- The XRP shows a prudent investor sentiment, with 275,000 tokens in the action to the side of Bitcoin.

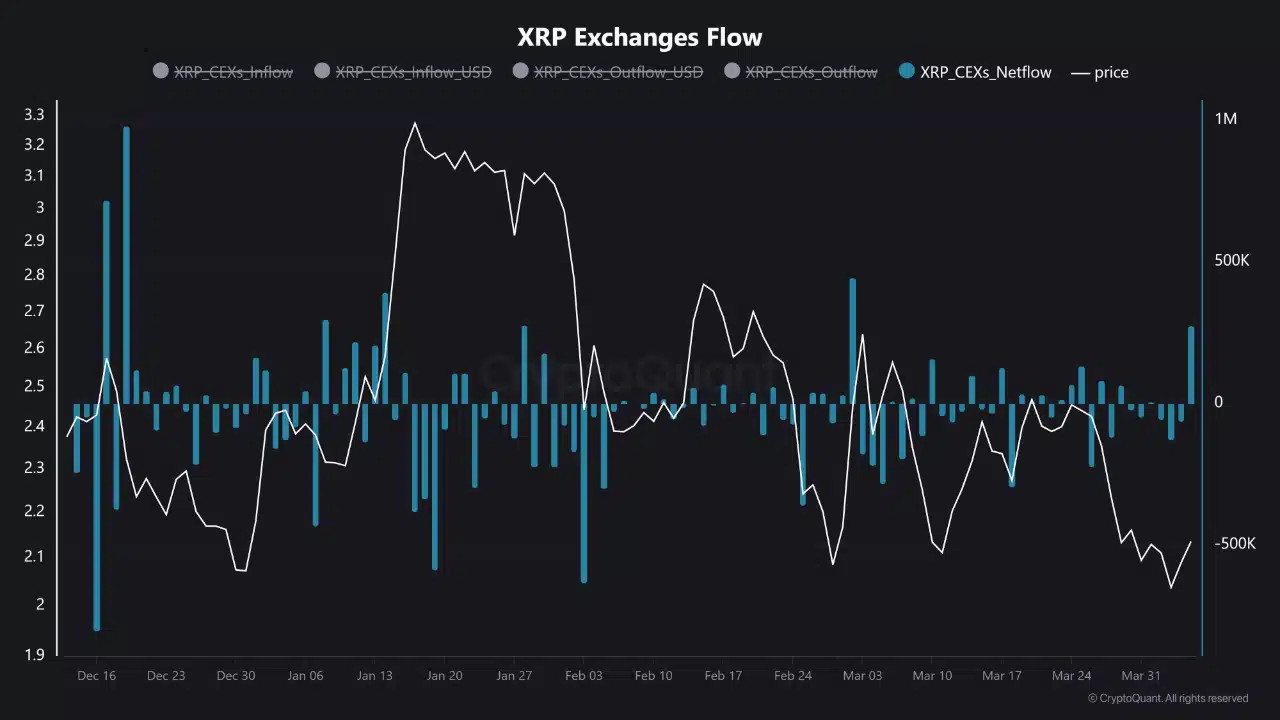

- Increased XRP exchange deposits have proposed potential sales pressure, and traders are waiting for the next movement of Bitcoin.

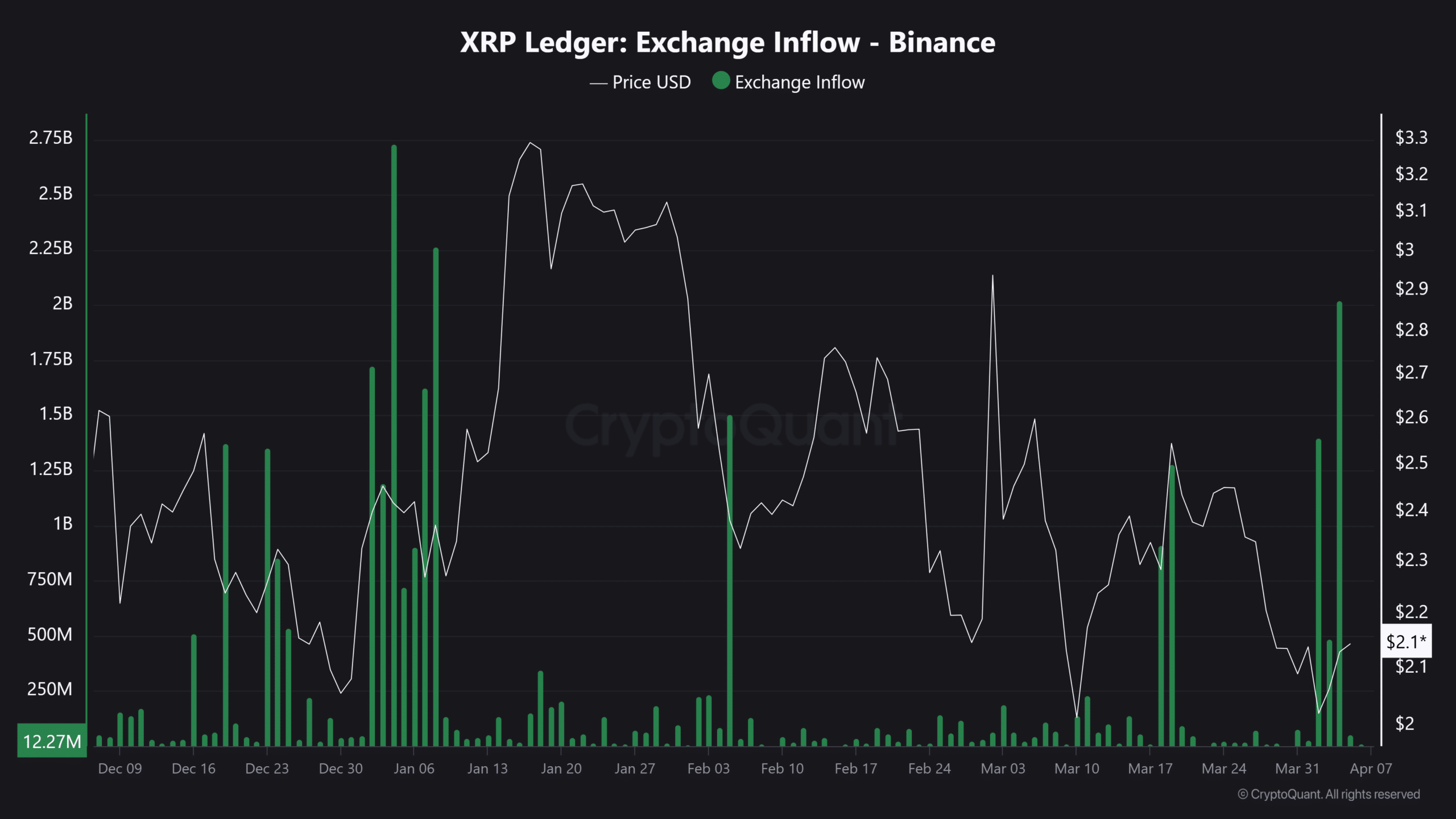

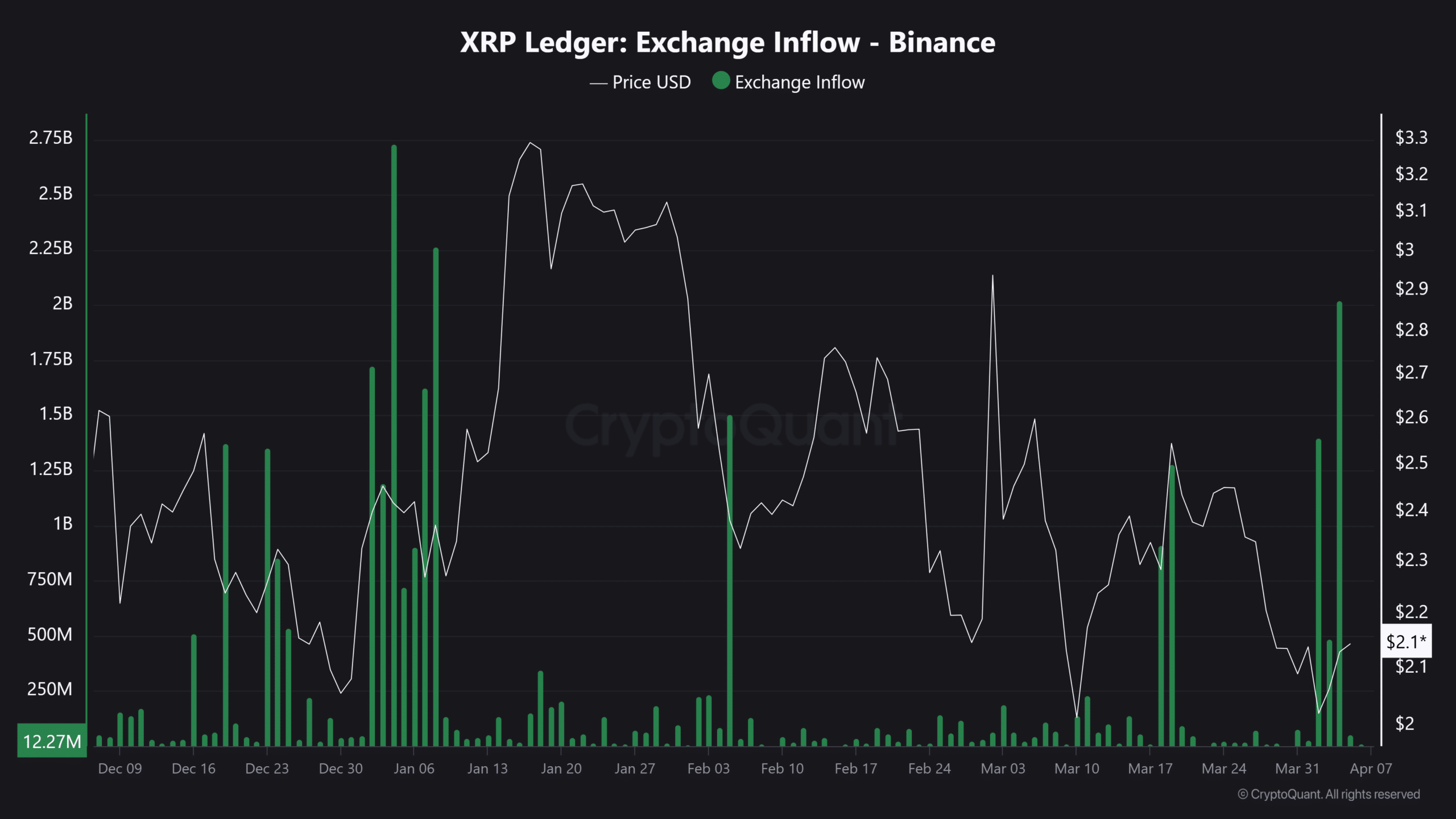

Ripple (XRP) entered the centralized exchange quietly and dropped over 275,000 tokens.

Bitcoin’s sudden surge in XRP while continuing to move sideways is similar to market anxiety moments, such as checking the phone in a dull conversation.

If Bitcoin is trapped in this identity and fails to restore momentum, the movement of XRP will show the imminent change that crosses a wider encryption environment.

The big movement of XRP is not random.

On April 5, XRP’s sudden inflow of 275,000 tokens is not noise. The price of Bitcoin was less than resistance.

Historically, during market uncertainty, these inflows often suggest investors’ dangerous -off behavior.

Source: cryptoquant

Bitcoin’s side is vulnerable to Altcoins, and XRP seems to be the first to blink.

If this indicates the beginning of a wider dangerous rotation, we can see more ALTs in the future. The timing does not go away for market watchers. This is a classic hedging act when confidence is triggered in the next movement of BTC.

It is noticeable, but not panic… yet

Investors do not say that if you move XRP to the exchange, you have a feeling of emotion.

Source: cryptoquant

According to the encryption data, the inflow of April was the largest in a few weeks, and it occurs as the total altcoin momentum decreases. Bitcoin can’t surpass $ 1,74K historically of the second token, which can affect the trading behavior.

In addition, rumors of regulations on Korea’s cryptocurrency pairs have appeared in April. This rumor can urge the Asian XRP holders a careful approach.

The XRP does not have a conflict, but the market sentiment has shifted from optimistic optimism to a more cautious and waiting approach.

What is coming next?

The net inflow pattern of XRP often signals the upcoming selling, but its impact is not always immediate. According to the data, the time to reach this level in late January was a decline in prices within a few days.

The main takeout indicates that liquidity is accumulated on the exchange, and when the demand is concrete, the supply is prepared to meet the demand.

Without significant Bitcoin brake out to restore market trust, XRP can increase short -term sales pressure. But when the buyer comes in, this setting can be a fake.

Nevertheless, capital closely tracks the next behavior of Bitcoin with movement.