- Trump’s WLFI lost Ethereum and questioned institutional trust in ETH.

- Despite Eric Trump’s approval, Ether Lee’s 46% drop signals potential retreat from famous encryption patrons.

In an impressive pivot, Liberty Financial (WLFI) by Donald Trump has offset a significant portion of Etherrium (ETH) with a notable loss.

This dramatic change follows the claim that the initial claim of Eric Trump is a “good time” to buy ETH. His statement briefly raised institutional attention.

But since February, Ether Lee’s rapid decline has focused on WLFI and questioned the trust between market timing, political impacts and prominent encryption supporters.

Ether Lee’s slide after Eric Trump’s nodded

Source: X

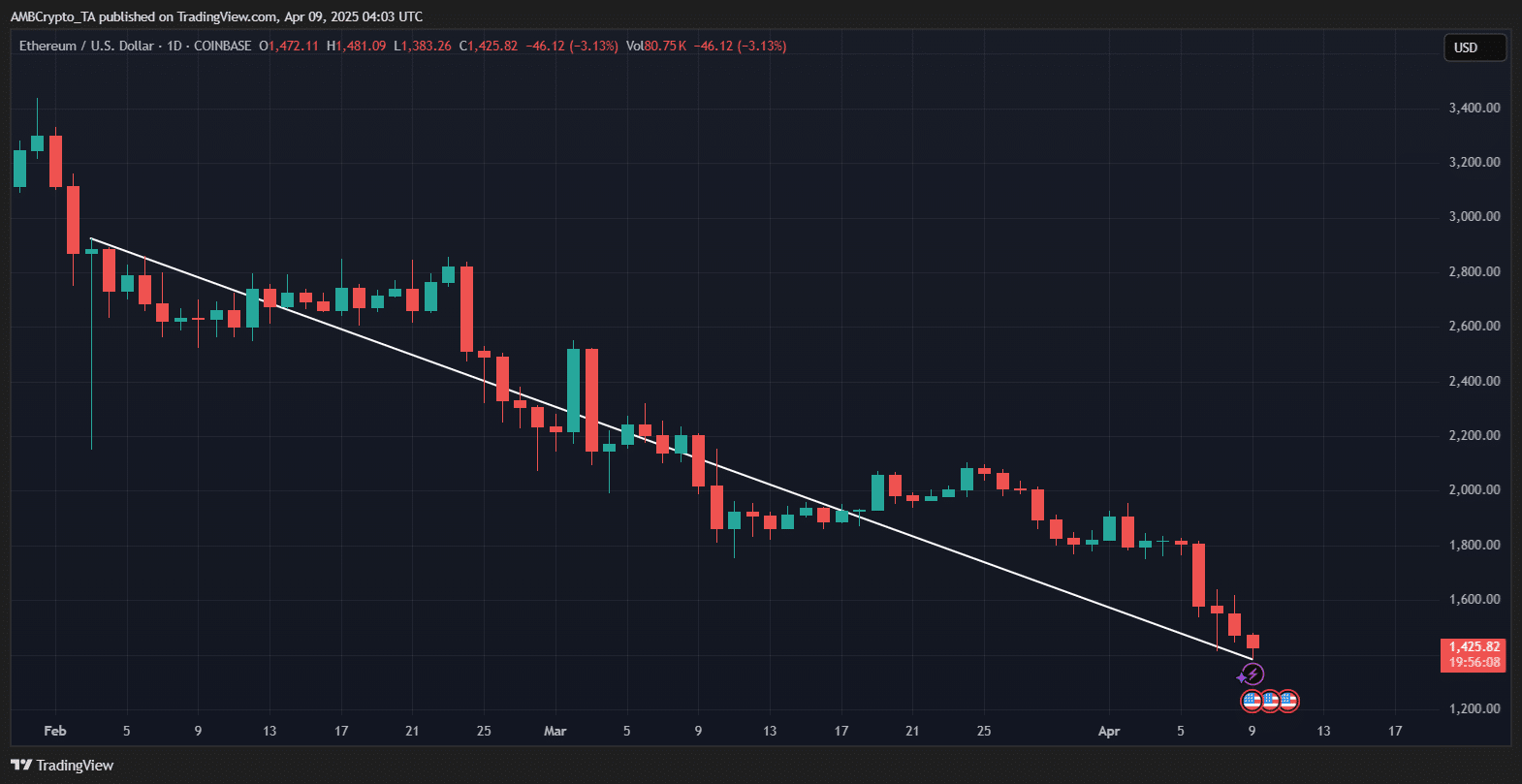

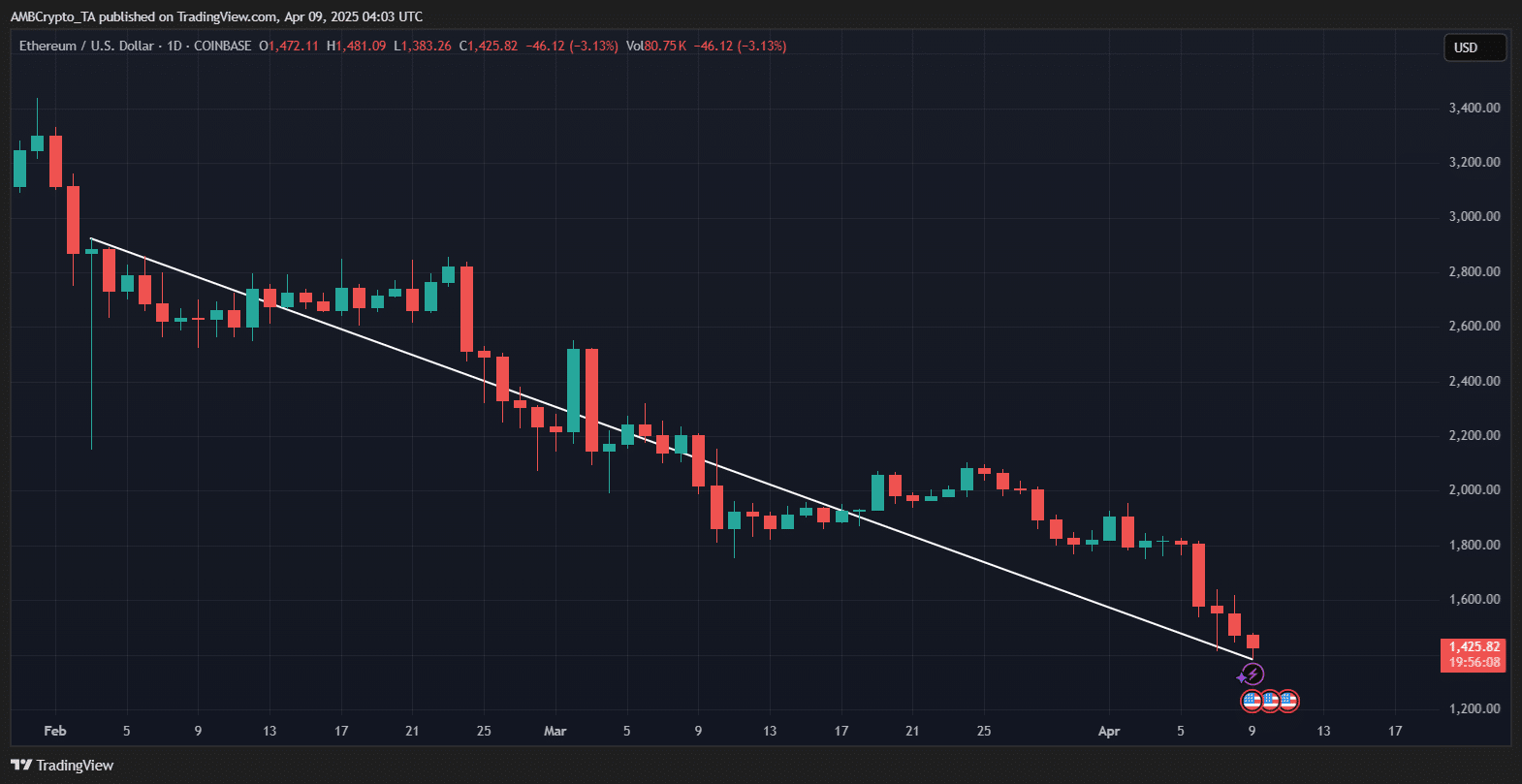

On February 4, Eric Trump approves Etherrium through the Viral Post, consisting of nearly $ 3,000 ETH transactions. Since then, the price has plunged by about 46%, down to $ 1,425 to the press time.

Source: TradingView

As you can see from the chart, ETH struggled to recover from a consistent decline and invalidated the simple optimism triggered by Trump’s guarantee.

The exit of WLFI is just speculation that institutional support can increase faster than expected.

WLFI’s movement contradicts Trump’s encryption investigation.

Despite Eric Trump’s brilliant approval, Trump support WLFI has since sold tens of millions of Ether Leeum with a steep loss.

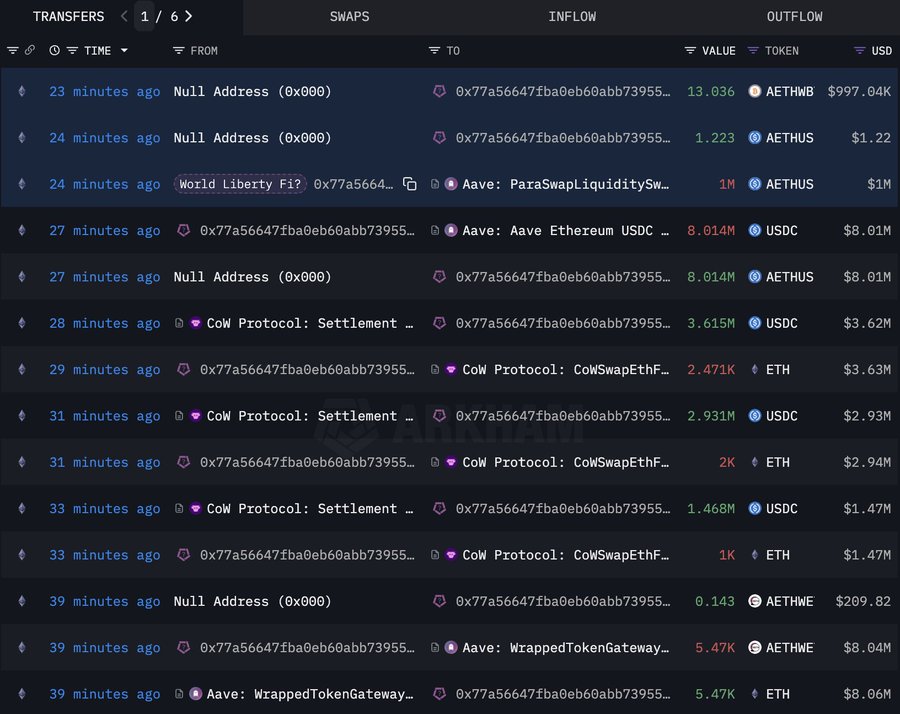

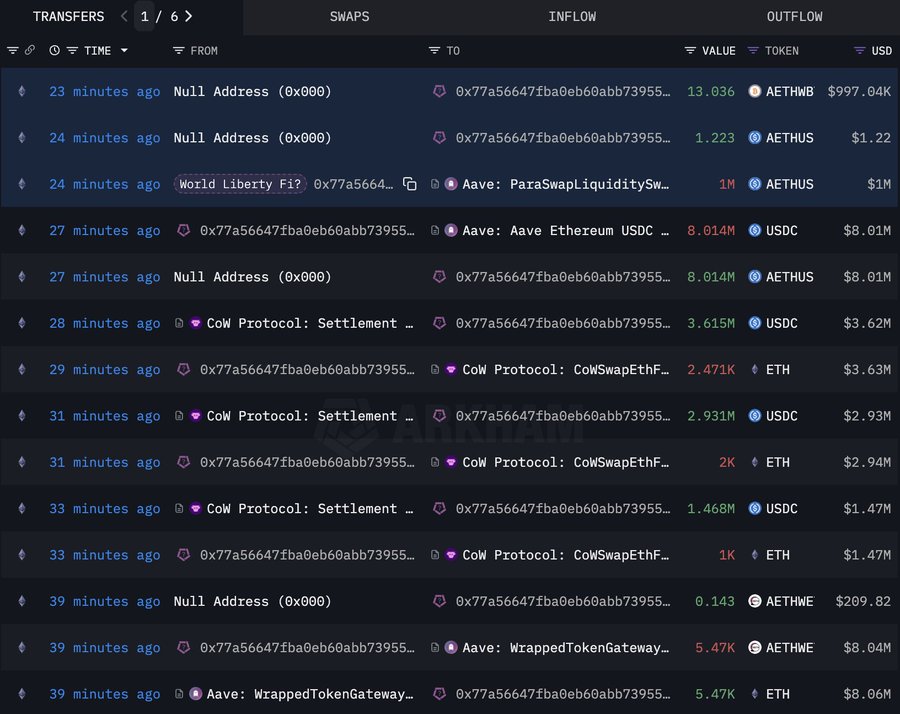

The data from Arkham Intelligence shows that WLFI offered 5,471 ETH for $ 1,465 a few minutes ago. The average purchase price is much lower than the $ 3,259.

Source: Arkham

This movement emphasizes the increase in disconnection between public encryption boosters and behind -the -scenes positioning.

For investors who have taken Trump’s tweets to face value, WLFI’s Silent Exit does not feel like a belief and feels like surrender.

Trump’s connected wallet is quietly retired

The sale of WLFI reflects the withdrawal tendency withdrawal from Trump connection password assets.

Only two days ago, $ 30 million was moved mysteriously with Melanie tokens tied to the community fund and is now sold without explanation. This situation raises more than Ether Leeum’s price problem. This is a good task of reputation.

A prominent figure like the Trump family reduces encryption and raises important questions. Are you institutional interest in ETH fading, or is it not completely established?