- Weekly DEX trading volume on the BNB chain surged to $17.74 billion, the highest since December 2021.

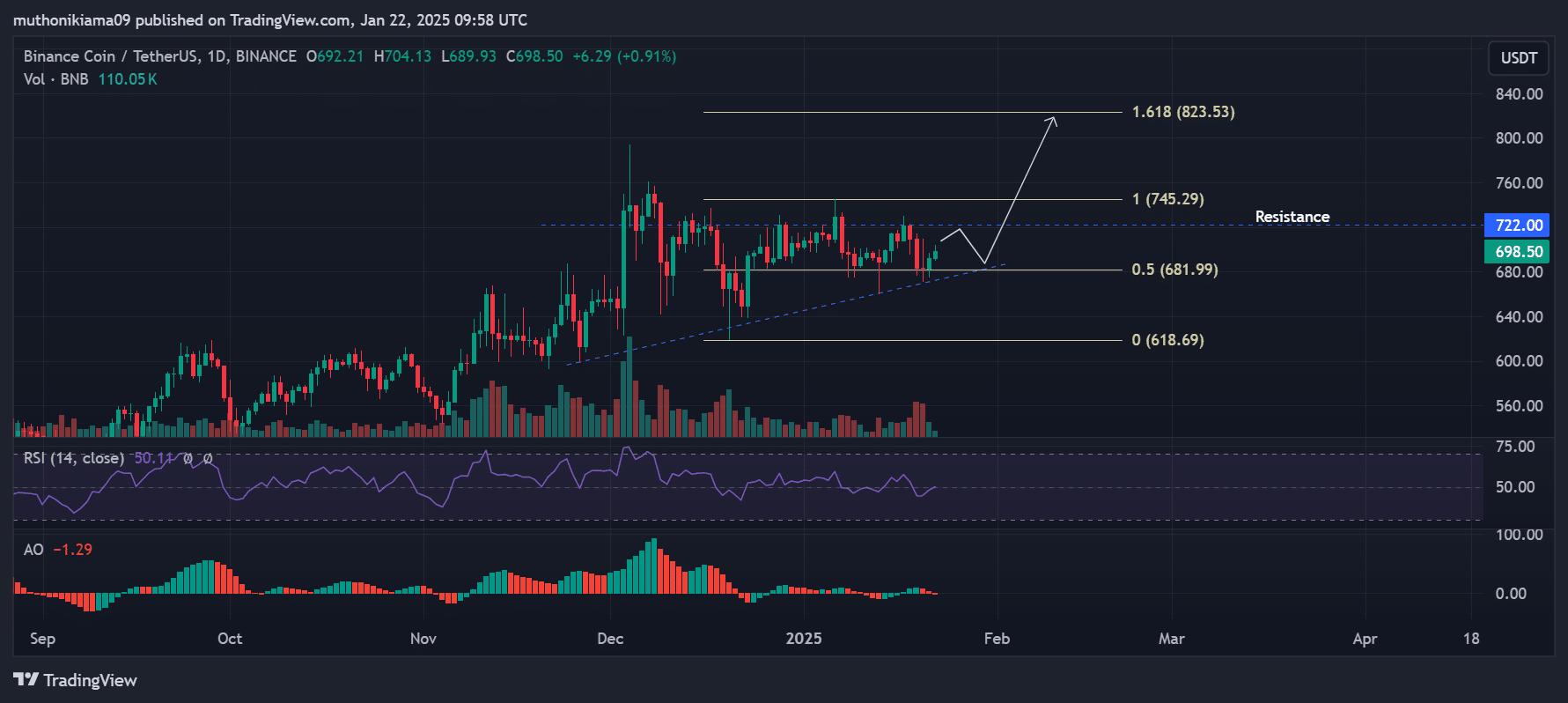

- BNB was also trading within an ascending triangle pattern on the daily chart, which could support a breakout towards the 1.618 Fib level.

Binance Coin (BNB)the sixth-largest cryptocurrency with a market capitalization of $100 billion, was trading at $697, up 2% in 24 hours at press time.

These gains reflected a slight recovery across the broader market.

BNB hit an all-time high of $793 in early December. Subsequent attempts to regain this level and break above $800 were met with strong resistance at $722.

However, increased DeFi activity could help us achieve this breakthrough in the near term.

DEX trading volume surges to $17.74 billion

Source of data DeFiLlama Weekly DEX trading volume on the BNB chain surged to $17.74 billion, the highest in three years.

Source: DeFiLlama

The two protocols driving this growth are PancakeSwap and THENA, with weekly volume increases of 298% and 111% respectively.

This rise could bode well for BNB, the blockchain’s native token. As more people rely on the network for DEX trading, demand for BNB may increase and support price growth.

In addition to this bullish showing for the BNB chain, the token’s daily chart showed a bullish trend that could help it break $800.

BNB’s ascending triangle pattern analysis

BNB is trading within an ascending triangle pattern on the daily chart, indicating that the bulls are in control. The upper trendline of the pattern is located at $722.

If BNB violates this level, it could lead to a continued upward trend.

Source: TradingView

The Relative Strength Index (RSI) has been on the rise and is above 50, indicating that buyers are re-entering the market. A surge in buying pressure could lead to a breakout to the 1.618 Fibonacci level ($823).

However, traders should be wary of the bearish trend indicated by the red Awesome Oscillator (AO) bars.

If the bears regain control and the price falls below the support line at the lower trend line of the ascending triangle, the bullish theory may be invalidated.

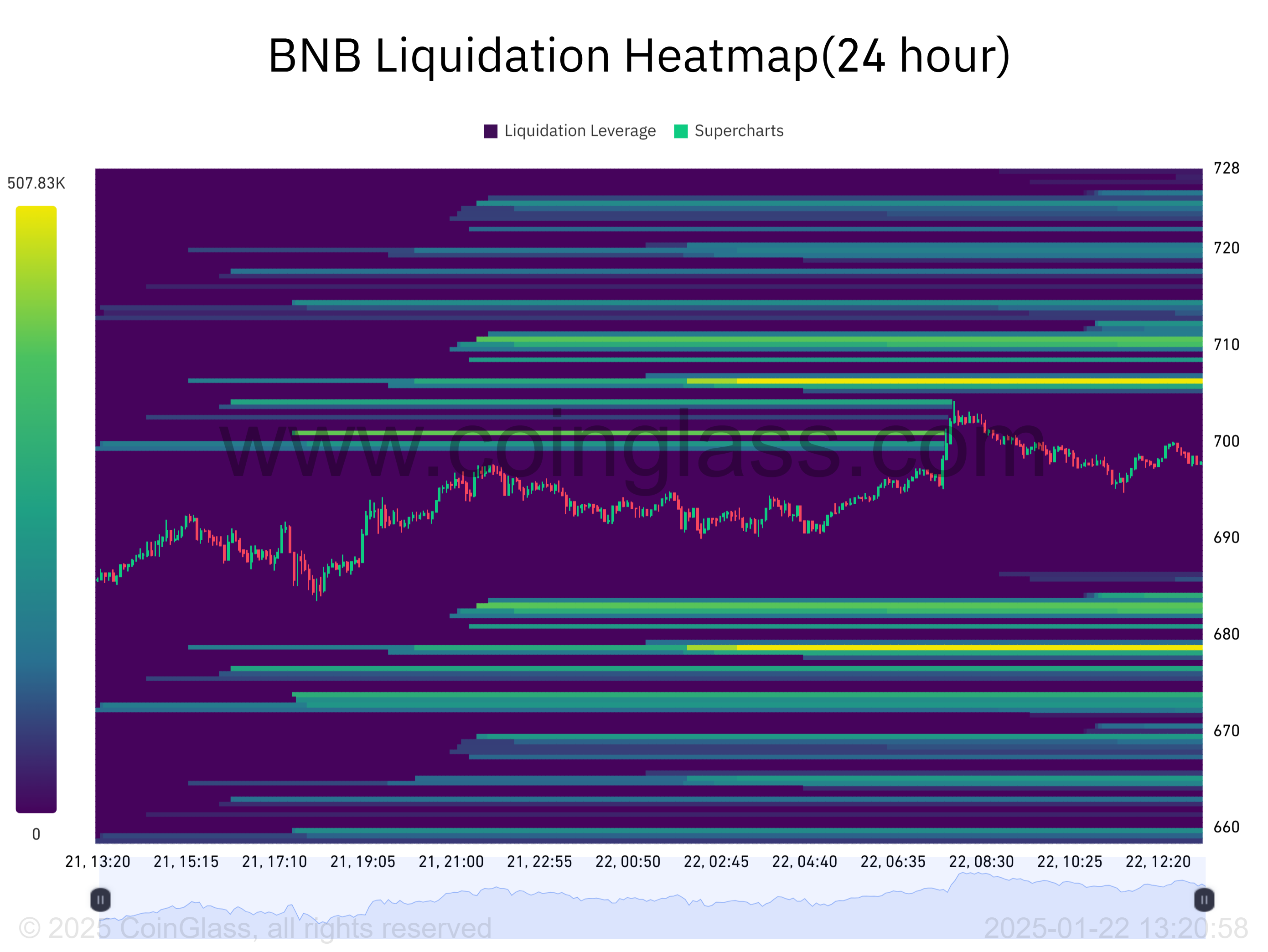

Is BNB Heading for a Short Squeeze?

BNB’s liquidation heatmap with a 24-hour lookback period shows that a cluster of liquidations is emerging above the current price.

If BNB rebounds above 706 and triggers a liquidation, short selling pressure will occur, causing short sellers to buy and liquidate their positions. This action could fuel an upward trend.

Source: Coinglass

Read Binance Coin (BNB) price prediction for 2025-2026

There is also another liquidation level below the $678 price. If BNB falls below the lower trend line of the ascending triangle and falls to this price, a long liquidation will push the price lower.

Therefore, traders should watch out for important support at 0.5 Fibonacci ($681). Because a violation of this level could strengthen the bearish case.