- As the OI signal retail investors have been reduced for a long time, Ether Lee’s short position increase is weak.

- Binance is despite the large amount of ETH and other encryption. MACD checks optimistic crossovers.

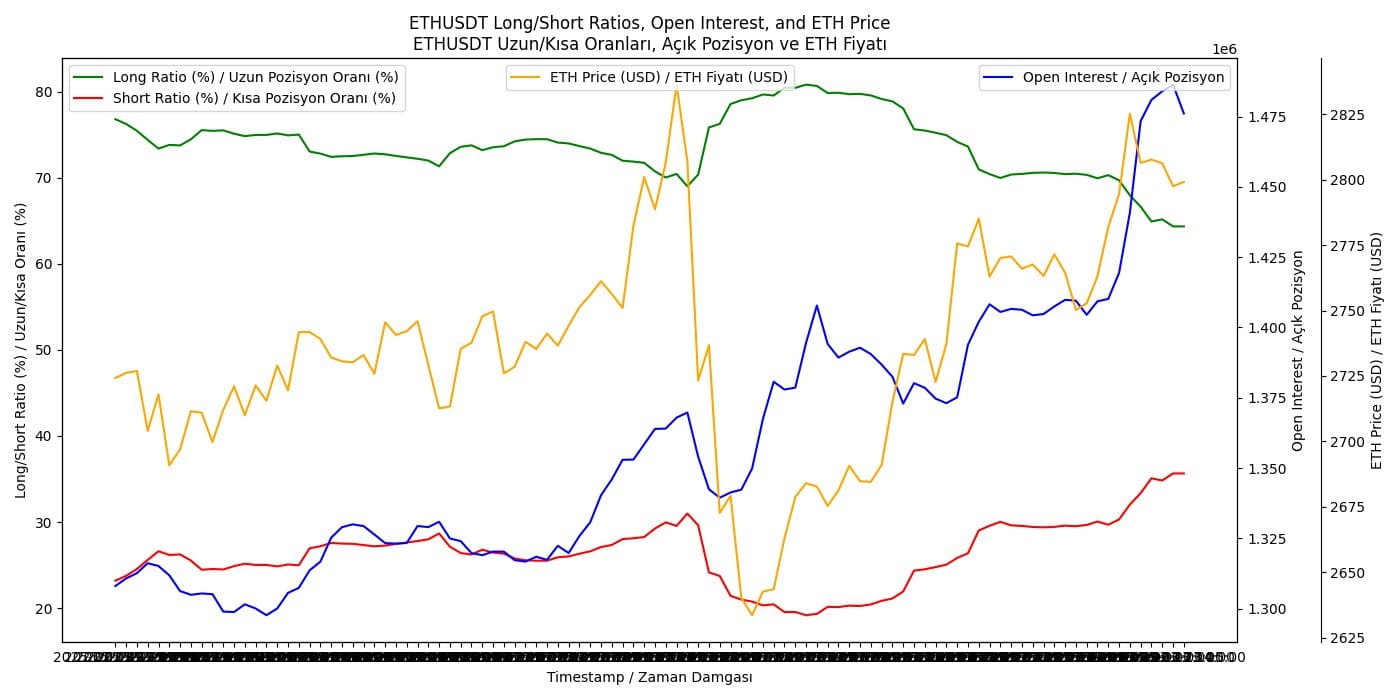

Ether Leeum (ETH) retailer ratio is rising, and the ratio of long -range positions is decreasing. The short ratio rises more than 30%, while the long ratio is less than 75%.

This change suggests that retail investors are betting on Etherrium as the public interest (OI) increases.

As of the Prestation, the price of ETH has risen more than $ 2,775, but if this weakness prevails, a full back of $ 2,700 is possible.

On the contrary, if the OI continues to increase while the shorts are pressed, the ETH can be over $ 2,825 and aim for higher levels. As long as the long position decreases, this can mean anxiety about Ether Lee’s short -term growth potential.

Source: X

If this trend continues, the ETH can test the low support level. On the contrary, when market feelings begin to increase with shifts, we can observe rebounds for more than $ 2800.

Binance continues to offset the ETH.

The feelings of retail investors are consistent with Binance, which relocates a large amount of Etherrium to the centralized exchange bridges and market manufacturers. The amount of money is 1.003K ETH from $ 2.79m to 1.52K ETH.

This high level of activity, including big influx to market manufacturers and exchanges, can indicate that Binance is promoting liquidity or reducing its stake according to market conditions.

The potential impact on Etherrium price is mixed.

Source: Arkham

On the other hand, if this transfer is to meet the demand for increasing demand for exchanges or market production purposes, the liquidity and trading volume can be high, which can stabilize or increase ETH prices.

If Binance liquidates its stake, it can lead to a drop in prices due to the increase in the supply of the market.

This means that the strength of additional sales from the exchange checks the weak trend or meets the sufficient purchase demand.

MACD checks optimistic crossovers

But Ether Lee’s price action showed a strong signal as MACD moved over the signal line.

This strength, combined with stabilization at a major support level of about $ 2,650 after BYBIT hacking, suggests the potential of price increase.

The immediate goal of this strong signal can be a $ 3,000 resistance. If Ether Lee goes through this barrier, the next intensive care level can be about $ 4,000 or more.

Source: TradingView

On the contrary, if optimistic momentum changes and does not maintain, ETH can resume support for $ 2,650.

The breaks below this point can lead to further decline, and the following important support is $ 2,490.