- POPCAT’s long/short ratio was 1.05, indicating strong optimism among traders.

- POPCAT’s RSI suggests there may be ample room for memecoin to rebound.

As the larger market shows signs of recovery, Solana-based memecoin POPCAT has captured the attention of many traders and investors. This lasted for over eight days after the altcoin broke a prolonged consolidation phase on the charts.

POPCAT escapes long-term consolidation

With this breakout, the sentiment surrounding POPCAT may be ready to shift from a bearish trend to an uptrend. In fact, MEMCOIN has already recorded a price surge of over 23%. However, at press time, it appears that some price adjustments are in the works.

The past two and a half months have not been favorable for Memecoin as it has faced sustained downward momentum leading to a price drop of over 70%. In addition to the price decline, Memecoin is also facing trendline resistance. This contributed to the price reversal whenever Popcat’s price approached it.

POPCAT technical analysis and key levels

This time, the price surged more than 23% and entered the trend line. At the time of writing, it appears that we have encountered a price correction at this level.

According to AMBCrypto’s technical analysis, if POPCAT breaks this strong trend line and closes the daily candle above the $0.75 level, it is likely to rise 50% in the coming days and reach the next resistance level of $1.15.

Source: TradingView

Currently, Mimcoin is trading below the 200 exponential moving average (EMA) on the daily time frame, indicating a downward trend.

On the positive side, POPCAT’s Relative Strength Index (RSI) is 43, a technical indicator that suggests there may be plenty of room for memecoin to rally significantly in the future.

Bullish on-chain indicators

In light of the bullish technical and price action of Memecoin, intraday traders are now excited.

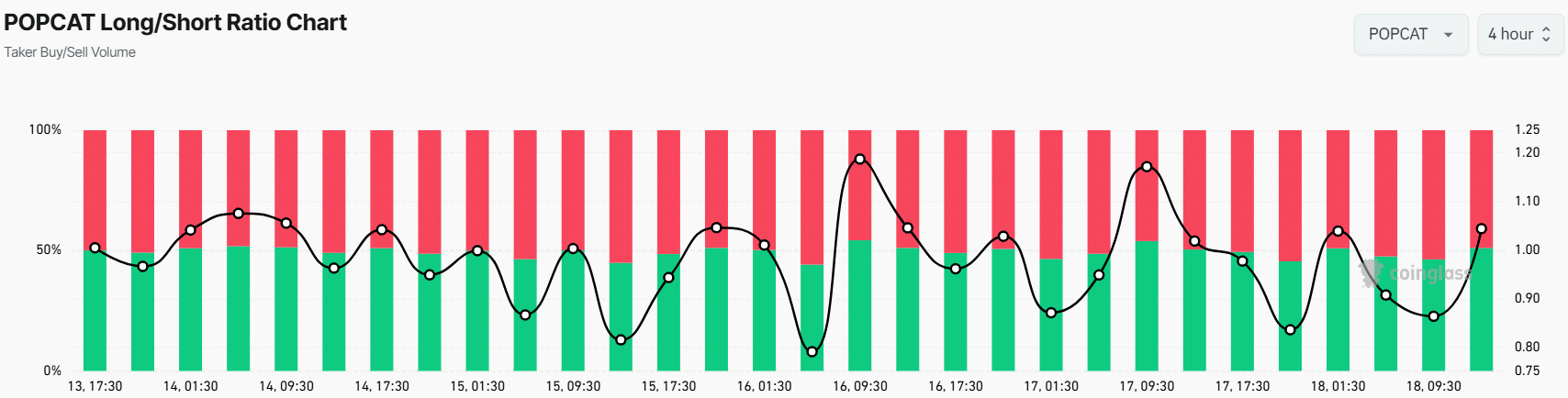

In fact, as on-chain analytics firm Coinglass reveals, they are betting heavily on the long side. The POPCAT long/short ratio was 1.05, highlighting the bullish sentiment of traders.

Source: Coinglass

Additionally, 51.50% of the top traders across the exchange hold buy positions, and 48.5% hold sell positions. However, the proportion on the buy side appears to be continuously increasing.