- Toncoin’s risk exposure ratio is rising, indicating market confidence.

- Market indicators suggest that TON could confirm a trend reversal and take profits.

On the weekly chart, Toncoin (TON) recovered modestly on the price chart. During this period, the altcoin soared from a local low of $4.7 to a high of $6.09. However, over the past three days, altcoins have rebounded somewhat. In fact, at the time of writing, Toncoin is trading at $5.66, down 0.98% in the last 24 hours.

This comes after the altcoin fell 10.81% on the monthly chart.

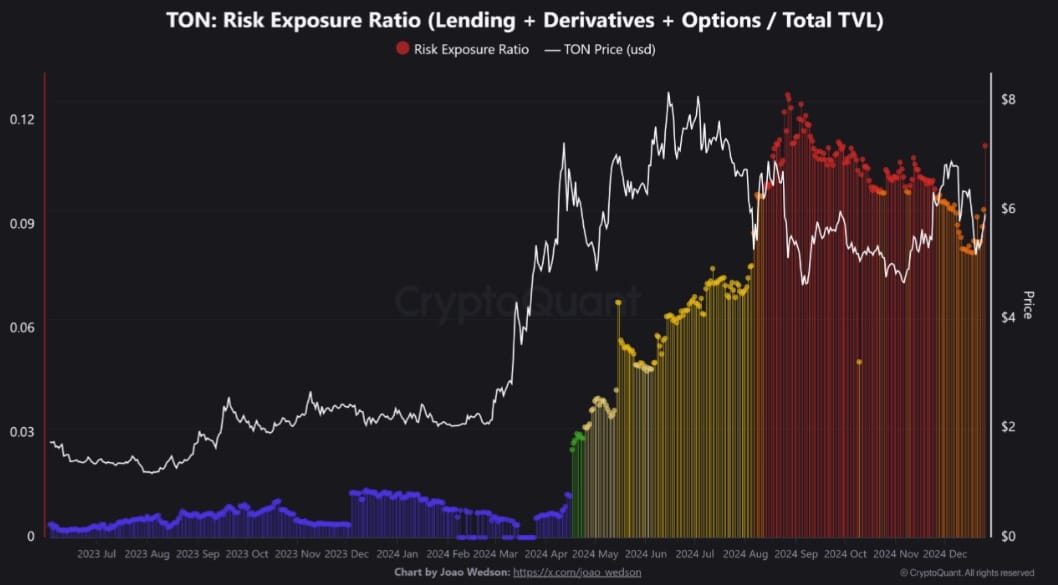

This market volatility has analysts talking about it. One of them is CryptoQuant analyst Joao Wedson. The analyst pointed out that TON’s risk exposure ratio has soared. This is a sign of potential strength.

Toncoin’s risk exposure ratio rises

In his analysis, Wedson assumed that TON’s risk exposure ratio suggests that the level of risk within the Toncoin network is currently moderately high.

Source: CryptoQuant

According to him, the reason for this rise is that a significant portion of TON TVL is allocated to various areas such as loans, derivatives, and options, which are highly exposed to market liquidity risks.

As such, since Toncoin’s last major price rise, the risk exposure ratio has continued to trend upward. This upward movement is a sign of increasing capital inflows into leveraged financial products such as loans and derivatives.

The increase may raise concerns about stability, but it could also signify confidence in the market. Rising demand for derivatives and leverage signals increased market optimism. This is a sign of confidence in market trends and investors’ optimistic sentiments.

However, overleveraged networks can magnify losses during a bearish trend. Therefore, speculative traders who embrace the growing demand to utilize derivatives markets may view this aspect as positive.

What does the price of TON mean?

Rising risk exposure ratios can signal caution as they are correlated with increased volatility, but they can also imply market confidence and optimistic sentiment.

Source: Santiment

We can see this bullish sentiment and market confidence through the continued decline in supply on exchanges.

This was down from 1.9 million the previous week to 1.82 million. This is a sign of increased accumulation as investors transfer TON tokens to their personal wallets for self-storage.

Source: IntoTheBlock

Additionally, whales have been strong over the past three days, with net flows from large holders turning positive at 122.33 million TON tokens. This means that whales are buying and accumulating more tokens than they are selling.

Increased capital inflow from whales shows market confidence.

Source: Santiment

Lastly, Toncoin’s price DAA divergence has remained positive over the past week. A positive DAA divergence means that the recent price rise is supported by an increase in active addresses. Therefore, the market is healthy based on strong fundamentals.

In conclusion, it appears that rising risk exposure ratios are attracting more speculative traders to the market. If this trend and capital inflows continue, Toncoin will benefit further. Therefore, TON can recover to the $6.2 level. However, if conservative investors avoid the market and close their positions for fear of greater volatility, TON could fall to $5.4.