The 2025 encryption market is facing intense turbulence. One trend of capitalization, such as memes coins, plunged. Capital was escaped from the decentralized Defi protocol, and the total value lock (TVL) of Defi decreased from $ 120 billion to $ 8.7 billion.

In this context, SONIC is noticeable. It was consistently hit by the new TVL highs, and it reached $ 1 billion in April after growing almost 40 times after the beginning of the year. So why is Sonic a bright spot in a stormy market?

Investors are spending capital on Sonic

SONIC scored at a rapid TVL growth rate and far surpassed a better known blockchain. According to Defillama, SONIC has reached $ 1 billion on TVL within 66 days. In contrast, the SUI took 505 days and the aptos needed 709.

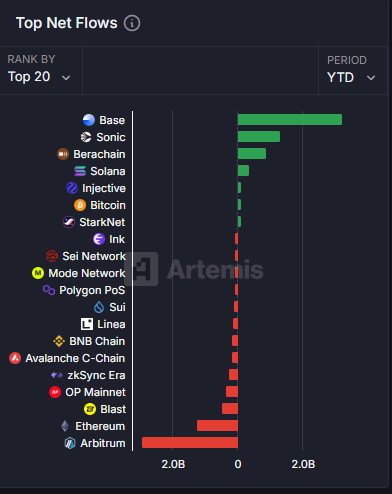

This achievement reflects strong capital inflows in the sonic ecosystem despite the extensive flaw of the withdrawal of capital. Artemis’s data ranks SONIC as the second highest Netflow protocol this year. Trace the base, the blockchain that Coinbase supports.

Growth is beyond the number of TVL. SONIC’s ecosystems are attracting a variety of projects, including derivatives exchange such as AARK DIGITAL and Shadow Exchange, and protocols such as Snake Finance, Equalizer0x and BEETS. There is still a small tvL in this project, but it can attract new users and capital to create a momentum of Sonic.

But the problem still remains, can the inflow of this capital maintain sustainability while the market fluctuates?

Andre Cronje on SONIC’s potential and strength

SONIC’s developer Andre Cronje shared the ambition to push this blockchain beyond competitors in an interview.

Andre Cronje said, “Sonic has a fine final of 200 milliseconds and is faster than human reactivity.

According to Cronje, Sonic is not just about speed. This platform also focuses on improving user and developer experience. He moves to DAPP, not an effective test, and creates incentives for developers to build.

Unlike other blockchains, such as Ether Reeum, which is limited by long block time, SONIC theoretically utilizes an enhanced virtual machine that handles up to 400,000 transactions per second. But Cronje admits that the current demand has not yet pushed the network to the maximum capacity. Nevertheless, these technical advantages are attractive options for developers looking for more user -friendly DApps.

He also has the possibility of attracting users by revealing a new feature of Sonic.

Andre Cronje said, “If you download the first touchpoint with the user and buy this token in the exchange, you have lost 99.9%of the user. You do not need to access DApps using passwords, fingerprints, and face, and you don’t need to interact with Sonic or token.

Future danger and challenge

Although it has reached an impressive milestone, Sonic is not in danger. The price of the token decreased significantly at the highest point. According to Beincrypto, it has reduced about 20% from $ 0.60 to $ 0.47 last month, strengthening the volatility of the larger market.

GrayScale also removed Sonic from the recent list of assets in April. This decision reflects changes in the expectation of the fund and raises concerns about the ability to maintain TVL that investors should stop emotions.

Sonic also faces fierce competition with other high -performance chains such as Solana and Base. Sonic has a clear advantage at speed, but long -term user adoption depends on whether it can provide real value as well as high ecosystems with high ecosystems.

disclaimer

By complying with the Trust Project guidelines, Beincrypto is dedicated to unbiased and transparent reports. This news article aims to provide accurate and timely information. However, readers should check the facts independently and consult with experts before making a decision based on this content. Our Terms and Conditions, Personal Information Protection Policy and Indemnity Clause have been updated.