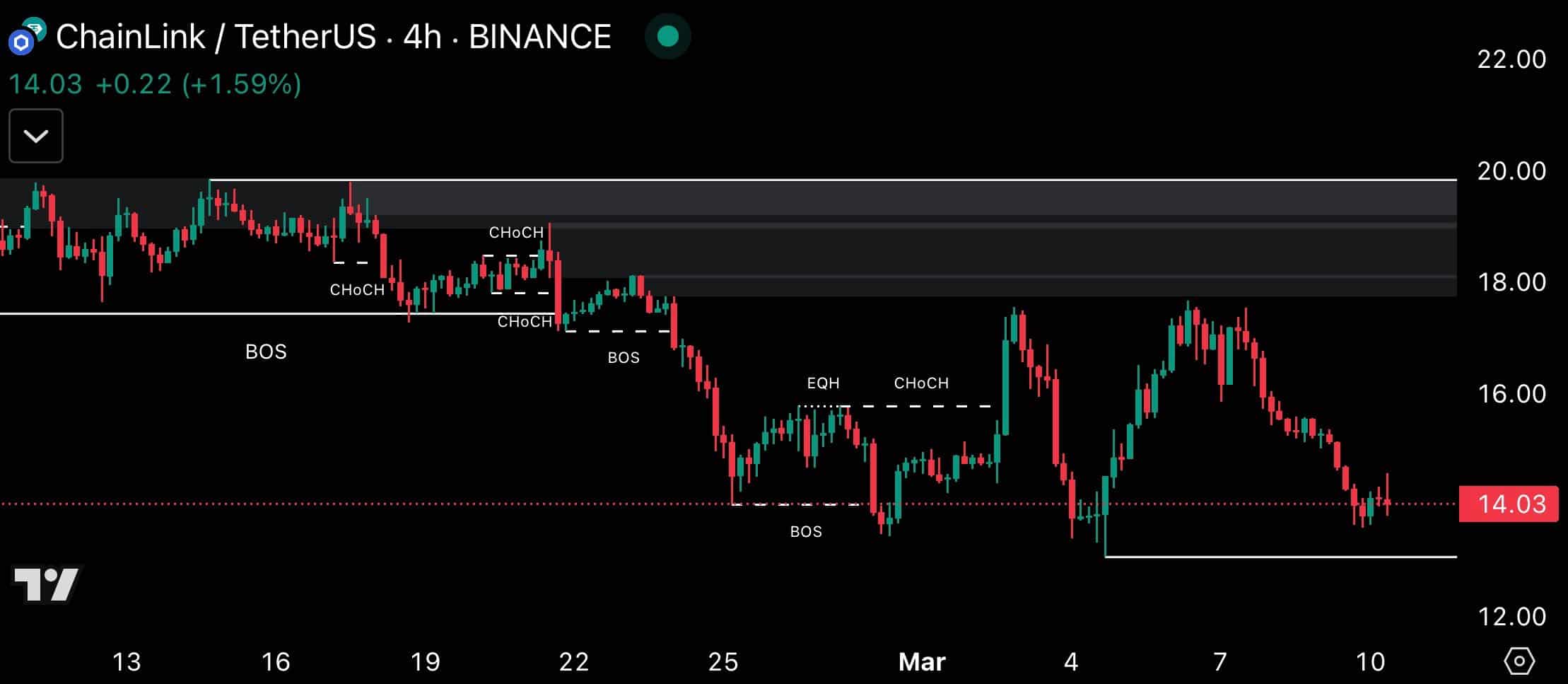

- After a number of choches and BOS, the chainlink sat in the Key $ 12 support area based on Prest Time.

- The strong reaction here can be returned to $ 16- $ 18, and the rest can be seen with a link of less than $ 10..

The price of ChainLink (link) was traded for about $ 12 and decreased by about 11% in 24 hours.

The four -hour price behavior emphasizes the change of personality and the BOS (Break of Struction) points to indicate market structure and momentum change.

The chain link is traded at a downward down of about $ 20.00, and the choch and BOS have been weakened by about $ 18.00, $ 16.00 and $ 14.00.

After cleaning the equal EQH of about $ 16, BOS was less than $ 14.03.

Source: Trade perspective

If the support of $ 12.00 is suspended, a strong strength response can be reinstated to $ 16.00-$ 18.00, which matches the resistance area.

However, the failure of less than $ 12.00 can take a re -test of less than $ 10.00 if the weak momentum continues.

The $ 14 level is the central tribe. More than $ 15 will invalidate the weak scenario, but the drop of less than $ 12.00 will confirm the additional disadvantages. Volume and candle patterns near the $ 12.00 area are important for confirmation.

The main level decision of the link from the profitable chart…

The more analysis of the link’s “price/out price” showed that $ 12.00 is the most important support level.

The address, which is about 674.2m link volume, 43.78%, has strong support at this level.

“Outside of funds” accounted for 55.19%, which is about 605.8m links, which showed a potential resistance above the current price.

Purchasing demand requires this level, so if the link is lower, 43.78%of less than $ 12.00 supports potential floors.

This level of suspension can be connected to the $ 14.00 resistance area with high pressure.

Source: INTOTHEBLOCK

Rest of less than $ 12.00, with only 0.98%rest, can fall to $ 10.00 with little support.

The difference between 43.78% ~ 55.19% is a threshold. Over $ 12 extended purchases can indicate bulls, and the down falls can cause additional sales.

In addition, according to the “active address by profitability”, most of these holders have purchased a link for about $ 4.00.

This is composed of early adopters, which makes it a major support for paying attention. For these active addresses, 54.46%purchased less than $ 12.

Only 5.12%of the links, about 51.14m, earned money. The range of $ 4- $ 9.99 shows possible support areas when the link is dropped, and Bulls has set it to defend it to prevent further loss.

Source: INTOTHEBLOCK

It is highly likely to fall to $ 4 if bear pressure overwhelms the bull. However, 54.46%of profits can benefit from purchasing profits and limit about $ 10 losses.

If you invade less than $ 12, you can test $ 10, but staying above you can see the link reversal. “At Money” owners have little sales pressure, and if the amount is not reduced, there is a little optimistic feeling.