- If SOL does not maintain $ 136, it can decrease 12% and reach $ 120.

- Solana’s weak outlook is potentially moving when the candles are soaring and closing every day of $ 146.

Solana (SOL) seems to be preparing for price drops by forming a weak price behavior pattern.

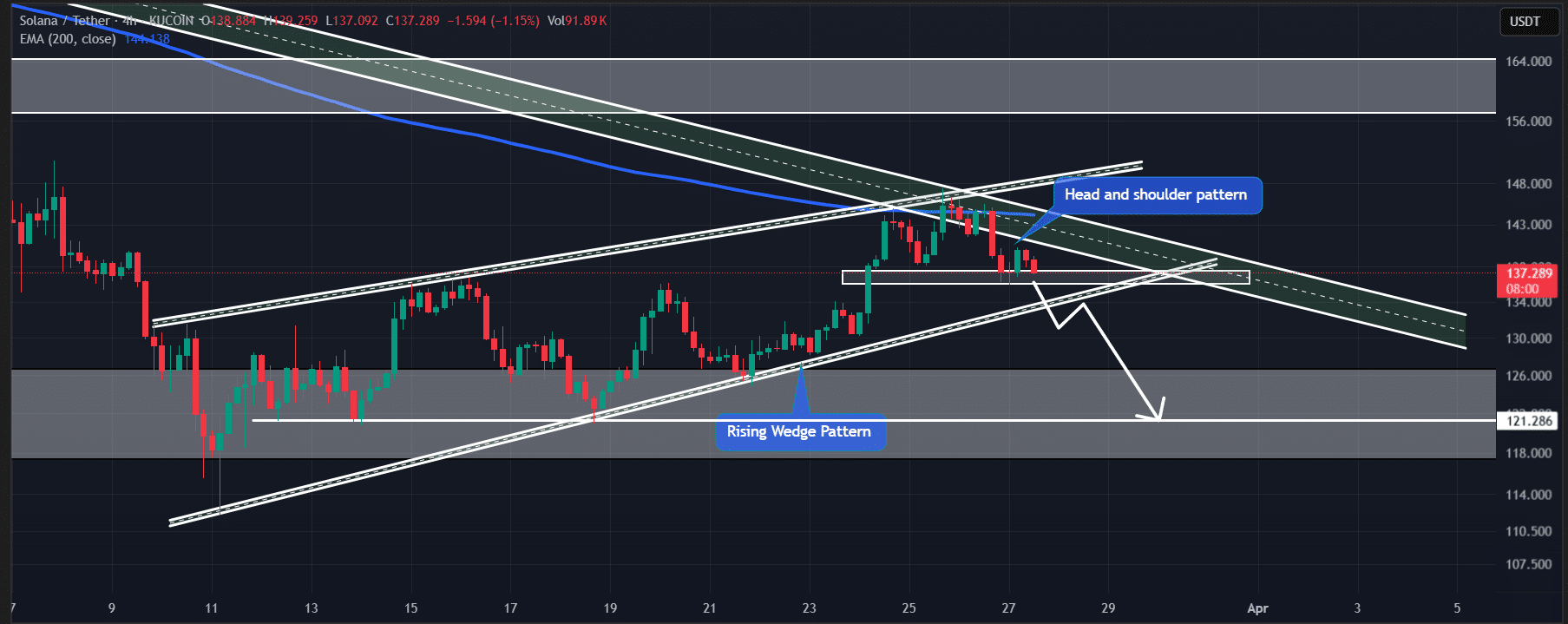

While the wider market is recovering, Solana has formed a wedge pattern that is weak for four hours similar to Bitcoin (BTC).

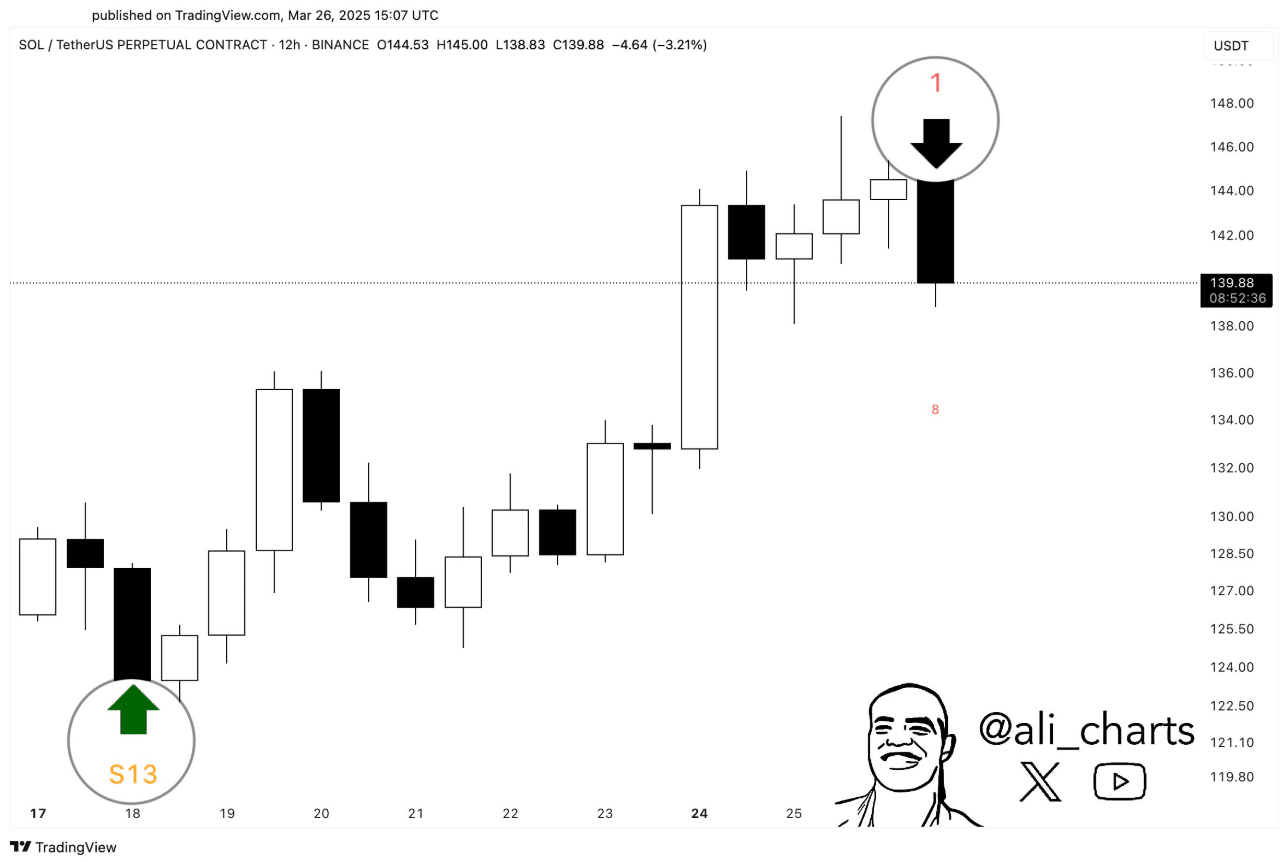

Solana’s technical analysis and price behavior

In the press time, SOL made a deal near $ 137.5. It reflects the price of 4.76%over the last 24 hours.

During this period, trading volume decreased by 10%, reducing merchants and investors’ participation compared to the previous day.

The price drop is a four -hour head and a neckline of four hours of hair and a shoulder pattern, and the wedge is $ 136 for $ 136 for the neckline.

According to AMBCRYPTO’s technical analysis, if the SOL closes the four -hour candle to $ 136 or less, it can decrease 12%and reach $ 120 in the next $ 120.

Source: TradingView

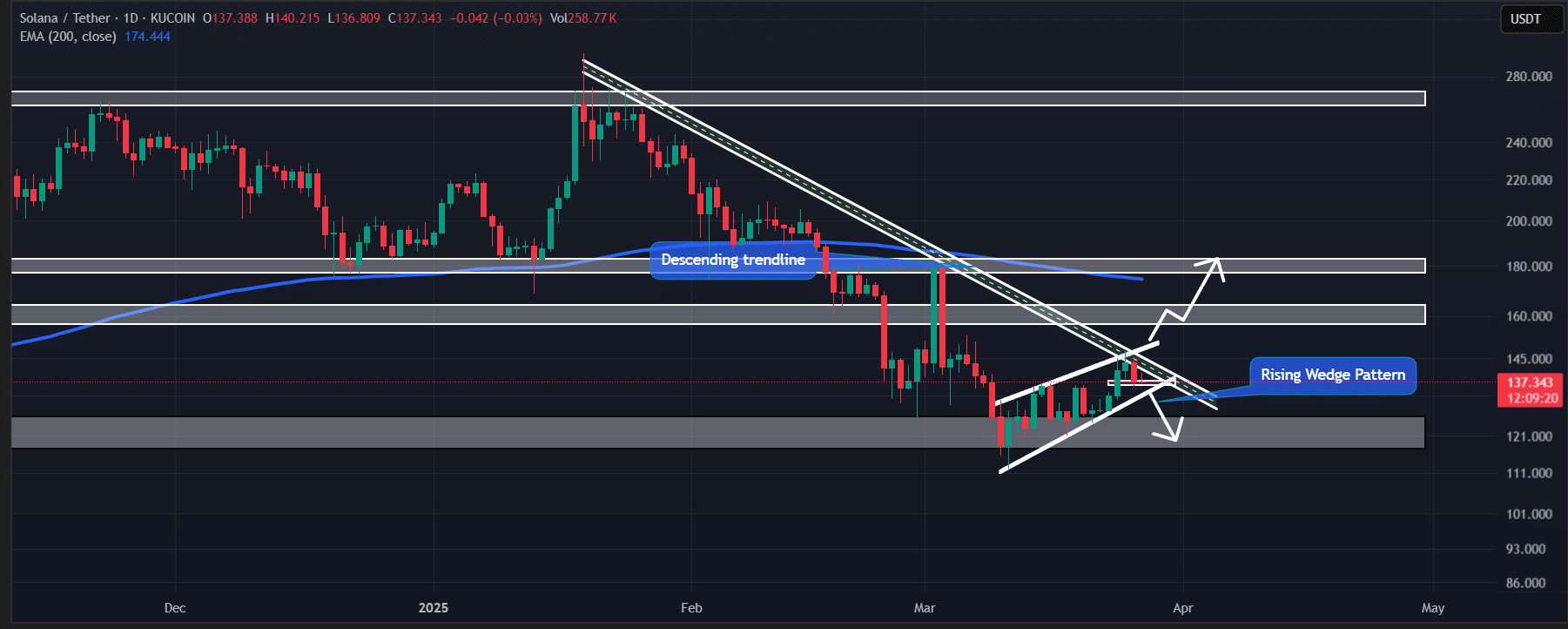

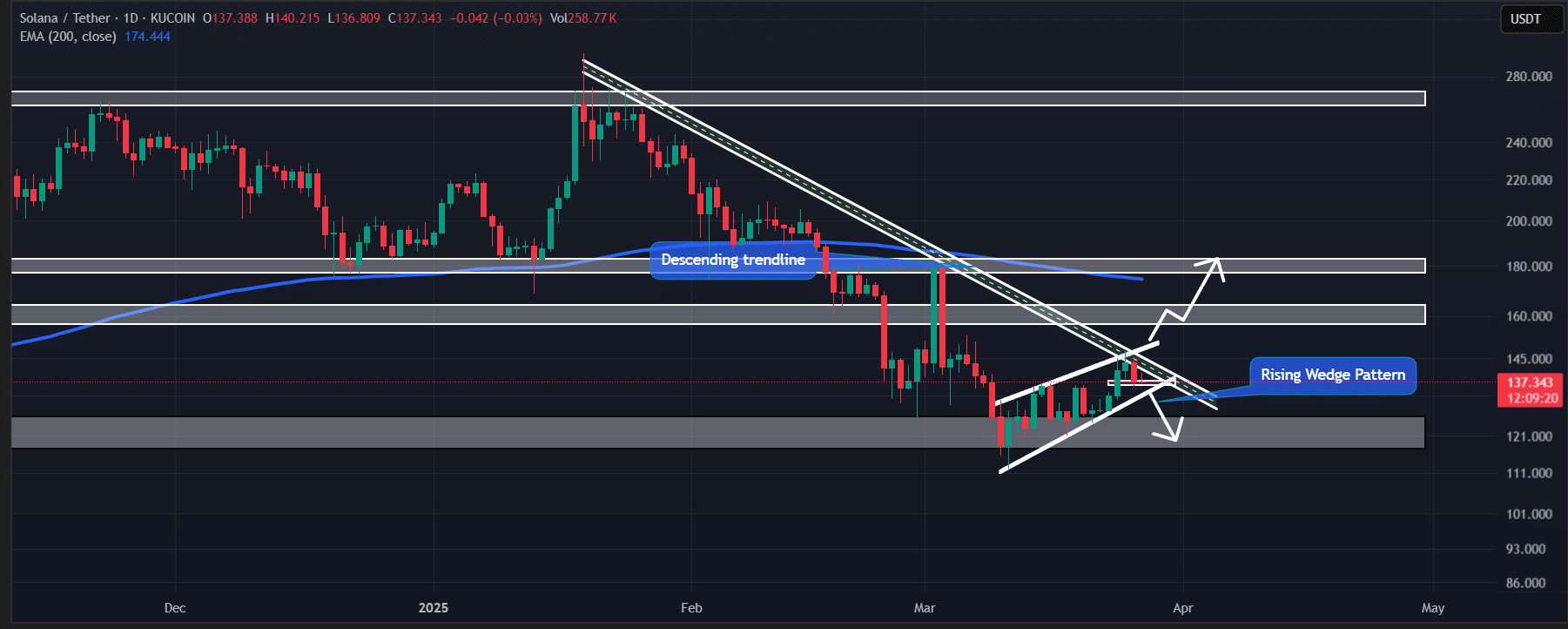

In addition to this weak pattern SOL faced rejection from the lower order of resistance since January 2025.

This rejection combines with the formation of weak candlestick patterns to strengthen the prospect of weakness.

However, if Solana breaks the trend line and closes the candle of more than $ 147.50 every day, the weak feelings can change. If this happens, the SOL can potentially rise by 22% and reach $ 180 in the future.

Source: TradingView

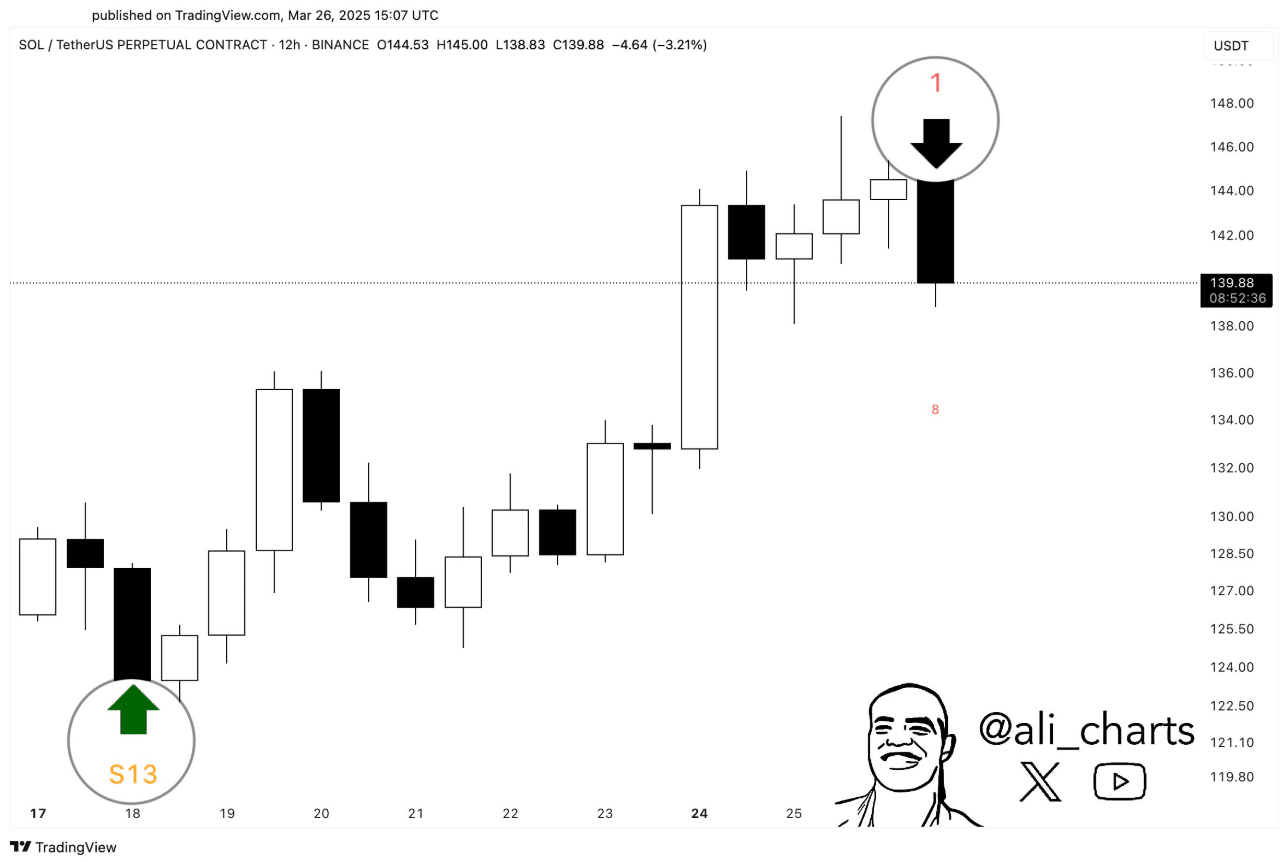

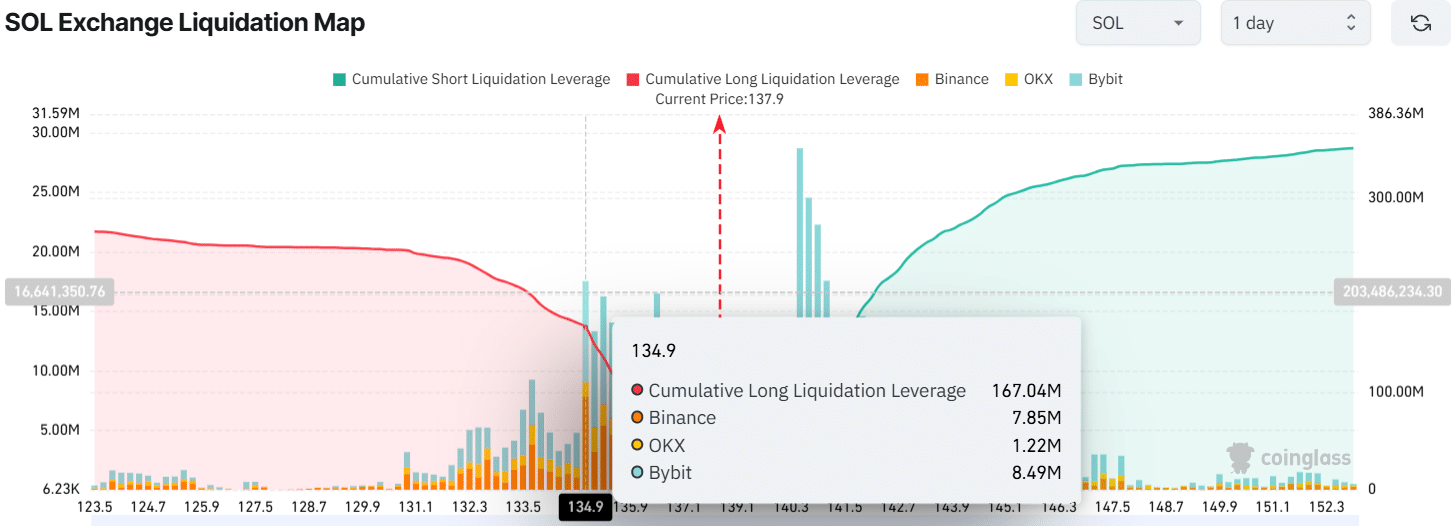

The analyst said it is blinking a signal that the indicator blinks.

The notable password expert on X (formerly Twitter) has strengthened Solana’s weak prospects.

Source: X

Experts emphasized that the TD sequential indicators, which had previously signed the purchase before the 22% rally of SOL, now showed the signal of sales.

This raises questions about whether the price will continue to fall or if the indicator is just a signal journal.

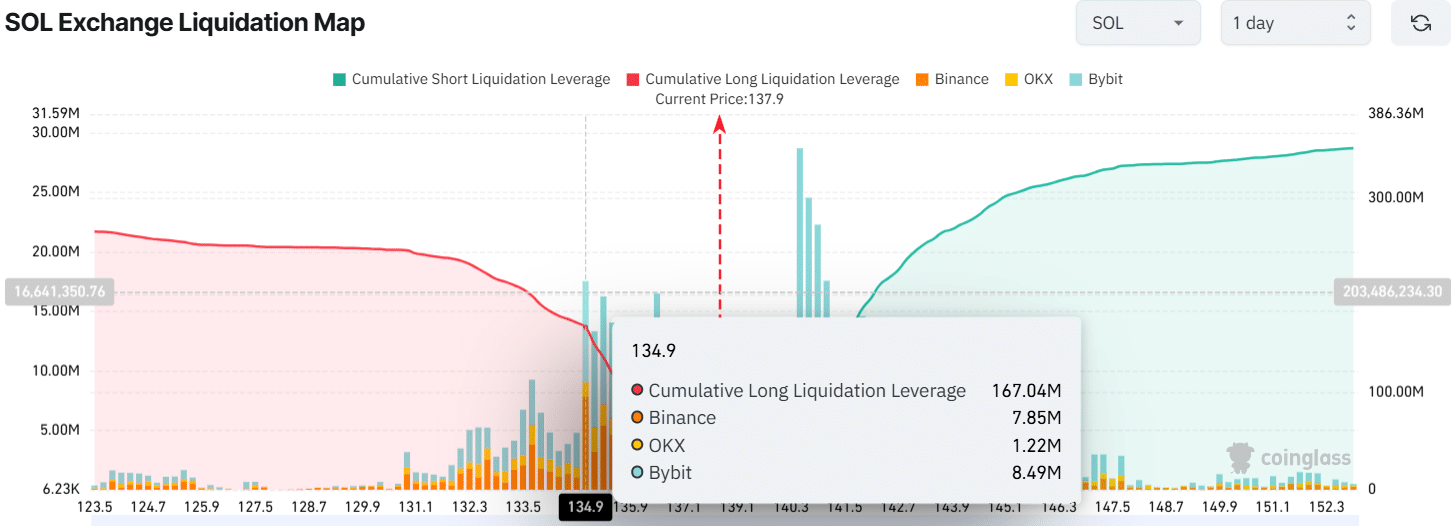

Merchants’ view of Solana

However, patient merchants seem to be contrary to the overall market sentiment because they bet strongly on the long side.

According to data from CoingLass, an on -chain analysis company, merchants currently have a long position worth $ 167 million at $ 135 at the bottom.

The $ 140, on the other hand, is another level of $ 140, where other merchants have built a short position worth $ 83 million.

Source: COINGLASS

This emphasizes that the bull is now dominant despite the outlook of the weakness.