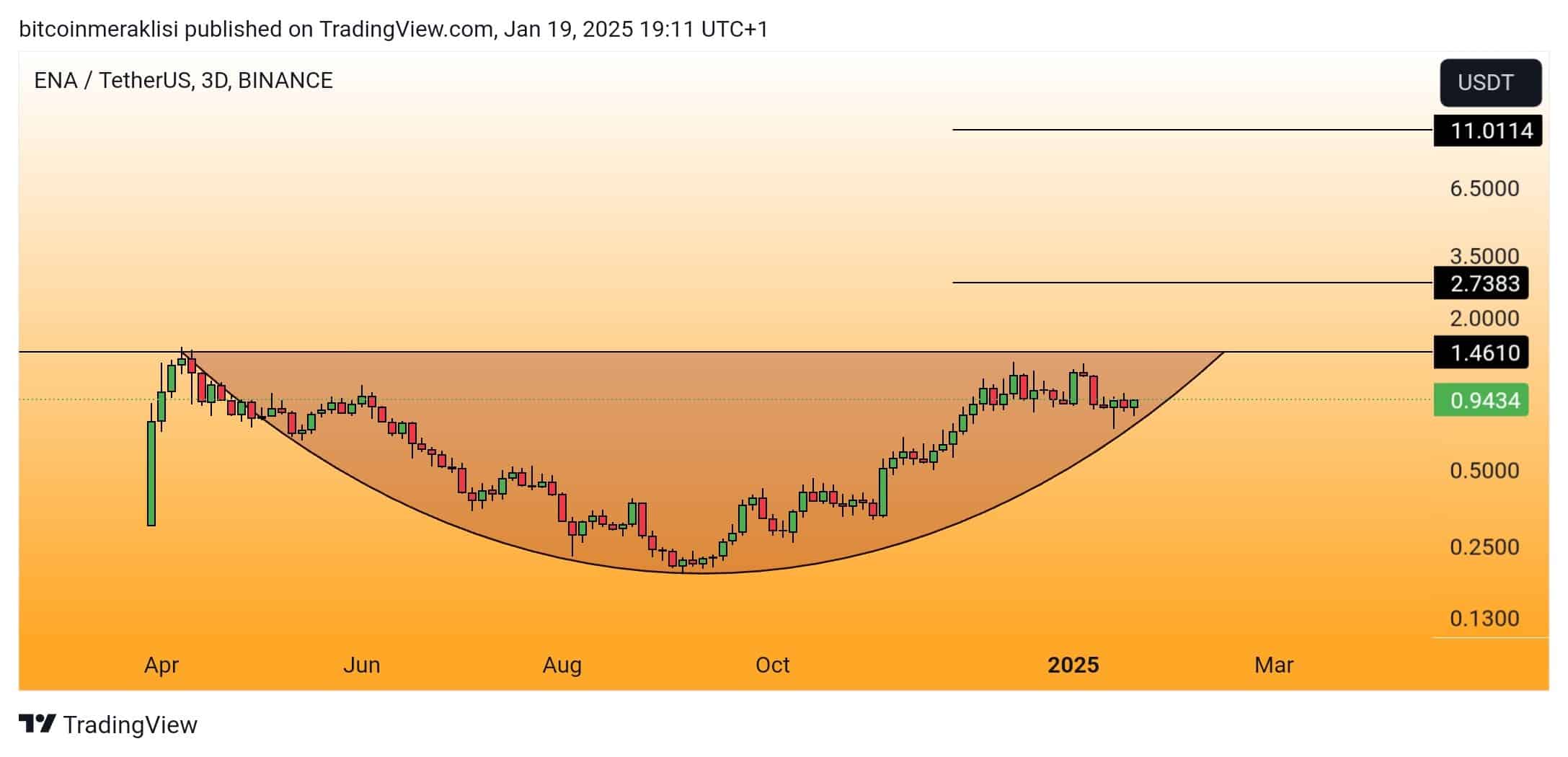

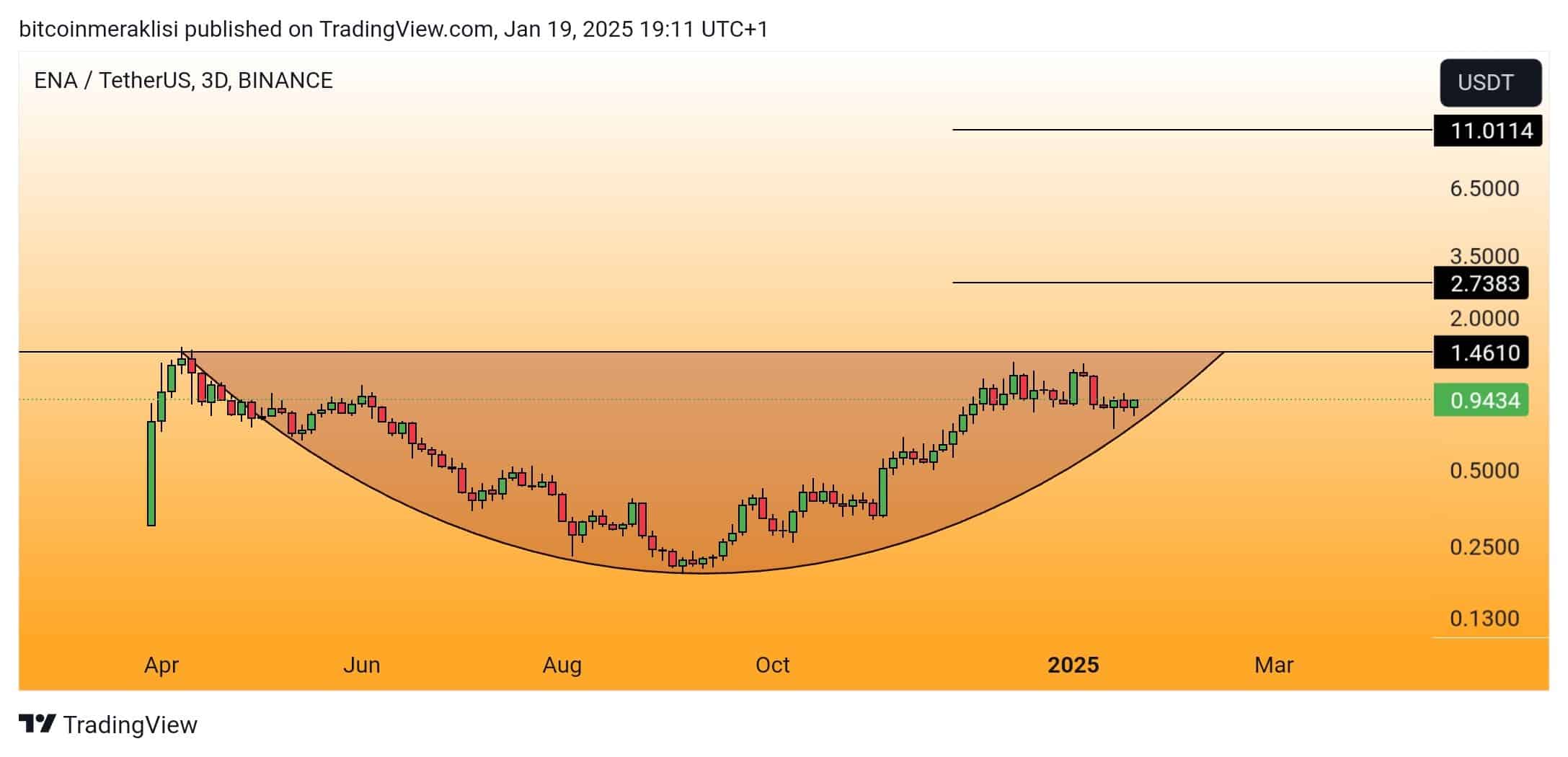

- ENA’s rebound from the Fibonacci level of 0.618 implies a bullish final target of $2.61.

- Analysts predict that ENA will rebound above the $1.46 resistance level for medium- to long-term gains.

Athena (ENA) The price structure showed a strong technical setup forming higher lows within a defined upward channel.

This price action has caught the attention of market analysts who see potential for further upside based on Fibonacci retracement levels and key resistance targets.

Technical setup indicates a bullish trend.

ENA was trading at . $0.915 As of press time, 24-hour trading volume was approximately $1.24 billion, up 5.80% from the previous day.

Recently, the price moved back towards the Fibonacci 0.618 level, a widely observed support zone in bull markets.

This level, which coincides with the lower border of the rising channel, is acting as a springboard for potential upward momentum.

According to the analysis of rose premium signal,

“ENA is showing bullish potential with a bounce from the strong Fibonacci 0.618 retracement area within the ascending channel.”

Analysts highlight these settings as examples of disciplined market structures that provide trading opportunities.

Source: X

Key targets and resistance levels

ENA’s current price action is consistent with its mid- to long-term goals of increasing the level of cryptocurrency testing. The first target is $1.6373 and marks an important resistance area.

A move above this level would confirm the optimistic outlook for ENA in the medium term. The second target is $2.1521, with some selling pressure expected. Continued trends suggest that this level is achievable.

The long-term target of $2.6178 represents the high point of the expected move within the rising channel. This is achievable if momentum continues.

Additionally, another analyst, Bitcoin Enthusiast, said: famous The importance of the $1.46 resistance level, which is a key threshold within the cup structure formed after ENA’s listing.

The analyst said:

“We believe that a real upward move will begin once ENA rises above this level.”

Source: X

Network activity and market sentiment

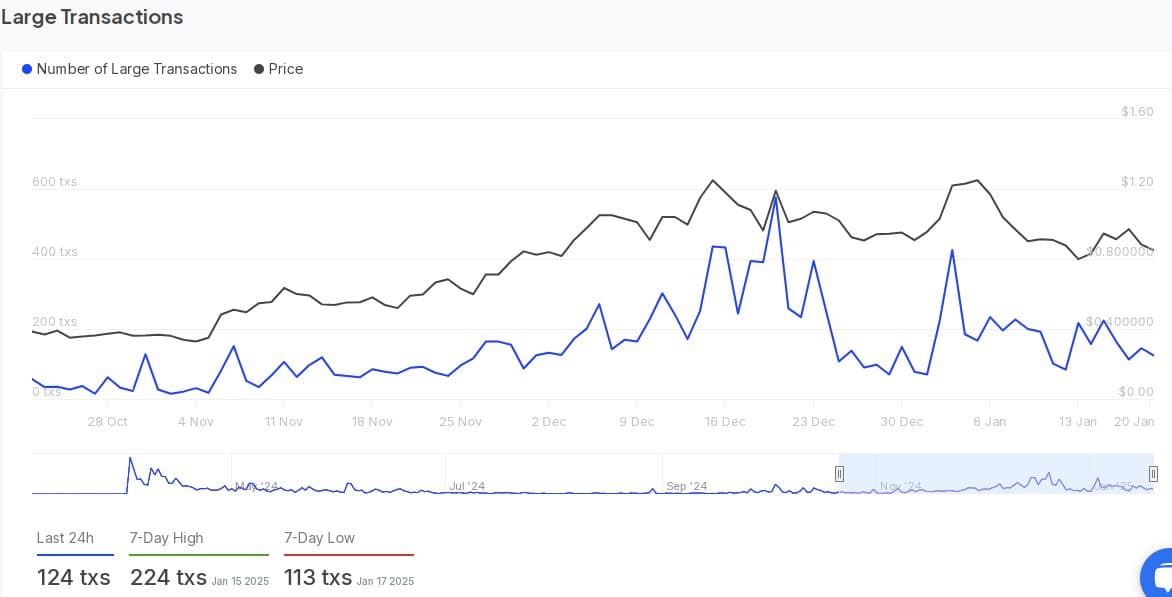

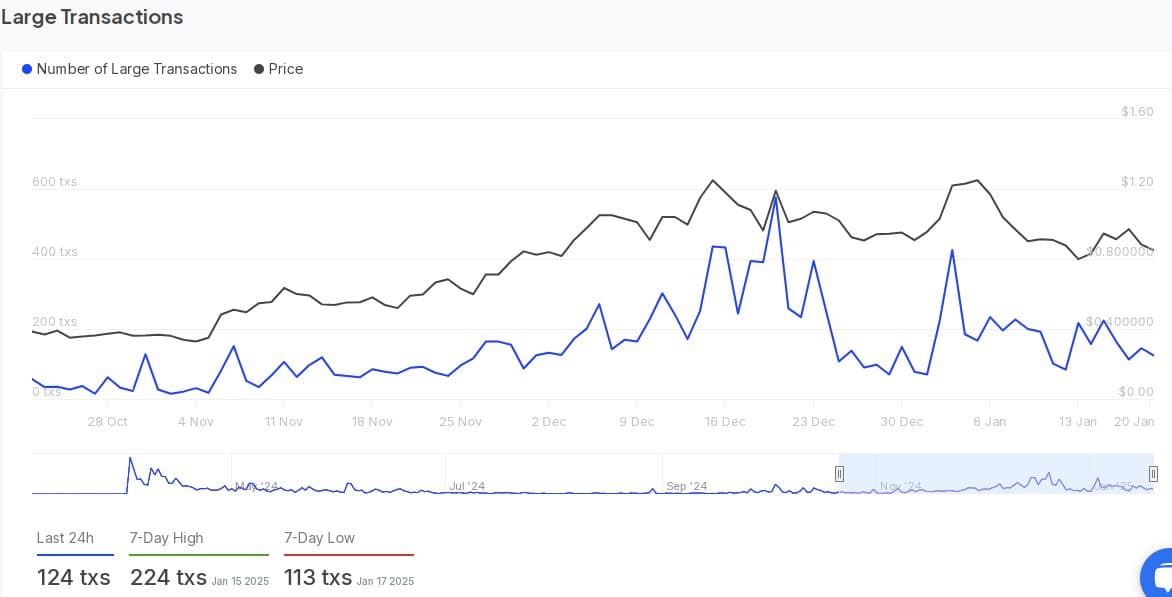

The recent rise in ENA prices is consistent with broader market activity. Large transactions peaked in mid-December 2024, with over 600 transactions recorded, indicating increased participation from large investors. Into the Block data.

Source: IntoTheBlock

However, trading volume has since slowed, with 124 large transactions recorded in the last 24 hours.

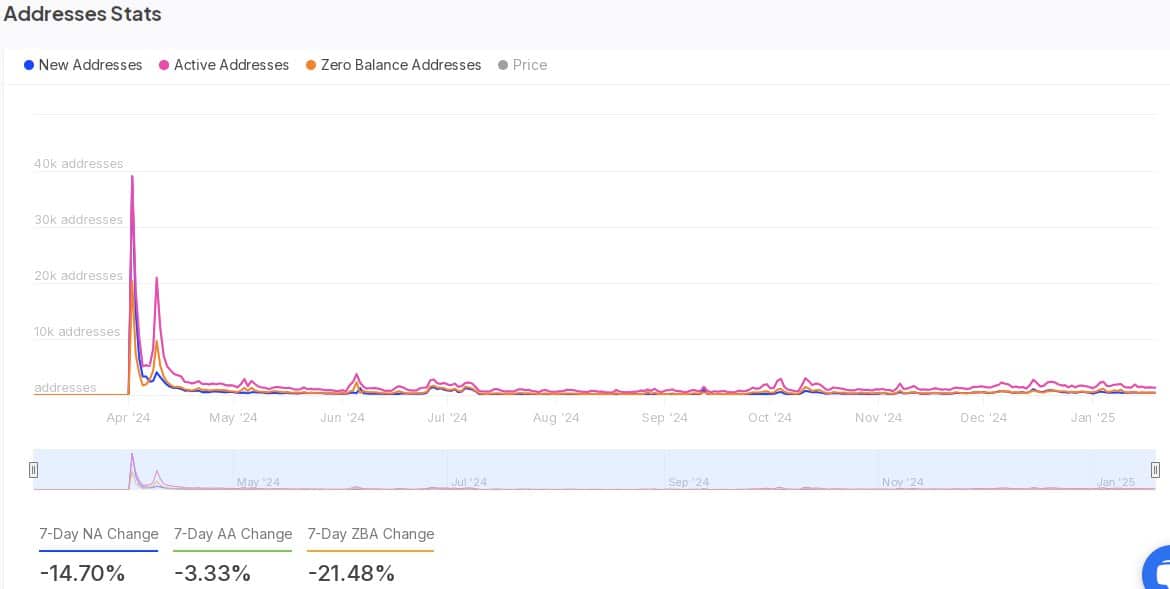

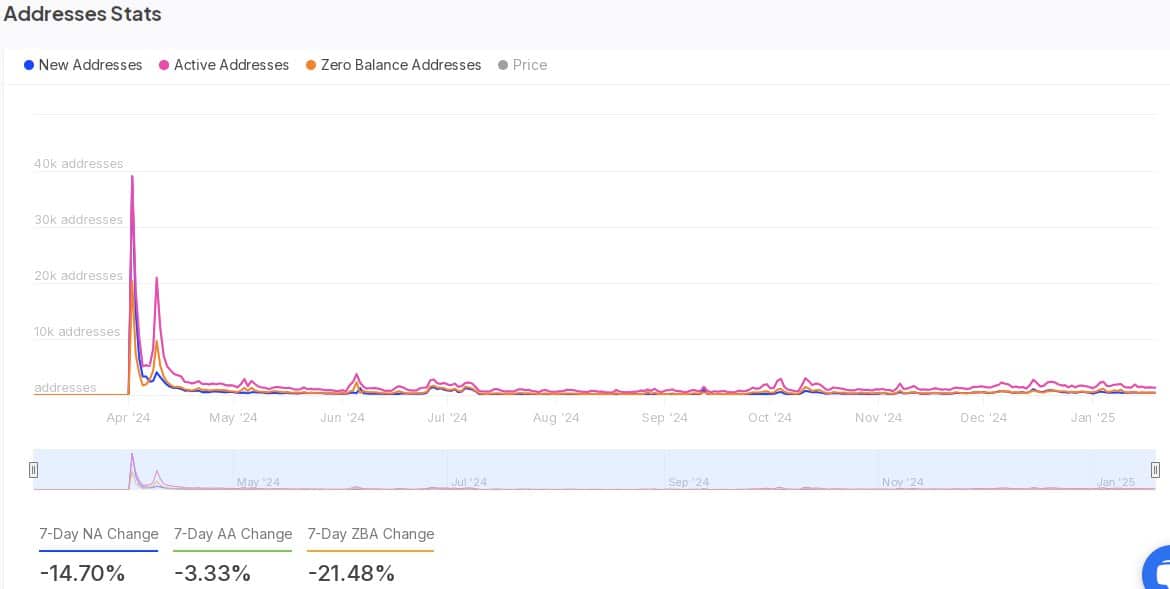

Meanwhile, address activity data shows that new addresses have decreased by 14.70% over the past seven days, with active addresses and zero balance addresses also decreasing by 3.33% and 21.48%, respectively.

Source: IntoTheBlock

Read Ethena (ENA) Price Forecast for 2025-26

While these trends suggest some slowdown in network growth, price action indicates continued interest in the asset.

ENA is showing bullish momentumA breakout of the Fibonacci 0.618 retracement within the ascending channel indicates the potential for further upside.