- ETH turned green on the daily and weekly charts, up 1.67% and 1.74%, respectively.

- Ethereum futures signaled a potential recovery as selling pressure eased.

Ethereum (ETH) has struggled to maintain upward momentum over the past two weeks. During this period, the altcoin traded within a consolidated range between $3,500 and $3,300.

These general market conditions have led key stakeholders to wonder what could push ETH towards recovery.

CryptoQuant analyst Burak Kesmeci therefore pointed out four key futures market indicators and what they suggest about Ethereum’s trajectory.

Futures Market Values Ethereum

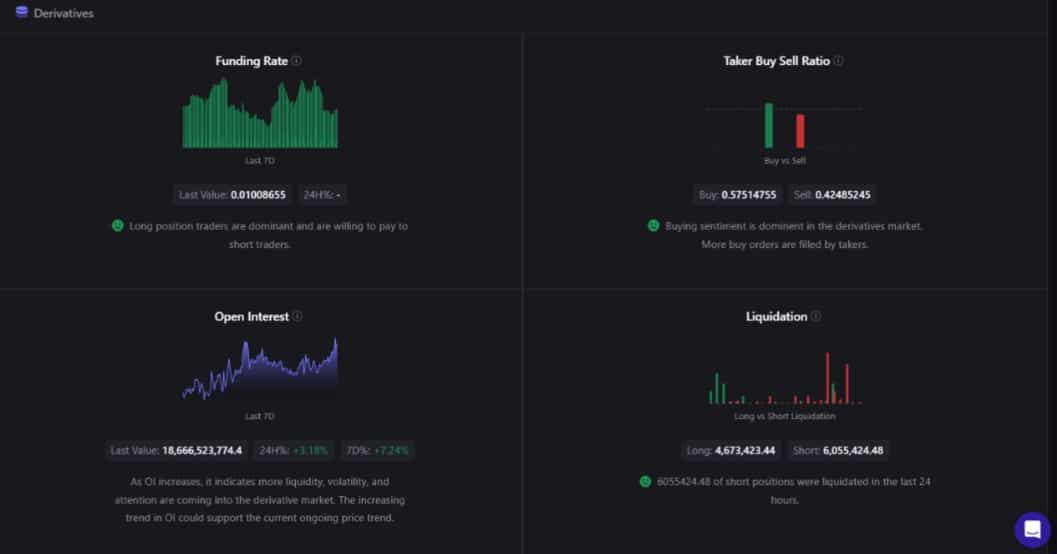

Kesmeci cited four important futures market indicators in its analysis, including funding ratio, taker bid-ask ratio, open interest and liquidation.

Source: CryptoQuant

Ethereum’s funding ratio was 0.01 at press time, indicating that the market is healthy and can support the spot market for ETH for a long time.

Second, Ethereum’s Taker Buy Sell ratio is 0.57, indicating that buying sentiment dominates the derivatives market.

When buyers are active, buying pressure increases, which is critical to driving up prices through demand.

Additionally, Ethereum’s open interest surged 3.18% in 24 hours, signaling a slight, albeit short-term, uptick in derivatives.

Finally, liquidations on Ethereum have shown a significant amount of short positions being actively liquidated, amounting to $6 million over the past day as of press time.

This reduces selling pressure in the derivatives market, canceling out the impact of increased open interest.

As a result, selling pressure in the ETH futures market has eased significantly. However, while open interest may show that the market is heating up, the bulls have entered the market and appear to be strengthening.

Can futures push ETH towards recovery?

Ethereum’s performance in the derivatives market offers promising prospects, but it is important to check again what its performance in the spot market is saying.

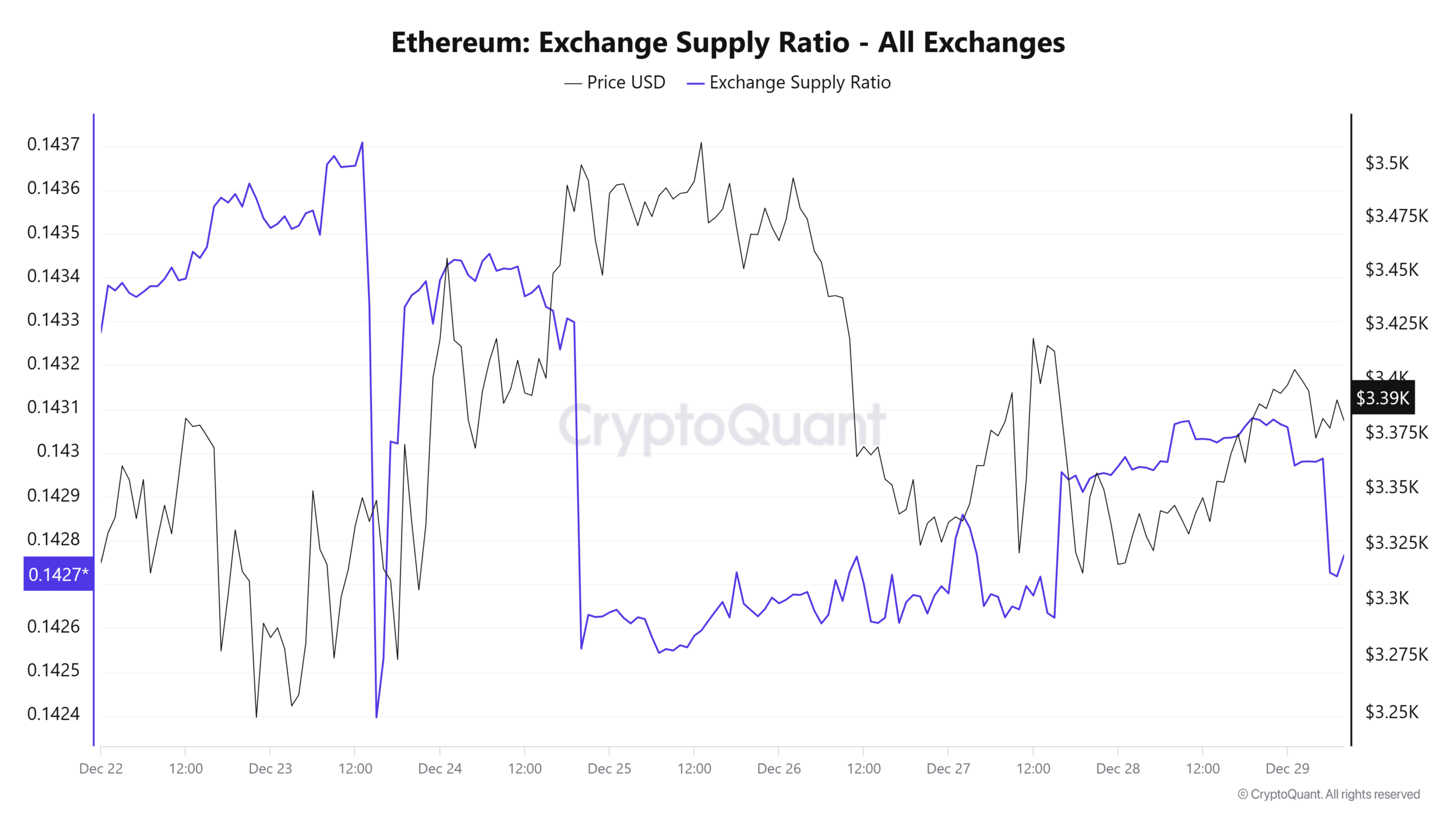

First of all, although exchange supply rates are not limited to the spot market, exchange supply is correlated with spot market activity.

Source: CryptoQuant

Accordingly, ETH’s exchange supply ratio decreased to 0.14 last week as of press time. This decline suggests that investors are keeping their assets off exchanges.

This market behavior reflects accumulation and hoarding in anticipation of better prices.

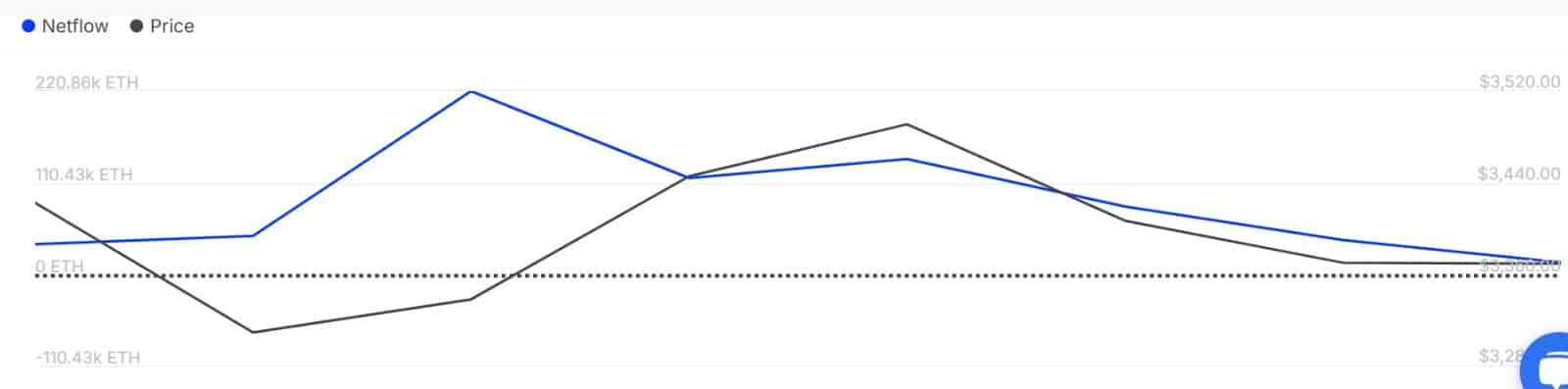

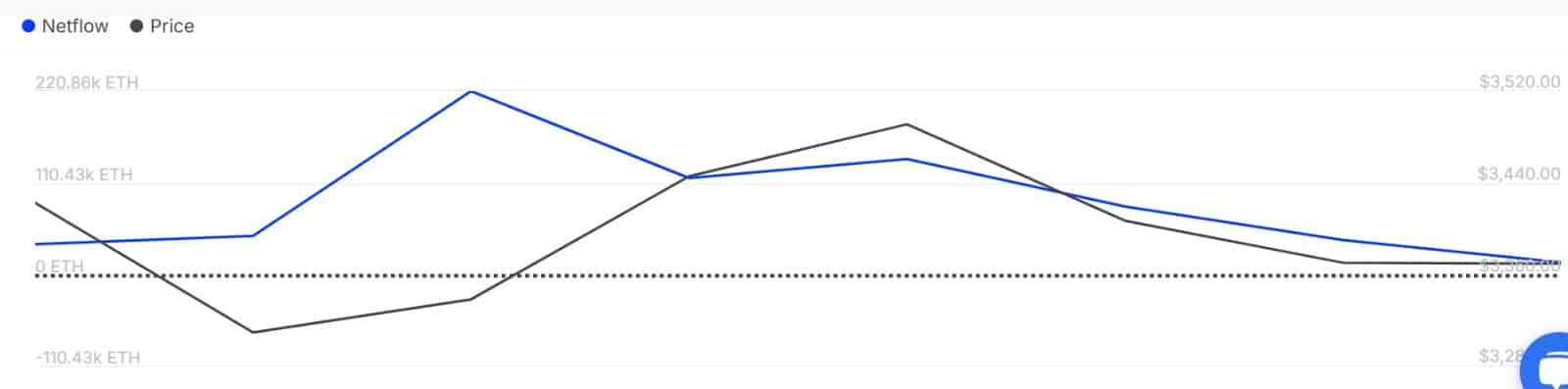

Source: IntoTheBlock

This positive sentiment was also widespread among large holders last week. As a result, net flows from large holders remained positive throughout the week.

This means more capital coming from whales.

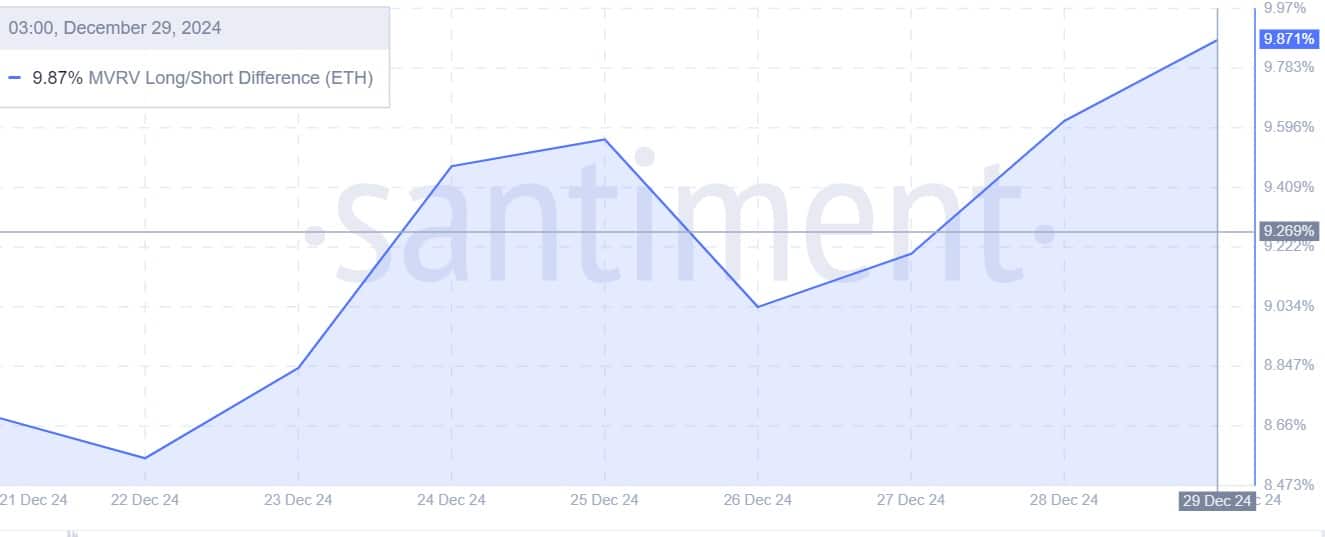

Source: Santiment

Finally, during the accumulation process, long-term ETH holders have become optimistic and confident about the prospects of altcoins since their profit margins are greater than short-term holders.

In conclusion, strength was strengthening across derivatives and spot market activity. As investor confidence in these two increases, Ethereum could see a significant recovery on the price chart.

Read Ethereum (ETH) price prediction for 2025-2026

With rising positive sentiment in the market, ETH could see more gains on the price chart. If these conditions continue, Ethereum could break out of the consolidation range and recover to the $3700 level.

However, if the downside crushing these sentiments outweighs the upswings, ETH could fall to $3200.