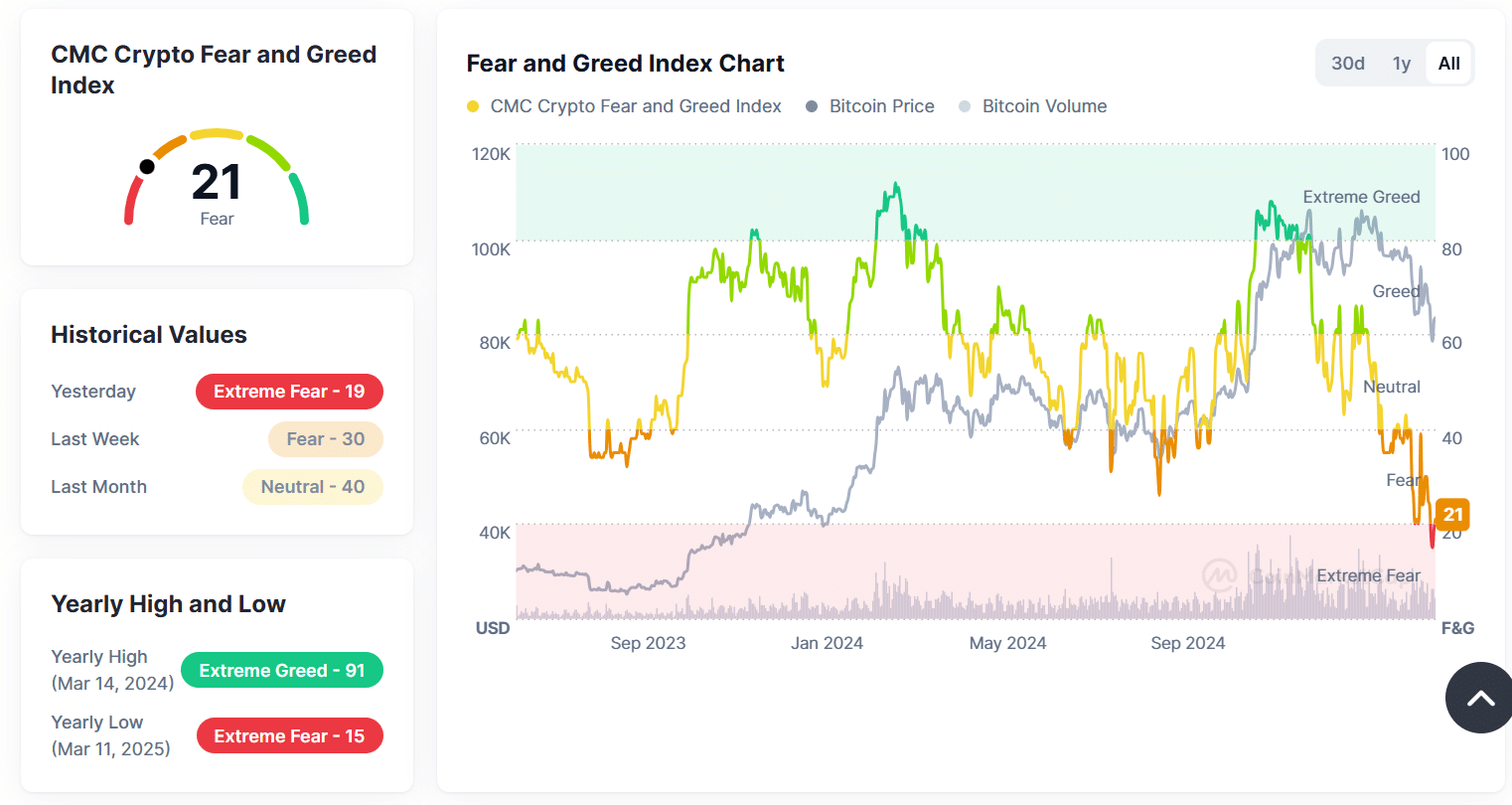

- The fear and greed index plunged to 21, increasing fear in the market.

- The ETF pure flow shows a mixed trend, and the BTC has a mild inflow and ETH is struggling with continuous leaks.

The CryptoCurrency market is fearing as the Crypto Fear and Greed Index has plunged.

This rapid decline reflects the increase in uncertainty due to significant leakage of ETFs, market cap reduction and extensive macroeconomic problems.

Encryption fear and greed index fall

The encryption market sentiment has been hit hard as the fear and greed index plunged to 21, which indicates extreme fear among investors.

Last month, the index stood at the 40th neutral, and trust fell sharply as the market deteriorated.

Source: Coinmarketcap

This decline coincides with the larger market correction reflected in the market capitalization and ETF trends in the last 30 days.

The market cap is undergoing a big decline.

TOTAL CRYPTO market capitalization is about $ 3 trillion in popularity, with Bitcoin (BTC) and Ethereum (ETH).

Bitcoin’s market capitalization decreased by 15.11% to $ 1.65 trillion in the press time, while Ether Lee’s decreased by 30.53%, down $ 227.41 billion, down by 30.53%.

Meanwhile, Stablecoins remained relatively stable at $ 2,162.22 billion, reflecting the transition to dangerous avoidance assets when uncertainty increased.

Source: Coinmarketcap

Other ALTCOINS also faced major sales volume, and group market caps fell 19.76%.

ETF Netflows reflects mixing feelings

ETF Netflows provides additional insights to investor behavior.

Bitcoin spent $ 13 million in positive inflows, but Ethereum has leaked $ 10 million, emphasizing investor feelings between two major cryptocurrencies.

Source: Coinmarketcap

Over the past month, the negative flow of many days has contributed to the weakness, strengthening the extreme fear reflected in the index.

Continuous leaks suggest that investors are still hesitant to deploy capital and weigh more on market recovery.

Implications for the encryption market

This level of fear and greed index generally signals the overbug market, but indicates the lack of trust between investors.

Historically, this extreme fear level gives priority over the recovery stage as opportunist traders try to take advantage of their low prices.

However, the market capitalization continuously decreases and the road to recovery with continuous ETF leaks can still face resistance.

If Bitcoin does not maintain its market dominance and Ether Lee’s leak continues, the weak trend can continue to strengthen more liquidation and intensify market correction.

On the other hand, the transition to positive ETF inflow and the stabilization of the cigar capacity can be marked with the beginning of the emotional reversal.

conclusion

The current market sentiment suggests a cautious approach to merchants and investors. Extreme fear can offer purchasing opportunities, but macroeconomic factors and capital outflows still remain a major risk.

ETF trends, stablecoin domination and market strength monitoring are important for determining the following main movements: