- Stellar reversed SUI by market cap after rising more than 11% in 24 hours.

- XLM’s rally can be attributed to buying pressure, with RSI moving closer to overbought territory.

Stellar (XLM) turned over SUI Based on market capitalization, after rising more than 11% in 24 hours. At press time, XLM, which currently ranks as the 12th largest cryptocurrency with a market capitalization of $14.21 billion, was trading at a weekly high of $0.467.

XLM may be poised for further gains due to the bullish outlook on the lower period chart. This is a sign that we could hit a multi-week high of $0.52 in the near term.

XLM Eyes Get More Gains

Stellar formed a double bottom pattern on the 4-hour chart, suggesting that a continuation of the bull run is imminent. In fact, the critical resistance at the neckline of this pattern also flipped, indicating that the uptrend looked strong.

Now the next target for price is the 1.618 Fibonacci extension level ($0.52). This uptrend will see XLM hit monthly highs.

The volume histogram bars show that buyers are behind this surge after purchase volume reached $154 million. This was also confirmed after the relative strength index (RSI) rose to 71. This is a sign that XLM may be approaching overbought.

(Source: Trading View)

The moving average convergence divergence (MACD) indicator also highlighted the bullish momentum. At the time of writing, the MACD line is positive and sloping northward, highlighting that the bulls are in control.

Long-Term Traders Could Derail XLM’s Rally

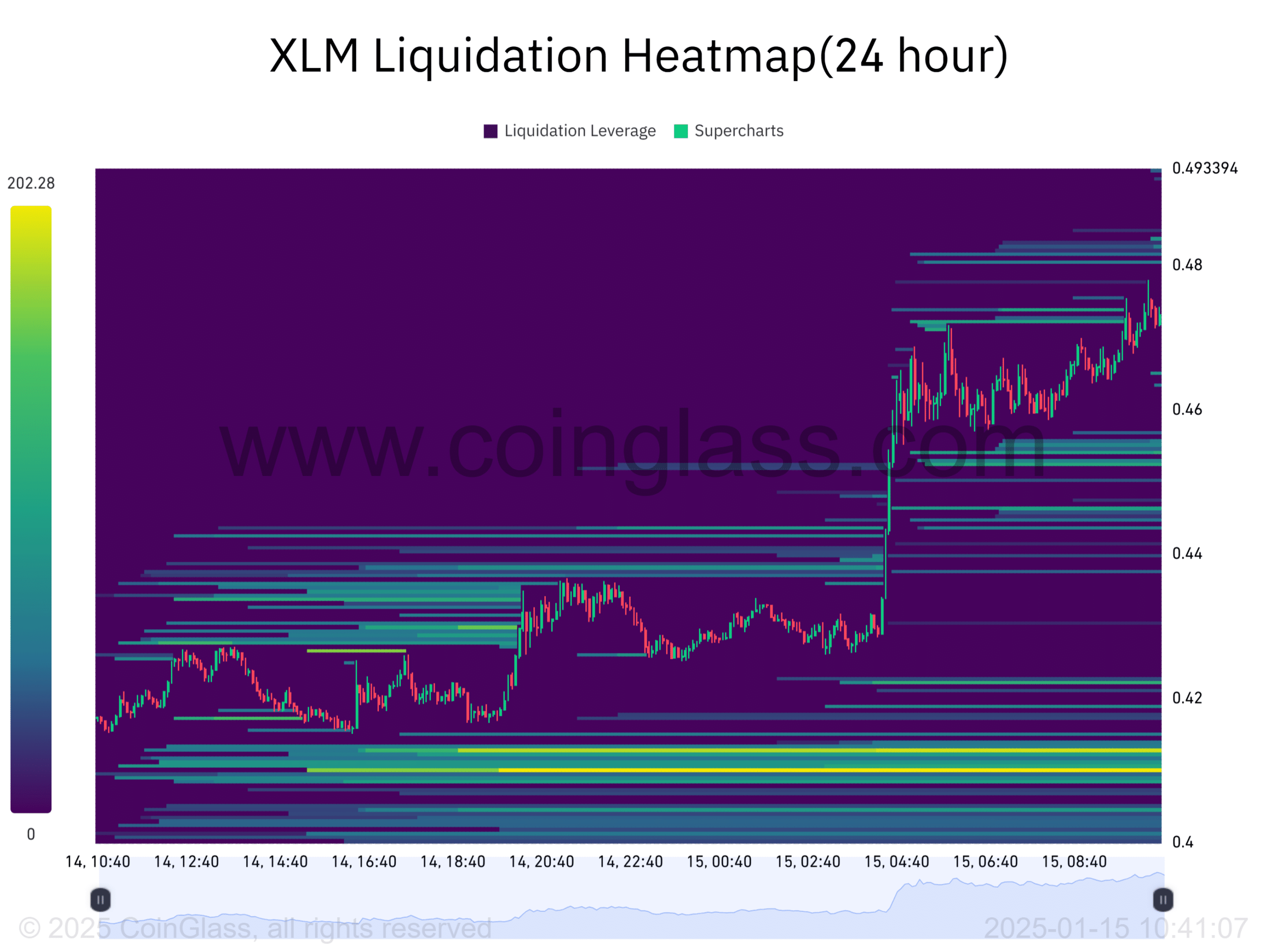

Stellar’s recent gains resulted in a loss of over $1.5 million in short positions. Liquidations appear to have stimulated demand for long positions after the funding rate reversed positively, according to Coinglass. This outlook shows that long traders are now willing to pay fees to hold their positions.

XLM’s liquidation heatmap with a 24-hour viewing period highlighted these short liquidations as the price rose. However, there is a cluster of liquidation levels below the price that can act as magnet zones and push XLM lower.

(Source: Coinglass)

The main clearing zone to watch is $0.40 – $0.41. Many long traders are at risk of being liquidated at this price level. An unexpected decline can trigger a sharp downturn as traders begin to liquidate their positions.

Can XLM emerge as a top 10 cryptocurrency?

After a recent surge in market capitalization, XLM is now close to a turnaround. Avalanche (AVAX)The market capitalization is $15.34 billion. To become a top 10 cryptocurrency, it would need to add more than $5 billion to its market capitalization. Tron (TRX).

This rise could occur considering that XLM’s market capitalization increased from approximately $9.8 billion to $14 billion in the first five days of 2025. However, these gains will depend on whether Stellar can continue and maintain its upward trend.