- UNI large transactions surged 694% in the last 24 hours.

- Positive on-chain indicators and bull/short ratio suggest further price rises are possible.

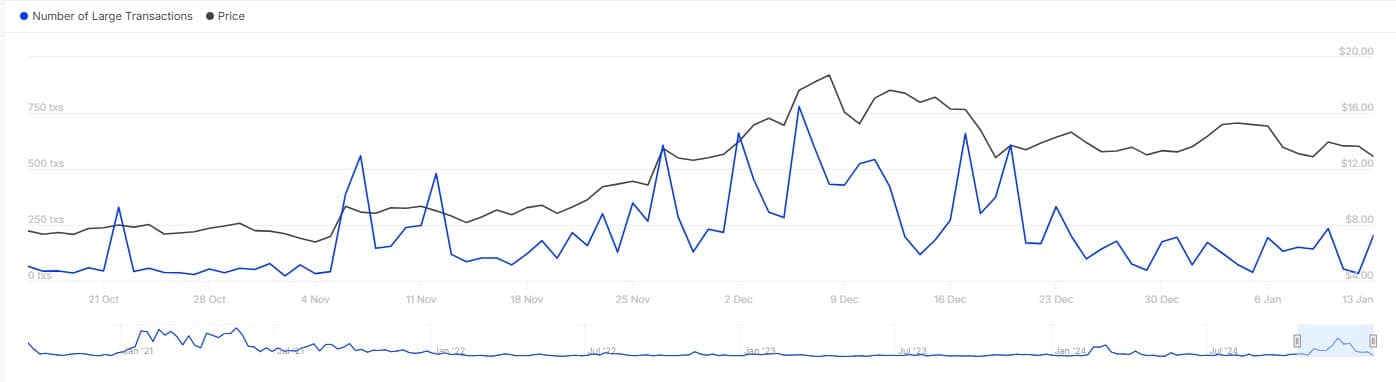

Uniswap (UNI) has recently seen a significant surge in large-scale transactions. According to data from IntoTheBlock, large transactions for the asset have surged a whopping 694% in the past 24 hours.

This surge highlights an influx of whale activity, with potentially big money-makers driving the market as the UNI price finds support near the $12 level.

Historically, an increase in whale activity is often a sign of increased confidence in the token. For UNI, this could set the stage for a notable price move.

Source: IntoTheBlock

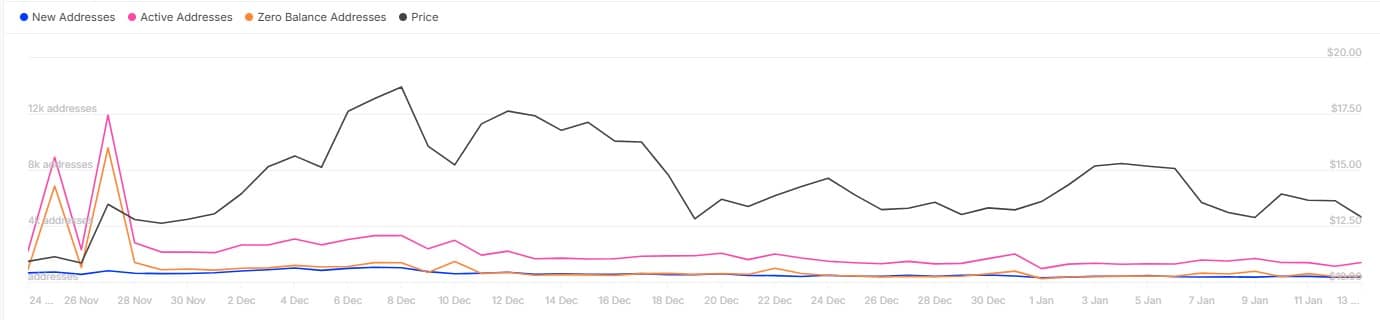

Thanks to this trend, UNI’s trade activities are also gaining momentum. In the same 24 hours, active addresses for altcoins surged by 23%.

This increase in trading activity reflects growing interest and participation in the network, potentially reinforcing bullish sentiment.

Source: IntoTheBlock

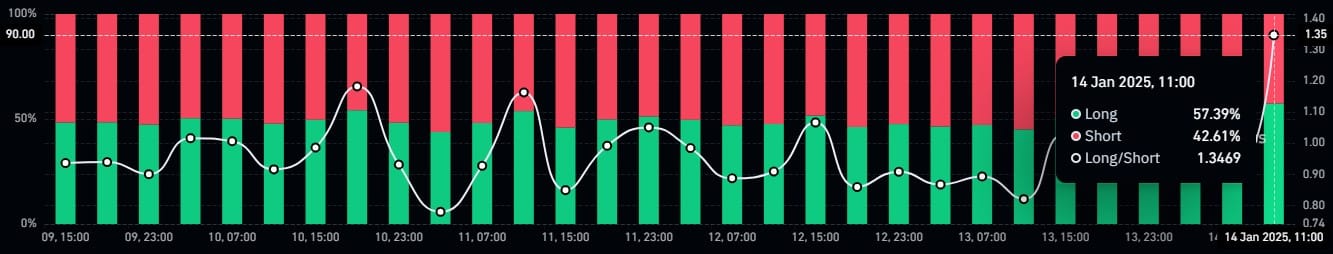

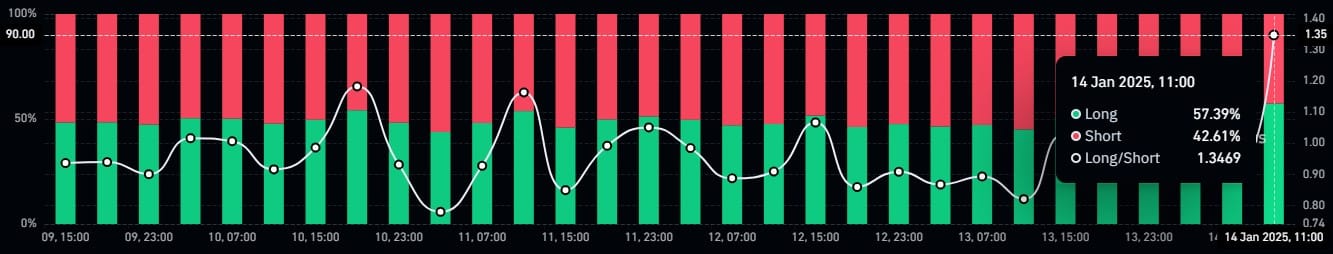

Long/short ratio tilts toward the uptrend

Another indicator that supports the optimistic outlook is the long/short ratio. At the time of writing, the rate was 57%. This indicates that long positions are currently dominating the market.

In general, when buy positions are greater than sell positions, this often signals market-wide expectations for further price rises.

This surge, combined with increased whale activity and relatively strong trading activity, paints an interesting picture for UNI’s near-term trajectory.

Source: Coinglass

Major resistance is seen at $17.

Technically, UNI faces a critical resistance level of $17. A rally to this resistance level may be possible if the current momentum continues. A break above this level could signal the start of a further bullish rally.

Whale activity usually serves as a precursor to significant price movements. With the number of whales increasing, UNI’s prospects look promising.

Moreover, the confluence of whale activity, active address growth, and bullish/short ratios creates a favorable environment for price appreciation.

Source: TradingView

Can UNI maintain the bullish momentum it is building?

Current indicators are encouraging, but market conditions can change quickly. Broader market trends and investor sentiment will play a significant role in UNI’s ability to maintain its upward trajectory.

Read Uniswap (UNI) price prediction for 2025-2026

UNI’s on-chain indicators and whale activity indicate a potential bullish move. If the next resistance level is reached at $17, the altcoin rally could gain further momentum if the current trend holds.