Main takeout

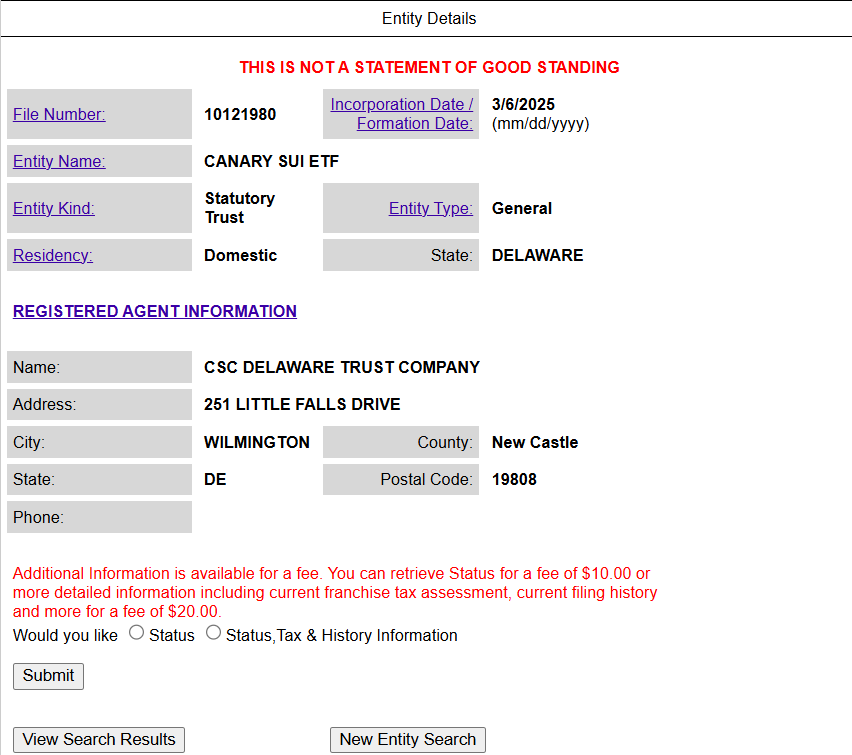

- Canary Capital has been raised to establish a trust for SUI -based ETFs in Delaware.

- The proposed ETF is an early stage for SEC registration and approval.

Share this article

Canary Capital was submitted to establish a trust group in Delaware for the proposed Canary sui ETF. This signals the submission of potential non -product products for regulatory approval.

This measure plans to add a partnership with the SUI blockchain after the World Liberty Financial, and then adds the SUI, the basic password asset of the project, to the strategic prospective fund “Macro Strategy.”

The SUI recorded more than $ 10% more than $ 10 after the collaboration announcement. But digital assets did not immediately react to Canary sui ETF news.

Canary Capital and Grayscale Investments have emerged as the most active asset managers for Altcoin Investment Vehicles. In addition to SUI -based ETFs, Canary aims to track other digital assets such as Litecoin (LTC), XRP, Solana (SOL) and Hedera Hashgraph (HBAR).

On Wednesday, Canary Capital submitted S-1 registration to the SEC of Canary AXL. ETF Focus on AXL tokens that supply power to the AXELAR network.

When the SEC submission is confirmed, Canary Capital officially becomes the first asset manager to propose SUI -based ETFs in the United States.

Share this article