- Whale activities and major support levels have proposed Ether Leeum’s potential price.

- Exchange reserving declined and the liquidation point increased volatility, but also signaled upward potential.

Ether Leeum (ETH) Recently, a large amount of withdrawal from major exchanges has resulted in significant whale activities. The new wallet has withdrawn 7,100 ETHs, worth $ 14.27 million from Gemini.

In addition, ETH’s significant transfers in Binance, OKX and Krake reached millions of dollars.

Some of these assets can be trapped or deposited in a loan platform like AAVE, showing optimistic intentions.

What does price behavior mean about Ether Leeum?

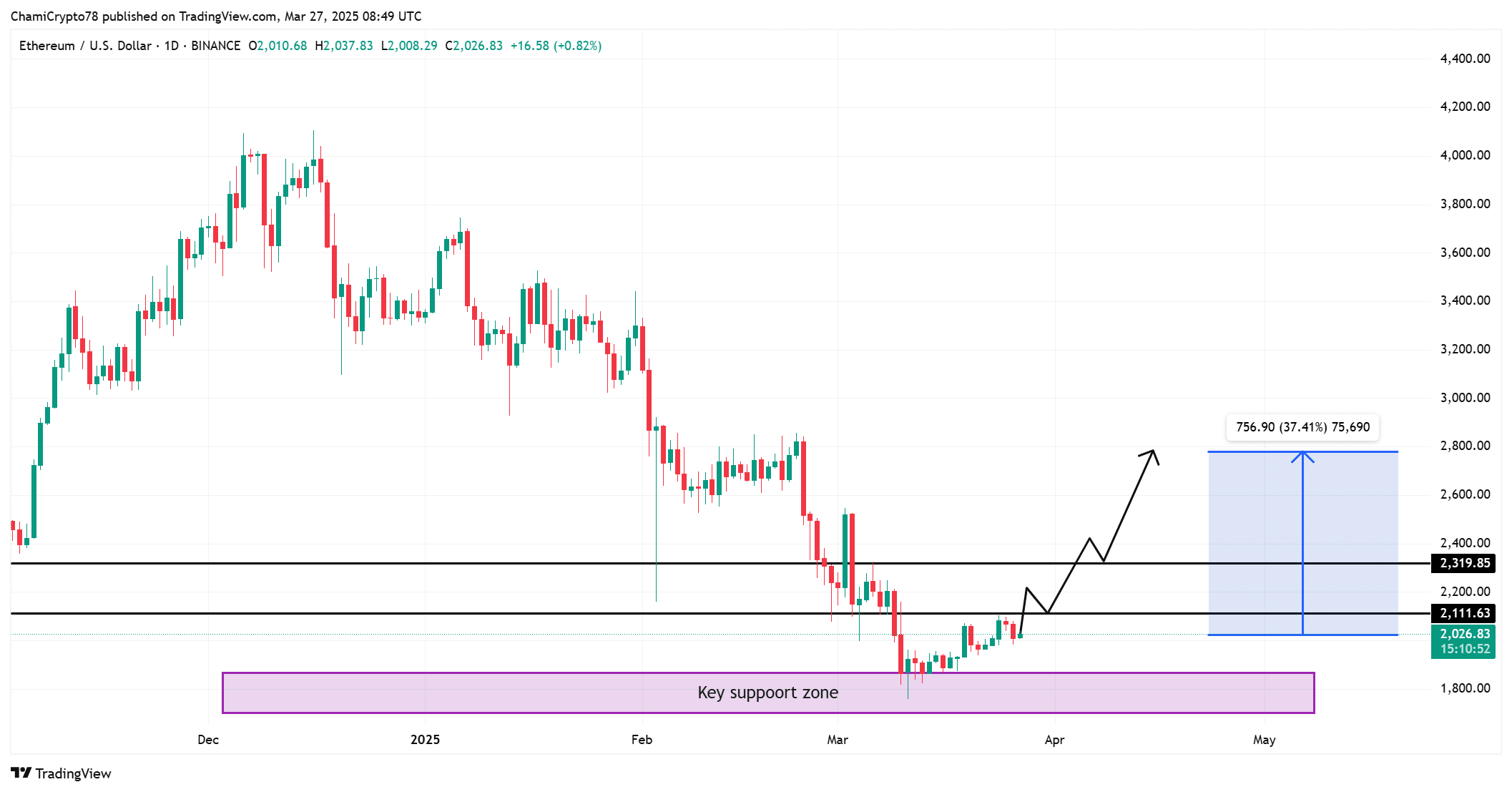

The price of Ether Lee in the prestime time was $ 2,030.76, reflecting slightly 1.21% decrease in the last 24 hours.

Despite this minor dip, Ether Leeum continues to be hovered to important support levels, especially $ 2,000. At the beginning of whale activities, Ether Lee is more likely to experience price rebound.

If the price increases the level of support, a rally may be over $ 2,100 resistance.

As a result, more purchases may occur if this threshold is exceeded, and the price has risen 37%to $ 2,800.

Source: TradingView

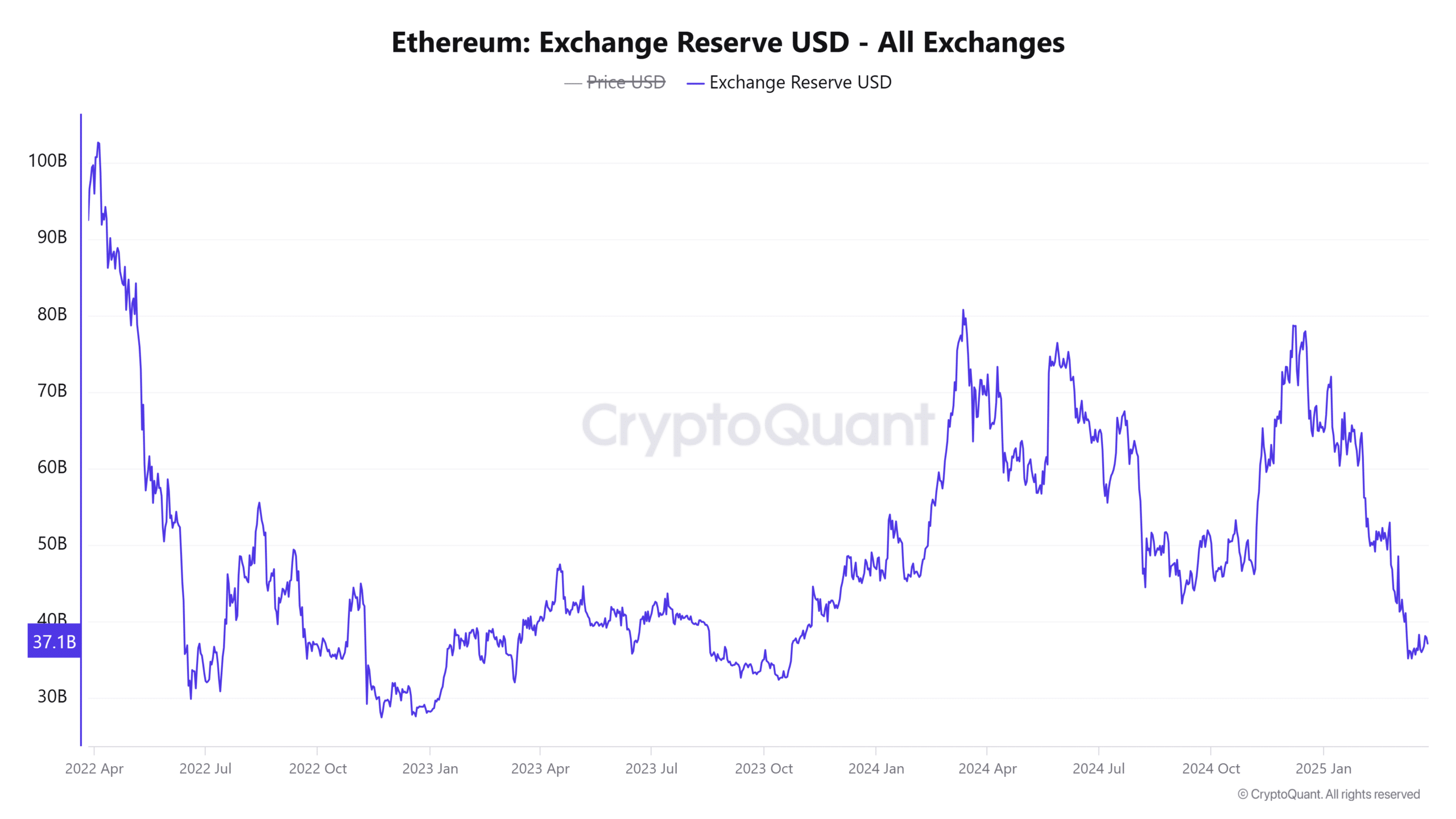

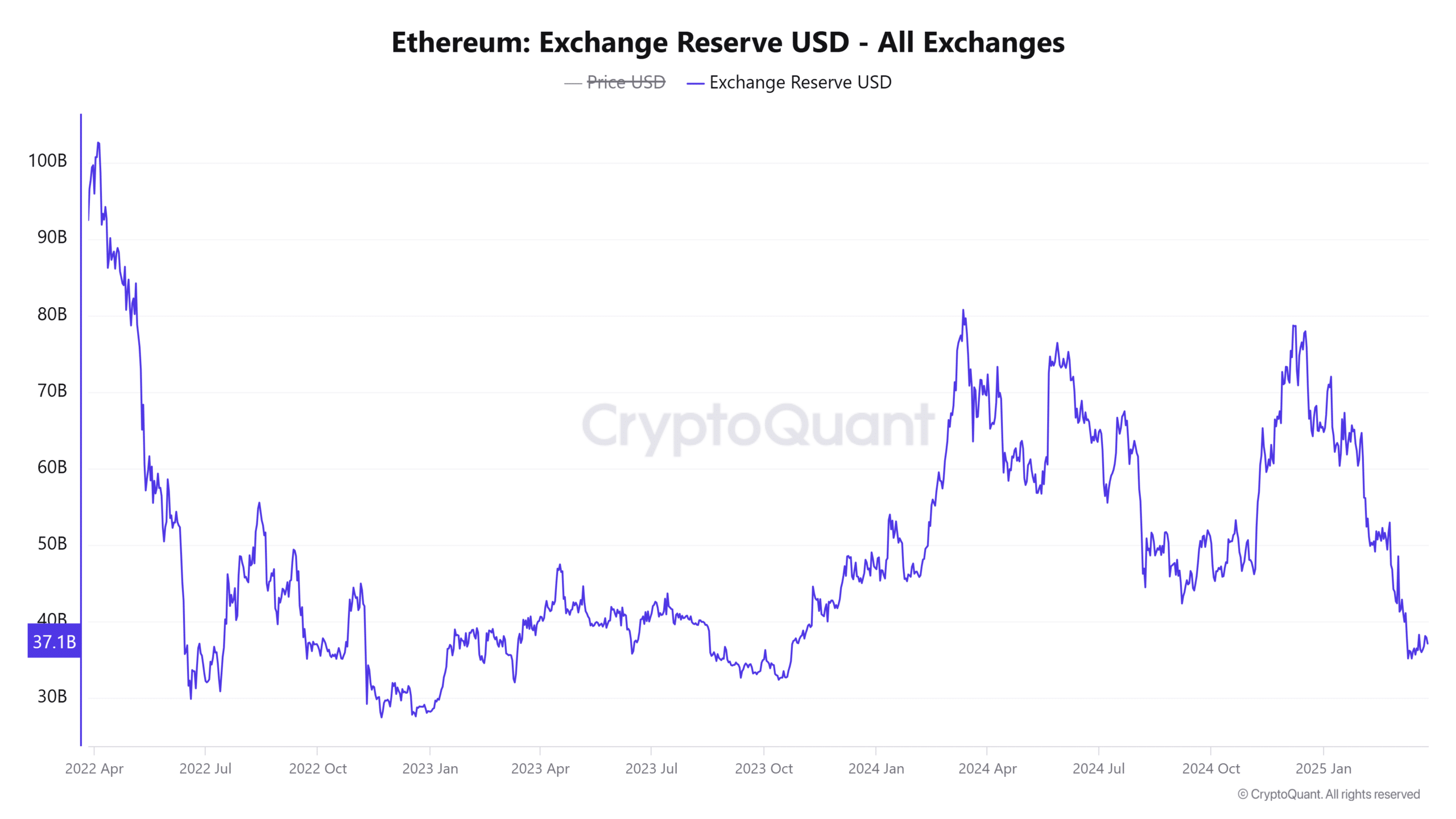

ETH ‘S Exchange

At the time of writing, Ether Lee’s replacement reserves were $ 37.1653 billion, down 2.16%. This reduction suggests that more ETH is getting out of the exchange and reducing the liquidity that can be used for immediate transactions.

This change can indicate that investors are moving their positions, moving their assets to other platforms, or moving their assets for long -term investments.

With more stringent supply to the exchange, Ether Leeum can experience the upward pressure for the next few days.

The reduction of the exchange reflects the evolving market epidemiology, indicating the decrease in sales of sales, and potentially inducing price hikes.

Source: cryptoquant

Liquidation archipelago: How does the liquidation level affect the price?

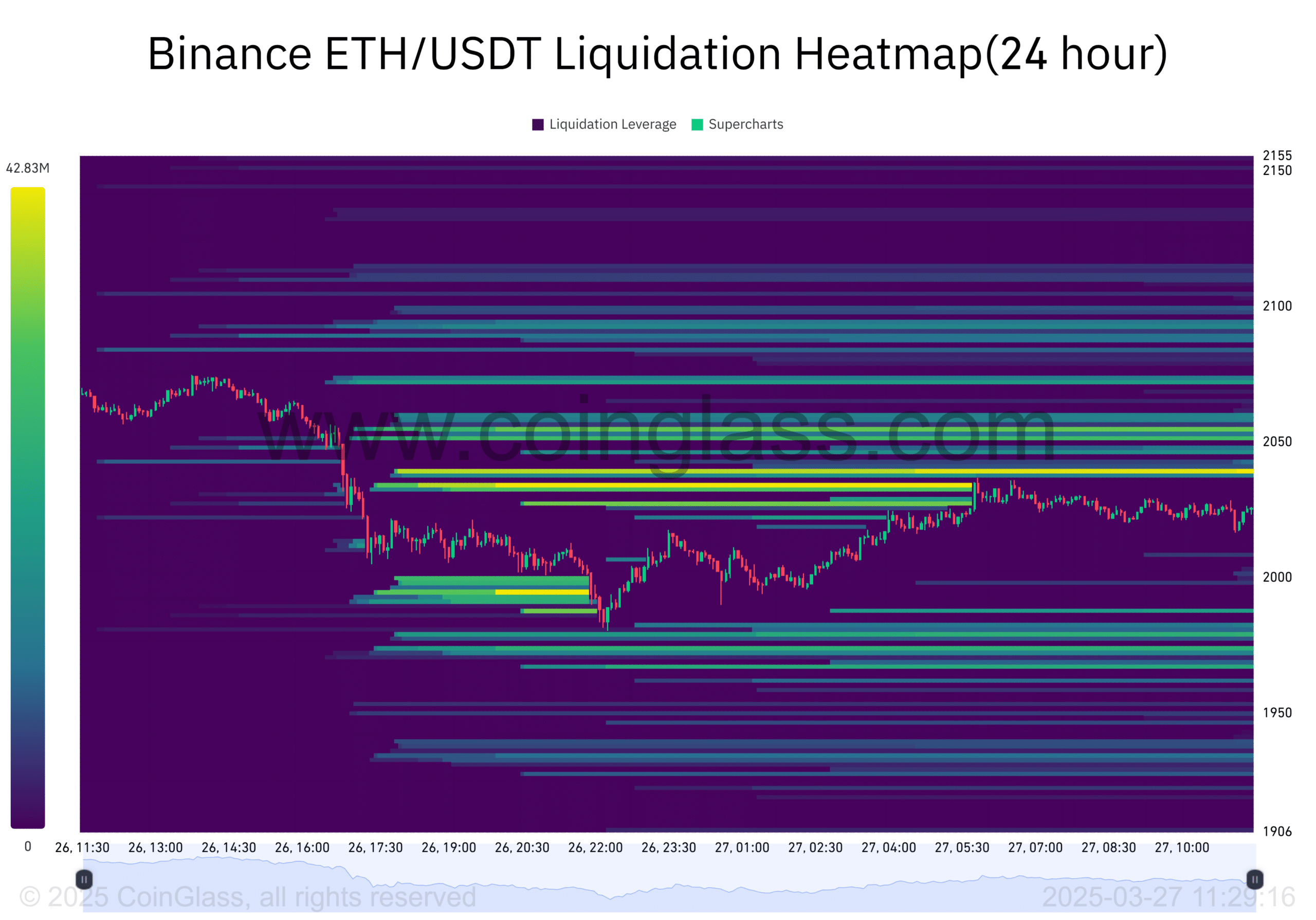

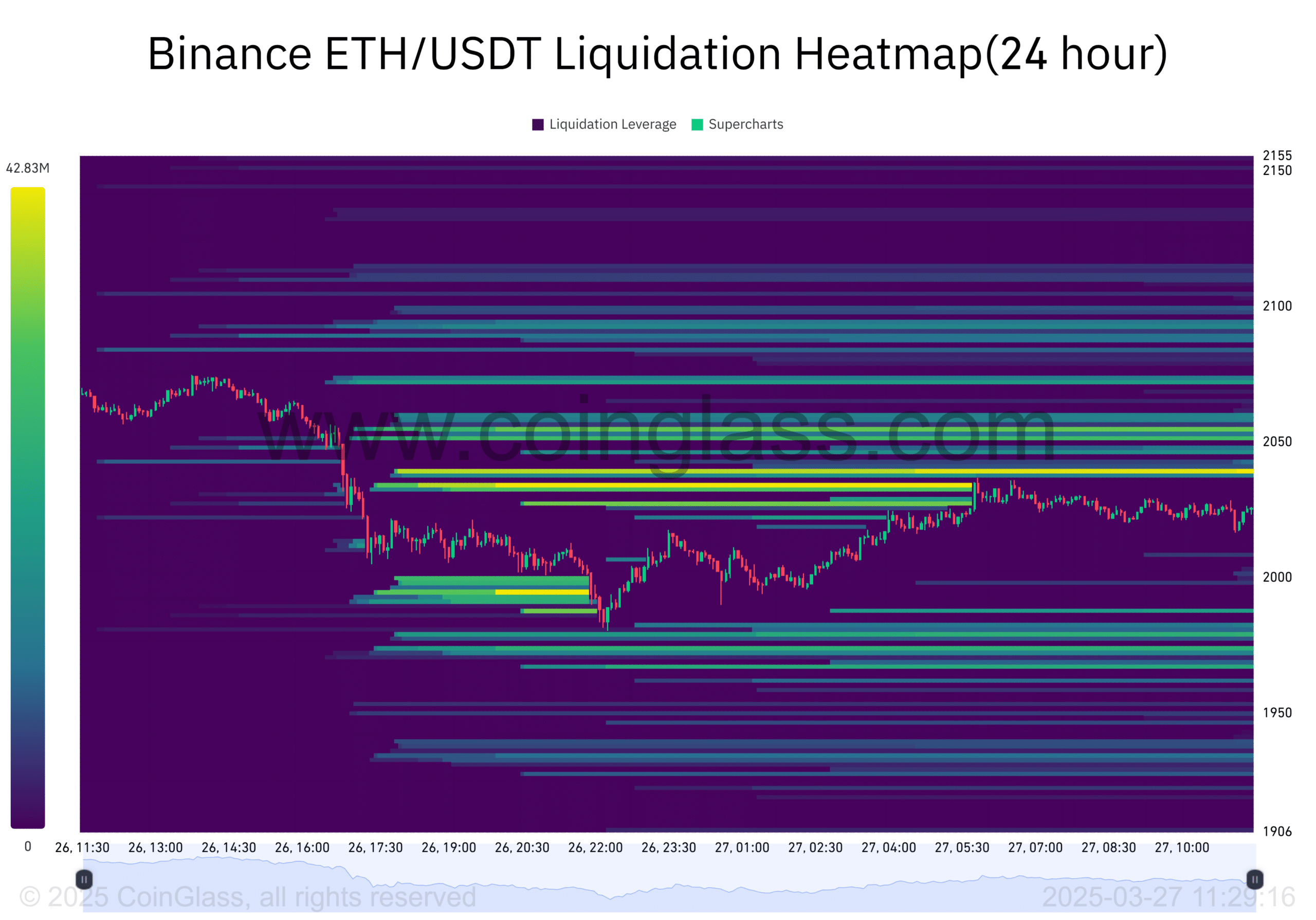

Dissolve the liquidation heat map of Ethereum in binance and the main support and resistance areas will appear.

Easy map shows a significant liquidation point between $ 2,000 and $ 2,100. As Ether Lee’s approach to this level, forced sales may occur, resulting in an increase in market volatility.

Increasing this volatility can increase the price of Ether Leeum to increase the price or face downward correction.

The price of Ethereum is under pressure because of the high liquidation scores, but it can increase rapidly if the market effectively absorbs these liquids.

Source: COINGLASS

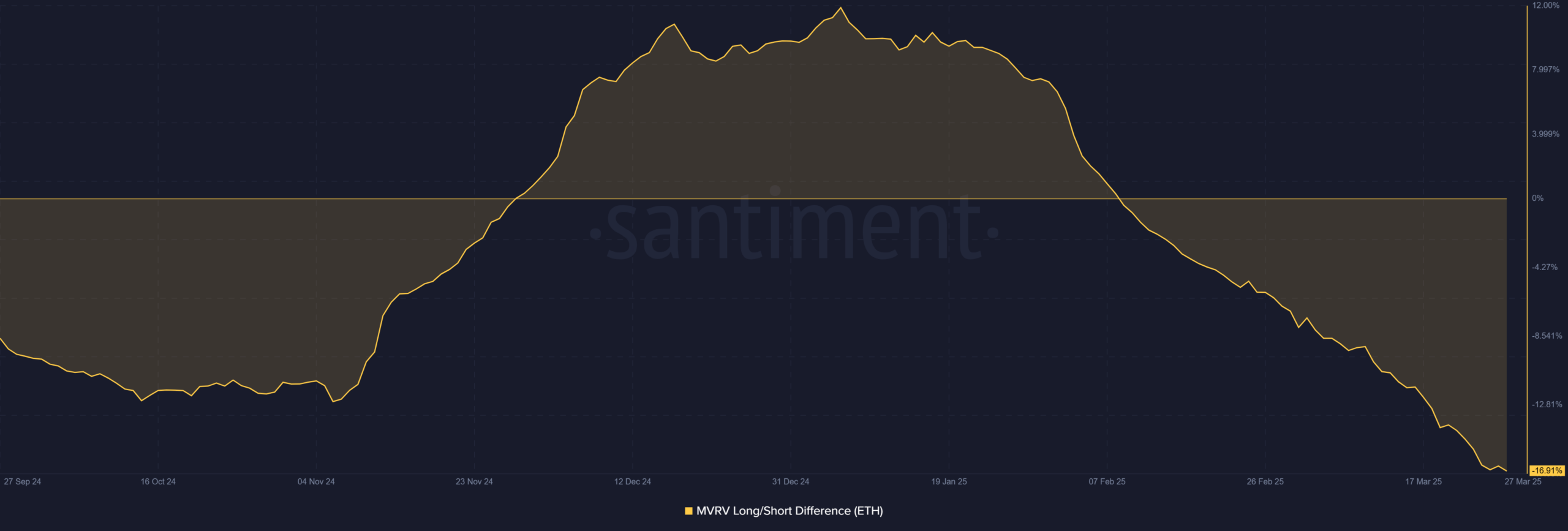

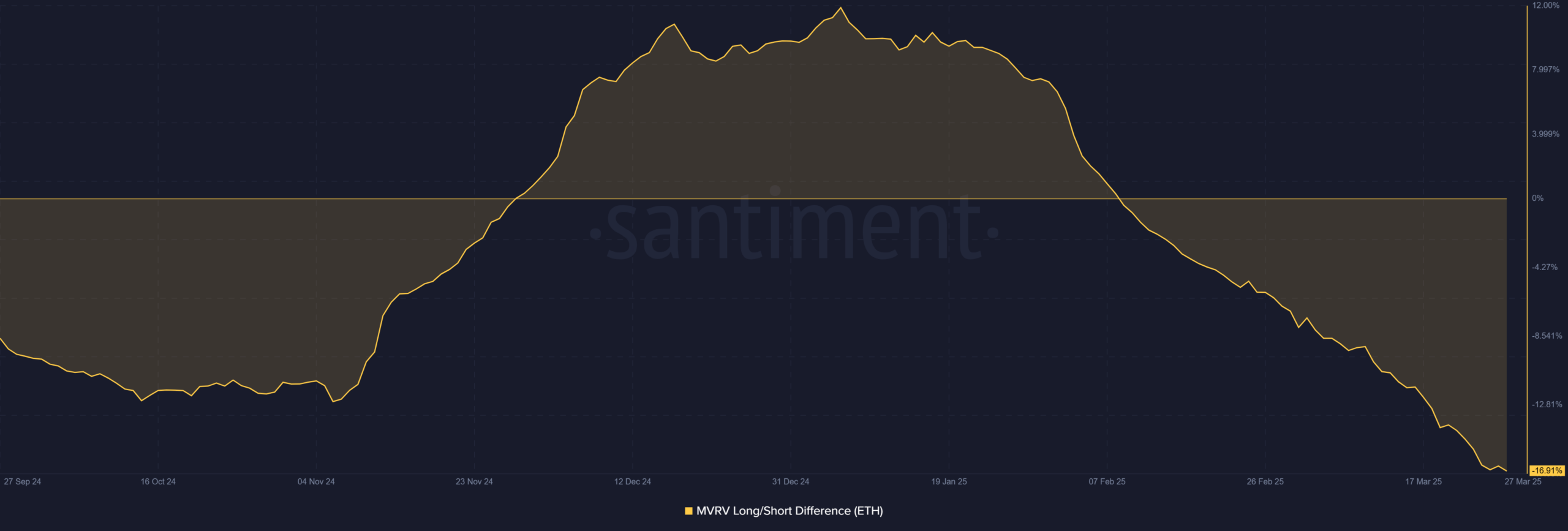

MVRV long/short difference: Market sentiment analysis

ETH’s long and short difference in MVRV reached -16.91 %. This negative value represents a weak emotion between long -term holders. However, such a serious divergence suggests that the market may be overlaid.

If the trader recognizes this as a purchase opportunity, the ETH can see that the price is reversed.

As more market participants move to take advantage of low levels, the price can be recovered quickly and add fuel to potential evacuation.

Source: Santiment

Is ETH set to breakout?

Considering Ether Lee’s whale activities, major support levels and market feelings, ETH seems to be ready for evacuation. Reduction of exchange reserves, rising whale activities, and combinations of technical indicators suggest upward price momentum.

Therefore, ETH can experience a significant price increase by breaking the level of resistance in the past and potentially reach $ 2,800.