- The achievements of XRP ledger flourish, despite the decrease in the warm chain of the traders as the fear is increasing in the encryption market.

- The chart of the XRP shows the potential drops by showing the head and shoulder pattern.

As the US SEC continues to ease the regulations and withdraws the lawsuit for the encryption community, Ripple (XRP) It is continuously benefiting as an ecosystem.

The director of XRP showed an impressive performance indicator that emphasizes efficiency as a blockchain ecosystem despite the recent drop in prices.

The average transaction fee is 0.0011 XRP and the nominal road fee is 0.00001 XRP, ensuring economic and accessibility. The average ledger spacing is 3.861 seconds, indicating fast transaction processing and the final finals of the ledger.

Each ledger processes about 102.56 transactions, and the system can handle 27.37 transactions per second.

Source: XRPL Explorer

This statistics reflect the scalable and cost -effective environment, which promotes the adoption faster and potentially affected the XRP price.

XRP formation head and shoulder pattern

The daily chart of the residue shows a weak reversal by showing potential heads and shoulder patterns. The neckline is about $ 2.00 and is pivotal to the short -term price trajectory of XRP.

Prestime current, the price has been slightly lower than the $ 1.98 Roy threshold after the maximum peak of about $ 3.50.

As the XRP goes bankrupt to less than $ 2.00, it can be reduced to the $ 1.63 support area, which is significant in the previous price integration.

Source: TradingView

As an alternative, if the XRP pushes to $ 2.00 or more, the weak pattern can be invalidated to inform the strong support. This can reflect the new strong sentiment, which can be priced at an previous high of about $ 3.00.

The immediate future of XRP depends on the ability to support or violate this important support level.

Meanwhile, XRP network activities have been reduced by 50%. The active address dropped from 202,250 to 101,169 in December.

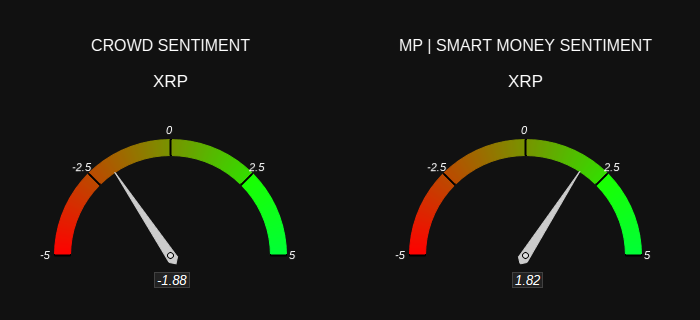

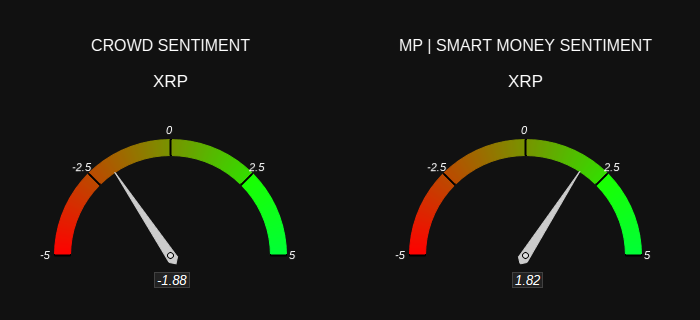

Market participant sentiment

On the other hand, the feelings of Ripple showed contrasting views between the public and the investors based on information.

The feelings of the crowd were quite negative at -1.88, indicating that they were widespread or lack of trust between general holders and retail investors.

In contrast, smart money feelings for XRP were positive at 1.82 and reflected the optimism of market players based on institutions and information.

Source: Market Proit

This divergence suggests potential conflicts of market epidemiology. If institutional emotions lead to a significant purchase activity, the price of XRP can increase, which can respond to the weak sentiment of the general crowd.

On the contrary, if negative public sentiment weakens Ripple’s market enthusiasm, it can suppress significant optimism. This can stabilize or fall prices despite optimistic institutional expectations.