- BonkDAO’s token burn reduced supply by 1.8%, but BONK faced resistance at $0.00003517.

- Market sentiment remained bearish due to high short-term interest rates and weak technical indicators for BONK.

BonkDAO’s decision to burn 1.69 trillion won BONK As part of the “BURNmas” event, the token gained attention in the cryptocurrency community.

With $54.52 million worth of tokens removed from circulation, BONK’s total supply decreases by 1.8%.

This could have a significant impact on the market. At press time, BONK is trading at $0.00003144, down 6.50% over the last 24 hours.

Considering these deflationary measures, the following questions arise: Will this affect the price of BONK and market sentiment in the future?

What is your outlook for BONK’s price action?

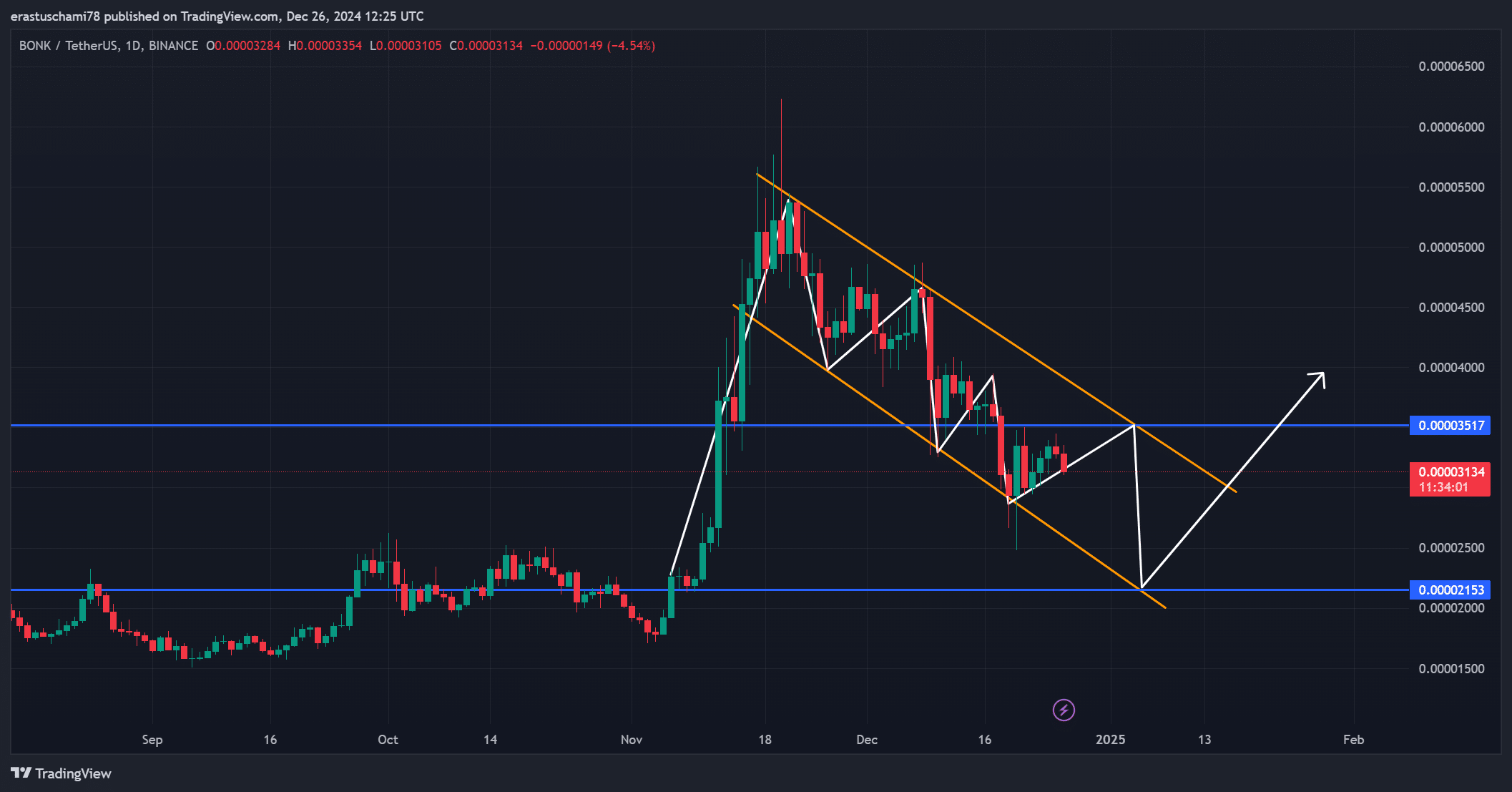

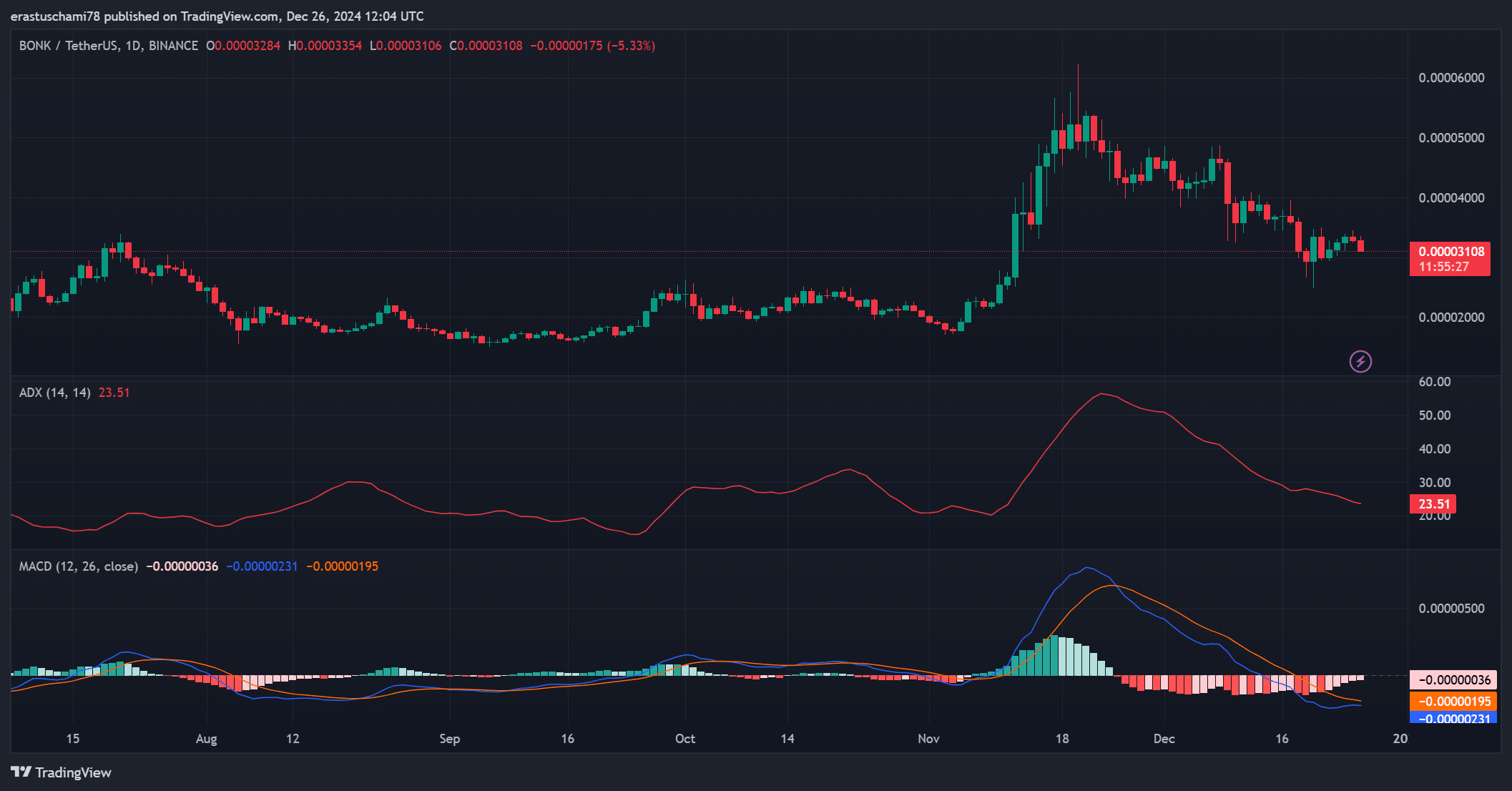

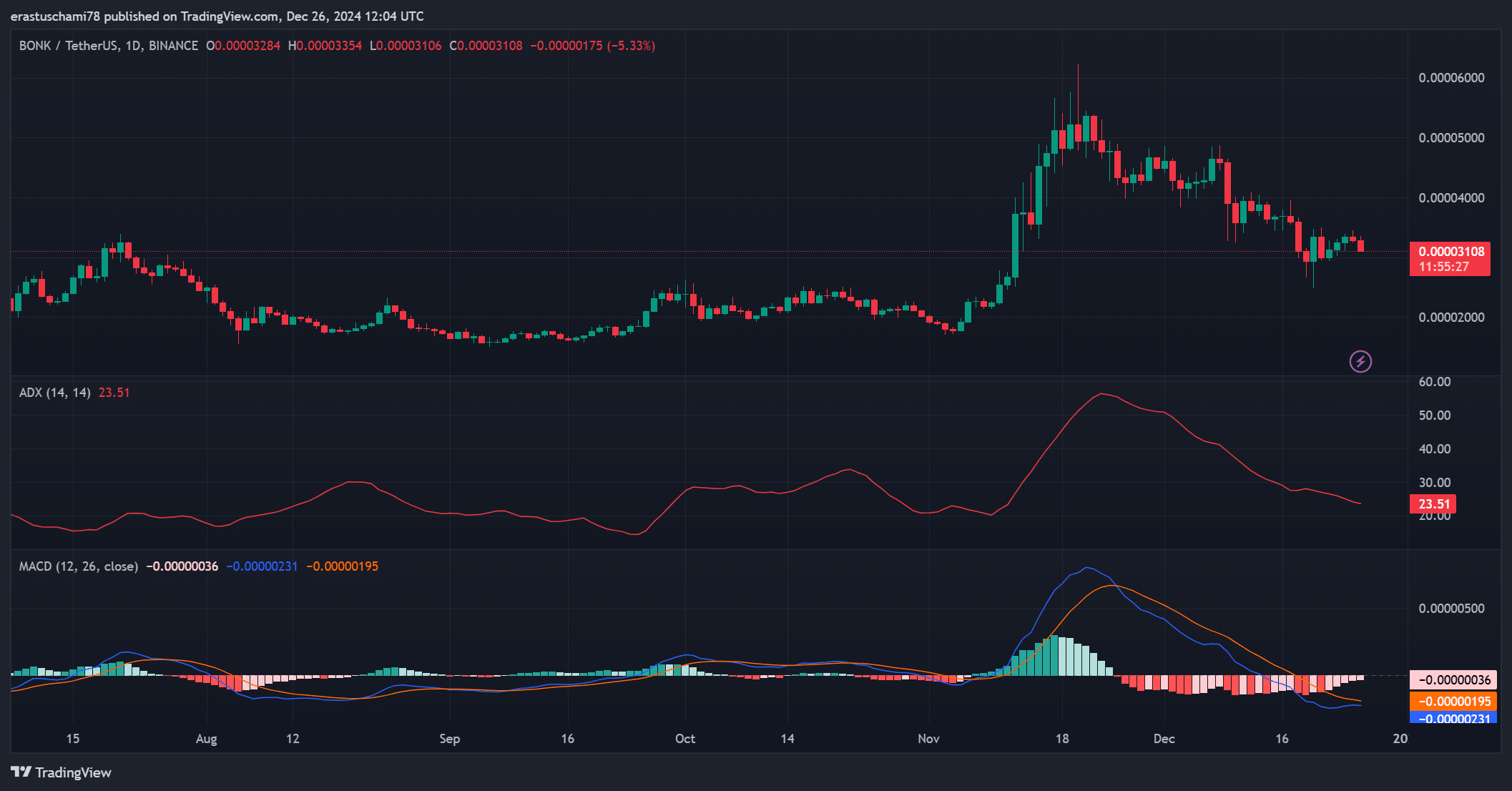

BONK’s price action reveals a resistance pattern, especially at the $0.00003517 level. This resistance point could act as a barrier to further upside unless significant buying occurs.

However, BONK is trading at $0.00003144 at press time, making it difficult to break this resistance without increasing market support.

The 6.50% drop in the last 24 hours indicates that the ongoing trend is still in a consolidation phase.

Source: TradingView

social scale

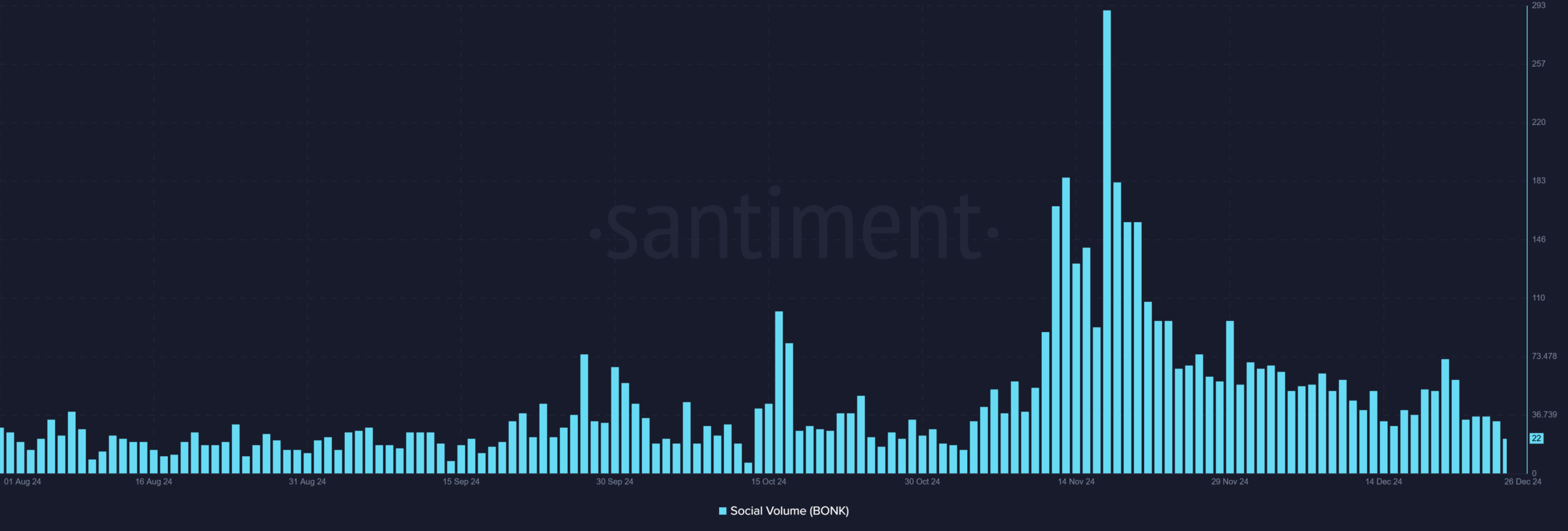

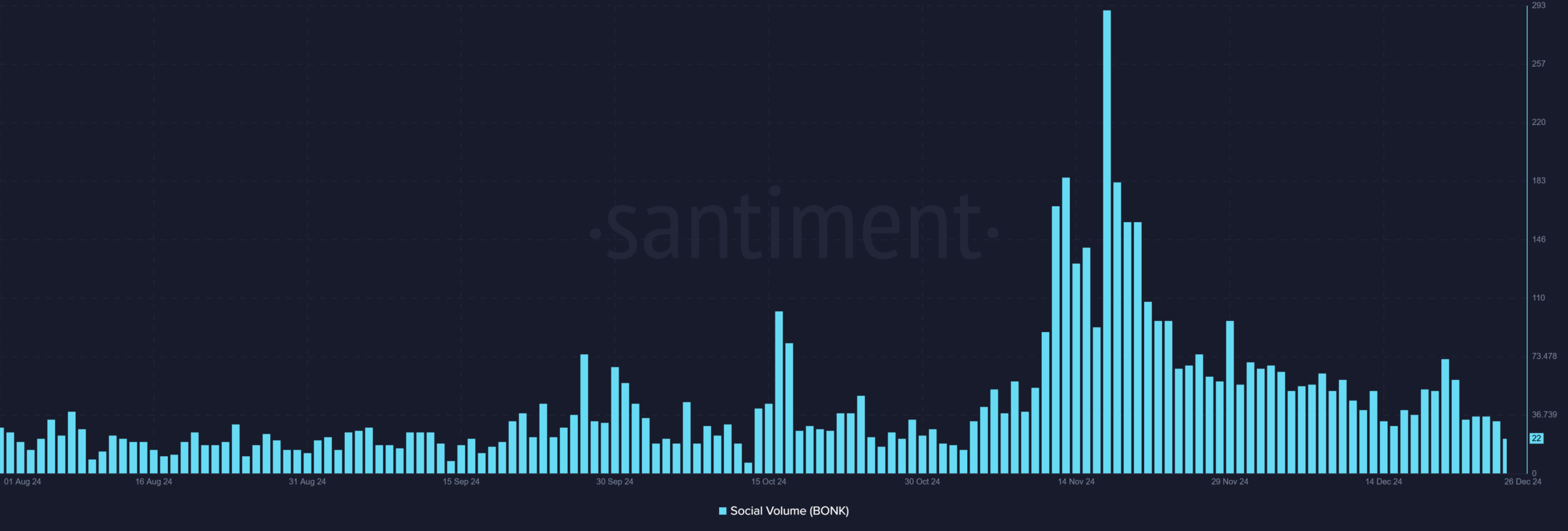

Social Volume data showed declining interest in BONK. Social mentions peaked at over 290 in mid-November, but fell to 22 by December 26.

This significant decline in social engagement suggested that the excitement surrounding token burning was fading.

While high social volume often signals strong price action, these pullbacks can be an indicator that the market is moving away from BONK and waiting for a new spark to reignite the momentum.

Source: Santiment

Are traders betting on further declines?

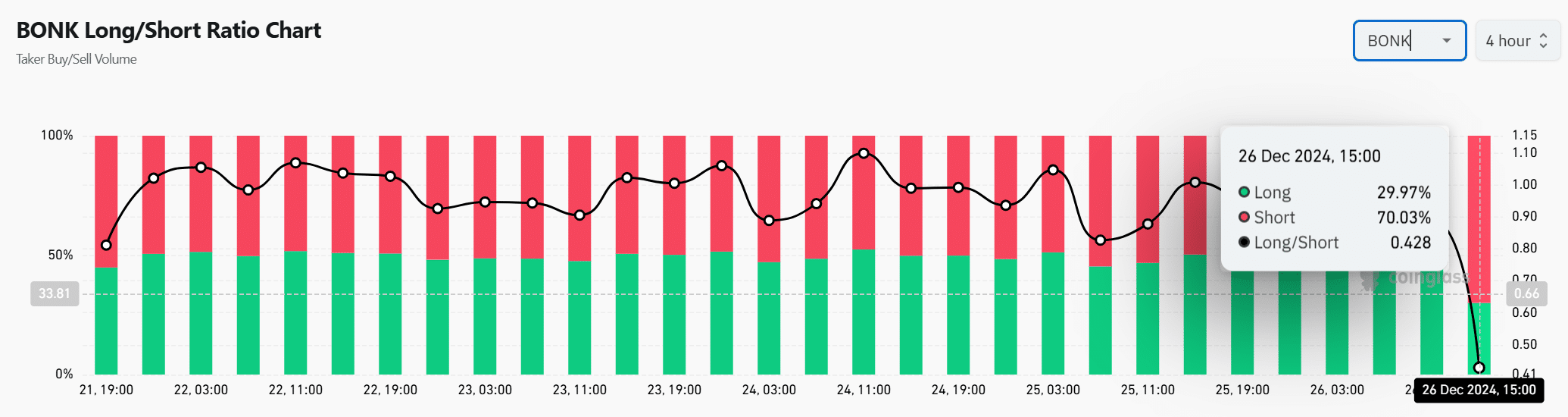

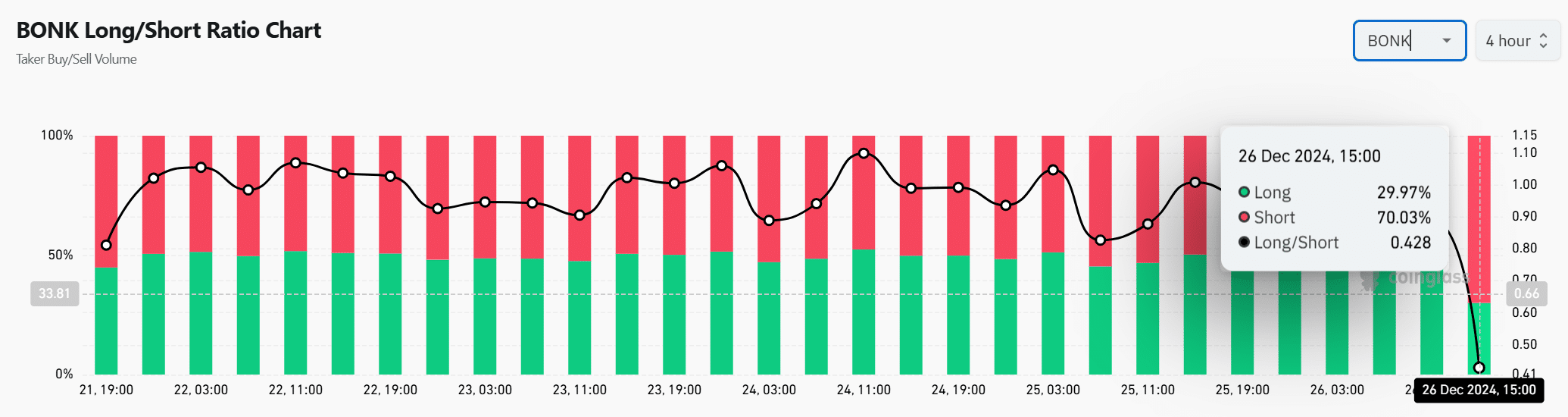

Market sentiment is heavily tilted towards short positions. As of December 26, only 29.97% of positions were long and 70.03% were short.

This shows that traders are expecting further declines in the BONK price.

Large near-term rates suggest a bearish outlook, but could lead to a short squeeze if the market moves in an unexpected direction.

Source: Coinglass

What do technical indicators suggest about the price trend?

Technical indicators show mixed signals. The average direction index (ADX) is 23.51, indicating a weak trend, and the moving average convergence divergence (MACD) is -0.00000036, indicating a negative trend.

These indicators suggest that the market lacks strong momentum to sustain significant price gains in the near term, even if a small rally is possible.

Source: TradingView

market psychology

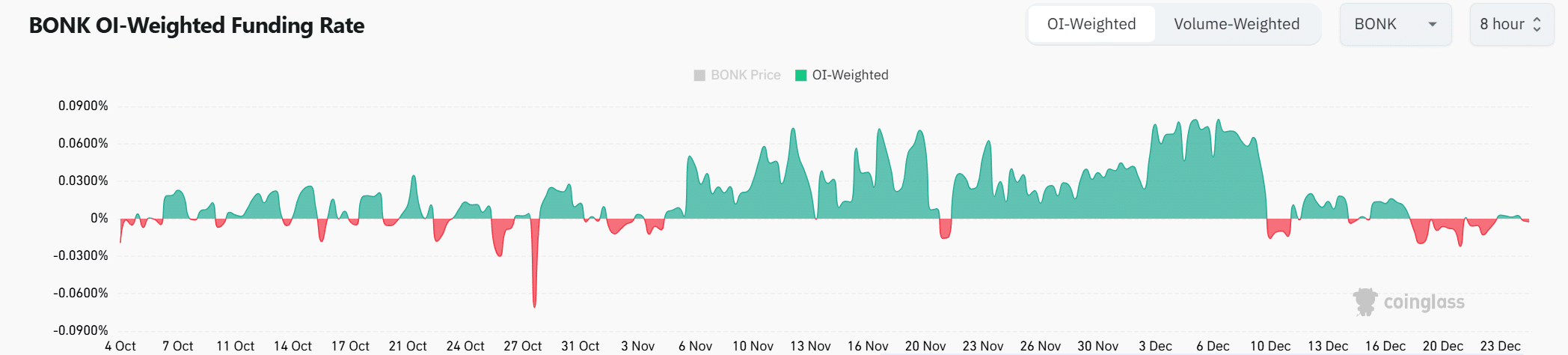

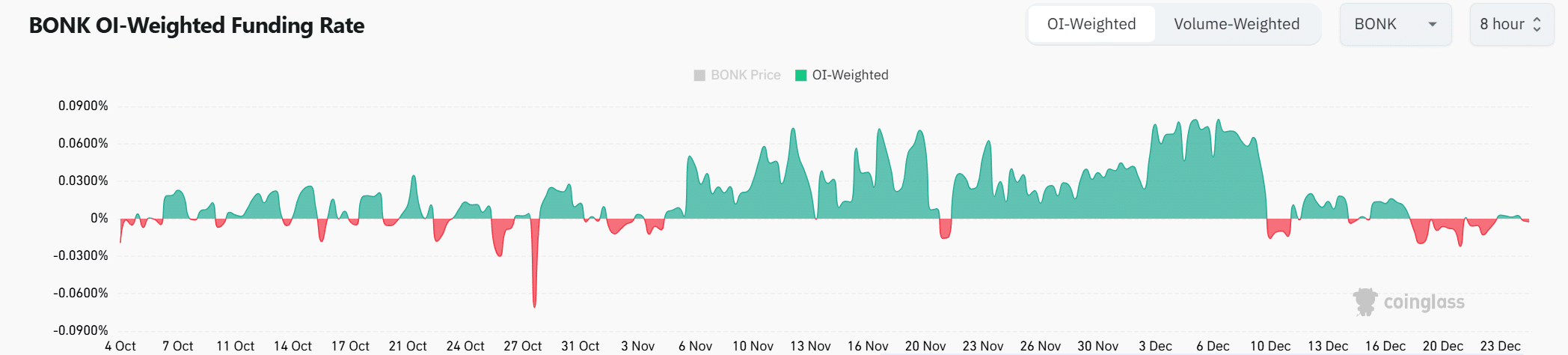

The OI weighted funding rate has fluctuated between -0.09% and 0.09% in recent months and was 0% at press time.

This indicates that traders are unsure about the direction of the market and are hesitant to take large positions, thus taking a neutral market stance.

Source: Coinglass

Read Bonk (BONK) price forecast for 2024-2025

While BonkDAO’s token burn event reduced the supply of BONK, the current bearish sentiment reflected in social volume, long/short ratio, and weak technical indicators suggested that this deflationary measure is unlikely to trigger significant price appreciation in the near term.

Therefore, absent a new catalyst, BONK is unlikely to experience significant price appreciation.