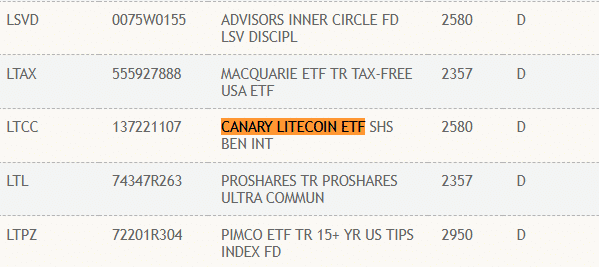

- Submission of Canary Capital Litecoin ETF can start trading as soon as possible.

- The dumping interest in Altcoin has increased the chain to almost $ 1 billion.

Canary Capital’s proposal Litecoin (LTC) The ETF has been listed on deposit trusts and clear ring Corporations (DTCC) so that analysts can guess that products can start trading soon.

Bloomberg ETF analyst ERIC BALCHUNAS has maintained a 90%chance of approval of LTC ETF. But he noted that the DTCC list is a preparation for the release of the ETF but not an obvious approval signal.

Source: X

LTC ETF speculation

NATE GERACI at the ETF store has anticipated the same feelings, but added that the product can start trading soon, similar to the BTC ETF approval process. that Sayed,,,

“List” in “Litecoin ETF” DTCC. There is a flashback to find BTC ETF…

For those who are not familiar, the Canary LTC ETF 194-B submitted to the Federal Registration on February 4.

The SEC can be listed on the Federal Register and can be approved or dismissed within the next 45-90 days. It will lead to the SEC decision in late March or in early May.

Grayscale and Coinshares also submitted similar LTC ETF applications and were recognized by regulators.

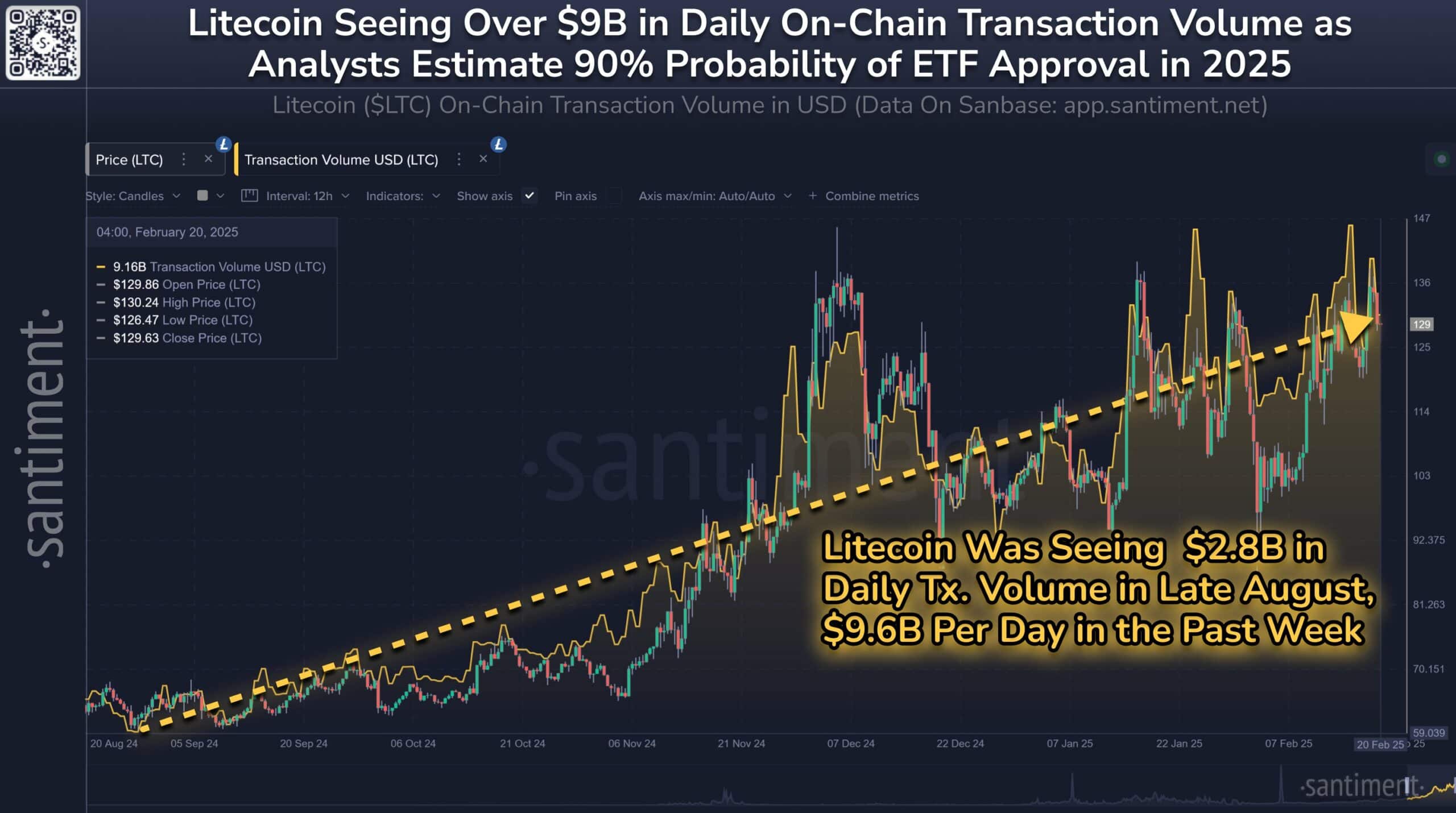

Interestingly, merchants jumped into the LTC in the ETF guess. According to singleLTC’s market cap surged 46%, while last week alone, daily trading volume surged to almost $ 10B.

“Some of these growth comes from the powerful increase of network utility, which has been dealing with $ 9.6B for daily trading volume over the last seven days.”

Source: Santiment

Inferred interest was observed in the futures market where the trader uses the opportunity using the leverage.

According to CoingLass, LTC’s public interest (OI) rate has increased to $ 869m. During the 2021 cycle peak, OIs surge to $ 1B, suggesting that dumping interest is close to the last cycle.

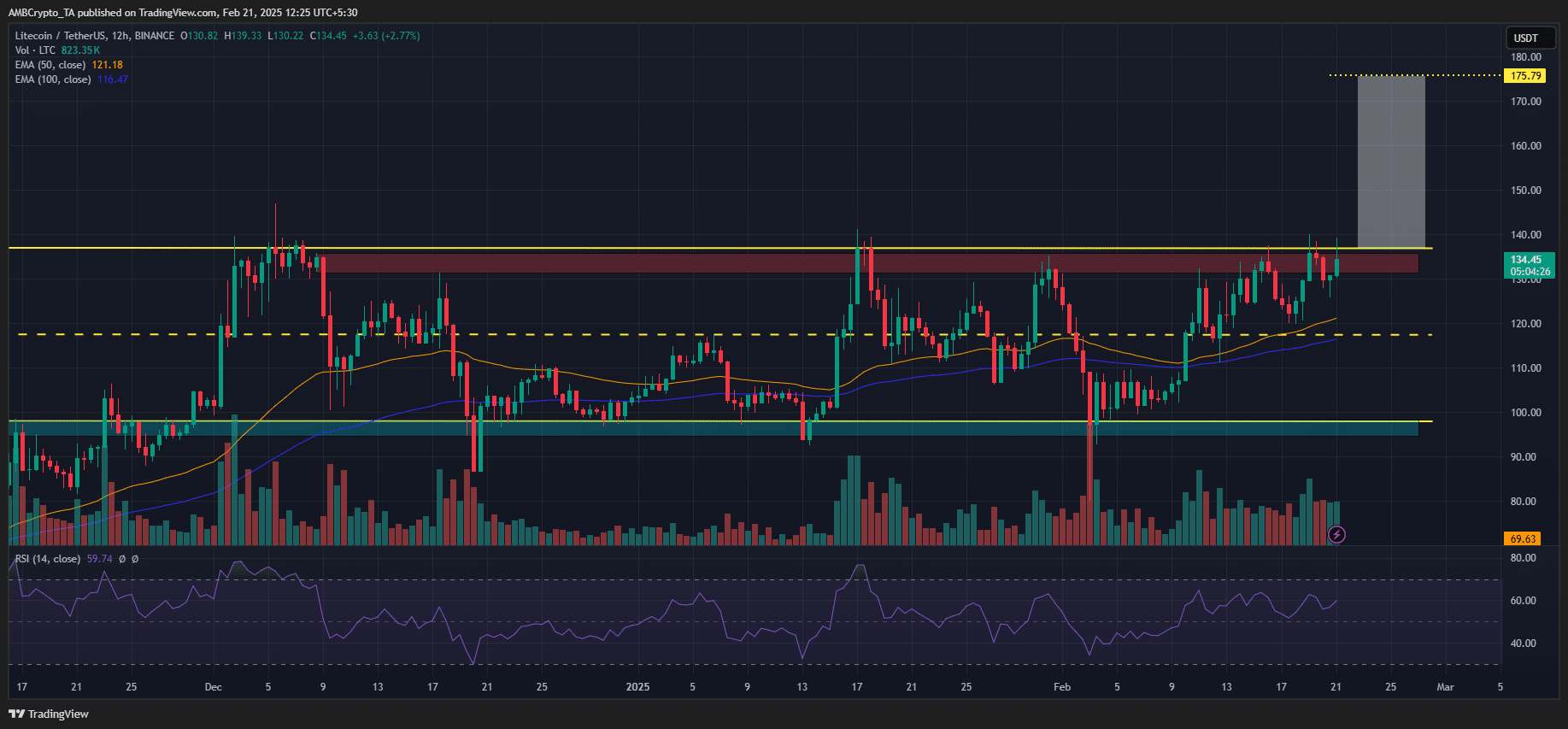

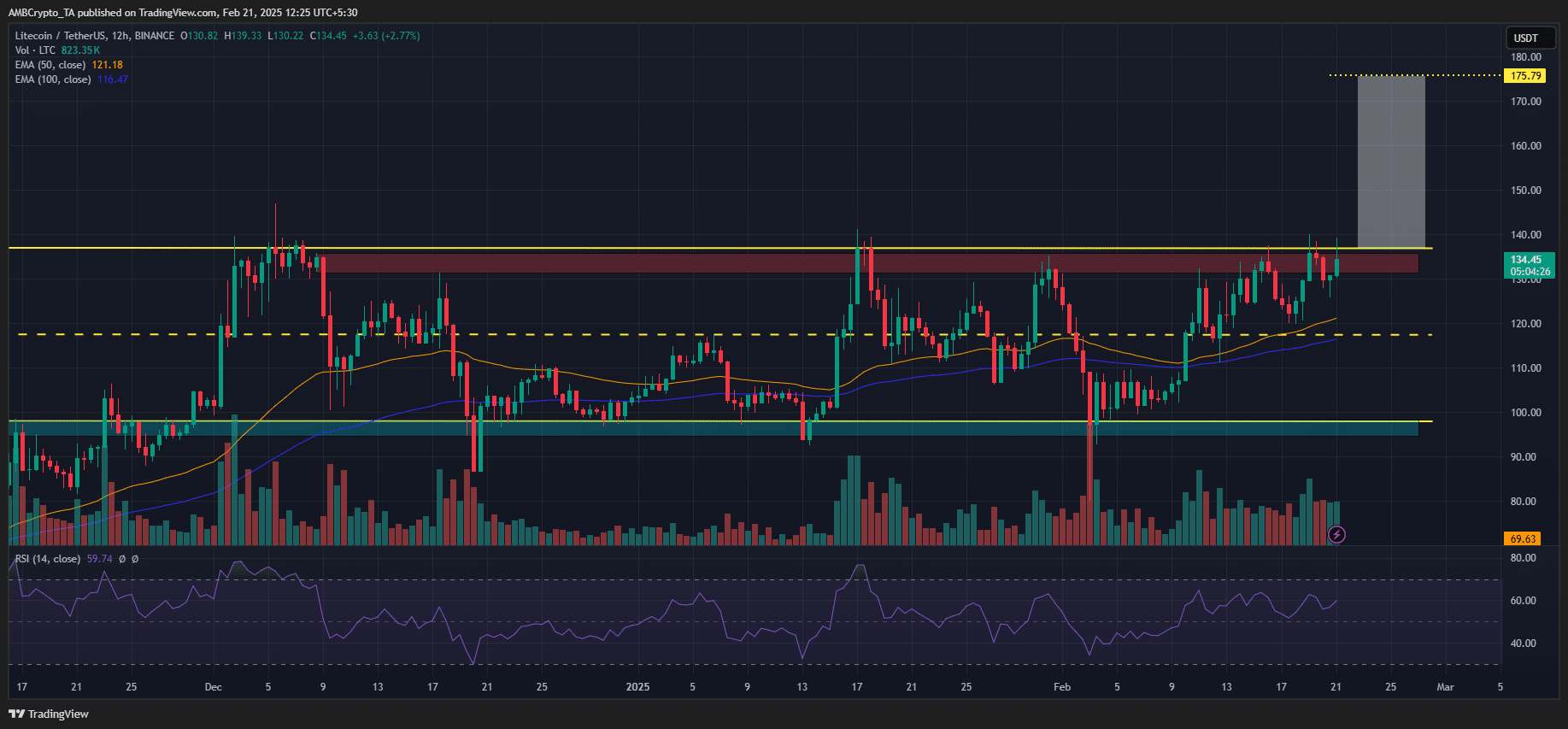

In the price chart, LTC was one of the few Altcoins that benefited in November. In February alone, Altcoin increased by about 37% and the press time was worth $ 134.

Source: LTC/USDT, TradingView

However, the price measures were in the high levels of short -term supply and range. The moving average and intermediate range of nearly $ 120 can act as a purchase opportunity if guess continues.

But the decisive Brake Out Rally You can push the LTC to $ 175.