- XRP’s impressive rally resolves short-term liquidation but increases the risk of a long-term squeeze.

- Risk indicators are rising and liquidity below $2.50 is low, suggesting higher volatility ahead.

XRP investors have reaped significant profits following the token’s recent impressive rise. But looming risk metrics seemed to hint at the chaos that could lie ahead. With over 90% of bearish liquidation levels exhausted and normalized risk reaching extreme levels, could now be the perfect moment to lock in profits before momentum shifts?

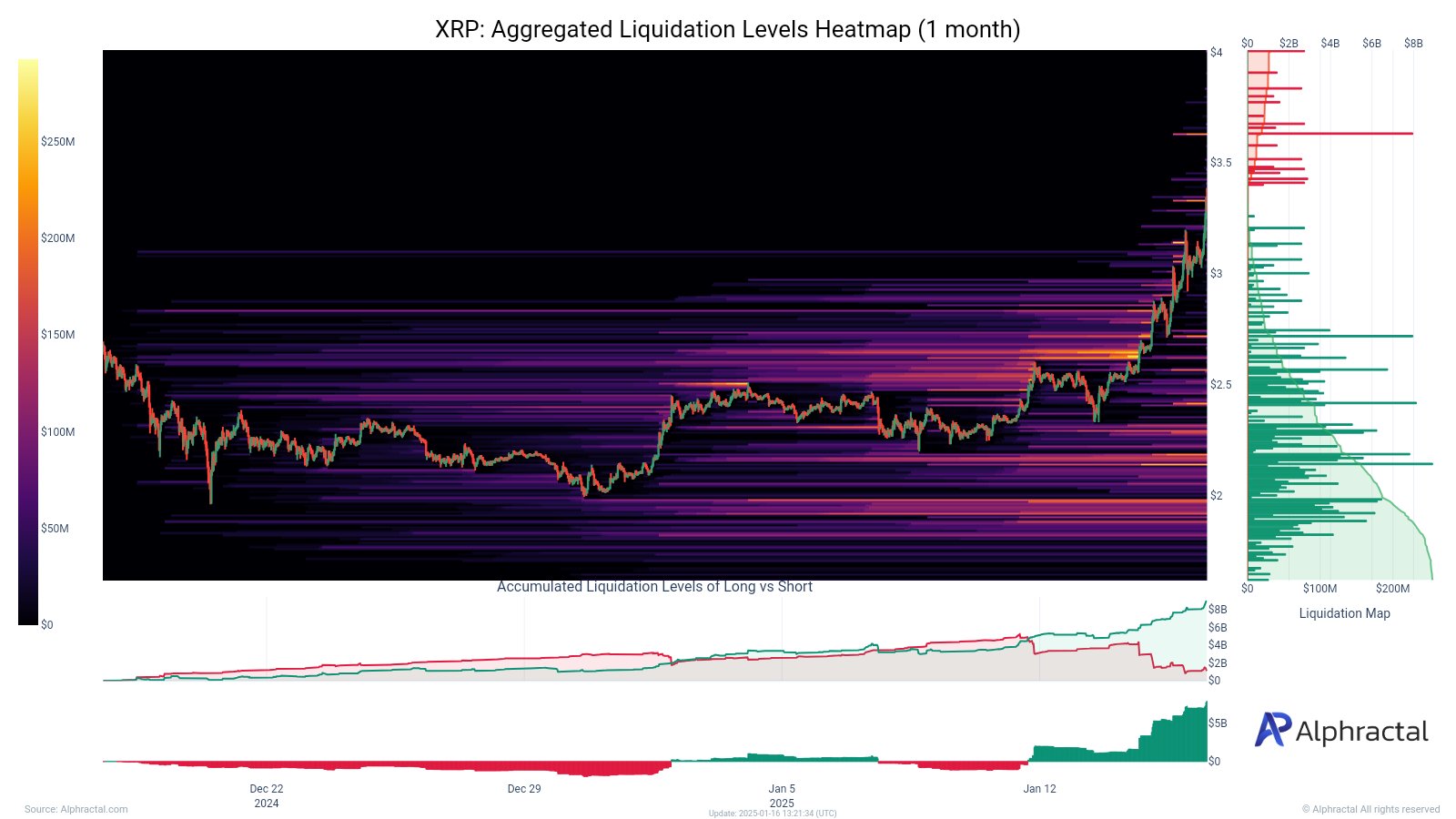

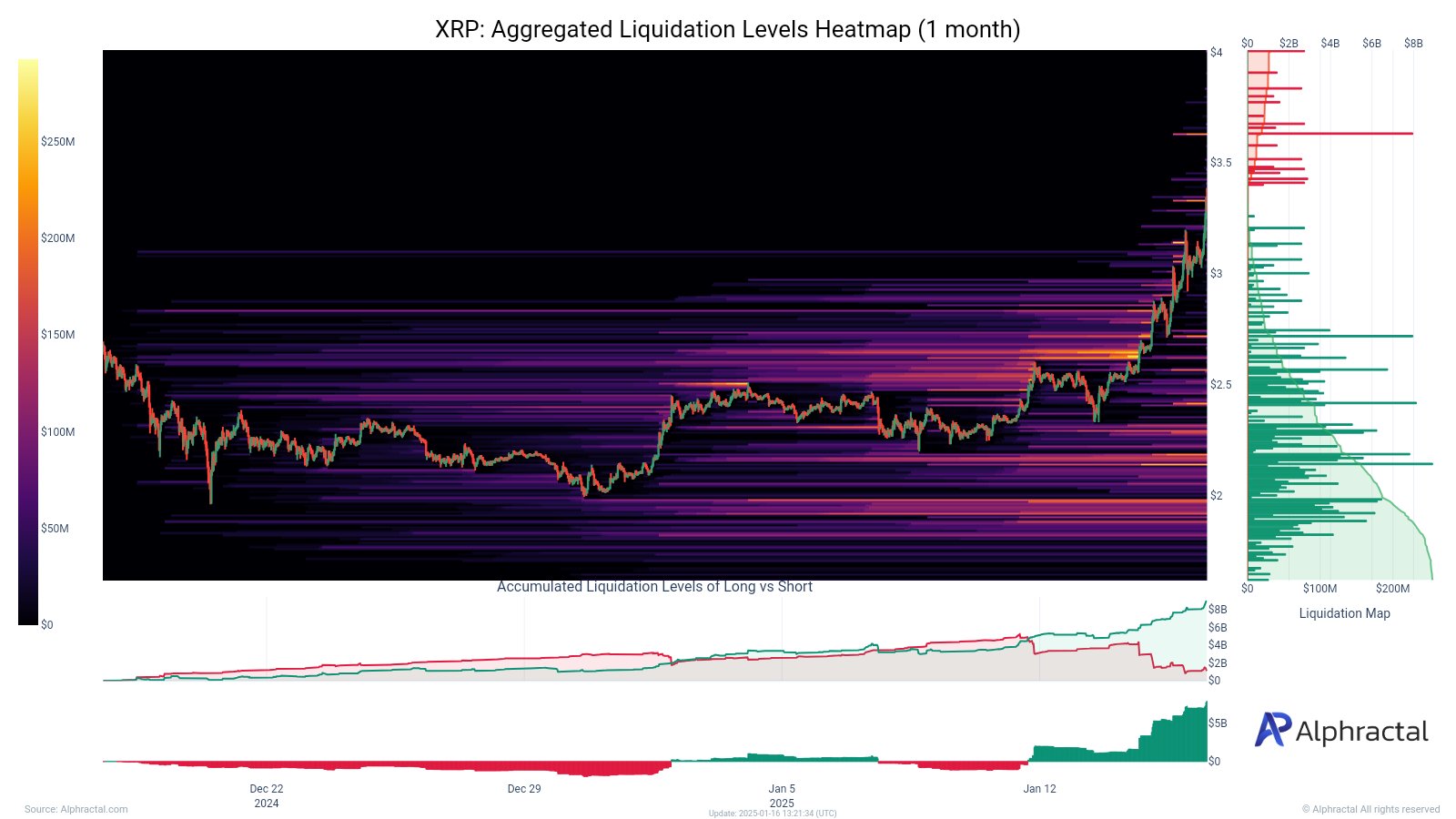

Liquidation heatmap reveals XRP’s weak market dynamics.

XRP’s liquidation heatmap highlights the token’s impressive upside while also exposing its growing market vulnerabilities. The 3-month heatmap shows a dense cluster of liquidations in the $3.00-$3.50 range, with most short positions liquidated, giving strength to the rally.

However, below $2.50, liquidity thins considerably, suggesting support may be limited if the price falls off the chart.

Source: Alpharactal

The one-month heatmap reinforces this view, showing bearish liquidation levels nearly exhausted and long positions accumulating in the $3.25-$3.50 range.

This raises the risk of XRP coming under pressure in the long term if it loses momentum, potentially triggering a sharp sell-off.

Source: Alpharactal

Additionally, the imbalance between stagnant short liquidation and increasing long liquidation is a sign that the market is biased towards bullish sentiment.

XRP’s rally has thrived on a short squeeze, but the lack of bearish liquidity and concentration of long positions means volatility could rise in the future.

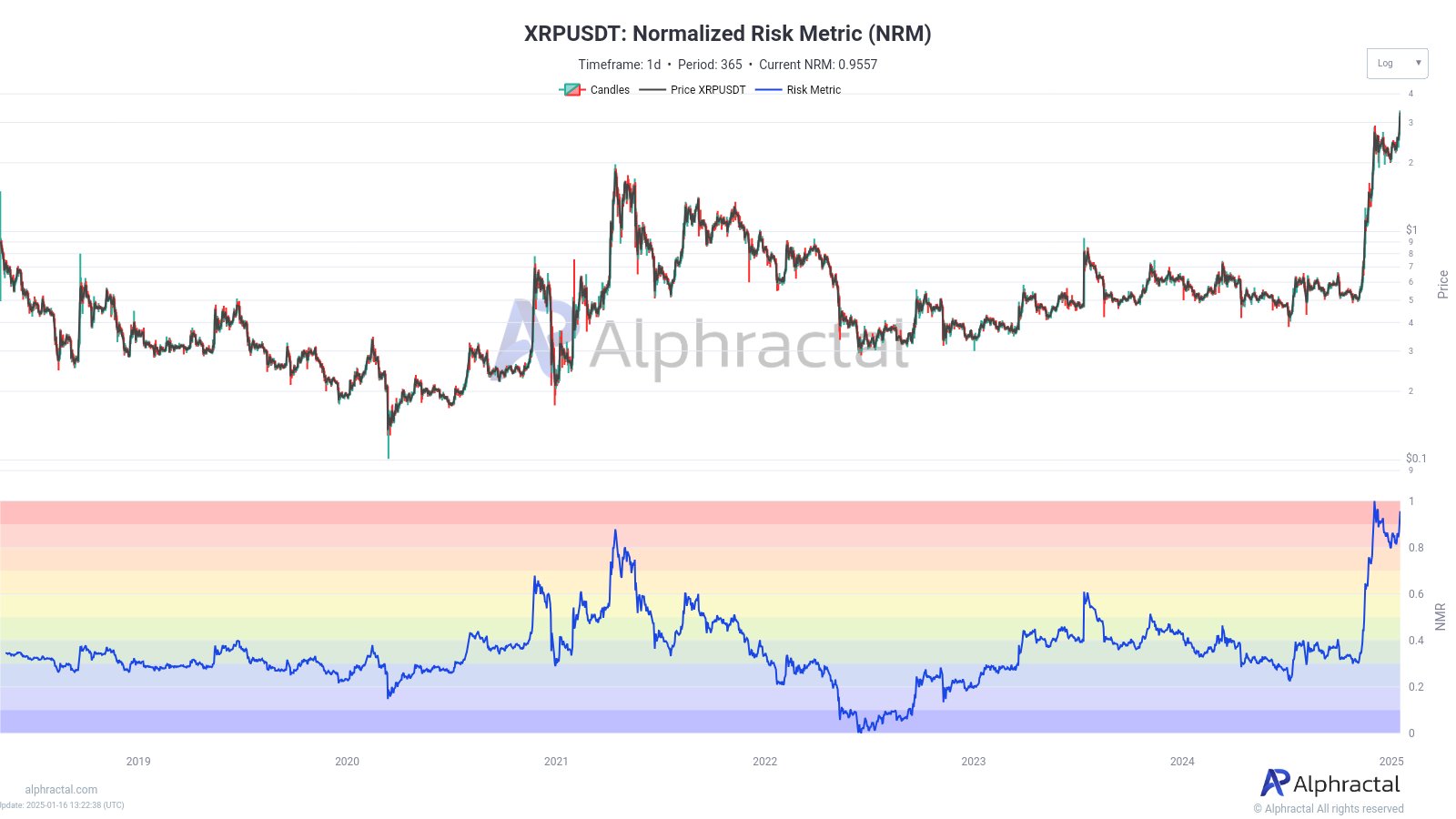

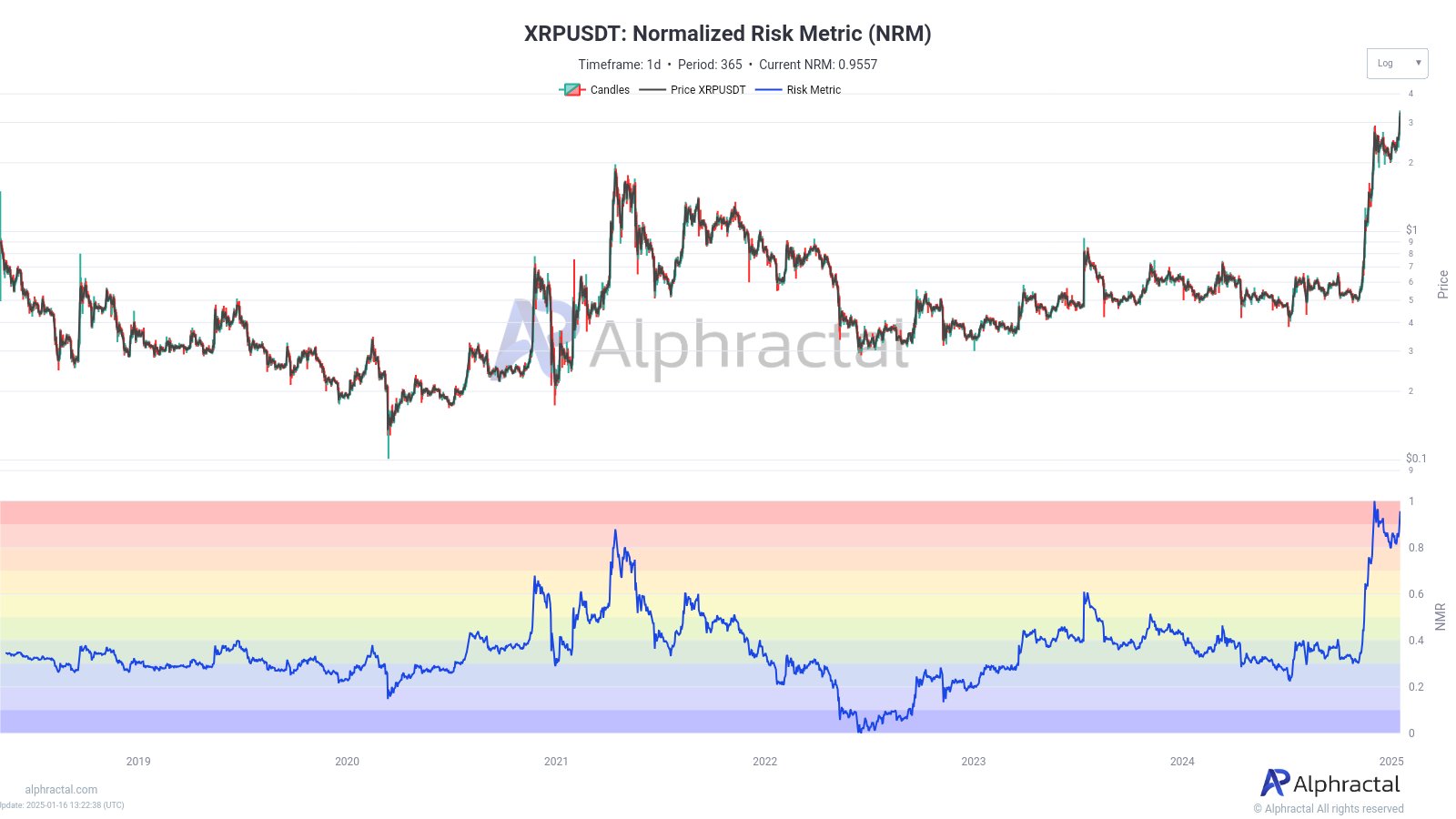

High Risk Indicators for XRP

XRP’s recent rally has been accompanied by worrying signs of heightened risks, with both standardized risk indicators and the Sharpe ratio approaching extreme levels.

NRM’s press time figure of 0.9557 appeared to be close to historical highs prior to past major market corrections, indicating an overheated situation. Now that XRP is firmly entrenched in the risky zone of the risk chart, the likelihood of a price drop will increase.

Source: Alpharactal

Likewise, the Sharpe Ratio, which measures risk-adjusted returns, is reaching unsustainable positive levels. This is the same pattern we saw before previous market corrections.

Source: Alpharactal

This means that XRP’s risk-reward balance is distorted, making the current market dynamics unstable.

Combining these risk indicators with an already overheated market will increase volatility and make charts more likely to revert.

Realistic or not, the XRP market cap in terms of BTC is: