- Ether Leeum registration loss over the last 24 hours

- In order for investors to buy dip, Ether Lee Rium must find $ 2,350 for potential rally.

In the last two weeks, Ether Lee (ETH) has seen some volatility on the chart. During this period, ETH’s price rose to a maximum of $ 2.7K. On the contrary, this period was the first time that Altcoin was less than $ 2,000 for the first time since November 2023.

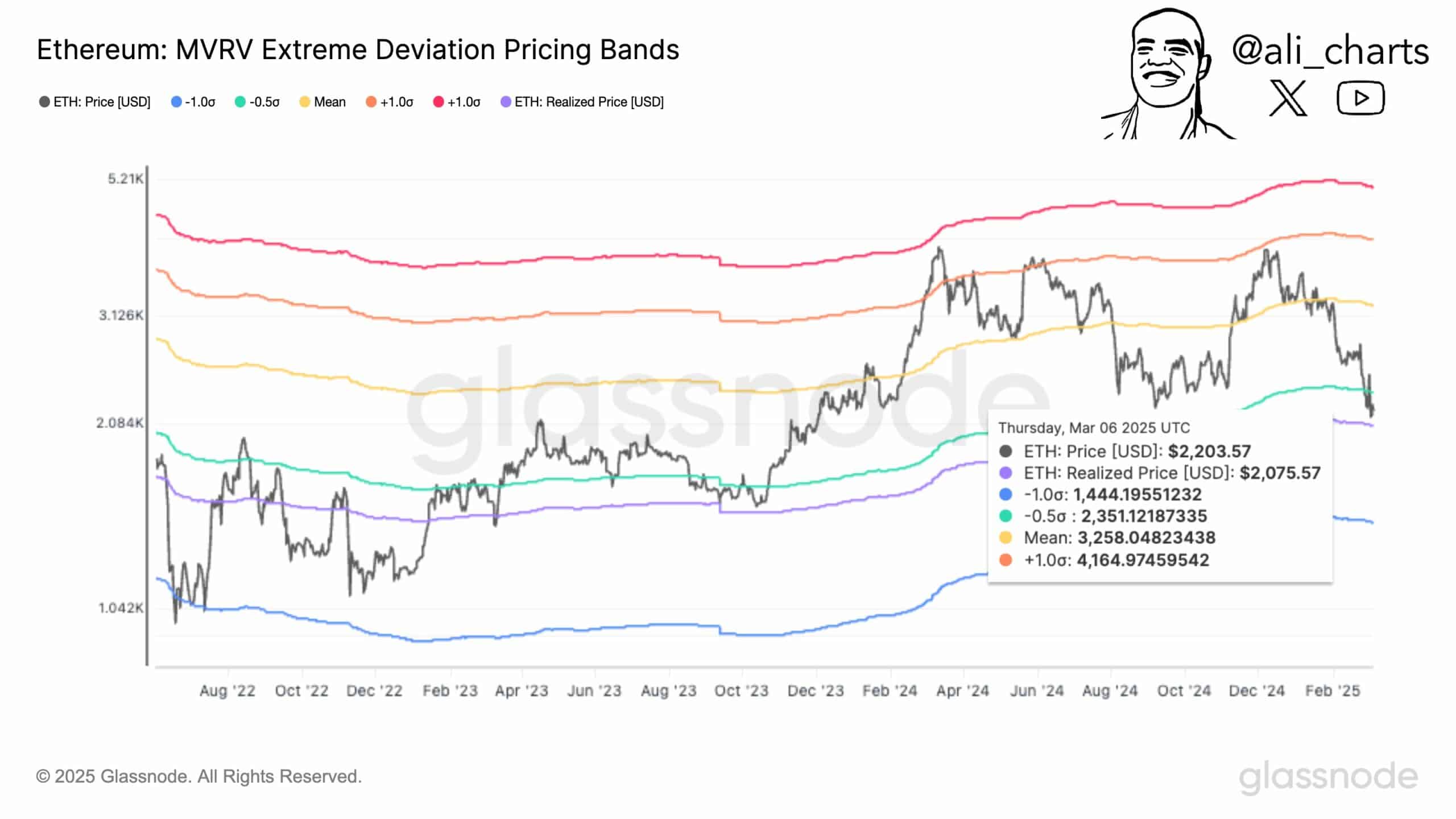

Due to the latest price fluctuations, major stakeholders shared different opinions, and some are still optimistic about ETH. One of them is Ali Martinez, and the encryption analyst quotes a price band and MVRV and suggests a potential rally for $ 3,260.

Can Ether Lee Rium meet for $ 3,260 on the chart?

In his analysis, Martinez observed that the general market conditions left $ 2,350 as the most important resistance of Altcoin.

Source: X

Therefore, if you move away from this level, you can cause significant purchase momentum and then try an important level of about $ 3260. Returning this level can have a psychological impact by confirming the strong trend change. This will lead investors to buy Altcoin and take a long position.

According to Martinez, the price of Ether Lee is lower than MVRV, creating a perfect purchase opportunity. Historically, at this level, purchases have generally provided the most profits, which have continued since 2016.

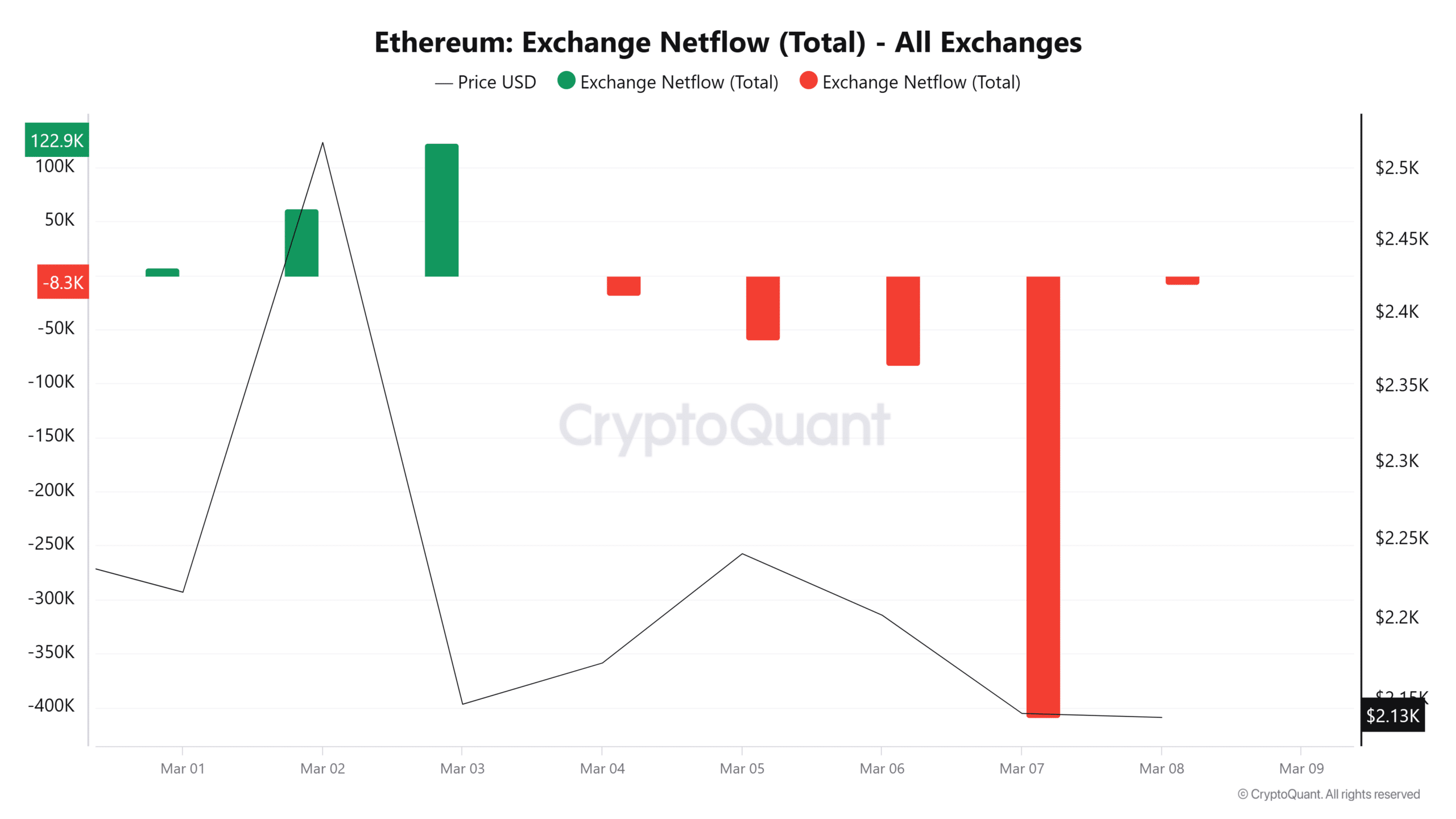

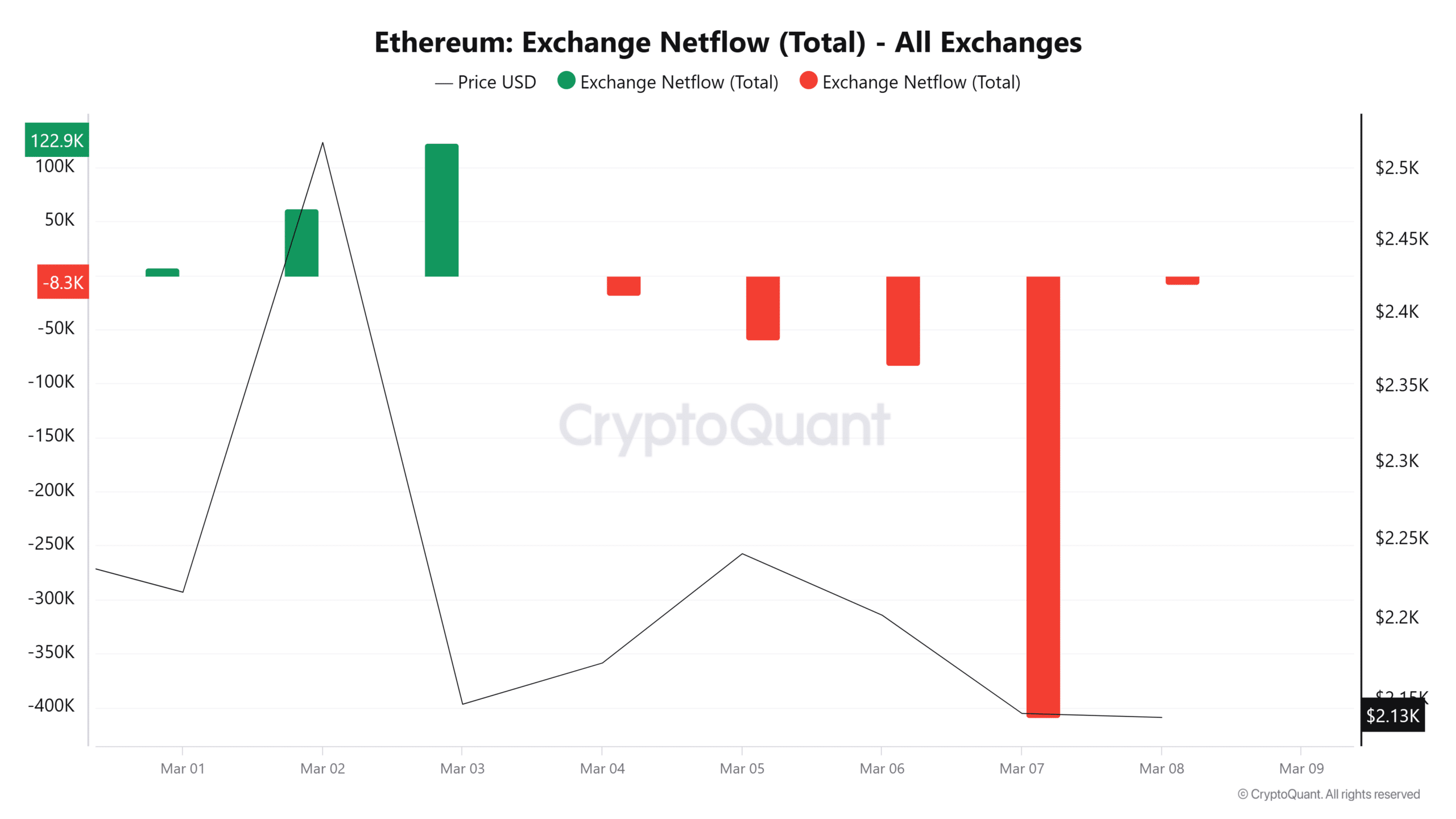

Source: cryptoquant

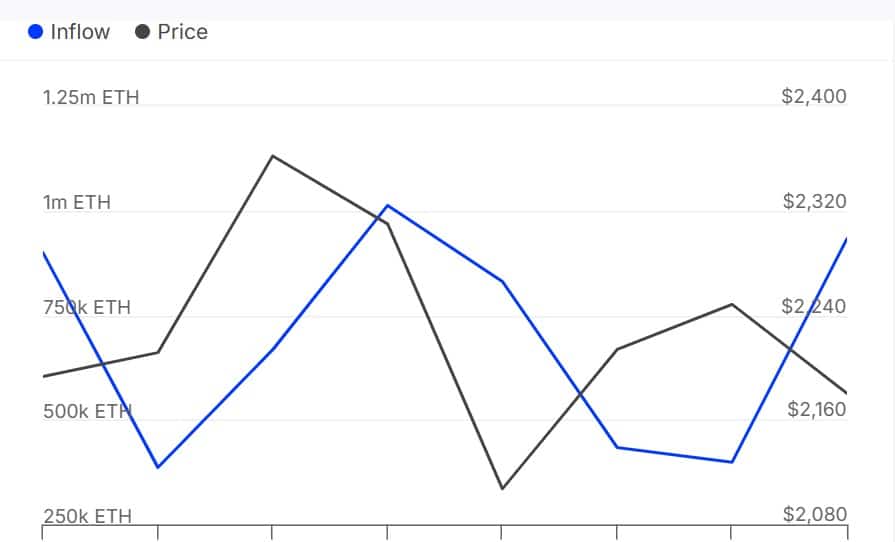

Thanks to this decline, investors seem to buy dip.

This purchase activity can be proven by Ether Leeum’s EXCHANGE NETFLOWS, which has been maintained in the last four days. Negative Netflows dominate the market and have more exchange leaks than inflow.

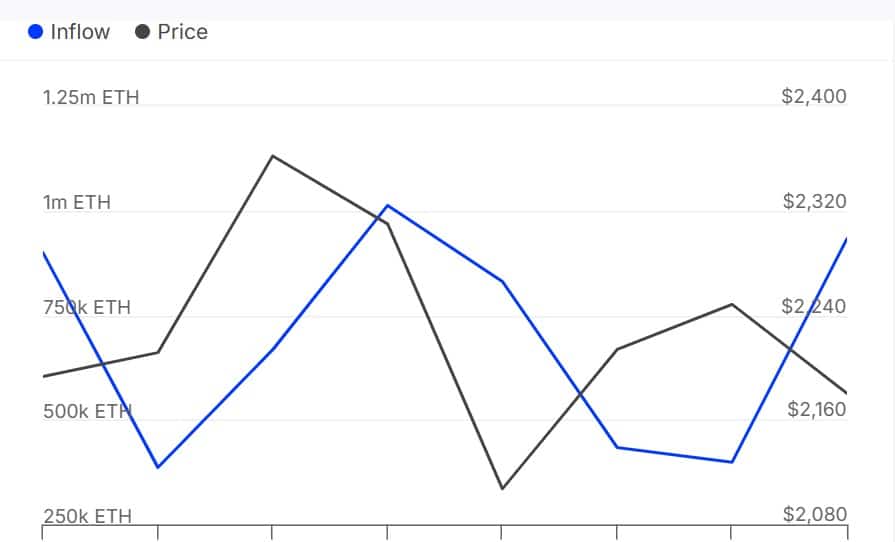

Source: INTOTHEBLOCK

In terms of whale activities, this purchase activity is more widespread among whales. According to Intotheblock, Ethereum Whale returned to the market with more than 932.79K ETH tokens last day.

Similarly, the net flow of large holders has soared to 474.89k. This suggests that the inflow of capital in whales is more than leakage. If the whale accumulates, the price will rebound, suggesting the strong feelings of strong strength. This will make dip a perfect purchase opportunity.

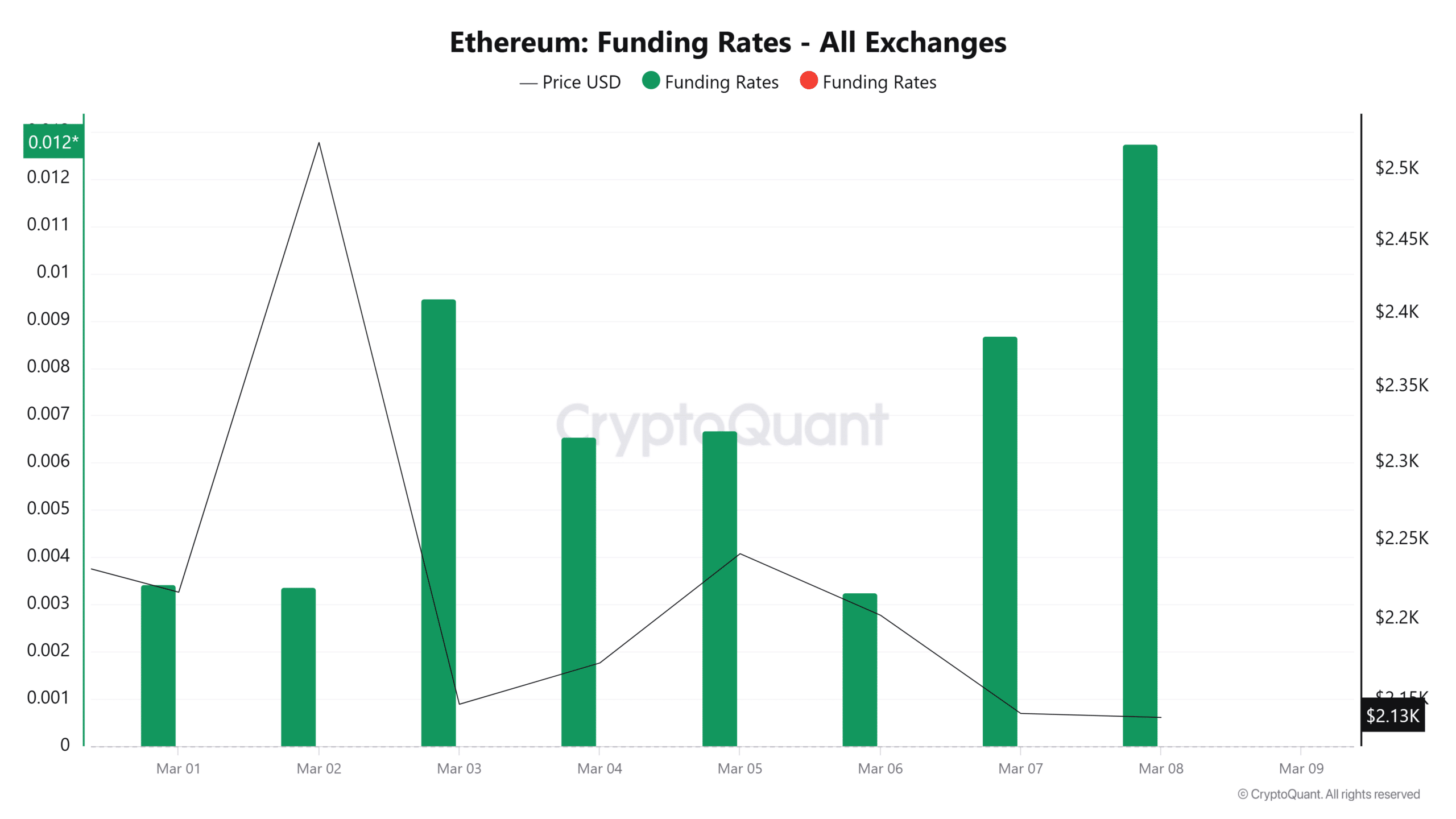

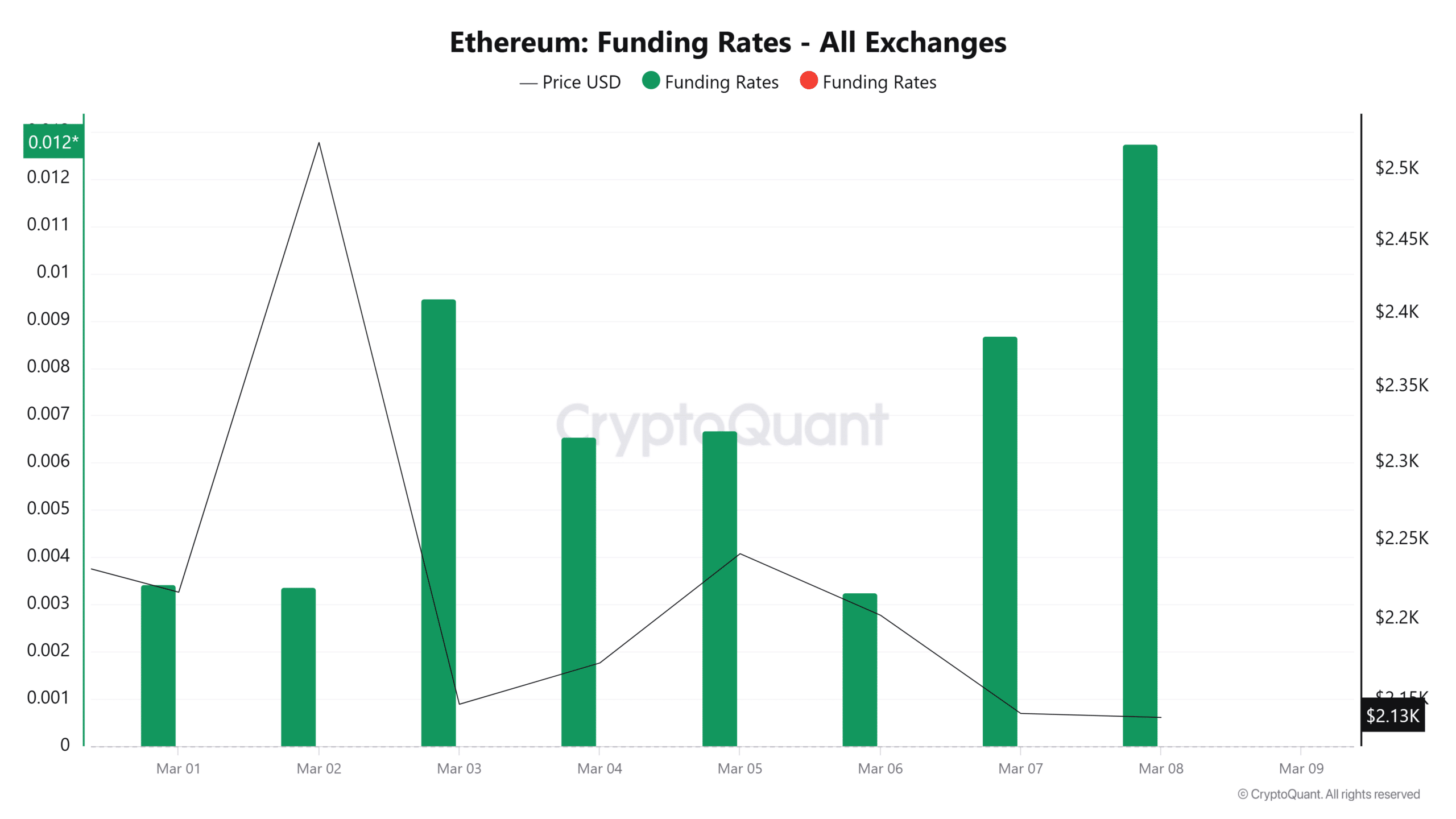

Source: cryptoquant

This fall can be further confirmed by raising the financing rate, and the same rise is climbed to 0.01 per week.

If the rate of financing rises, it means that the trader is paying a fee to take a long position. This rise is supported by an increase in accumulation, so we supported potential price rally.

What is the price of ETH?

In conclusion, Ether Leeum’s buyer has entered the market for both whales and retailers. If the seller looks tired, ETH can recover well. If we had the demand seen last day, we were able to reclaim $ 2,325 and try a rally for $ 2.7K.

But if Bulls fails to move, Altcoin will continue to see a transaction between $ 2,114 and $ 2,300. To increase the level that Martinez predicts, if the macroeconomic data is not advantageous, you must first find 2.7K and $ 3K in the short term.