- The U.S. Supreme Court has rejected Binance’s appeal to overturn a class action lawsuit against the exchange.

- The court’s decision caused the price of BNB to fall, resulting in a buy liquidation amount of $1.9 million.

The U.S. Supreme Court rejected an appeal filed by exchange giant Binance, which argued that Binance is not subject to U.S. securities laws because it does not have a physical headquarters in the United States.

that Appeal denied dealt a big blow to Binance Coin (BNB)It fell to a multi-week low of $660 before rebounding to $687 as of press time.

details of the case

This petition stems from a class action lawsuit filed against Binance in 2020. At the time, investors alleged that the exchange offered securities without being registered as a brokerage platform under U.S. law.

Binance has denied these claims, saying it is not a US company and is not subject to US regulations. In March 2022, Binance won the lawsuit and U.S. District Judge Andrew Carter dismissed it.

However, the lawsuit was revived in the Manhattan Court of Appeals in March of last year. that dominate Even though Binance is not headquartered in the United States, it is still subject to securities laws because U.S. investors purchased tokens on the exchange through U.S. servers.

Binance Requests Appeal

Binance appealed This decision was reached by the U.S. Supreme Court in December 2024. The exchange argued that technological innovations have made it easier and more efficient for investors to access foreign financial markets. According to Binance,

“While these opportunities were once available only to those who could travel abroad, work with international investment firms, or set up businesses abroad, the Internet has helped provide the same access to investors with fewer resources.”

But the U.S. Supreme Court rejected the appeal and upheld the Manhattan court’s ruling that U.S. law applied to the exchange. The current case proceeds accordingly.

Impact on BNB

The news that the appeal was rejected stimulated BNB price volatility. actually, coin glass exposed In just 24 hours, $2 million worth of open BNB positions were liquidated, of which $1.94 million were long positions.

Long buyers must sell BNB to liquidate their positions, putting downward pressure on the price. Moreover, long traders are no longer willing to hold positions as funding rates fall.

(Source: Coinglass)

At press time, BNB funding rates had flipped negative. This indicates that short sellers are willing to pay funding fees to maintain their positions.

Is BNB ready to recover?

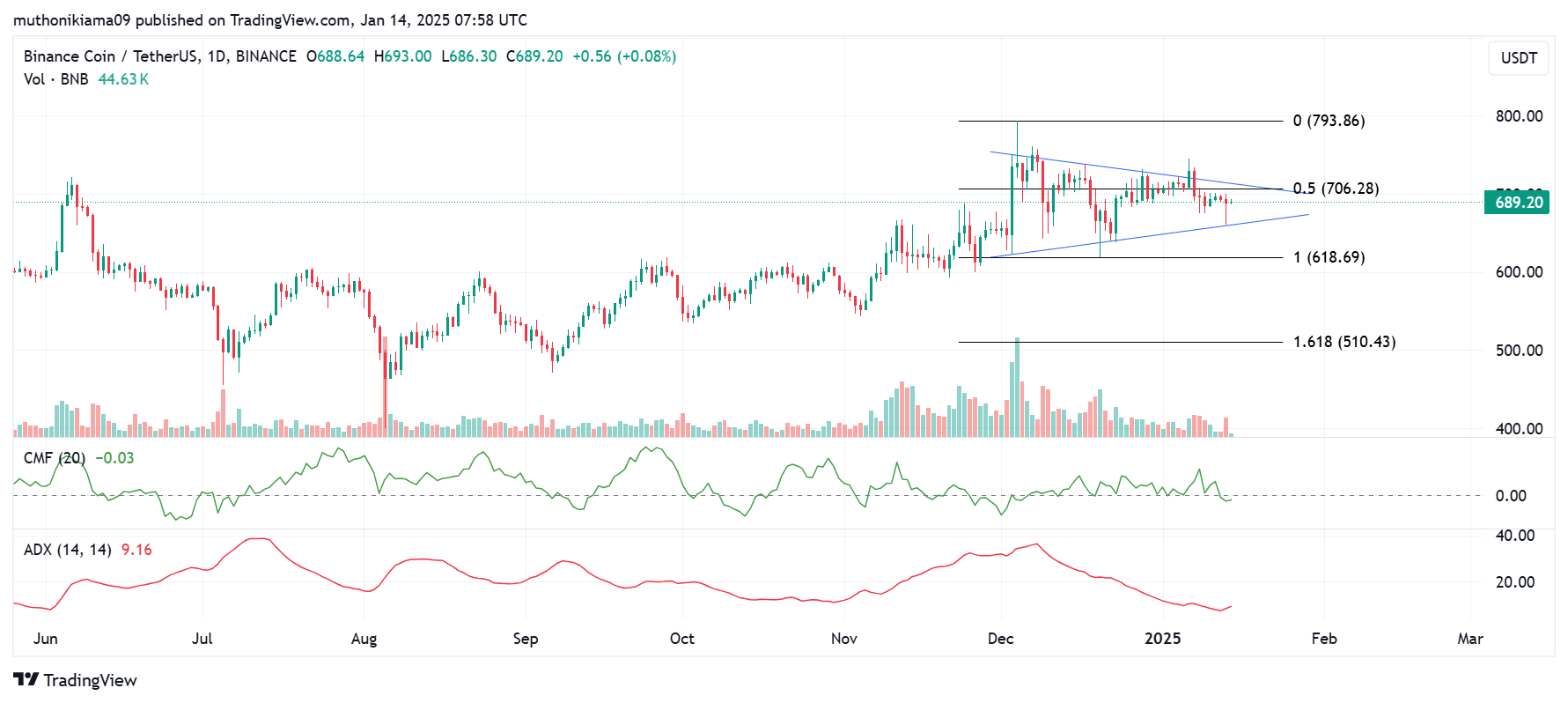

At press time, BNB appeared to be under extreme selling pressure. For example, the Chaikin Money Flow (CMF) indicator fell into negative territory for the first time in three weeks.

The Average Directional Index (ADX) indicator is also tilted northward, indicating that the general downtrend is strengthening.

(Source: Trading View)

Despite the selling activity, Binance Coin was still trading within a symmetrical triangle pattern. A bullish move from this pattern and a reversal of resistance at the 0.5 Fibonacci level (706) could nullify the bearish trend. However, a break below the lower trend line could lead to a decline towards $510.

One factor that could help the bull market is a change in leadership in the United States. Securities and Exchange Commission (SEC). Gary Gensler’s resignation as SEC Chairman could bode well for tokens that have previously been targeted by the commission.