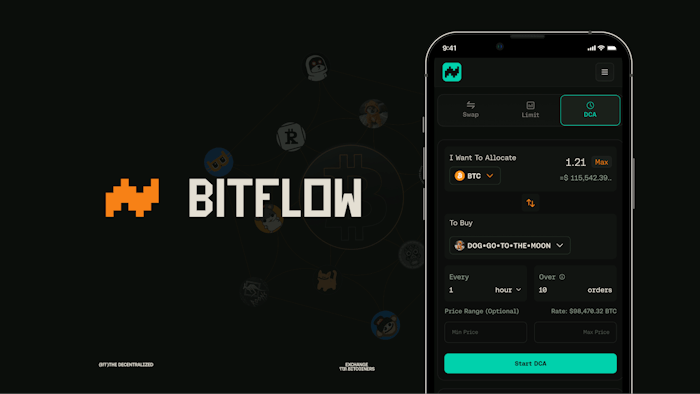

- Bitflow starts an automated dollar -based average (DCA) and a rune investment in the stack.

- AI drive DCA enables untrusted repeated investments.

- Future plans include adding yield strategies and cross layer flow.

Bitflow, a distributed exchange built in the stack ecosystem, unveiled an initial average (DCA), an breakthrough feature that introduces AI -based investment strategies for Bitcoin and related assets.

Automated DCA allows users to automate repeated purchases of popular runes such as Bitcoin (BTC), Stablecoins, and Stacks native STX tokens, SBTC and $ DOG.

Designed to simplify and improve the participation in the Bitcoin Native economy, the latest products of Bitflow display an important milestone in the financial (Defi) distributed in the stack layer 2 network.

Simplify Bitcoin Dipy Investment through Automation

The core of the automated dollar average (DCA) is the Bitflow Keepers, an intelligent automation engine that powers the DCA function. This technology enables users to make incomprehensible repetitive transactions without having to spend time on the market or manually run.

By supporting a wide range of assets, including SIP-10 tokens and Memecoin Sensation $ DOG (DOG • Go • To • Moon), Bitflow allows users to diversify their portfolios smoothly.

For the first time, the Defi lovers for the stack can program the investment strategy to turn Bitcoin into a dynamic yield creation asset.

In particular, the non -parenting design of Bitflow removes the dependence on third -party brokers while providing transparency and security.

Dylan Floyd, co -founder and lead developer of Bitflow, emphasizes the variations of this function, while Bitcoin Defi is entering the new automation era, where the user will use advanced tools to efficiently grow high -end tools. Can.

In particular, the automated DCA function is the first step in the roadmap for integrating AI driving automation into Defi. The upcoming improvement includes an automated yield agricultural strategy, which allows users to optimize profits for BTC -based assets without continuous supervision.

In addition, there is a plan for market trigger swap, which can lead to sophistication to Bitcoin transactions by setting conditions for executing transactions according to price fluctuations or volatility.

Bitflow also promotes smooth asset transmission between Bitcoin’s Layer 1 and Stack Layer 2 to improve fluidity, connecting the intervals between the two ecosystems.

This ambitious agenda emphasizes the role of Bitflow as a pioneer in the stacks ecosystem, where it serves as a liquidity hub for Bitcoin asset trading.

BITFLOW integrates runes and SIP-10 tokens into distributed exchange, expanding the scope of Bitcoin Native Finance and looking for an efficient way to participate in the market with both seasoned merchants and new immigrants.