- Fidelity moved SOL ETF, so only Blackrock was out of race.

- In the last three weeks, more than $ 470m brush has moved from the exchange.

Fidelity, a $ 15 trillion asset manager, has joined the United States. Solana (sol) ETF (Exchange-Traded Funds) race.

On March 25, the company submitted 19B-4. form SPOT SOL ETF with CBOE BZX Exchange with Securities and Exchange Commission (Securities and Exchange Commission).

SOL ETF race is heated

Only Blackrock has not yet created a similar application. But Grayscale, 21Shares, Bitwise, Canary Capital and Vaneck did so. The market expectation for approval was high at 86%per polymarket.

In fact, in February, the institution admitted all submissions and entered the window for 240 days for approval decisions by entering all submissions. At the time of this article, Franklin Templeton’s application has not yet been hit by FR.

Undoubtedly, Fidelity’s movement was expected later. registration A general passage for the publisher who trusts the trust of Delaware and a new ETF on March 20.

After the recent debut of ETF futures approval and CME futures, SOL was the best competitor in the Altcoin ETF lineup. Other Altcoins, such as Litecoin (LTC), Polkadot (DOT), Avalanche (Avax) ON (SUL)Dogecoin (DOGE) also saw ETF interest among the publishers.

However, the NATE GERACI of the ETF store expectation The agency will not be able to record all Altcoin ETFs.

“The optimism for the approval of various ALTCOIN ETFs will draw a line somewhere.

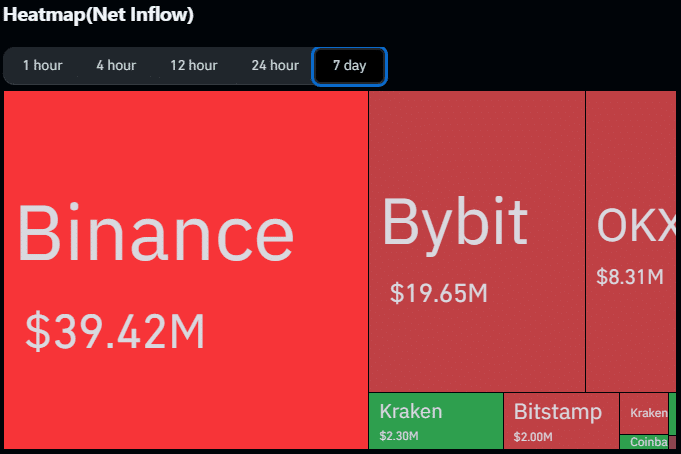

Market, speculator bet Price of Altcoin. Especially OIn the last seven days, the holders have withdrawn about $ 70 million from the exchange to show optimistic expectations for the future.

source: Coinglass

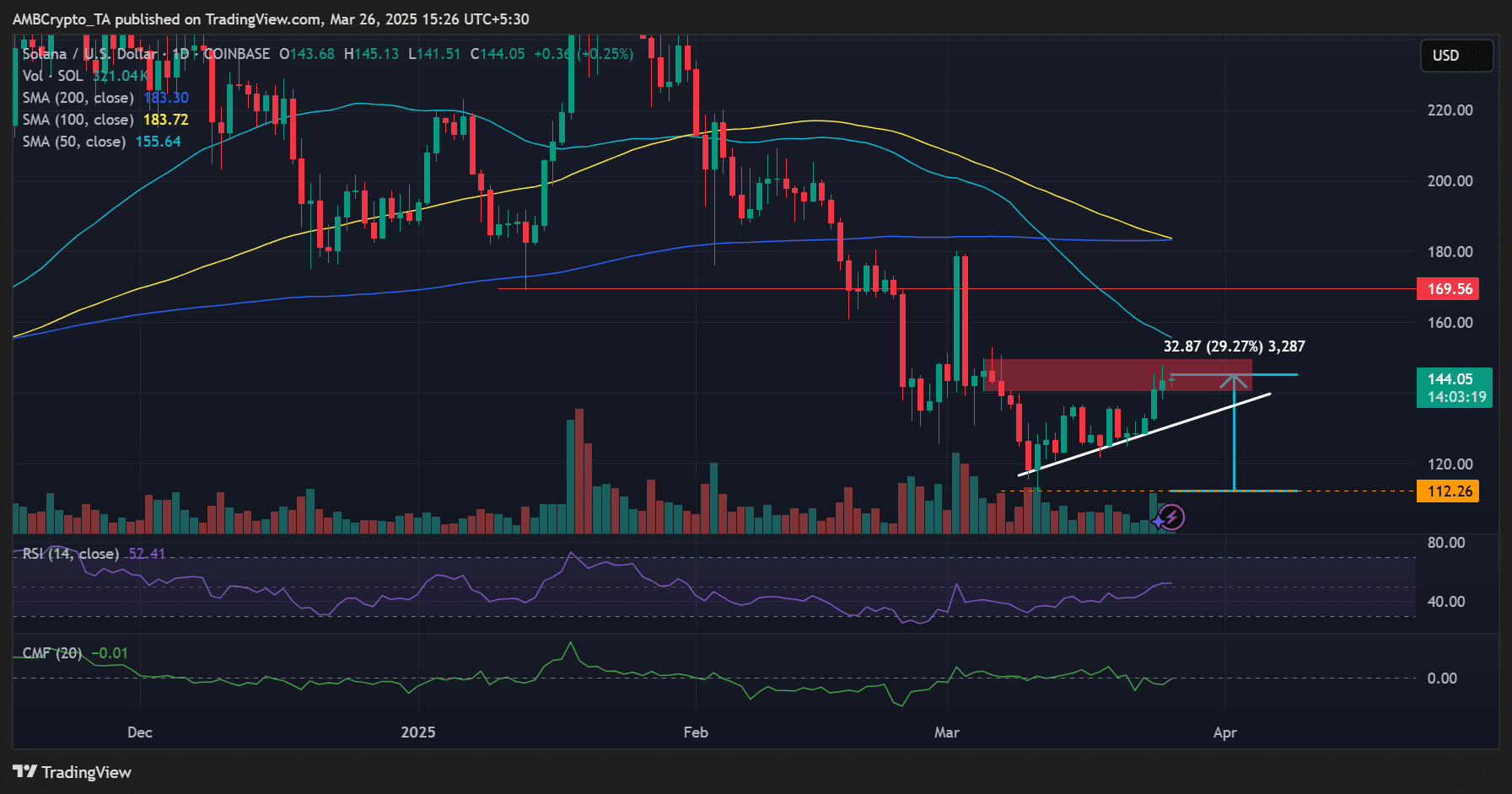

According to the CoingLass data, more than $ 4.7 million SOL has moved from the exchange over the last three weeks. This demand is almost 30%of Altcoin from $ 112 in March.

But Bulls had to be organized to further increase the $ 150 obstacle, or a short seller could restore the market advantage.

Source: Solusdt, TradingView