- Stellar re -tested $ 0.3 by resistance, but faced rejection for the last 10 days.

- Re -examination of $ 0.2 Demand may have some optimism, but investors must be careful.

Stellar (XLM) has faced a loss of 14.5%over the last 24 hours. This is after Bitcoin (BTC) falls to $ 74.5KA before the press time as the world’s stock market plummeted in the aftermath of tariff shockwaves. Altcoin trader should be careful. In particular, the weakness of the last three months has become much stronger due to the recent incident.

Buyers can be patient instead of trying to buy the floor right away. This is because there is no clue that the floor has been formed yet. BTC trends can also monitor clues to wider markets.

If the sales pressure is strengthened once more, it will fall to less than $ 0.2.

Source: TradingView’s XLM/USDT

The one -day trend was seriously weak. The 20 and 50 moving average was higher than the price and the weakness was dominated. MACD seemed to be moving over the zero line, and once again diving.

This resulted in a sharp loss in April as a result of an integration stage of about $ 0.25- $ 0.3 in March. The CMF has been lower than 0 since March, and once more capital flows come out of the star market, and once more dive to less than -0.05.

Momentum and sales pressure together meant more losses could be in the stars. After the November rally, the level of Fibonacci showed that the level of 78.6% was $ 0.207.

The price was just below this major support level. The level of $ 0.197 and $ 0.162 was also a long -term support level.

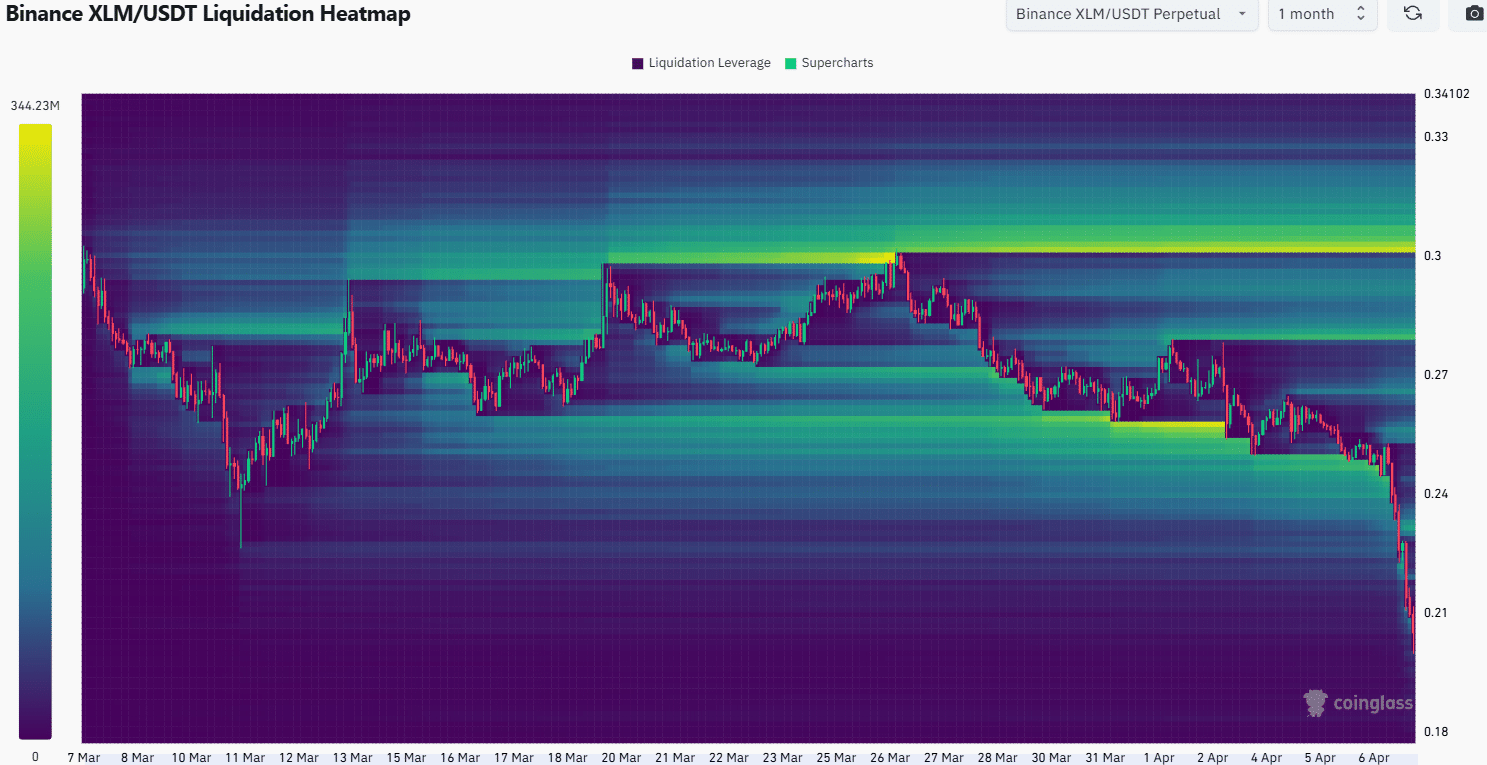

Source: COINGLASS

The one-month liquidation heat map showed that the $ 0.246-$ 0.26 area was filled with long liquidation.

They also matched the level of regional support in the first half of March. The latest price plunge was much lower than the $ 0.24 liquidity cluster.

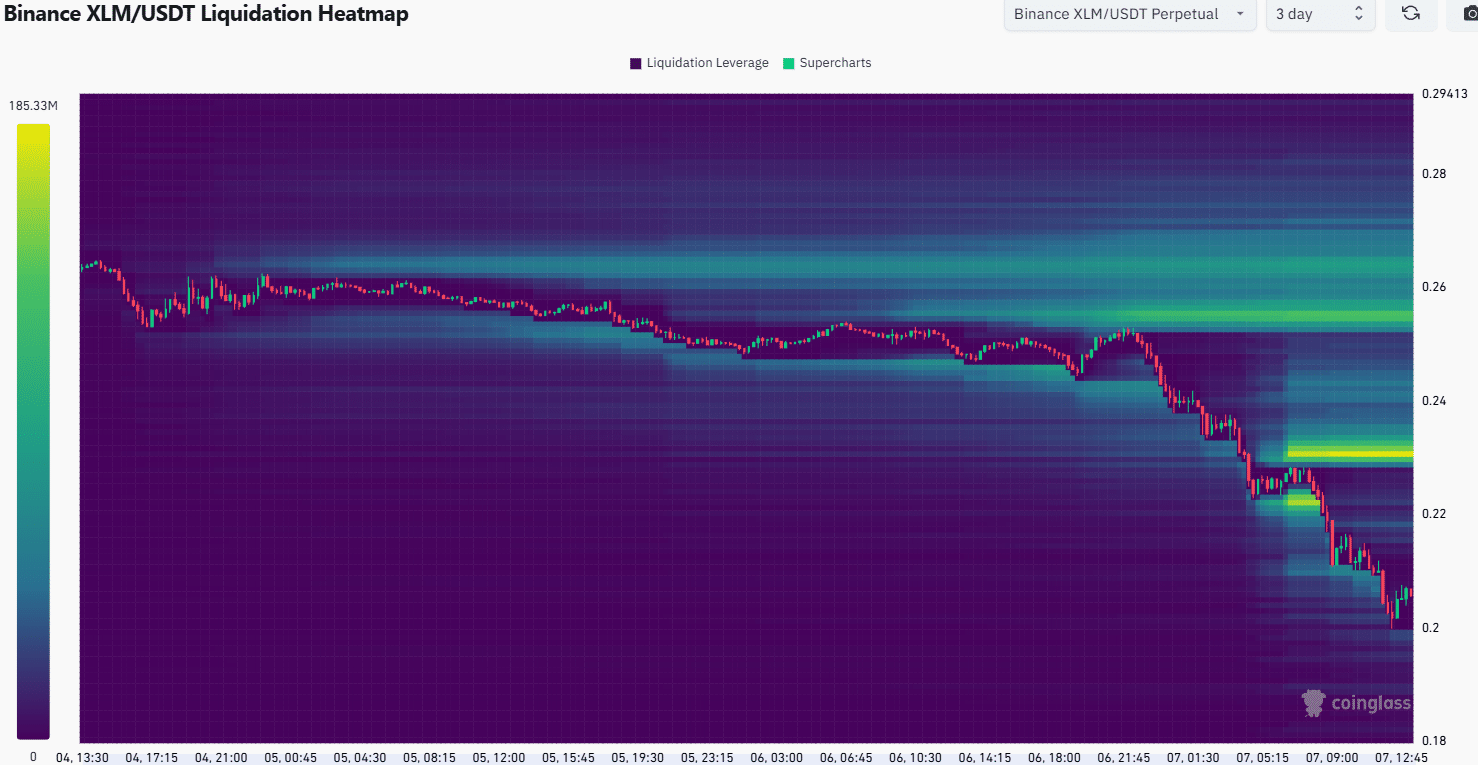

Source: COINGLASS

If you look closely at the level of local liquidation, there is a clue to the next movement of XLM. If the liquidity accumulates about $ 0.23, attractive goals and price bounces have the possibility of weak reversal.

In addition, the $ 0.255- $ 0.265 zone is the following magnet zone. Stella merchants must be careful and do not buy the floor right away.

Indemnity Clause: The information presented does not make up financial, investment, transactions, or other types of advice, and is entirely the artist’s opinion.