Encryption and financial markets are generally newly equipped with designated scientific pressure from volatility. As a result, speculation is being strengthened whether the Federal Reserve Bank (Fed) will recover to quantitative easing (QE).

Potential QE will remind us of aggressive financial intervention in 2008 and 2020. In the case of encryption, many traders are set for potential V -shaped recovery, and if many traders are set and QE is resurrected, it can be enormous for historical meetings.

Analysts share signals why the Fed can act.

Analysts shared why the Fed could lead to intervening, and one quoted the movement index. This is Wall Street’s “horror gauge” for the bond market. In 137.30, the index is now within the 130-160 range that the Fed has historically been in crisis.

Vandell, co-founder of the Black Swan Capitalist, said, “Now, 137.30, 137.30 in the 130-160 range that allows the Fed to step on, or it will soon reduce interest rates because they have to reset the debt to keep the ponzine.

This signal is consistent with other warning signals of financial instability, including the selling global market that creates an atmosphere of the Crypto Black Monday story. As a result, the Fed booked a door board meeting closed on April 3.

According to the analysts, this timing was not random, and the Fed Cave and Trump were likely to have their own way.

“If you imply the QE, everything changes in danger. Rewards are now advantageous for the bull. Be careful with uneven price behaviors, but do not miss the recovery rally, and remember.

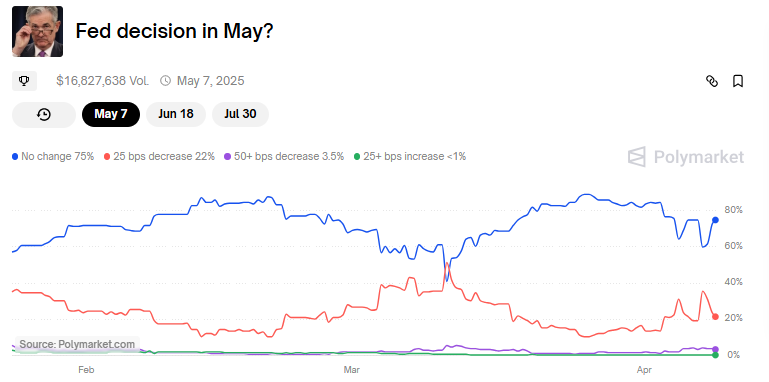

This suggests that investors are reading between the lines with the Fed’s next scheduled policy decision from May 6 to 7. JPMORGAN has recently become the first Wall Street bank to predict the US economic downturn with a proposed tariff by Donald Trump, adding to the urgency to the dialogue.

The bank suggested that the FOMC meeting may have to be cut faster with interest rate cuts or QEs before the FOMC meeting. In this background, encryption investor Elise shared a provocative take.

“I think Trump is doing all of this to accelerate the Fed’s process with low interest rates and QEs.

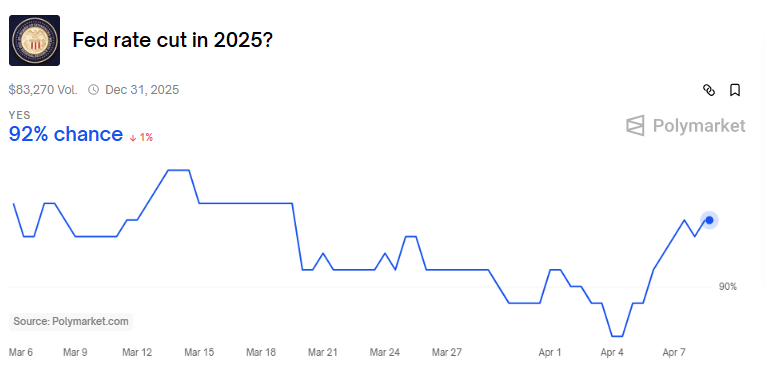

Given that the Fed must manage more than $ 34 trillion in federal debt, it may not be far away. Noteworthy, this becomes more difficult to service with higher interest rates. According to PolyMarket, the Fed is likely to reduce interest rates at some point in 2025.

Why Crypto can enjoy QE’s benefits

If QE is realized, history suggests that encryption can be one of the biggest beneficiaries. Arthur Hayes, founder and former CEO of Bitmex, predicted that the QE can inject up to $ 3.24 trillion in this system.

“Bitcoin has risen 24 times to Covid-19 thanks to the $ 4 trillion stimulus. If you see $ 3.24 trillion, BTC was able to record $ 1 million.”

This is consistent with the recent prediction that if the Fed moves to QE to support the market, Bitcoin can reach $ 250,000 by the end of the year.

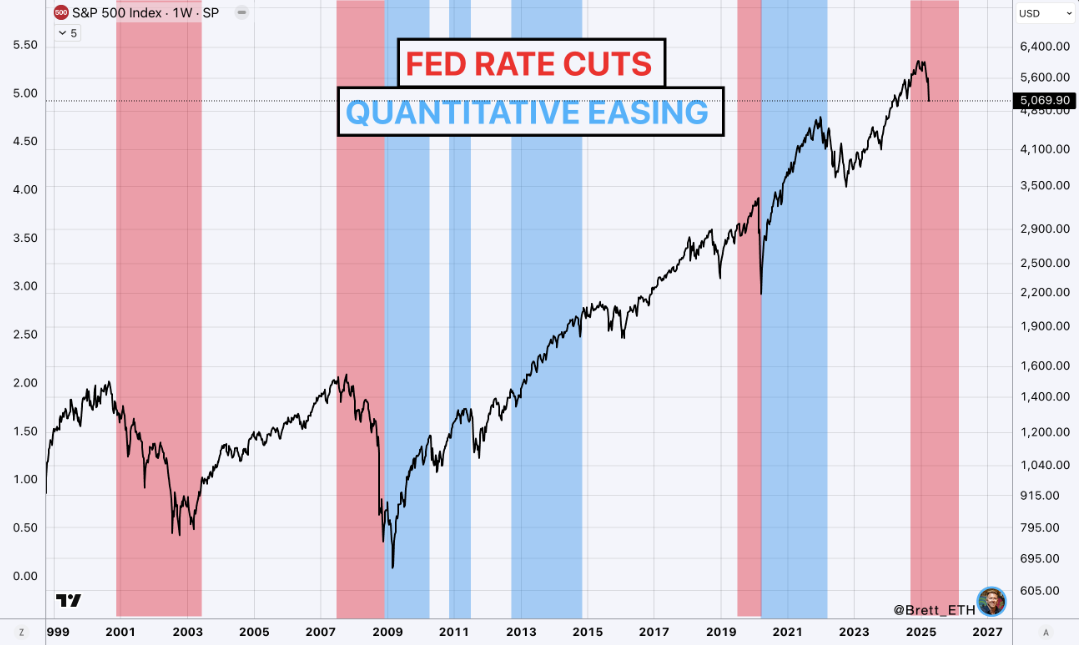

Analyst Brett provided more measured views, pointing out that QE generally follows fare cuts rather than before.

“We’ll see interest rates cuts by mid -2026, like 2008 and 2020, as in 2008 and 2020. PoWELL says that QE doesn’t come until the interest rate is cut.

Based on this, the analyst tried to buy optionally, but did not expect a V -shaped bounce unless it was bold.

The “something” can be a recession for Trump overturns his tariffs or the Fed front causes an emergency easing. Either way, the encryption market can gather hard and quickly.

Alt Season of Horizon?

On the other hand, according to our encryption dialogue, quantitative easing in May can lay the foundation for the possible Altcoin season.

Their predictions reverse the previous cycle in which QE caused the explosive movement of dangerous assets. When QE began in March 2020, Altcoins surged more than 100 times until the end of 2022.

Merchants are now noticeable as the potential kick off of the next liquidity waves, and the Better can build a 75%chance. If these odds move, the trader is expected to follow the money printer.

Some expect more prices “Chop” in the short term, but most of them agree that long -term settings are more advantageous.

“If QE actually starts in May, this cut is calm before the pump pump.

I am convinced that even if quantitative easing does not occur immediately, it will happen this year.

“Perhaps it may not be in May, not later. This year will happen, this is good for another rally and new highs,” Crypto Talk added.

So Buck stops with the Fed. Rate cuts, QE or both idden cryptos are huge.

When history repeats and the Fed will reopen the liquidity gate, Bitcoin and Altcoin can be captured for historical escape. This can be a sense of profits from 2020-2021 Bull Run.

disclaimer

By complying with the Trust Project guidelines, Beincrypto is dedicated to unbiased and transparent reports. This news article aims to provide accurate and timely information. However, readers should check the facts independently and consult with experts before making a decision based on this content. Our Terms and Conditions, Personal Information Protection Policy and Indemnity Clause have been updated.