- Analysts emphasized that over -advertising could drop to $ 13 by violating the symmetrical price behavior pattern.

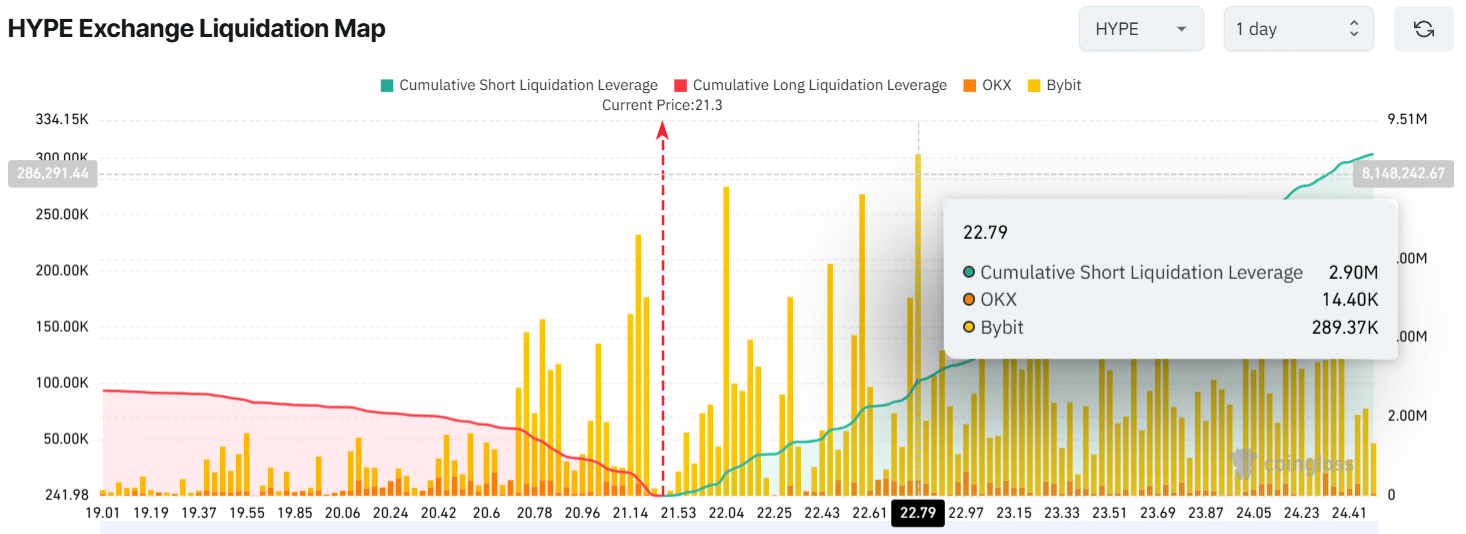

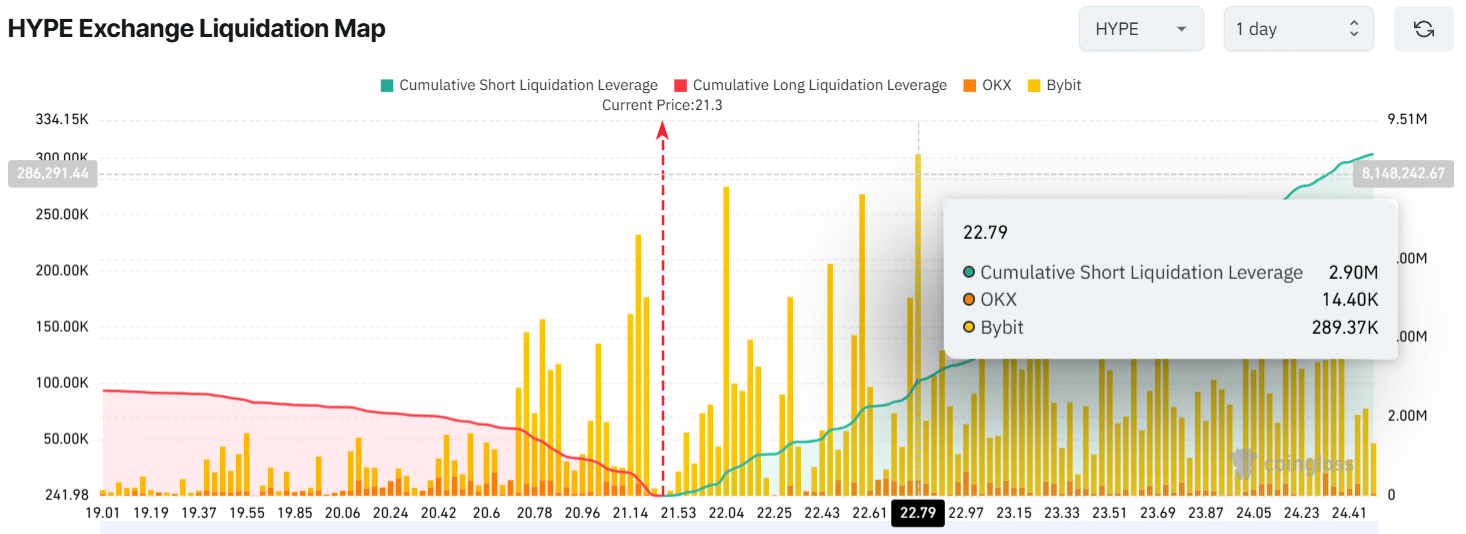

- Intraday merchants are excessive for $ 21.17 at the bottom and $ 22.79 at the top.

In the last 24 hours, the price dropped, and Hyper Liquid (hype) won the loser list and now reached an important level.

This decrease in over -advertising seems to have shifted the overall market sentiment to the side due to the formation of weak price behavior.

Technical analysis and price measures of overdose advertising

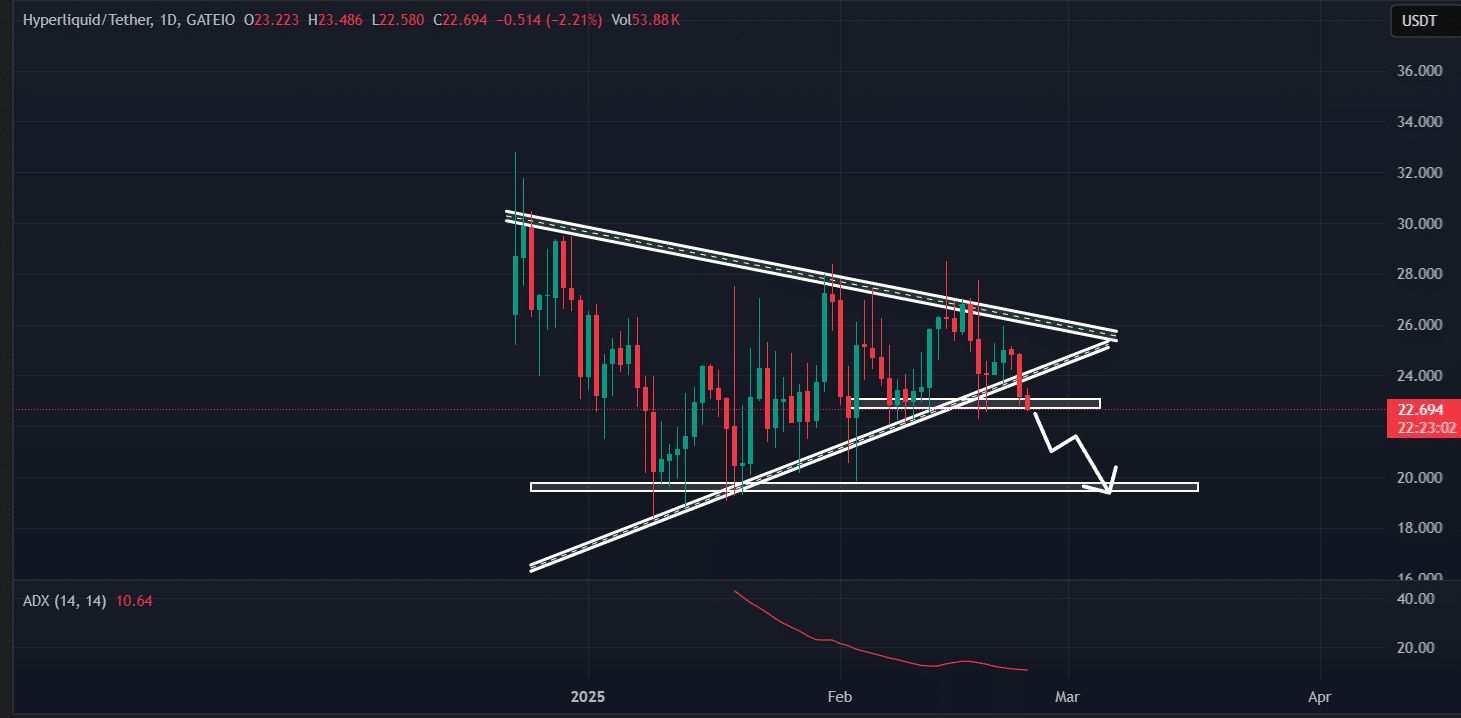

According to AMBCRYPTO’s technical analysis, HYPE has recently been classified in symmetric price behavior patterns. This rest has recently violated an important support level of $ 22.70 due to the recent drop in prices.

This classification at the level of major support has partially confirmed that assets are packaged for huge reductions.

Source: TradingView

Based on historical patterns, if the overdue is less than $ 22.50 daily, it can decrease 14% to $ 19 in the next $ 19.

Considering the current market sentiment, over -advertising seems to be easy to reach this predicted level.

In addition, the average direction index (ADX) of the Hype indicates a weak strength of the asset, 11.20 for the prestation time. This trend can explain the powerful disadvantages.

Analyst’s view on the decline in overtime advertising prices

Following the recent drop in prices and failures, prominent password analysts made bold predictions in the previous posts of X.

Experts say that if overdue violates the symmetrical triangle pattern, the assets may fall to $ 13 in the future, which is completely consistent with the analysis of AMBCRYPTO.

Current price momentum

Despite these predictions, HYPE traded near $ 21.50 at the time of writing and experienced more than 12% price in the last 24 hours.

During the same period, the volume of trading increased by 95%, increasing the participation of traders and investors. The surge is higher than the previous day.

It can also be caused by liquidation and asset off -road in long positions. It may also be due to the potential accumulation caused by a drop in prices.

Excessive location of hype advertising traders

According to CoingLass, a thermal chain analysis company, the bears seem to be strongly dominating their assets. This may be due to the belief that the price will not rise soon.

According to the liquidation data of Hype Exchange, the merchant is overdue at $ 21.17 at the bottom and $ 22.79 at the top. This level acts as a support and resistance of assets.

Source: COINGLASS

The traders also built a long position worth $ 4.15 million and a short position worth $ 29 million.

This is controlled by short sellers and strongly indicates the weak outlook for over -advertising.