The Stablecoin protocol level has increased the new venture capital to expand the $ 80 million return -to – -payment -paying stabil as the demand for the production of the yields increases with the reuse of the encryption price.

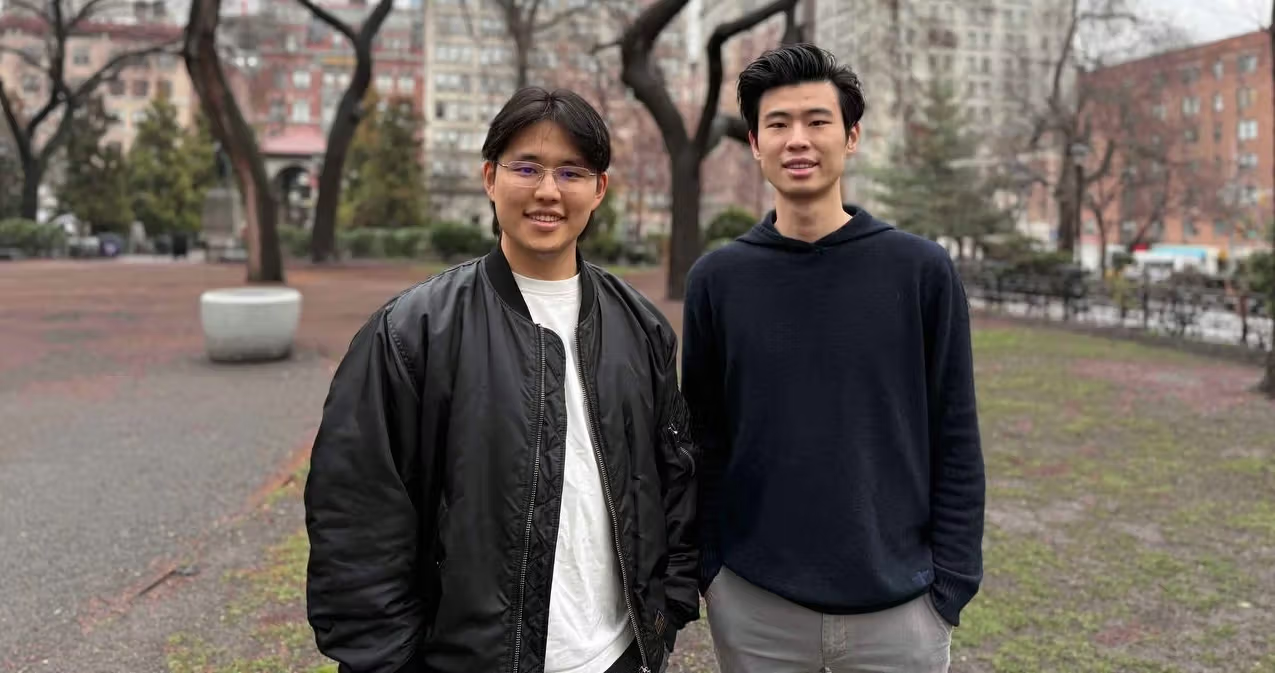

PEREGRINE Exploration, a level developer, received an additional $ 2.6 million led by the initial supporter DragonChain, with the founder David Lee and Kedian Sun in an interview with COINDESK. The new investors include Sam Kazemian and Albert of Injective of Flowdesk, Echo Syndicates Native Crypto and Feisty Collective, FRAX of Angel Investors.

The latest round was impressed in August, and total venture capital funds have reached $ 6 million.

Along with the Lvlusd tokens, the level is competing at the fast -growing Stablecoin Asset Class, one of the most popular sectors in encryption and love in venture capital. Cryptocurrencies, mainly with a fixed price connected to the US dollar, are the main infrastructure for trading and transactions of blockchains. However, the largest publisher usually does not provide a yield to the user obtained for assets in the sponsorship area. For example, tethers reported a part of the US Treasury yield, which supported $ 130 billion last year and supported $ 143 billion USDT tokens.

As a result, the new generation’s yield surgery Starble Lecomin is becoming more and more popular among encryption investors. Ethena’s usde creates a yield that has expanded to more than $ 5 billion even after a year of financing market neutral portable strategic harvest futures. Meanwhile, another stable alternative, tokenized version of Money Market Fund and financial expenses, recorded a $ 4.6 billion market cap.

Level’s Stablecoin provides investors to operate backup assets in distributed Defi loan protocols such as AAVE and at the same time automate retention management. The user can mint Lvlusd by depositing USDC or USDT Stablecoins in Circle. As of last week, the annual return on LVLUSD’s steak version was 8.3%higher than the token currency market fund return. Lvlusd, meanwhile, is integrated with Defi protocols such as Pendle, Spectra and Layerzero and can be used as a collateral of MORPHO.

Sven wellmann of Polychain, one of the protocol investors, said, “The completely transparent approach of the chain to get production is opaque and differentiated from competitors that rely on centralized methods.

According to Level’s calculation, the protocol surpassed rival Stablecoins’ yield offering last month, which has exceeded $ 80 million in five months since the beta was released.

Kedian Sun explained that the company plans to expand its marketing efforts with the latest funding and continue to expand the utility for LVLUSD, Kedian Sun explained. This protocol also plans to use MORPHO to produce yields in the next few weeks.

With this effort, LVLUSD can potentially promote the market cap of $ 250 million, the main milestone that the team wants to achieve, SUN said.