- The liquidity growth of the BNB chain was significant, and there was a rally of $ 730 in the chart.

- The mayor’s feelings show that there was a weakness of weakness, but the purchase volume is

For the first time for the first time, BNB has been optimistic on the chart, and encryption has increased almost 2% for 24 hours. This has been a loss of almost 17%of investors.

This rally can be marked with the beginning of the main movement, especially if the BNB passes the critical resistance line and sells pressure in the derivatives market. Therefore, it is worth deeply exploring the potential movement of BNB.

Liquidity inflow strengthens the price movement of BNB

According to AMBCRYPTO’s analysis, there was a notable inflow of BNB chain and the same reinforcement late. This inflow not only contributed to the price rally, but also triggered the rise of the total value lock (TVL).

TVL measures the amount of deposition and submerged BNB over other protocols of the BNB chain. According to Hiking, more investors are locking their assets and indicate trust in potential price rally.

Source: Defillama

Between March 12-15, the TVL of the BNB chain surged to $ 490 million, showing the amount of BNB in the protocol. Also, these size Liquidity inflows can be associated with hiking of the active address during this period.

At the time of writing, on March 8, the company reached a peak of 1.1 million people, with a minimum of 959,200 per month, and the number of transactions reached 4.5 million. Along with price and TVL, the growth of these metrics suggests the dominance of buyers of the entire market.

BNB faces major resistance

The price survey mentioned above has pushed BNB into a resistance line formed from mid -February. The overall decreased in the last two situations where the price was in contact with this resistance.

If this level of violation is seen, assets are likely to rise to $ 732, with a profit of 23.48%.

Source: TradingView

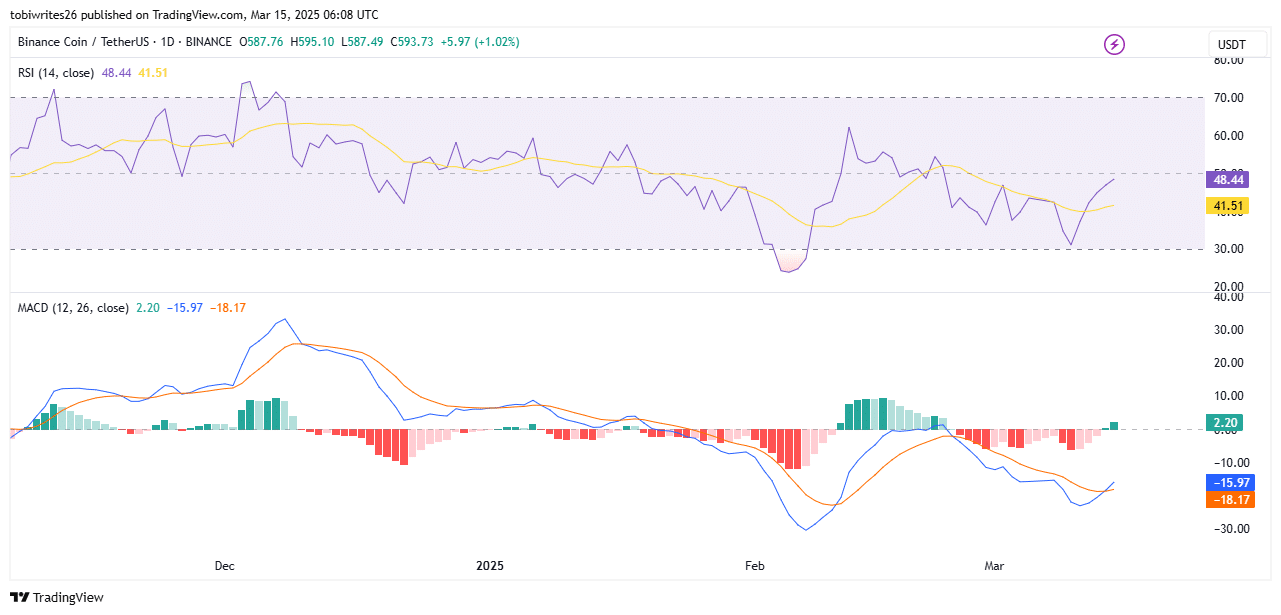

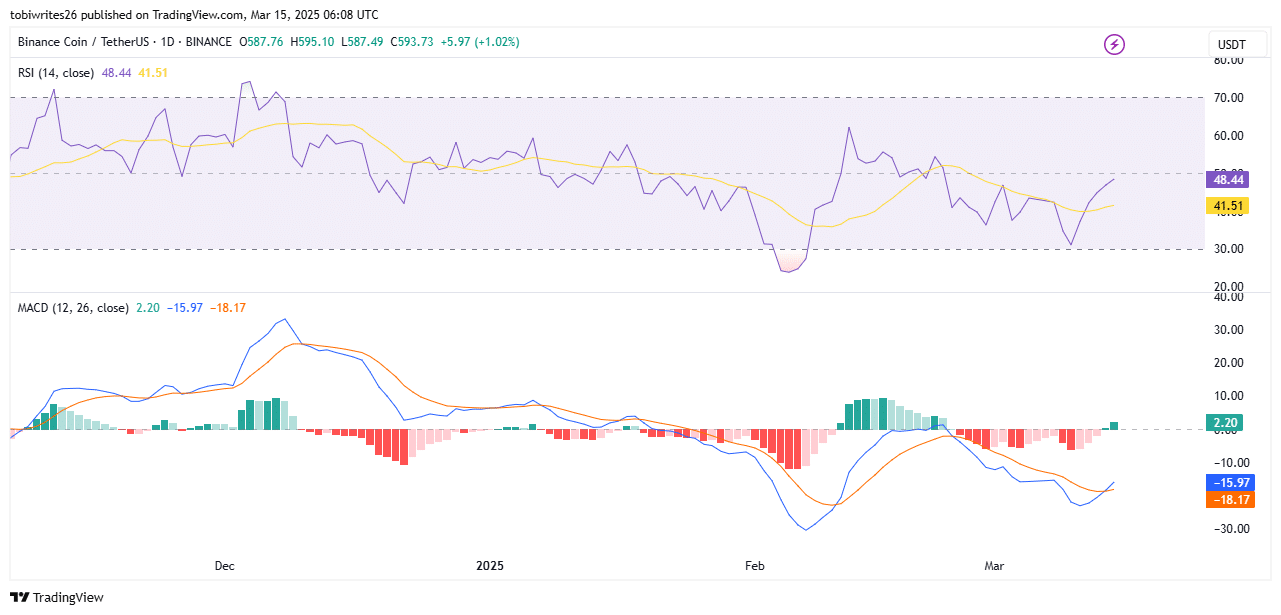

The technical indicator of the chart suggests the potential of the market rally. In the press time, the relative strength index (RSI) and the moving average convergence radiation (MACD) suggested an optimistic scenario for Altcoin.

The daily RSI movement also revealed that assets could continue to show high trends. In particular, the RSI seemed to close to 50 or more in the purchase area.

Source: TradingView

The MACD also formed a classic Golden Cross pattern, which occurs when the blue MACD line goes over the orange signal line.

Such patterns usually take precedence over optimistic movements in the market. If this occurs, the BNB brake out can occur in the short term.

Derivatives data show a mixed feeling between merchants.

Despite the strong feelings in the market, some merchants are selling. At the time of writing, open interest in the future and options market decreased 2.30% and 1.56%, respectively.

Disclosure interest reduction means that unstable contracts in the derivatives market can potentially be filled by short traders who expect prices. This usually stops moving as a rising price or affects depreciation on the chart.

Source: COINGLASS

But Binance and OKX’s derivatives traders continued to buy at a flashing rate of long ratio of 1.43 and 2.18, respectively. If this ratio is more than 1, there are more purchases than sales. And the higher the one or more, the stronger the purchase volume of the entire market.

If the derivatives traders of these exchanges continue to purchase, the sales pressure of other cohorts in the derivatives market is minimized. Only then can the BNB price come from the chart.