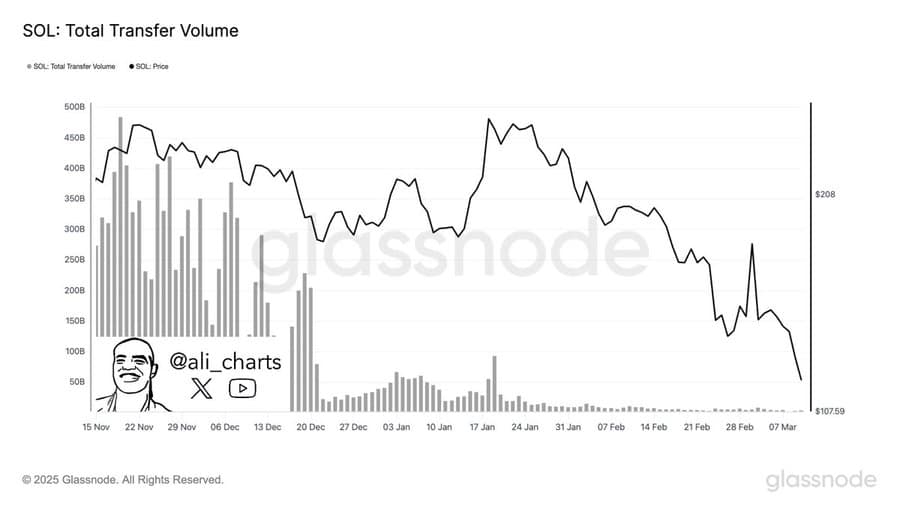

- Solana has significantly reduced trading volume and has fallen to the lowest level of 2024.

- In the chart, SOL may be risk of lowering the total value, especially if the total value is lowered.

Over the past month, Solana’s price has been slightly slowed down and has decreased 36% on the chart. At the time of writing, Martket sentiments seemed to decrease as more sellers entered.

Analysis of liquidity exercises showed that hiking of SOL leaks has emerged over the past month. This tends to continue because it usually loses the level of support that provides rebound.

The amount of exercise falls significantly as the solids weaken.

The significant contribution to Solana’s decrease in the driving force dropped rapidly. In fact, according to the press time data, Altcoin’s trading volume has fallen to the lowest level, and the daily trading volume is only $ 3 million.

If the volume and price drops at the same time, it means that the market participants sell their shares. This can potentially reduce demand.

Source: Glass Node

The tvL, which tracks liquidity flow in the Solana -based protocol, has also dropped significantly. After reaching the peak at $ 12.9 billion in January, it took almost half as it amounted to $ 66.9 billion in the press time.

The large -scale liquidity leak of the protocol is a sign that investors who first immersed their assets are currently selling their assets. This is probably possible because of the lack of trust in assets and trying to protect yourself from the additional price drop.

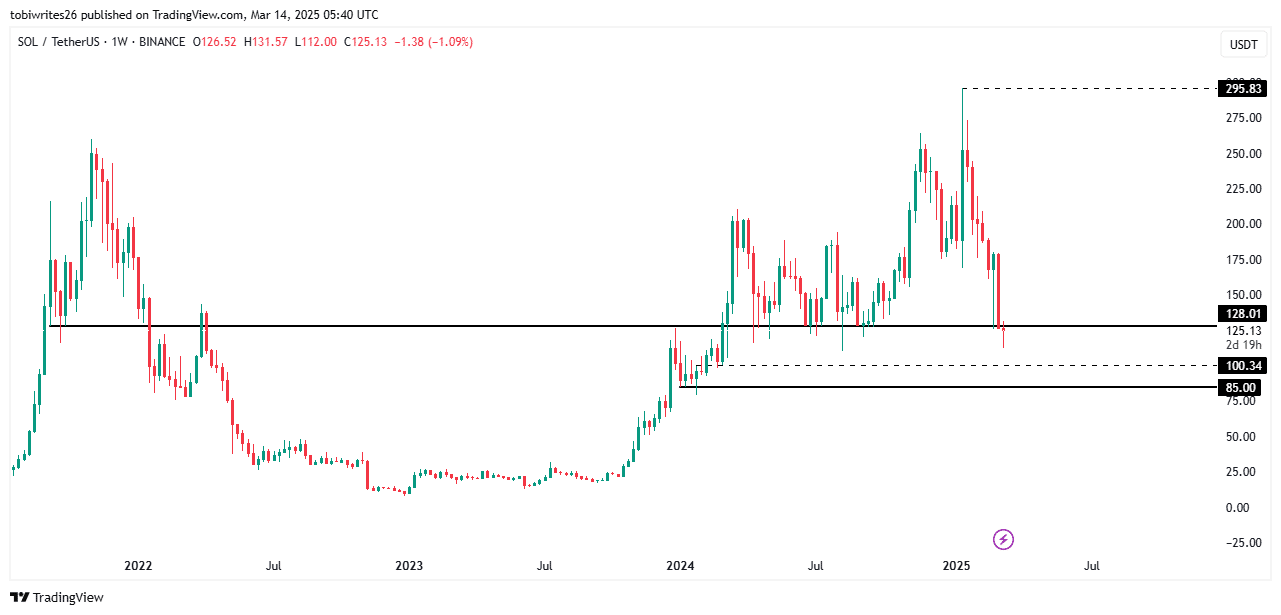

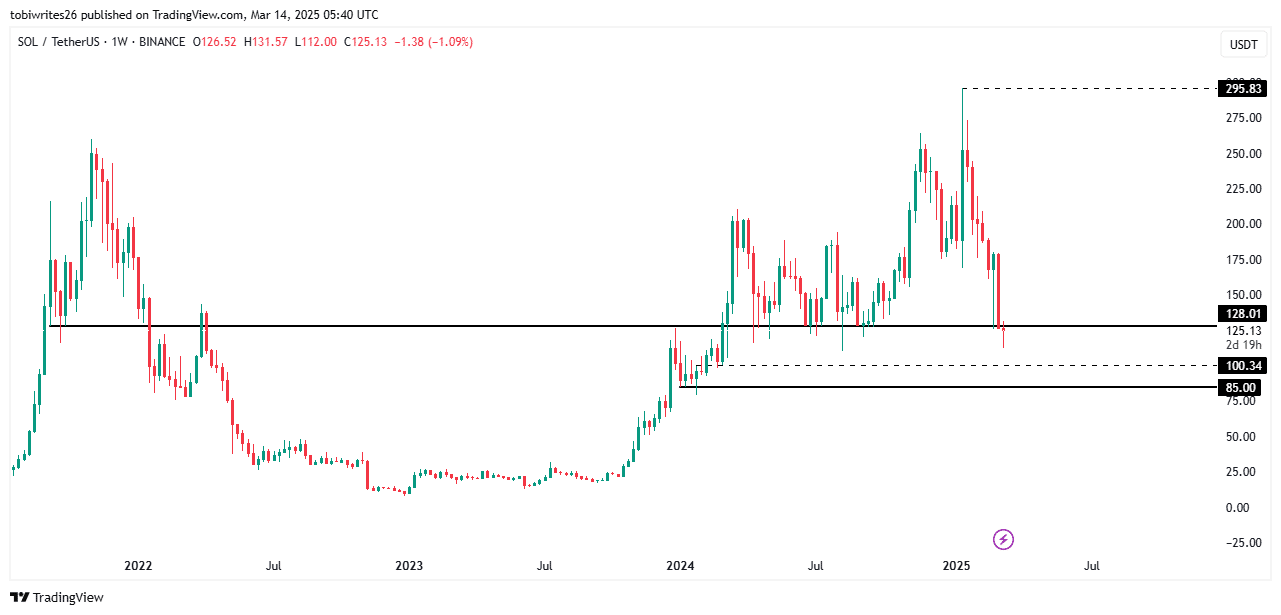

Potential reductions fall below $ 100

AMBCRYPTO’s SOL ‘S Price Movement Analysis suggested that assets could be reduced to $ 100 after losing their major support levels to $ 128.01.

In general, the support level provides a cushion for the price and promotes the rebound to create a fall scenario to the rental. But when they are violated, it means that selling momentum is more important than buying pressure at that level.

Source: TradingView

If the SOL does not maintain the next support to $ 100.34, it can reduce it to $ 85. As a result, assets will return to the last two -digit price in 2024.

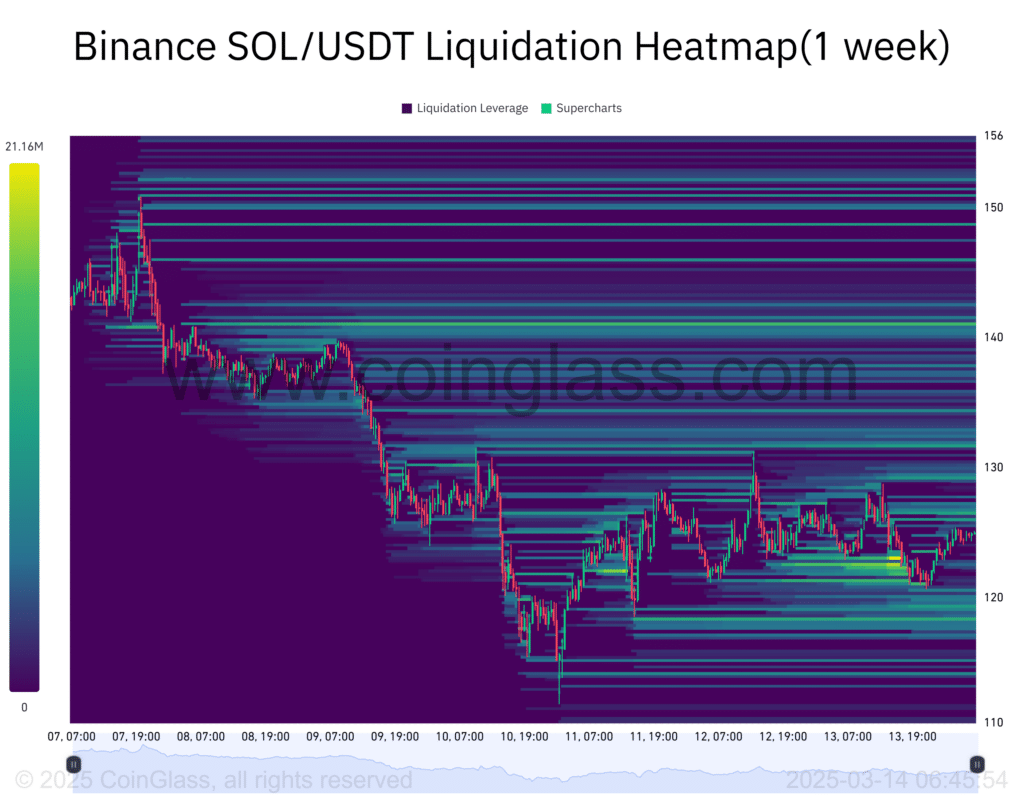

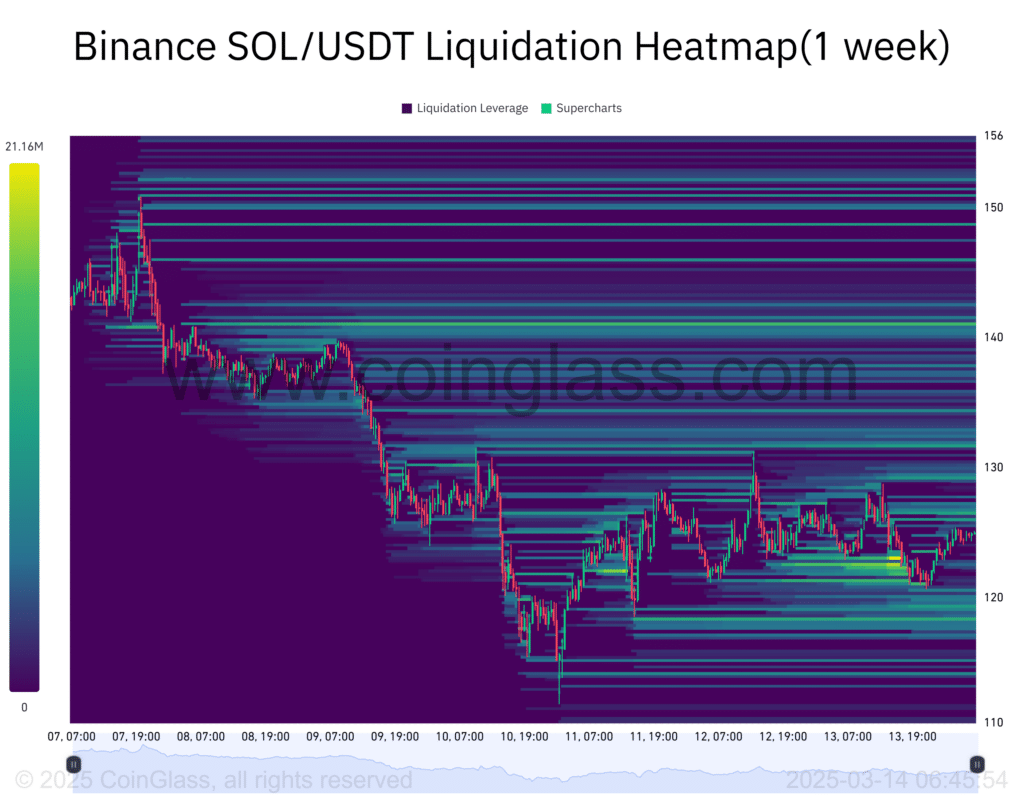

Analyzing the liquidation heat maps showed several liquidity clusters between $ 120 and $ 114. This cluster often acts as a magnet to increase the price and push it lower.

Given the prevailing decline, SOL can set a new lowest point on the chart.

Source: COINGLASS

Not all merchants are weak

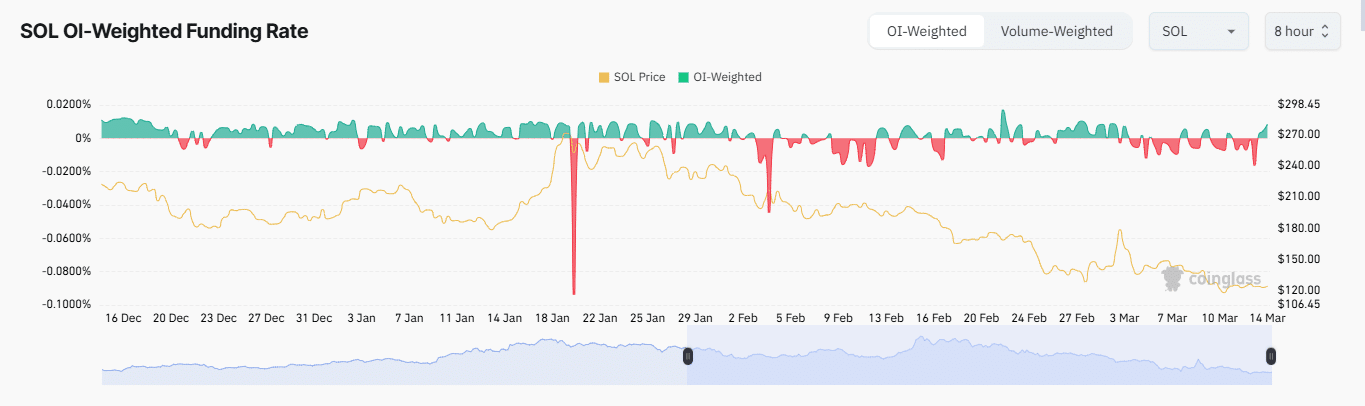

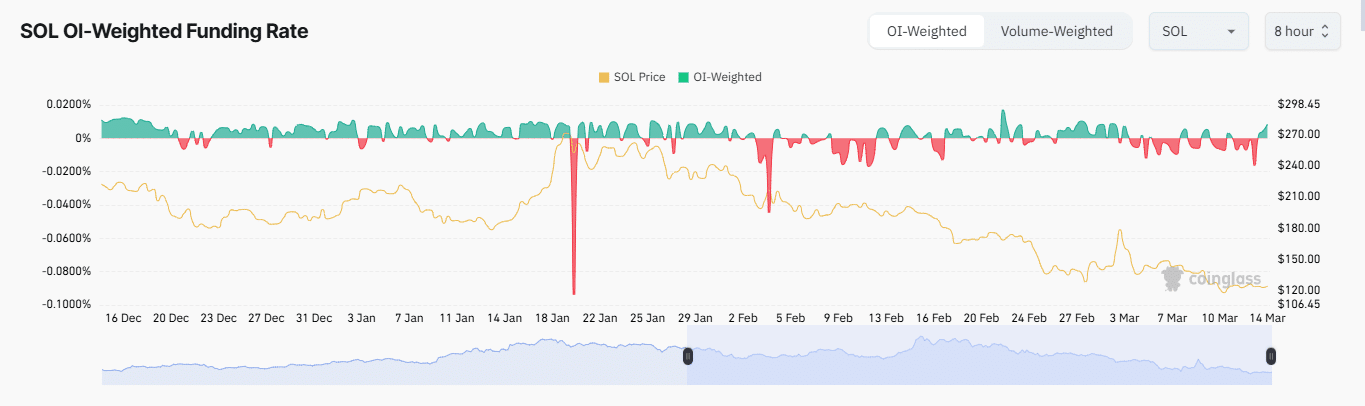

In the derivative market, some traders are betting in long bets in anticipation of SOL rebounds. In recent years, purchases in the derivatives market have increased with the rate of financing.

The long proportion of CoingLass, which measures the purchase volume compared to sales, has read 1.004 for the prestation time. The level of 1 or more indicates that there are more buyers than the seller within that period.

Source: COINGLASS

This purchase appraisal can be further confirmed by the OI weighted funding rate, which combines public interest and financing fee data to provide more accurate market emotion readings. At the time of writing, feelings have been registered with 0.0086%thanks to the rise that began on March 13, and changed positively. This suggested an increase in the long position.

It is still strong to buy volume in the derivative market, and if Solana finds lost for $ 128, the rebound may be imminent. Otherwise, Altcoin can no longer fall.