- Avax tested the Key $ 19 support that integrates symmetrical triangles and signals.

- The weak thermal thermal signal and the high proportion of high underwater investors have proposed a potential decline.

Eye Soldier (AVX) In the four -hour chart, integrate within the symmetrical triangle pattern and test an important level of $ 19.

This support has been firmly maintained in recent prices, which can show potential rebound. AVAX is currently important and trades at $ 19.56, a 0.20% increase over the last 24 hours.

Will AVAX maintain support or fall further? Let’s find out.

What is the current price measure about AVAX?

AVAX’s price in the prestation time has tested the major $ 19 support level, which is a reliable layer in the previous price fluctuations.

The symmetrical triangle pattern currently formed suggests the construction of market uncertainty that both buyers and sellers are waiting for the next movement.

If AVAX can stand beyond the upper boundary of the triangle, the price can experience short -term rally. However, if you do not maintain this support, the price may be lowered, which can lead to deeper modifications.

Source: TradingView

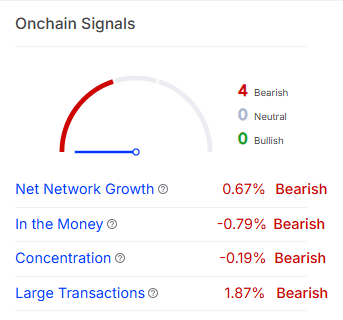

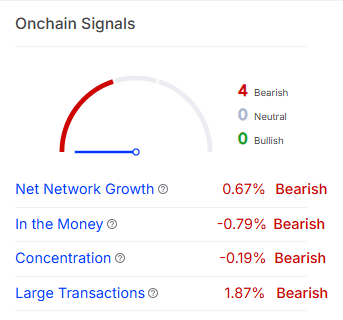

Is the warmth signal an optimistic or weak feeling?

If you review Avax’s chain signal, the overall view seems to be weaker than optimism. Pure network growth is slightly reduced by -0.67%.

It also indicates that the “money” indicators decreased by 0.79%, making it less profitable.

In addition, the concentration metrics are -0.19%, indicating that there is little change in the distribution of AVAX tokens.

Finally, a large deal decreases 1.87%, suggesting that there is a lack of significant optimism among large investors. All of these warmth signals indicate that there is a lack of strong strength at this point.

Source: INTOTHEBLOCK

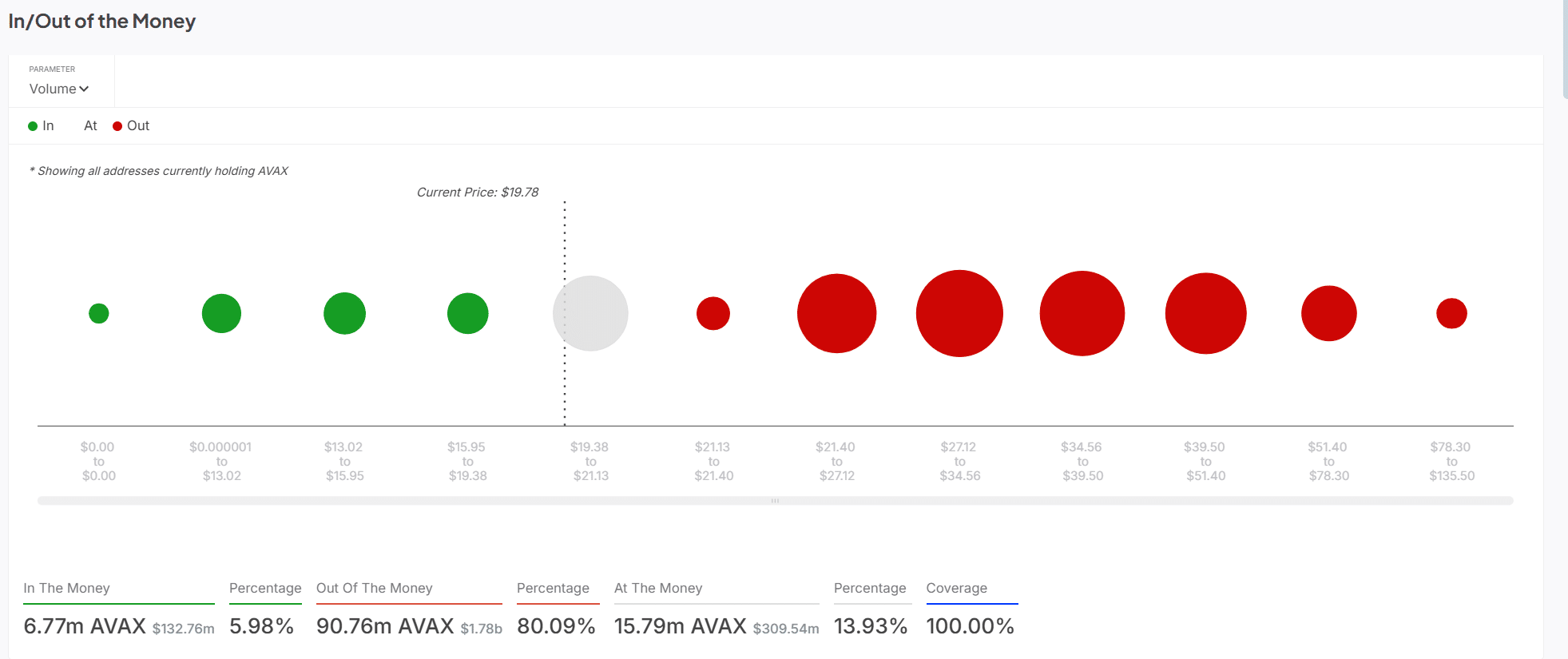

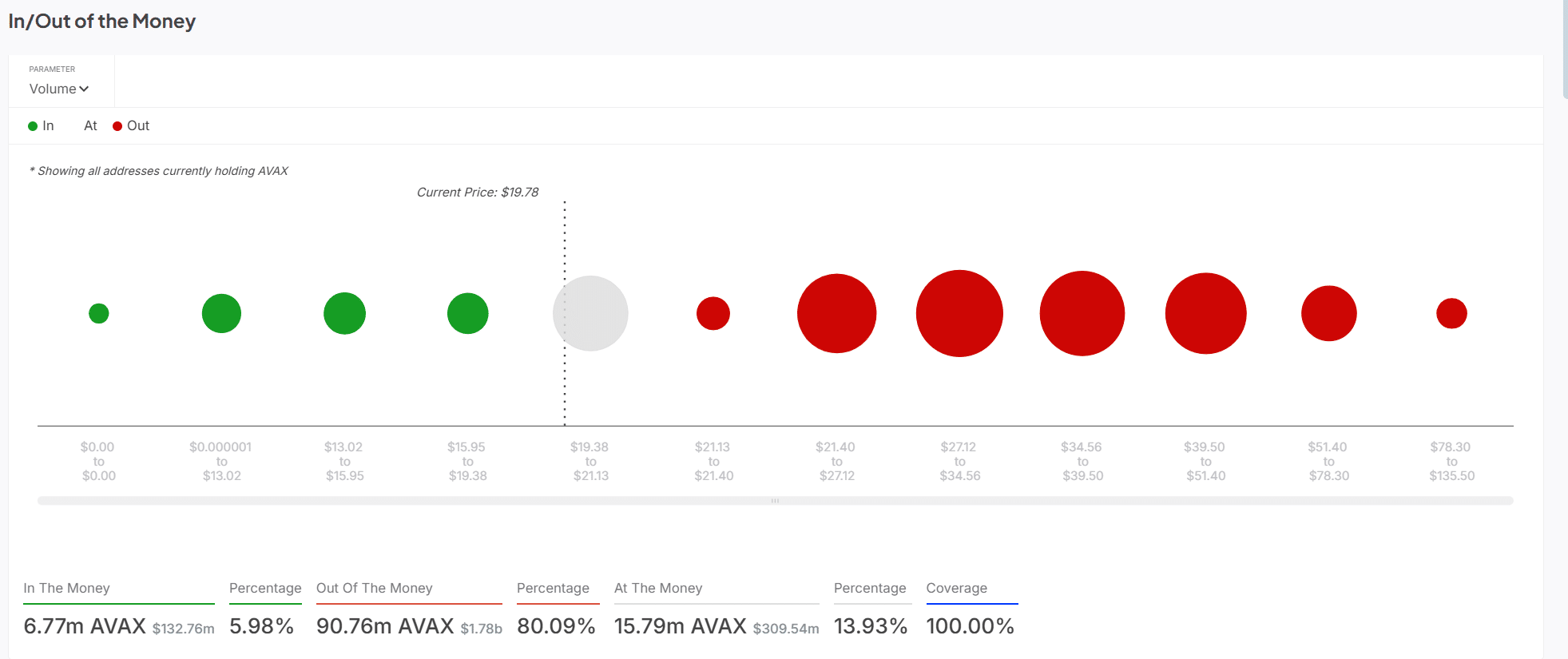

How does the internal/out of money data affect price measures?

The phosphorus/out of the money chart emphasizes the weakness of the weakness around AVAX. At the time of writing, 80.09%of the address with AVAX has no money, and much of this investor has a loss. Only 5.98%of the holders are currently gaining profits at the current price level.

This suggests that many investors are in hand and can seduce sales if the price is lower than $ 19.

In addition, as the price struggles to increase this level, more sales pressure can be applied to lower the price of AVAX.

Source: INTOTHEBLOCK

Can AVAX have $ 19 or will it be lowered low?

Avax is at a critical point, and you can determine the next few hours of reaction or lower part.

The symmetrical triangle pattern formation and crane signals are tilted, resulting in higher risk of failure.

Avax may have difficulty in maintaining $ 19 support, considering the overwhelming investors’ overwhelming investors.

Therefore, if the price does not maintain this core level, Avax will soon face more fall.