- The number of transactions on Solana has increased recently, but market activity appears to be dominated by sellers.

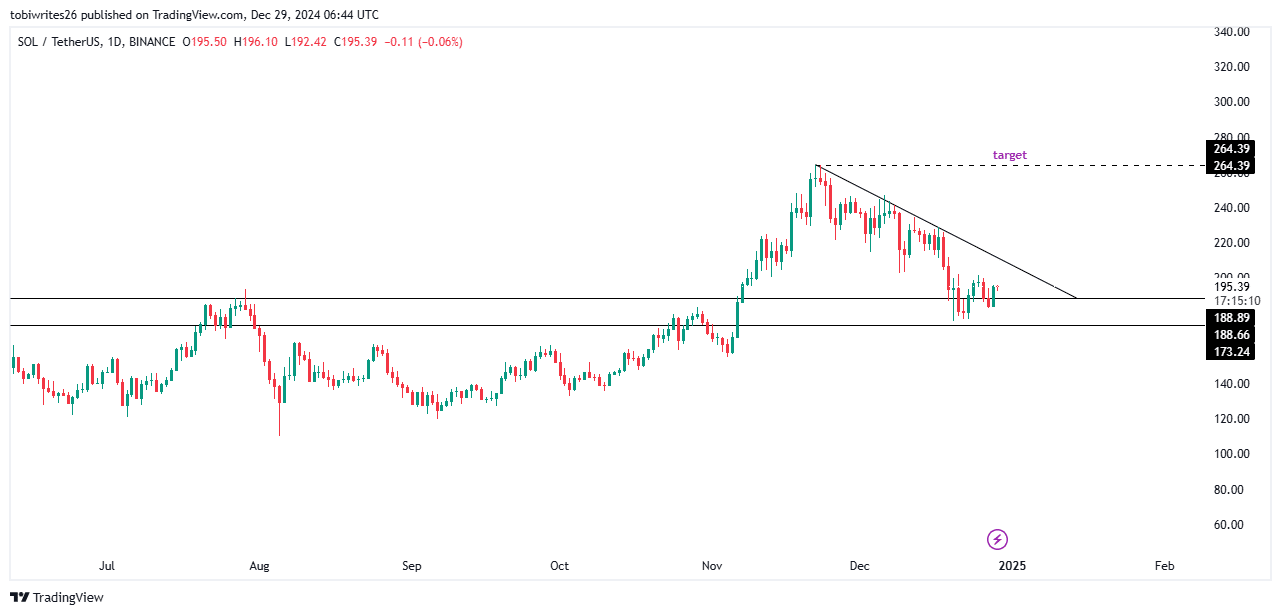

- On the chart, SOL stayed within a bullish pattern that could lead to a return to previous highs.

Solana (SOL) hit an all-time high in December and then rebounded, falling 18.18% over the past month.

However, the narrative appears to be changing, with the asset up 7.09% in the past week and 5.42% in the last 24 hours.

Despite the apparent bullish momentum, uncertainty persists. The overall structure is bullish, but recent selling pressure is raising questions about the sustainability of the trend.

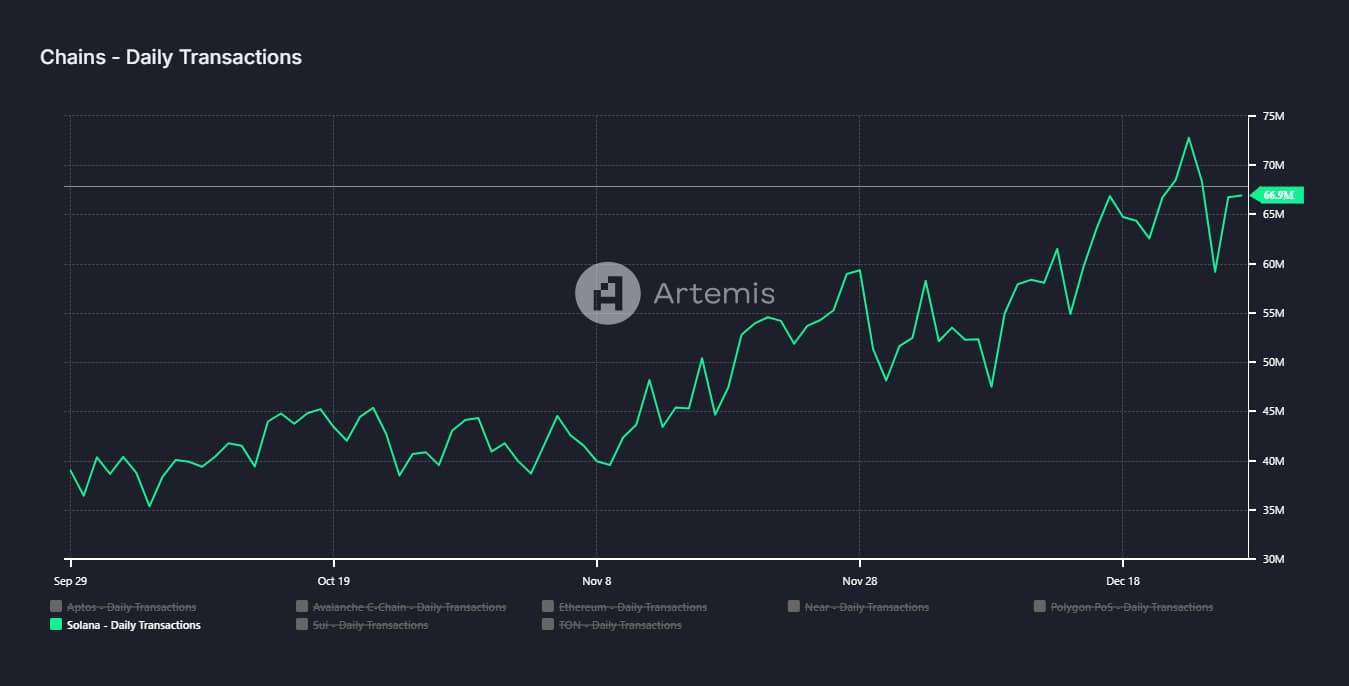

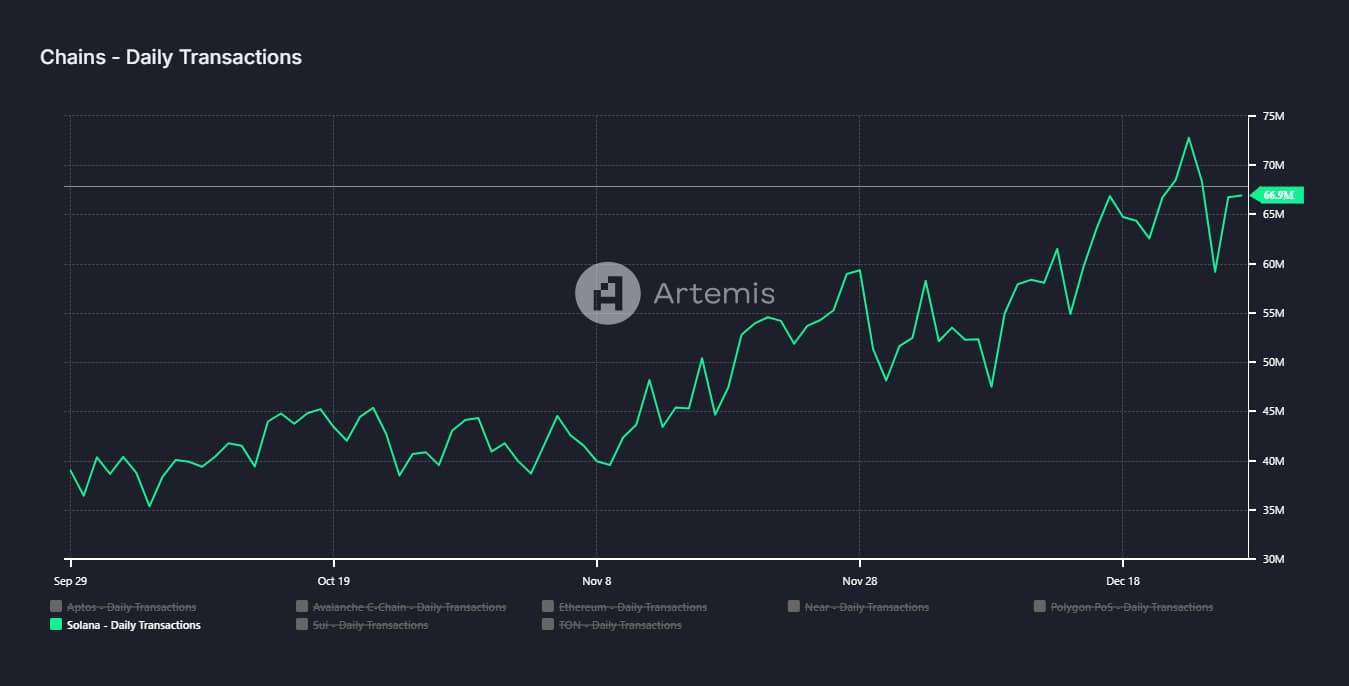

Number of transactions has surged, but sellers dominate

Solana’s network has recorded a surge in trading activity, with 66.9 million transactions executed in the last 24 hours. This happens as the asset gradually recovers from its recent decline.

Source: Artemis

A spike in the number of transactions can indicate bullish or bearish sentiment, depending on whether market participants are buying or selling. To identify trends, AMBCrypto analyzed Solana’s Exchange Netflow.

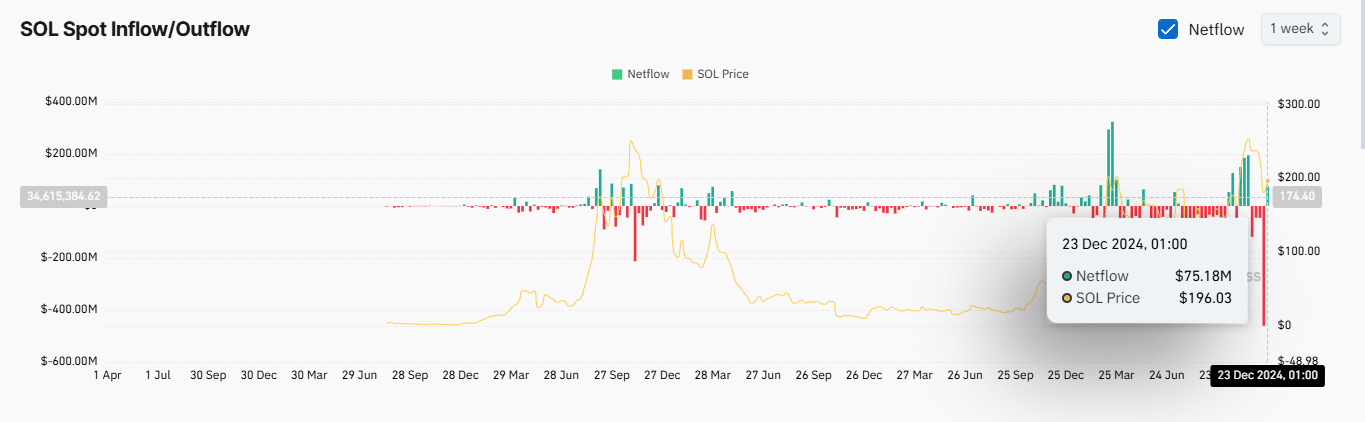

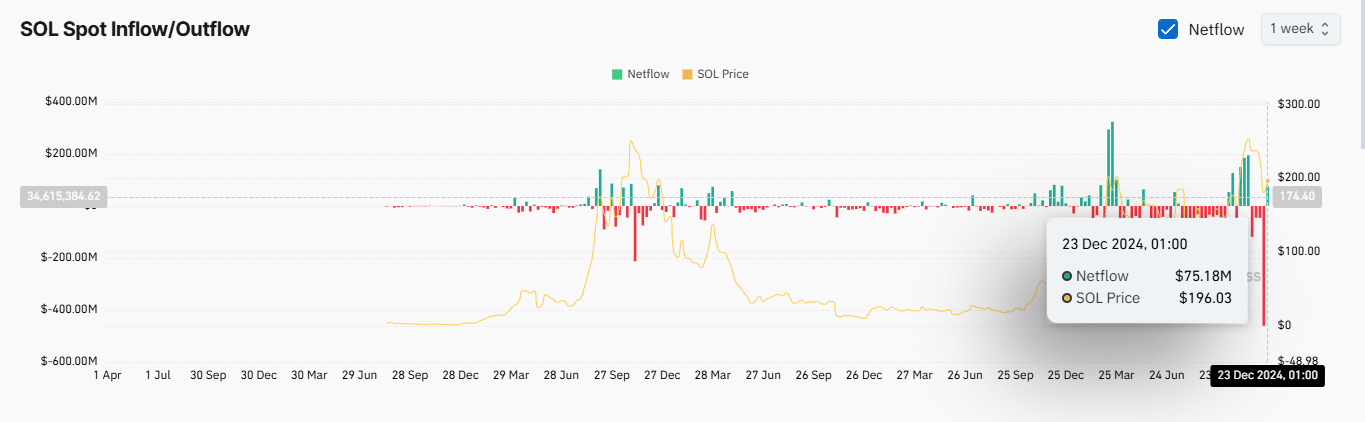

Exchange Netflow measures the difference between inflows and outflows of assets on an exchange. A positive net flow means there is more selling activity, while a negative net flow means buying pressure is dominant.

Currently, Solana’s Exchange Netflow is negative on both daily and weekly timescales, suggesting that buying activity is outpacing selling.

$6.15 million worth of SOL was sold in the last 24 hours, and $75.18 million worth of SOL was sold in the last 7 days.

Source: Coinglass

Despite the observed buying pressure, SOL’s price surge of 5.42% in the last 24 hours looked fragile.

A closer analysis of trading volume revealed a 25% decline. This suggests that the recent rally may lack sufficient market momentum to continue.

Typically, when a price spike is accompanied by a decrease in trading volume, it indicates a temporary increase without any real market support.

Unless Solana sees a corresponding increase in volume to support price movements, the asset is at greater risk of downside.

SOL maintains bullish potential despite pressure

SOL has entered a key support area on the chart, trading within a bullish triangle structure.

This support level ranges from $188.89 to $173.24. This is an area that has historically been associated with significant buying pressure, but currently no such activity has yet materialized.

Source: TradingView

Read Solana (SOL) price forecast for 2025-2026

If SOL breaches this support area, it will likely re-enter the consolidation phase it recently exited.

Conversely, if the support level acts as a catalyst for a rebound, the asset can experience significant upside. This could propel SOL to previous all-time highs and potentially beyond.