- Low social media participation and falling hot chains are urgent concerns about Doge.

- The lowest in October will be the next price goal of Doge.

Dogecoin (DOGE) has decreased by 20% from maximum $ 0.171 on Saturday. In the last 24 hours, there have been $ 31.5 million liquidation on all exchanges on Doge. Of these, $ 3,87 million or 85.78%were long.

Dogecoin saw a price slide of 22.6%in 24 hours, and Bitcoin (BTC) has shown 10.68%of its value after panic in the global market due to the development of the trade war. Investors must be patient because there may be more losses.

As the weak trend decreases, social media participation disappears.

Source: Santiment

The daily active address rose in November. Since then, it has fallen to the level that has been maintained since January. Another surge in activities came in mid -March, but the taper began quickly.

Social ruling trends are also falling. March was not the weakest month for Doge despite the price loss. Similarly, social volume set a new low in April. This means that the price trend will continue to be leaked from the market, where the price trend does not change direction.

As the daily activity address increased on March 12, social dominance soared. This emphasizes the importance of strength in the Dogecoin market after 20%of the price pops out per day.

Source: COINGLASS

The rate of financing was poured into negative figures after a brave effort from the bull.

This emphasized the favorable conditions for the seller. It should be noted that the price tends to increase in the short term whenever FR tilts negative body.

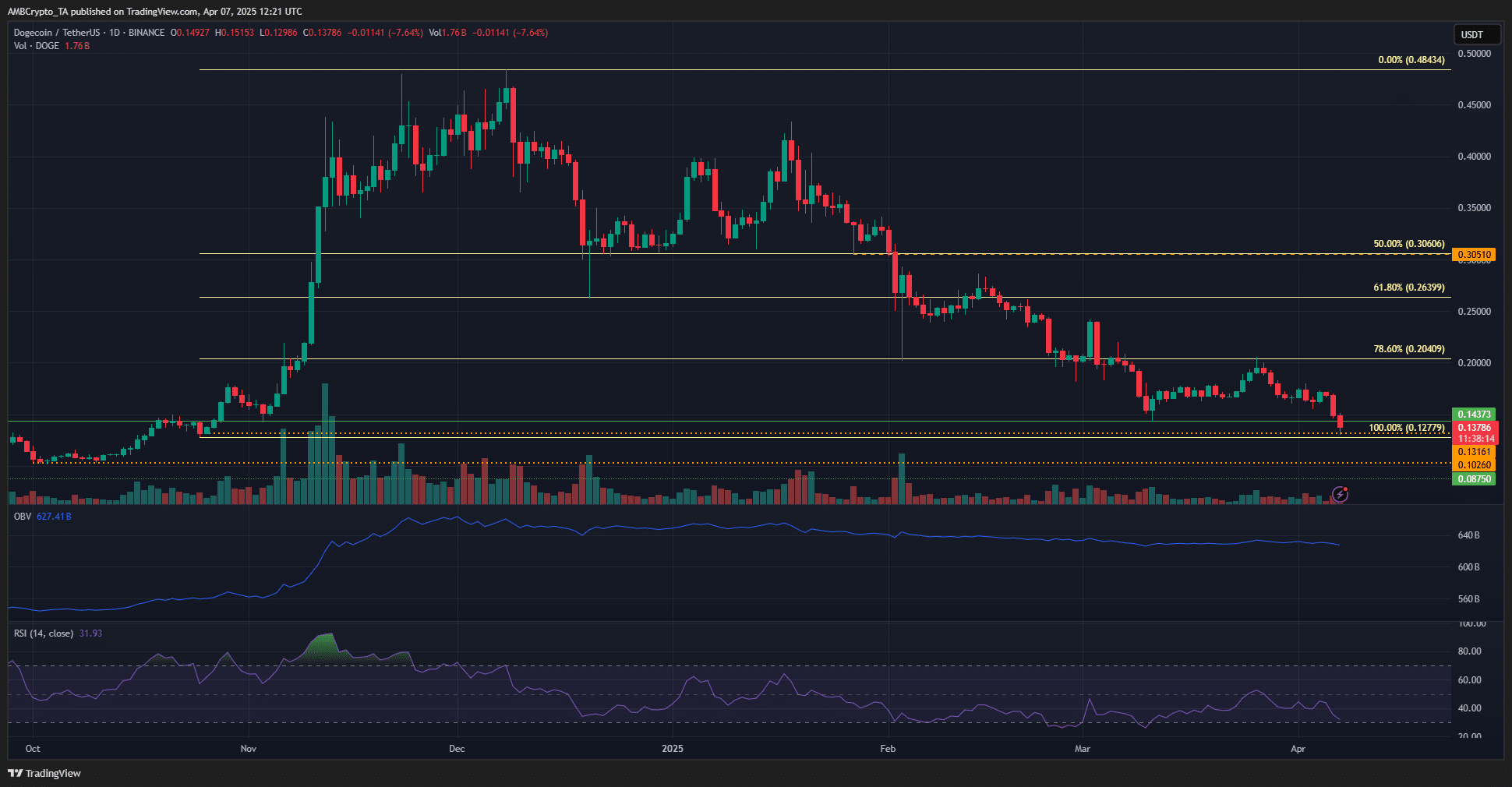

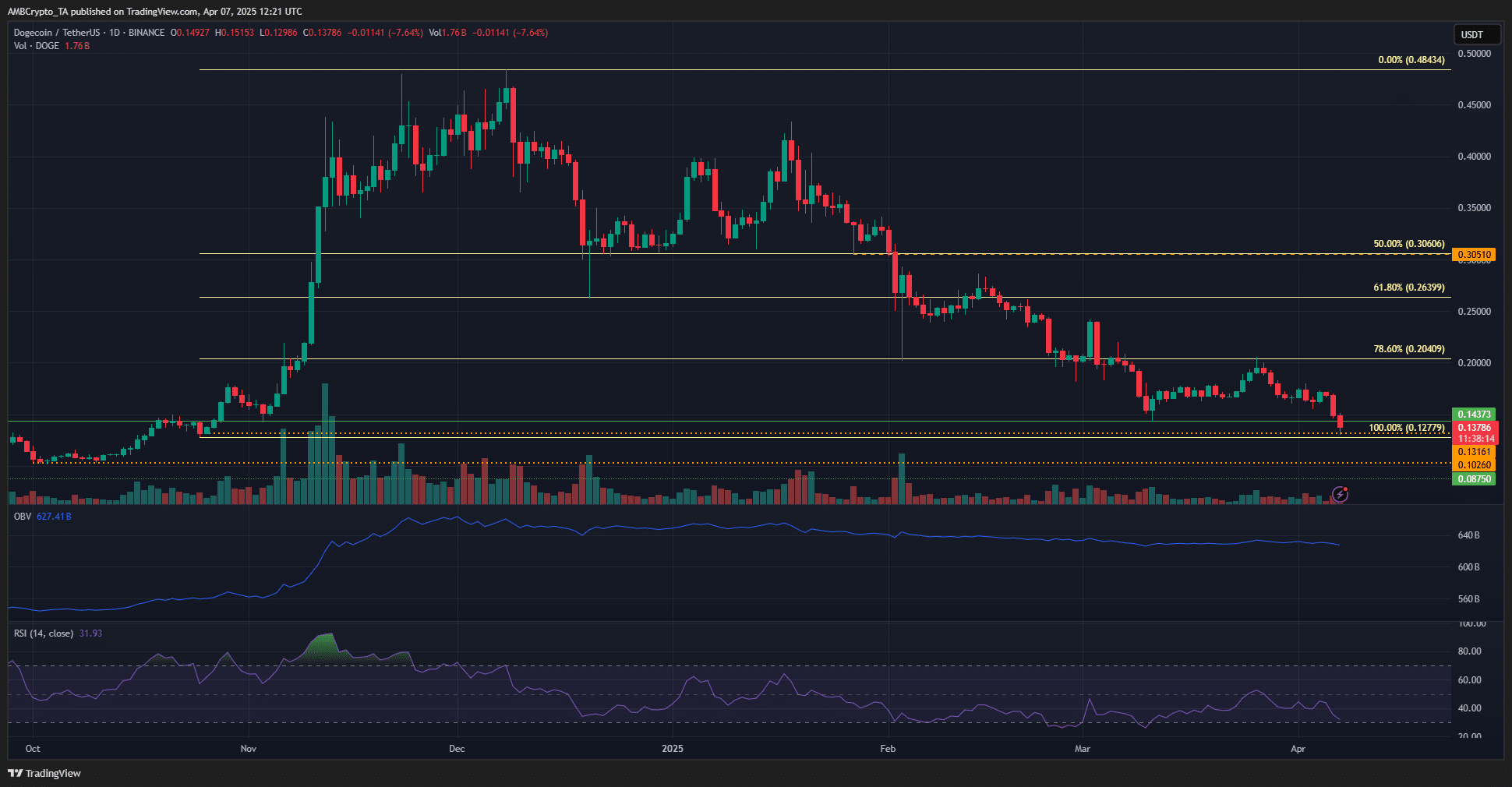

Source: TradingView’s Doge/USDT

On the 1st, the Dogecoin chart emphasized normal sales pressure since December. RSI has been weak since mid -January, with less than 50 neutral.

The level of $ 0.131 and $ 0.102 in October 2024 is now the next price target. The former has been tested for a few hours and can produce bounce with $ 0.154- $ 0.164. But despite potential 15% bounce, this trend will be firmly weak in the short term.