- Altcoin Season follows Bitcoin’s rule. Capital changes when btc.d decreases

- Some factors can cause serious threats to the Altcoin cycle.

BTC.D (Bitcoin Dominance) is a key indicator of tracking Altcoin season. If BTC.D falls, it usually means that investors are moving to Altcoin during market volatility.

But even though there are macroeconomic problems such as the upcoming FOMC meeting and Trump’s ‘interaction’ tariff on April 2, Bitcoin’s dominance is still strong. At the time of writing, I received 61.6%of reading, and still less than 64.3%of the peak in February.

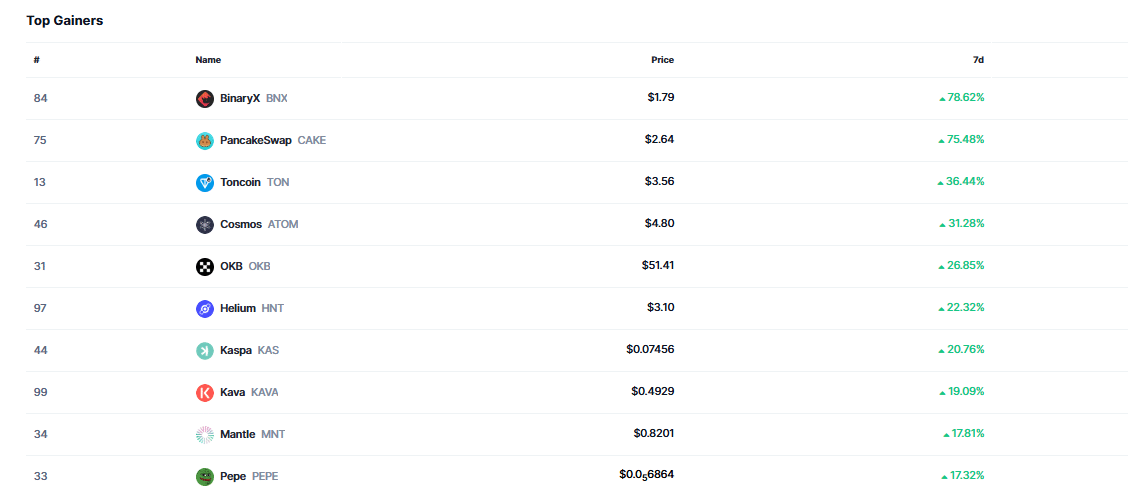

Interestingly, if you look closely at the best weekly beneficiaries, four out of five are found to be medium or lowland Altcoin. This change suggests that investors are getting farther away from large coins, preferring high risk options.

Source: Coinmarketcap

Bitcoin’s elasticity faced with altcoin overload

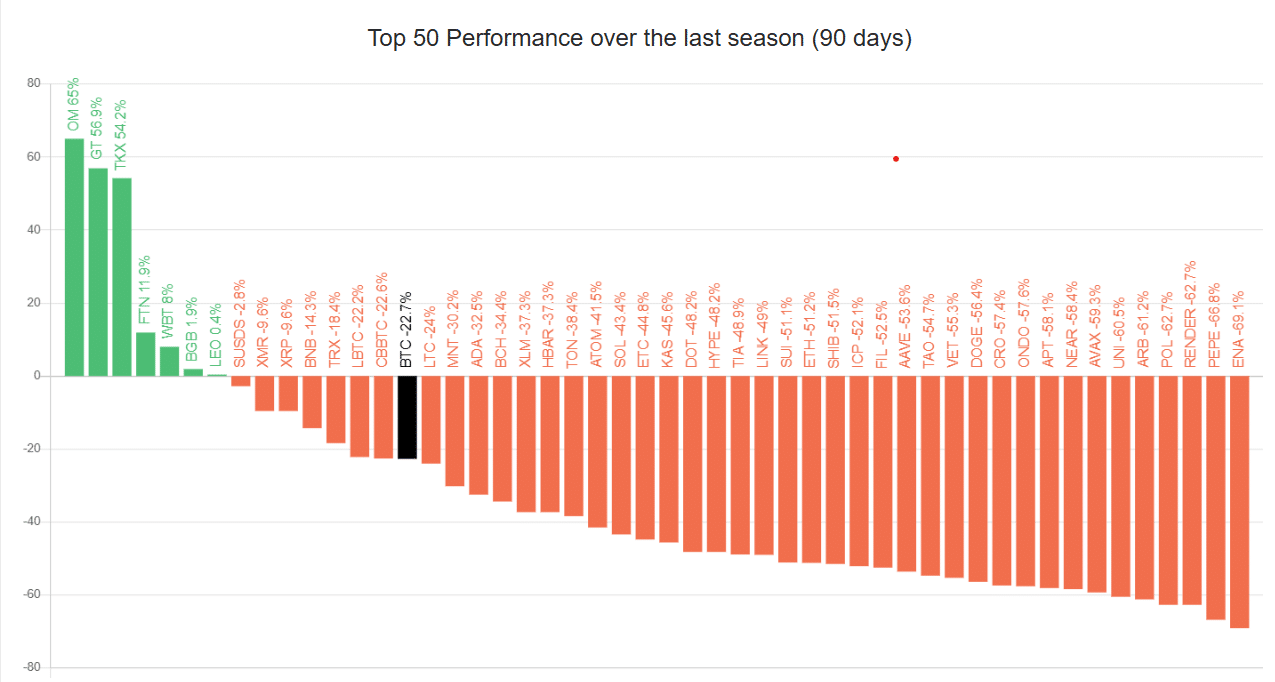

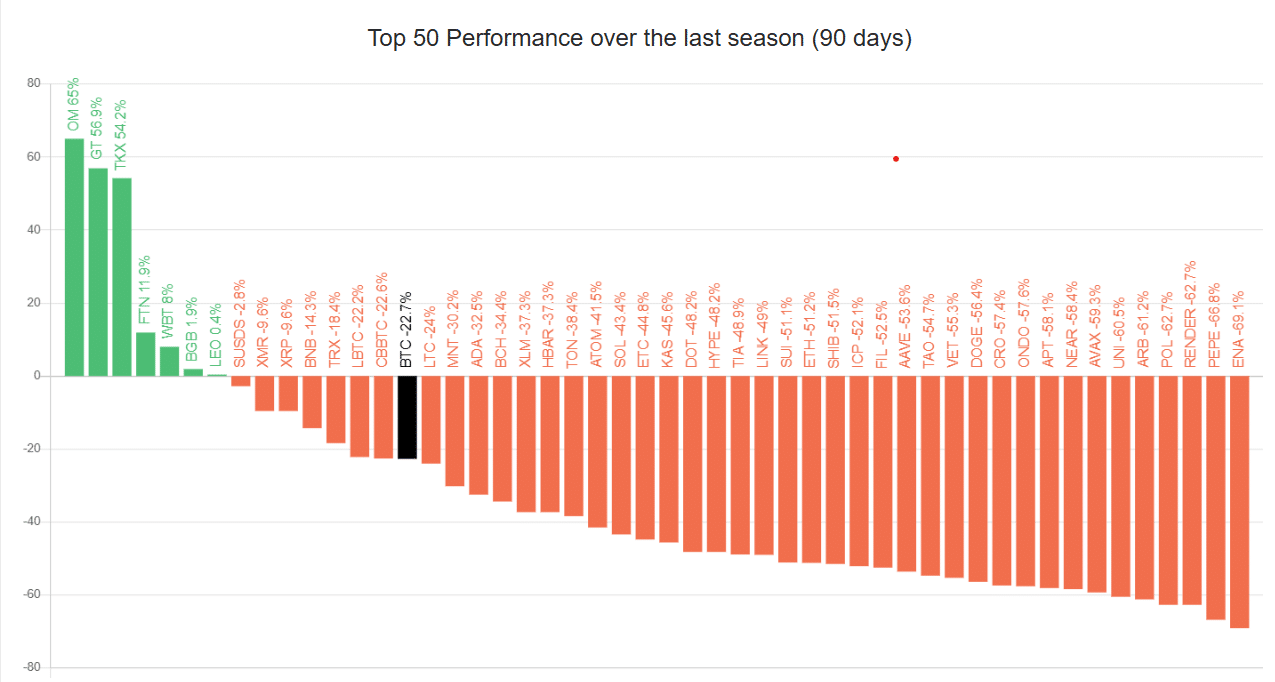

Historically, Bitcoin Dominance has been used as an important measurement of the Altcoin season. When BTC.D rises, it usually indicates that investors are moving their funds to Bitcoin for safety. But this time the situation is different. First of all, the risk of Bitcoin is higher than usual. Q1 did not end as expected. Bitcoin is still less than $ 100K, so many people were disappointed.

In addition, interest rate cuts are not expected by the end of the second quarter, so the market is maintained in the atmosphere. Nevertheless, the Altcoin season is not seen.

Despite the Bitcoin Holding Steady, Altcoin Season Index recorded a SAT at the age of 29 at the prestation time. That is, 58%of Altcoin is better than BTC. Especially low-mid cap coins.

But this was still much lower than the 75% critical price that is usually needed to start the true Altcoin season.

Source: Blockchaincenter.net

The key element of the migration cycle is the rise of Bitcoin ETF. Bitcoin ETFS has passed a few days before Bitcoin recorded $ 1,090,000 in January.

Since then, millions have been poured into this ETF and have been submerged in BTC. This change delayed the typical Altcoin season, especially because liquidity is limited.

The end of the Altcoin season?

As of March 18, COINMARKETCAP has been listed with more than 11 million digital assets from 11 million in February. This surge in Memecoins and Low CAP tokens spreads the investor’s attention.

Bitcoin dominance is powerful and delays Altcoin season, but investors are switching to high risk alternatives. Many tokens are now trapped in a market cap from $ 10,000 to $ 100,000, locking capital with short -term assets.

This is putting pressure on the top high cap coins. For example, the -ETH/BTC pairs have become stronger, but now fell to the lowest level.

Source: TradingView (ETH/BTC)

In conclusion, Bitcoin’s dominance is powerful by reconstructing the market with the injury of new tokens and ETFs. The general capital flow from Bitcoin to Altcoin is also faded, so it can control the cryptocurrency tightly.