- WIF is targeting regional highs set earlier this month.

- A near-term drop to $1.7 could be a buying opportunity.

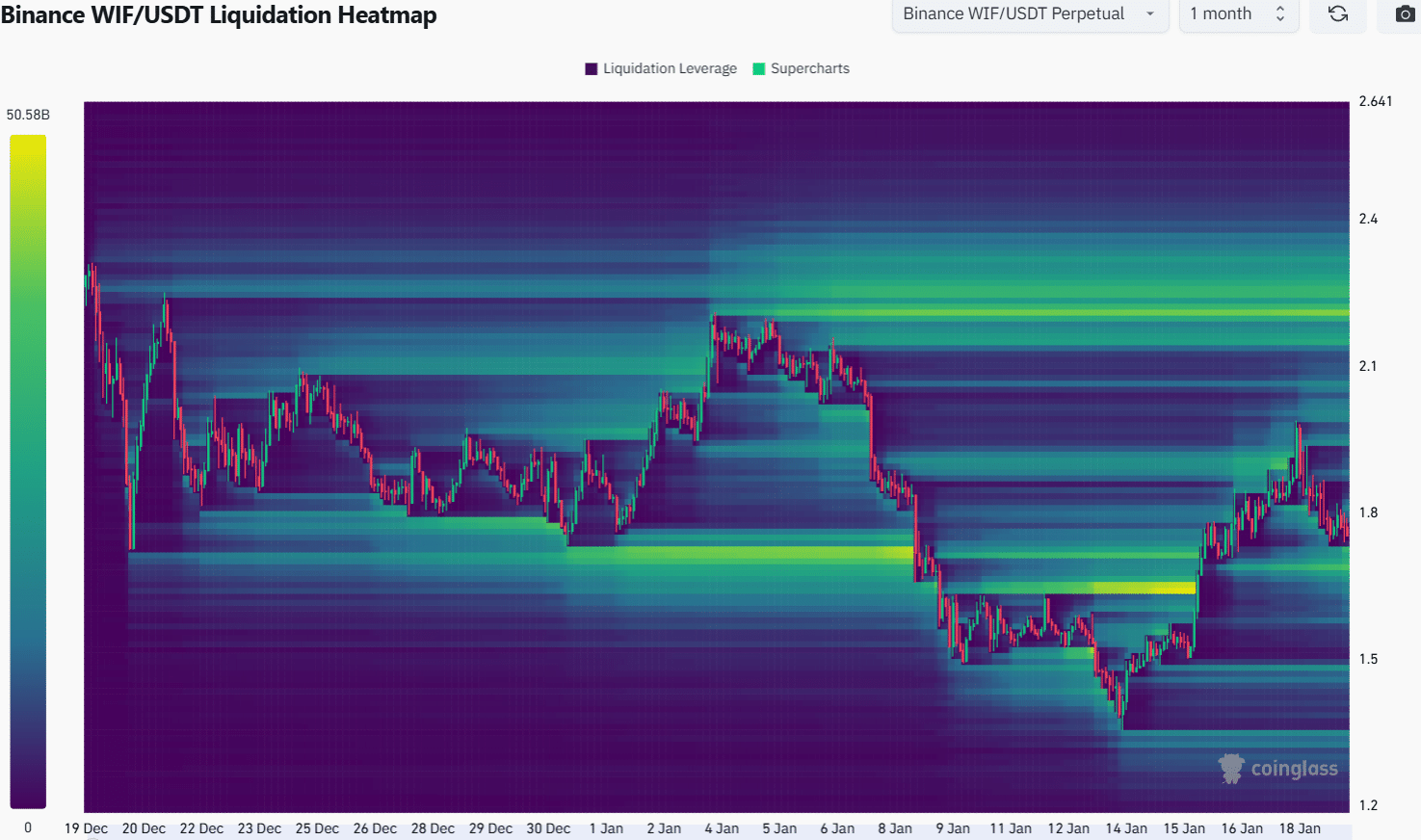

As of press time, dogwifhat (WIF) continues to trend downward on the daily chart. Despite Memecoin’s continued losses, there seemed to be some possibility of recovery. In fact, technical analysis pointed to a bullish momentum divergence. Additionally, the liquidation heatmap suggested a target price for WIF above $2, but there was insufficient buying pressure.

Can the bull market bounce back, or will it end up failing to surpass local highs?

Is WIF starting to recover, or is it bracing for further losses?

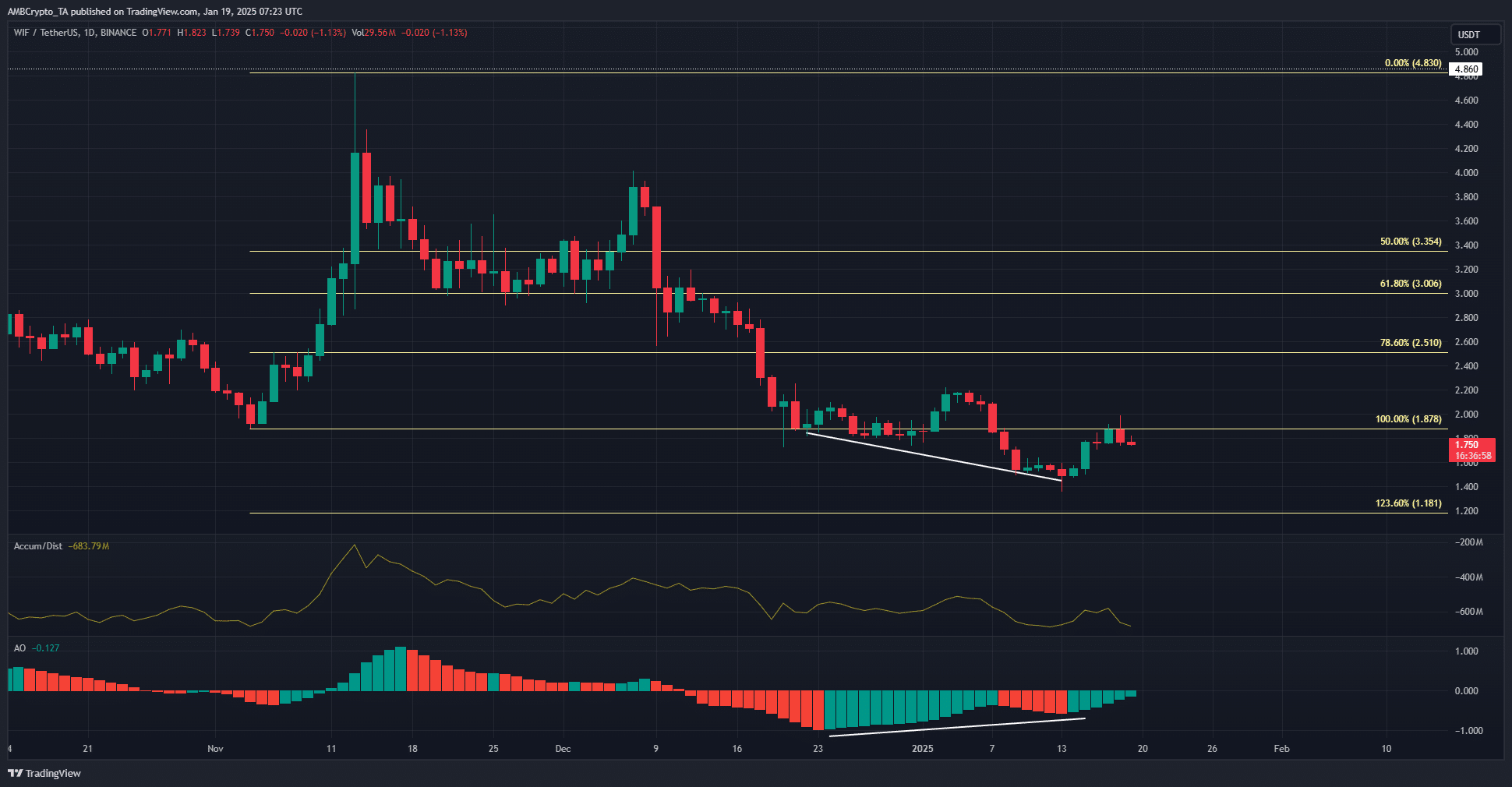

Source: WIF/USDT on TradingView

WIF’s lowest high on the daily chart was set at $2.22 earlier this month. Since then, it has maintained a bearish trend by making lower lows and bouncing back to retest the $1.878 resistance level.

The A/D indicator also showed a downward trend, showing that selling pressure was dominant. The Awesome Oscillator remains below the neutral line, indicating prevailing bearish momentum. Nonetheless, AO formed a bullish divergence against the price.

This means dogwifehat’s downward trend since November is almost over. However, unless capital inflows recover, traders should exercise caution.

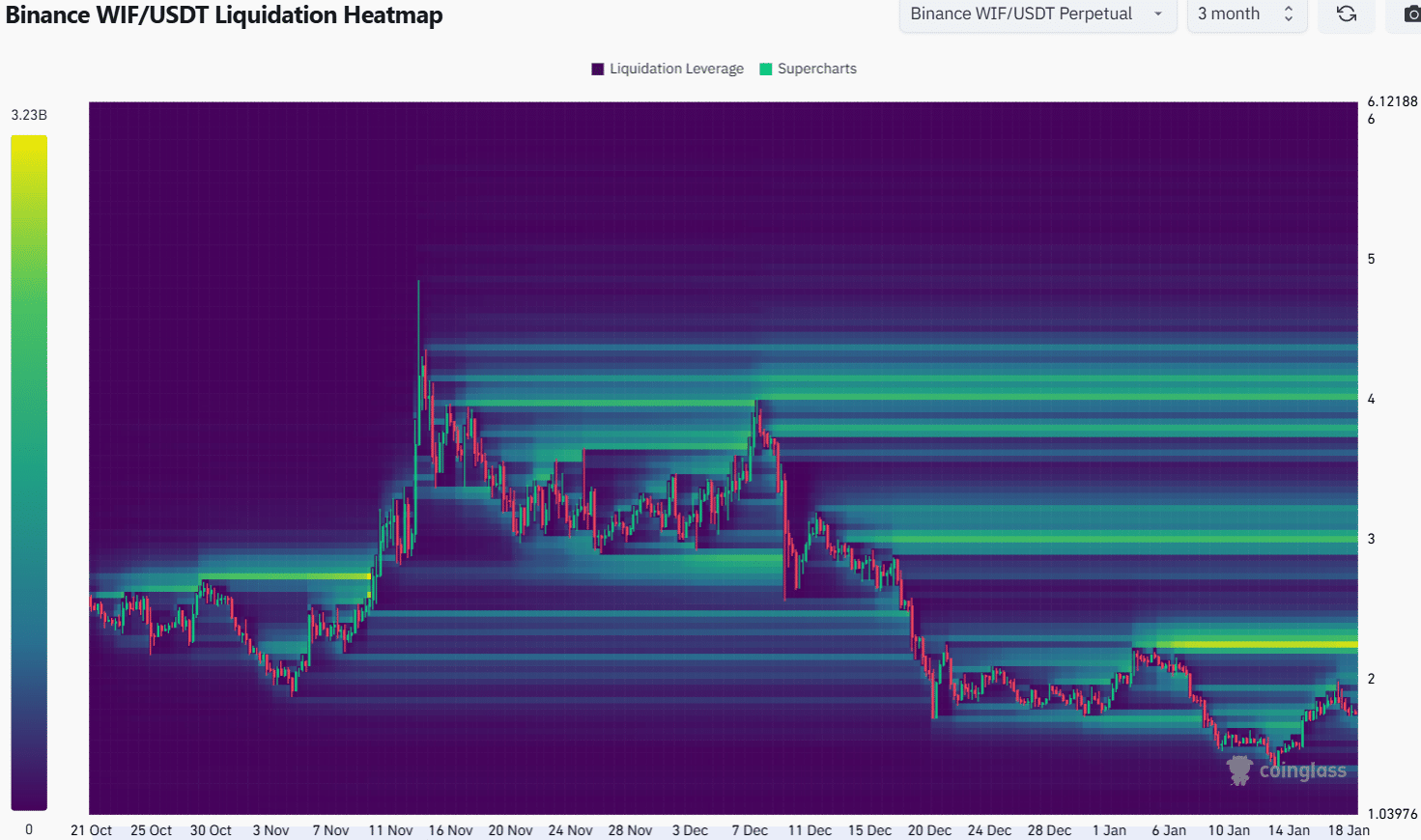

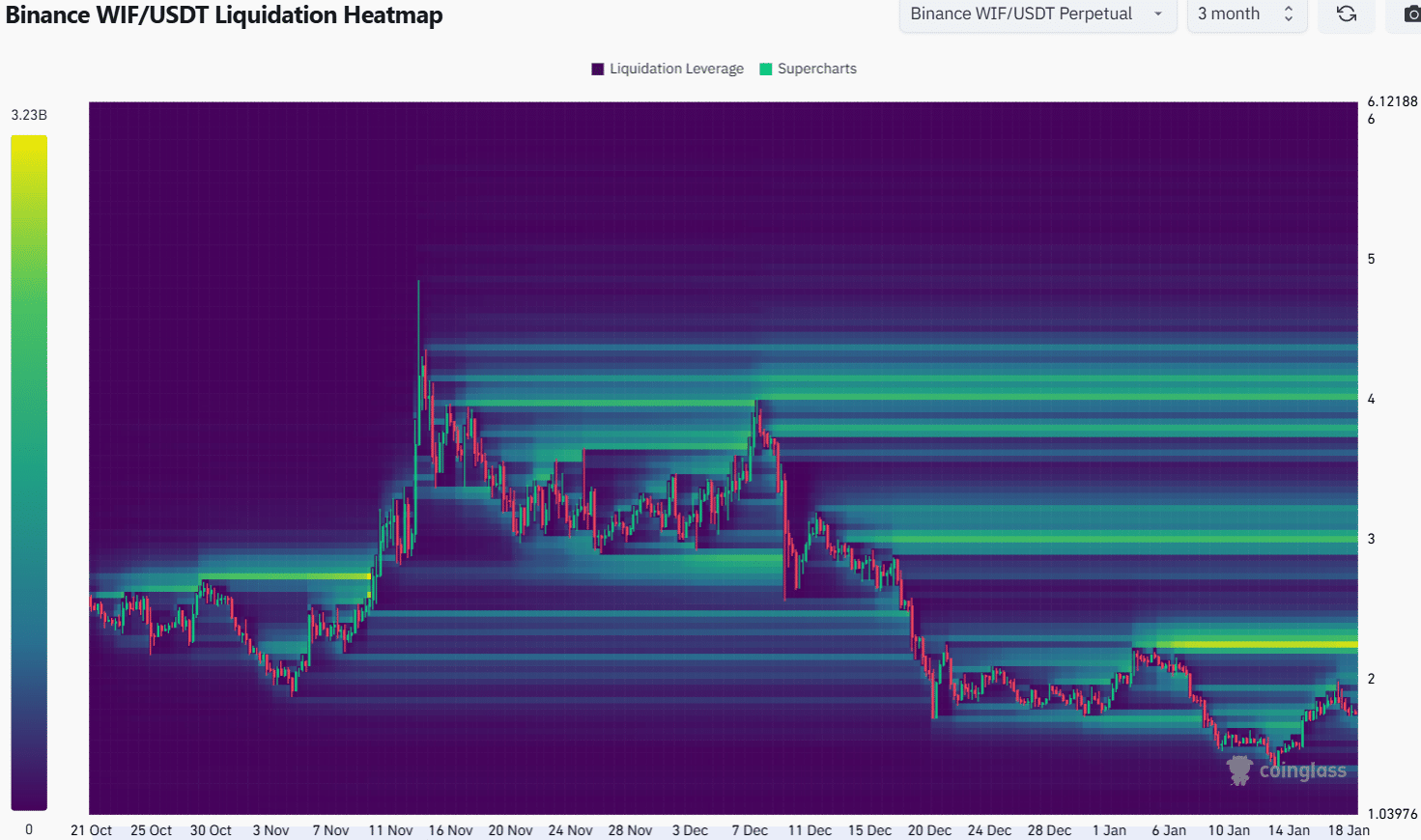

Source: Coin Analysis

The 3-month liquidation heatmap highlighted the $2.25 area as a strong magnetic zone. The local highs of early January were targeted as prices were attracted to liquidity by gathering a significant number of liquidation levels.

Beyond $2.3, the $3 zone would be the next medium-term target.

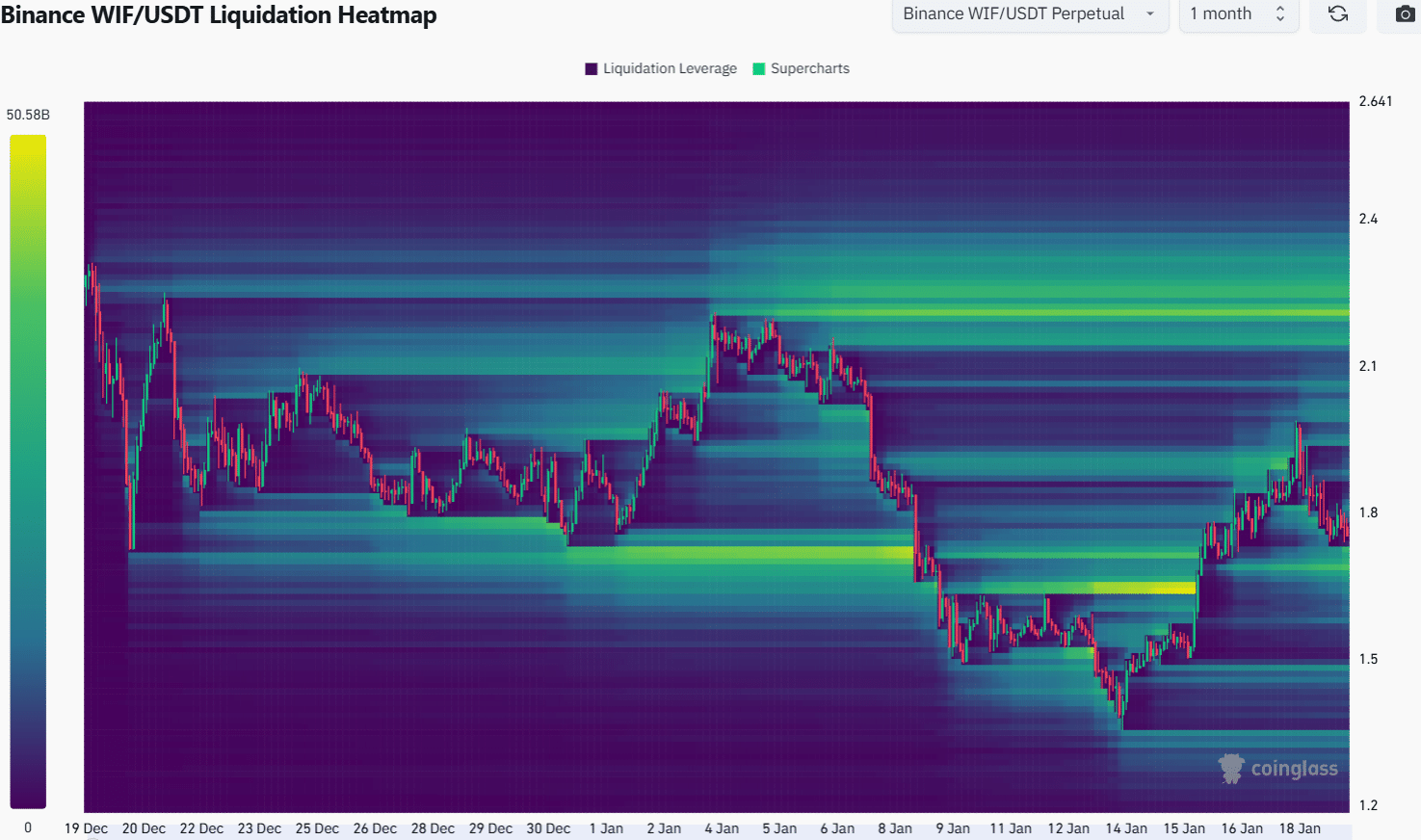

Source: Coin Analysis

Clearing data from last month also noted the importance of the $2.25 zone as a liquidity pool. To the south, the $1.7 level could attract traders’ attention.

Realistic or not, WIF’s market cap in BTC terms is:

At WIF, the price is likely to fall to $1.7 and then rise to $2.25. As there is no buying pressure, it seems highly unlikely that things will go above $2.25 as things stand. This may change over the coming weeks.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.