Berachain (Bera) has increased by 7% over the last 24 hours, pushing its market cap to more than $ 900 million. The recent surge in price is supported by strong technical indicators, and RSI approaches the excess level and shows that DMI can be tightly controlled by the buyer.

If the current rising trend continues, Bera can resume a level of $ 8.5 or higher and challenge the resistance to $ 9. However, if the momentum disappears, you can test the major support levels of $ 6.18 and $ 5.48 to determine the next direction.

It is close to berain RSI and 70

Berachain’s RSI rose from 35.9 three days ago after maintaining neutral for 8 days to 61.97. The relative strength index (RSI) is a momentum oscillator that measures the speed and change of price change from 0 to 100.

RSI of 70 or more represents excessive purchase conditions, suggesting potential fullback, while RSI of less than 30 shows bulletproof conditions, which can be rebounded. RSI between 30 and 70 is generally considered neutral and strong direction bias is not reflected.

The RSI of Berachain is 61.97, and the price is approaching excessive thresholds, but it remains in the neutral area. This increase suggests that when RSI is close to 70, it is strengthened by strength and interest.

However, if the RSI crosses the excess area, the short -term fullback or integration stage can follow when the trader gains profits. The next price movement depends on whether the purchase pressure persists as the RSI approaches the overpass level or whether the seller begins to dominate.

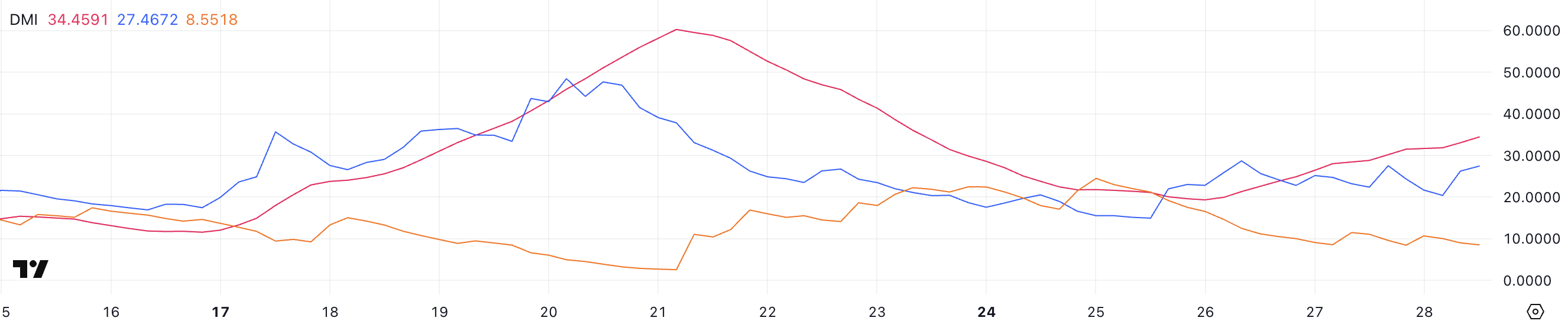

Bera DMI shows that the buyer is controlled.

Berachain’s DMI was found to have increased in 19.3, two days ago, after ADX, after reaching 60.2 when BERA’s price exceeded $ 8.5. The average direction index (ADX) measures the strength of the trend without indicating the direction from 0 to 100.

ADXs aged 25 or older have a strong trend, and the value of less than 20 is weak or suggests the non -stroke market. The increase in ADX indicates that it is gaining intensity by reflecting the momentum of the current rise and market conviction.

On the other hand, Bera’s +Di is 27.4, while the purchase pressure is strong, while the -DI falls from 8.55 and 11.1 in two days, indicating that the sales pressure is weakened.

This configuration confirms that Bera is rising and the buyer is clearly controlled. The zooming interval between the +di and -Di suggests that the optimistic momentum increases, resulting in a high sustainability of the upward trend. As long as the +di is maintained over -di and the ADX is maintained at 25 or more, Bera is more likely to maintain the upward trajectory.

Can Bera regain more than $ 9 in March?

Berachain (Bera) can test the level of more than $ 8.5, and if the current upward trend continues to gain momentum, you can challenge more than $ 9 resistance.

The market cap is $ 888 million, and the $ 1 billion critical price can be an important level for watching in the next few weeks.

But if the Uptrend is reversed, Bera may not test support at $ 6.18.

If this level is not maintained, the price will fall to $ 5.48, which will be deeper. This major support and resistance level will play an important role in determining Bera’s next price movement.

disclaimer

According to The Trust Project Guidelines, this price analysis article is used only for information provision and should not be considered financial or investment advice. Beincrypto is committed to accurate and prejudice, but market conditions can be changed without notice. Always do your own research and consult with an expert before making financial decisions. Our Terms and Conditions, Personal Information Protection Policy and Indemnity Clause have been updated.