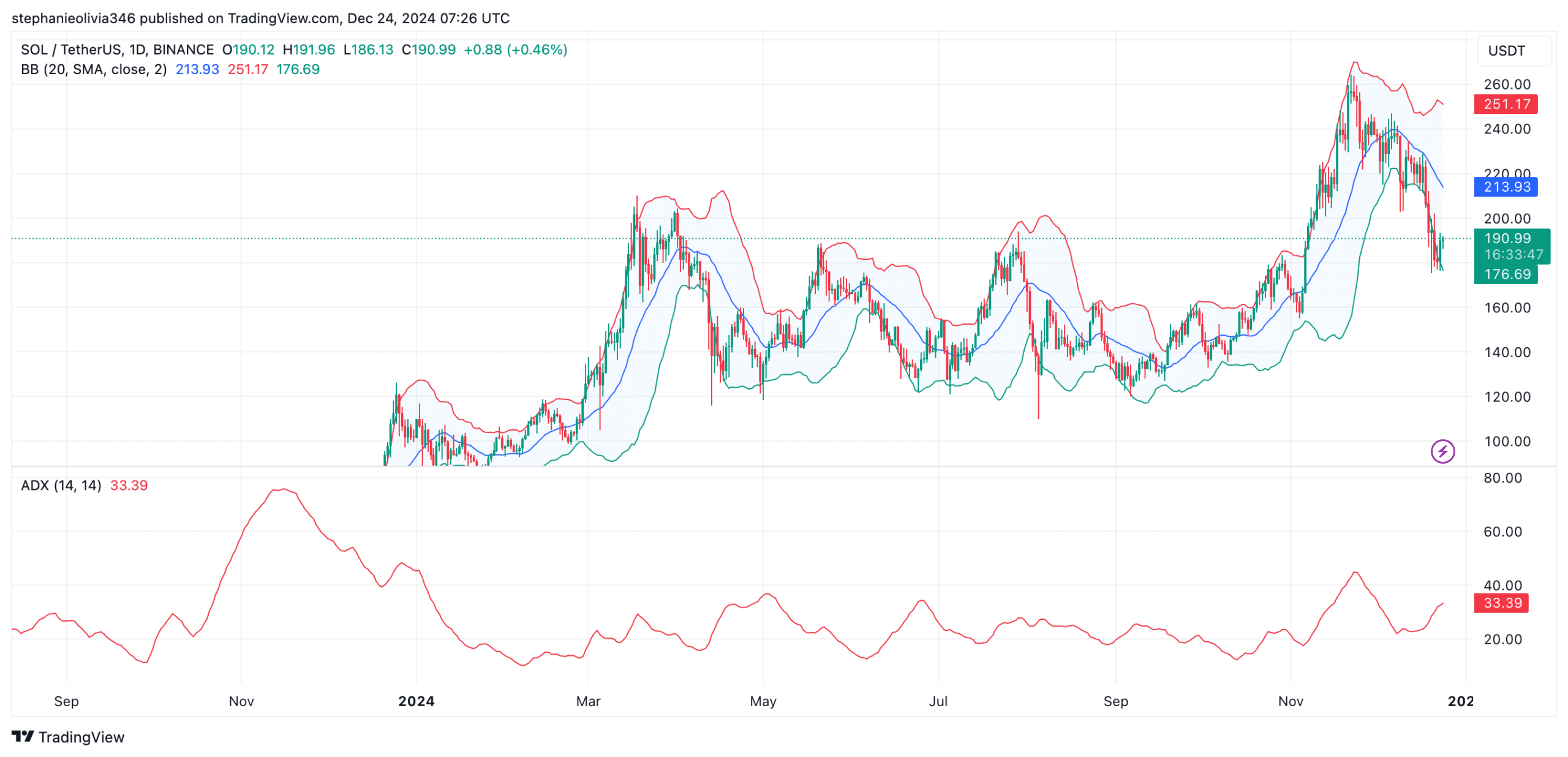

The 24-hour range from $180.35 to $192.86 reflects a consolidation phase, while the 7-day low at $176.72 represents strong support near the lower Bollinger Band.

Analysts predict a rebound based on technical indicators.

The TD Sequential indicator posted a buy signal on the daily chart, raising expectations for a price recovery. Cryptocurrency analyst Ali (@ali_charts) famous,

“This signal is often a harbinger of strong bullish momentum and suggests an opportunity to take a long position at these levels.”

Source: X

According to the daily chart, the Bollinger Bands suggest oversold conditions and SOL is trading near the lower limit at $176.52. Resistance is at $213.88, which coincides with the midline of the Bollinger Bands, and the upper limit is $251.24.

A break above this level could spur further momentum, but a drop below $186 could lead to a decline towards $165, a historically important demand area.

The Average Directional Index (ADX) is currently at 33.39, confirming the strength of the ongoing trend. While the recent bearish momentum continues, ADX levels indicate that a break above resistance could lead to a strong upside.

The downside is that traders are closely monitoring $186 as an immediate support level.

source: TradingView

Strong fundamentals support Solana’s growth

Solana’s network fundamentals remain strong, with a Total Value Locked (TVL) of $8.312 billion, an increase of 1.83% over the last 24 hours.

network diagram recorded The stablecoin market capitalization is $4.972 billion, and it generated $3.08 million in fees and $1.54 million in revenue within 24 hours.

Activity on Solana’s decentralized exchange protocol continues to surge. Solana performed better Ethereum (ETH) In December, it traded with another competitor, trading over $97 billion compared to Ethereum’s $74 billion.

The platform has 4.16 million active addresses and 70.34 million transactions were processed in the last 24 hours.

Signs of growing interest in derivatives markets

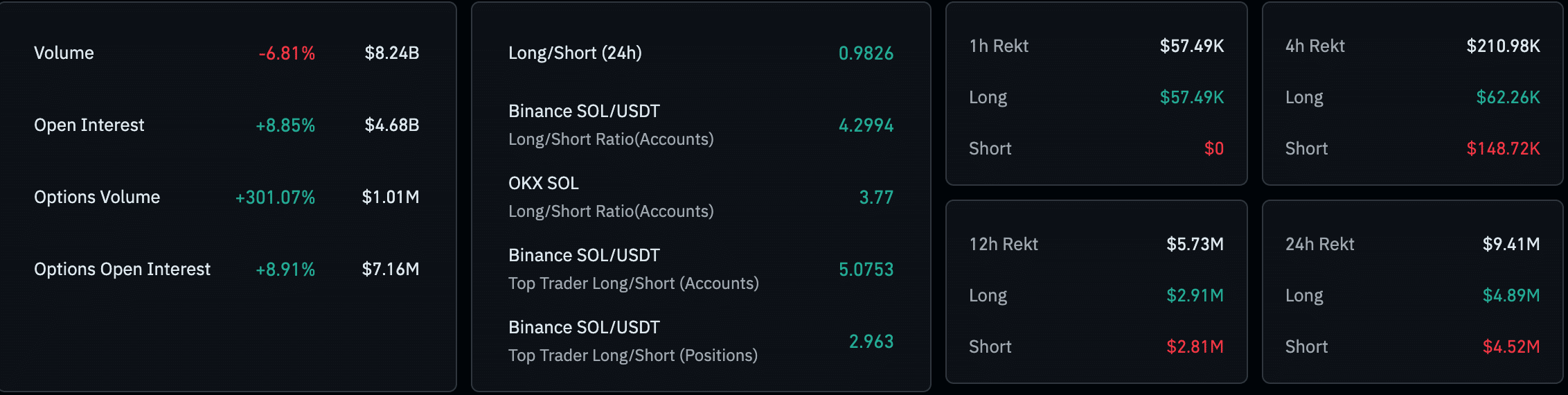

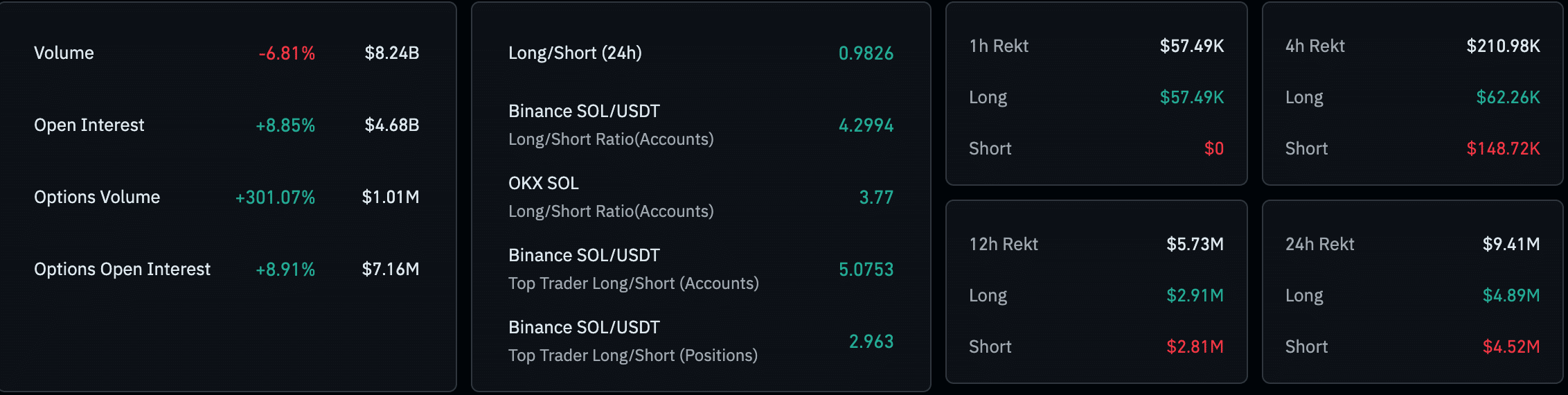

recent data coin glass The derivatives market is showing mixed signals. Open interest increased 8.85% to $4.68 billion, while options volume increased 301% to $10.1 million, reflecting increased speculative activity.

The Binance long/short ratio of top traders is very bullish at 5.07, indicating that most traders expect upward momentum.

Source: Coinglass

Despite the optimism, trading volume fell 6.81% to $9.24 billion, suggesting caution in the market.

Realistic or not, the market cap of SOL in BTC terms is:

Clearing data shows balanced pressure with $4.89 million in long clearing and $4.52 million in short selling, indicating a tug-of-war between bulls and bears.

Solana’s technical setup combined with strong network activity suggests recovery potential if key resistance levels are broken.