- The market structure of the day seemed to be weak.

- Solana’s achievements and demand for Ether Leeum were optimistic signs.

SOLANA (SOL) has increased trading activities on chains and promoted a short -term strength of $ 120 or more.

But the presence of a powerful supply area of about $ 140 mean that the bulls would do a hard work to start a true long -term recovery.

The Solana network surpassed Etherrium (ETH) on several fronts. The SOL/ETH pairs made the new best, and the SOL has increased its inflow compared to Etherrium network. Can this factor be enough to lead the continuous price rally?

Increasing purchase pressure gives SOL investors hope.

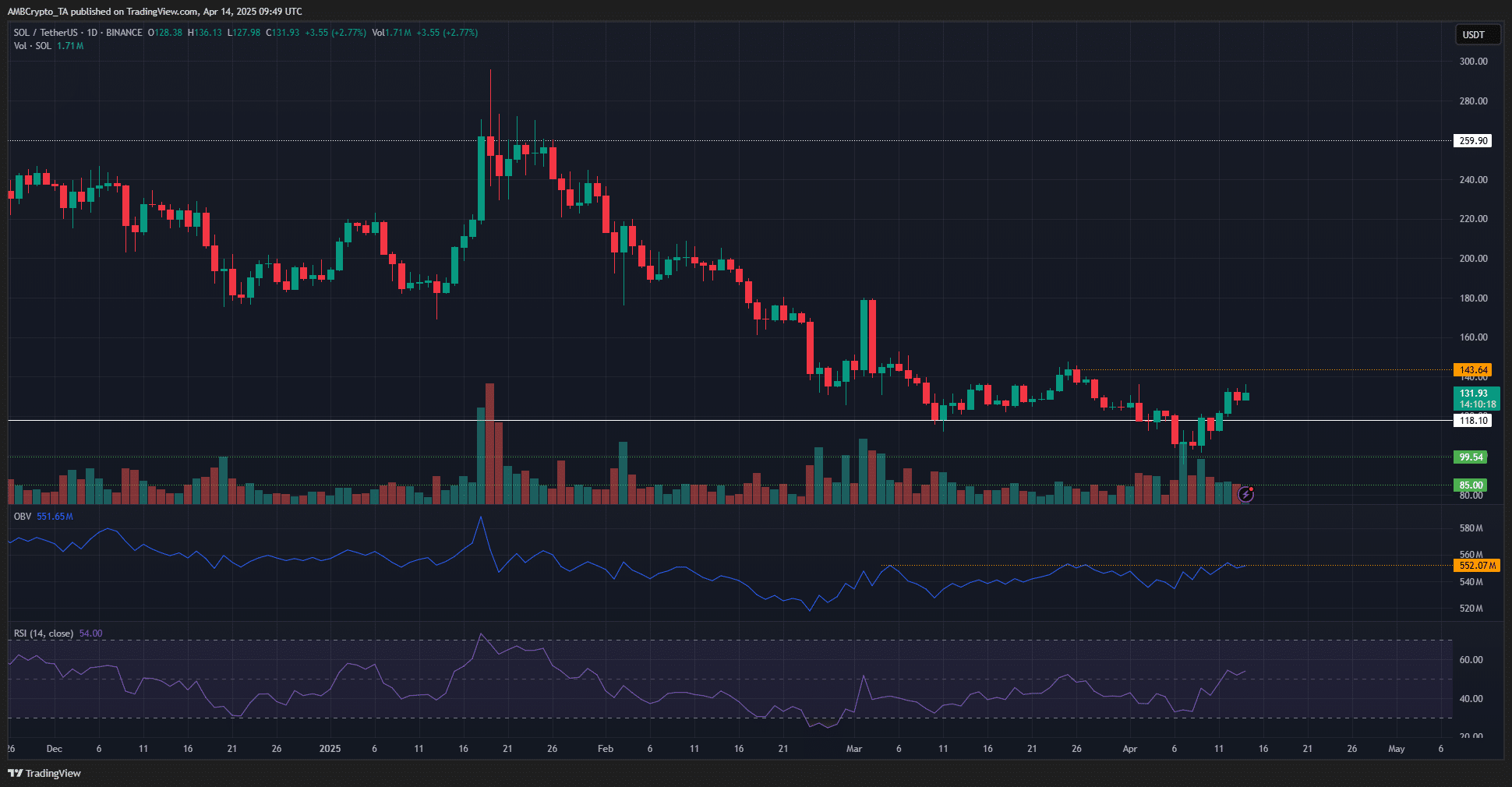

Source: TradingView SOL/USDT

The $ 143 level was the lowest of the last three months. This was to violate the one -day market structure. There was an initial sign that this result would be achieved for next week or two weeks.

RSI came to 50th in neutral and marked optimistic momentum moving. It was still early, but I stayed for more than 50 for the longest three days since January. In addition, OBV challenged the highest set in early March.

Solana’s price was about $ 180 at the time. Therefore, the purchase pressure has been shown to have increased, which can lead to more than $ 143. But until then, traders and investors can continue carefully.

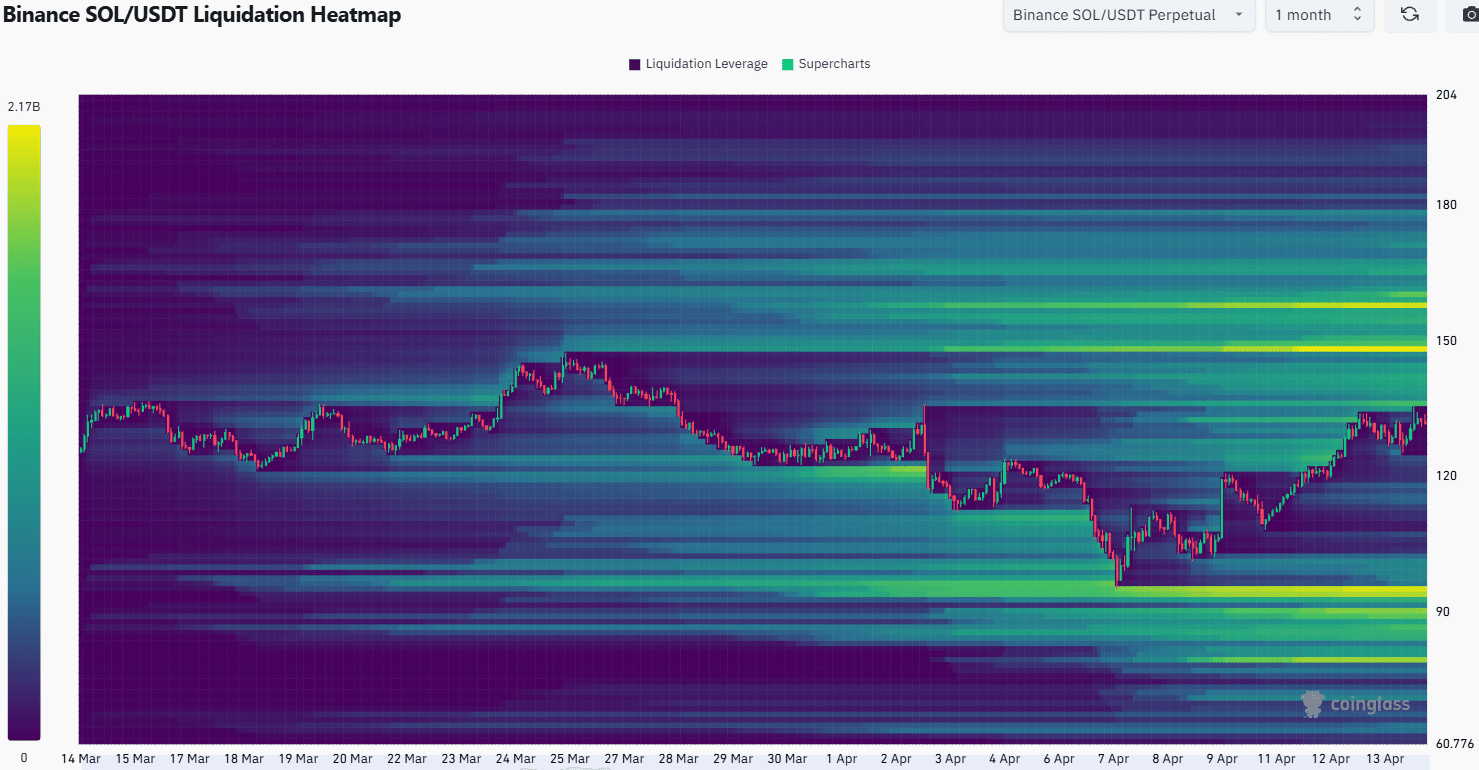

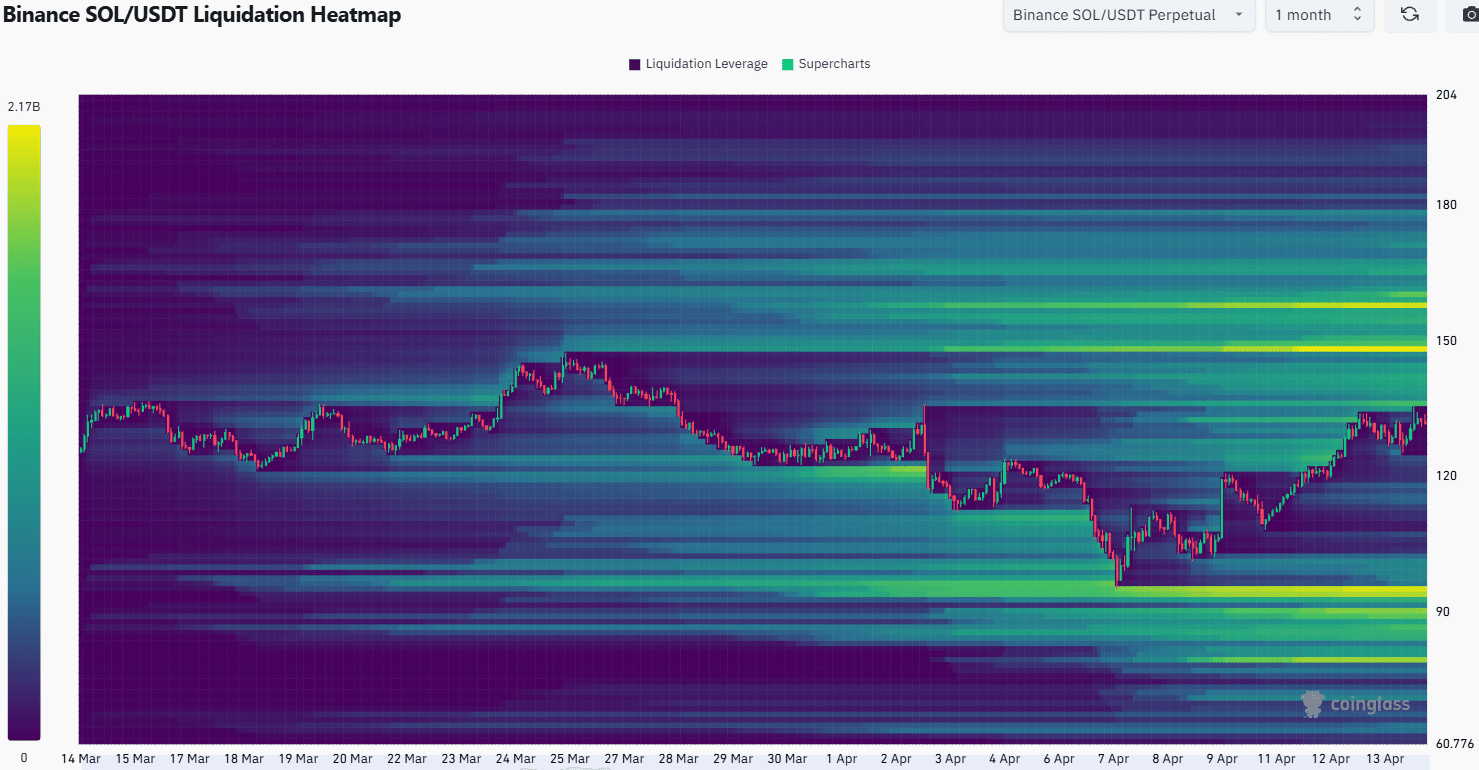

Source: COINGLASS

One month later, the look map emphasized $ 150 and $ 158 with the most important self -area nearby. This level includes more than $ 2 billion liquidation. The $ 136- $ 142 range also formed a significant liquidity cluster.

To the south, the remarkable liquidation pocket was observed for $ 95. But the distance is unlikely to be a short -term goal. Based on heat maps and technical indicators, the movement to $ 150-$ 160 seems to be possible for the next few days.

It is still uncertain whether the bull can maintain $ 140 with support.

Success at this level shows the beginning of the strong trend according to Bitcoin (BTC) recovery and positive emotions in a wider password market.

Indemnity Clause: The information presented does not make up financial, investment, transactions, or other types of advice, and is entirely the artist’s opinion.