- Link regained the daily trend line as Bulls defended $ 12.25 in the mild rising exercise.

- The hot chain activity has dropped sharply, but the basic and reserves have been suggested by the possibility of recovery.

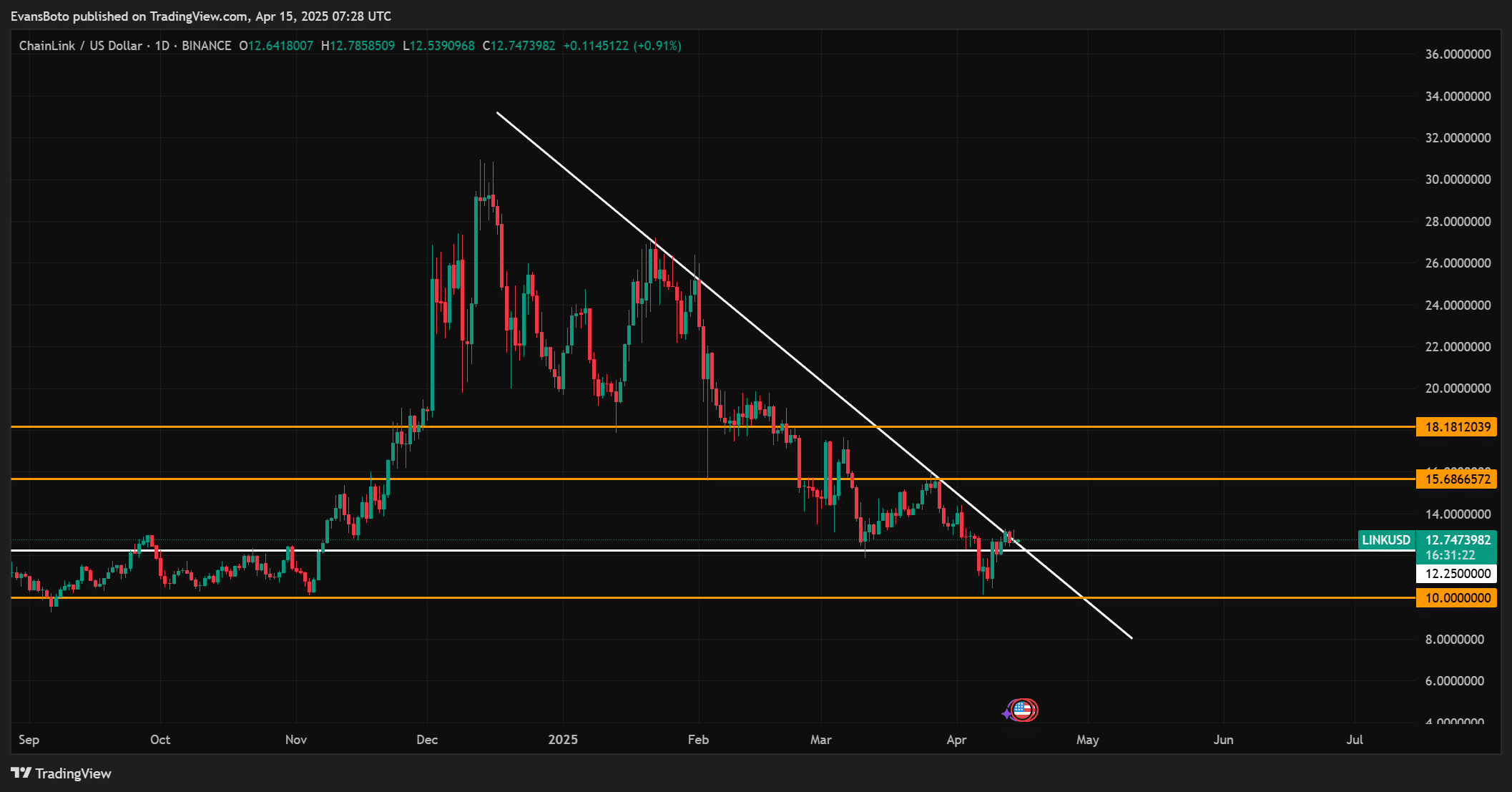

Chain Link (link)At the time of writing After violating the trend line of the uphill trend throughout the year, we will test the important failure area again. This seemed to suggest a decisive moment for the short -term direction of Altcoin.

In fact, despite the momentary rebound, there is a level 12.25 level. Appeared As a key battlefield of the bull aiming to regain control. If this support is not maintained, the disadvantages of $ 10 and $ 7.50 can be focused.

In the technical front, the link has recently suggested the potential changes of the trend beyond the descent trend line on the daily chart. However, the driving force was weak and the price could still be flirtation as a major support area.

The link to the prestime has been traded at $ 12.67 with a profit of 0.41%over the last 24 hours. The bull must maintain a pressure of $ 12.25 or more to check the sustainable reversal.

Source: TradingView

New partnership and reduced reserve -will the foundation will be recovered?

ChainLink recently announced strategic collaboration with PI networks to improve distributed applications through real -time data integration. This movement can strengthen the smart contract function of Chainlink and become a long -term stronger.

However, the market reaction has been muted so far, indicating that traders can be more focused on the technology structure than the foundation in the short term.

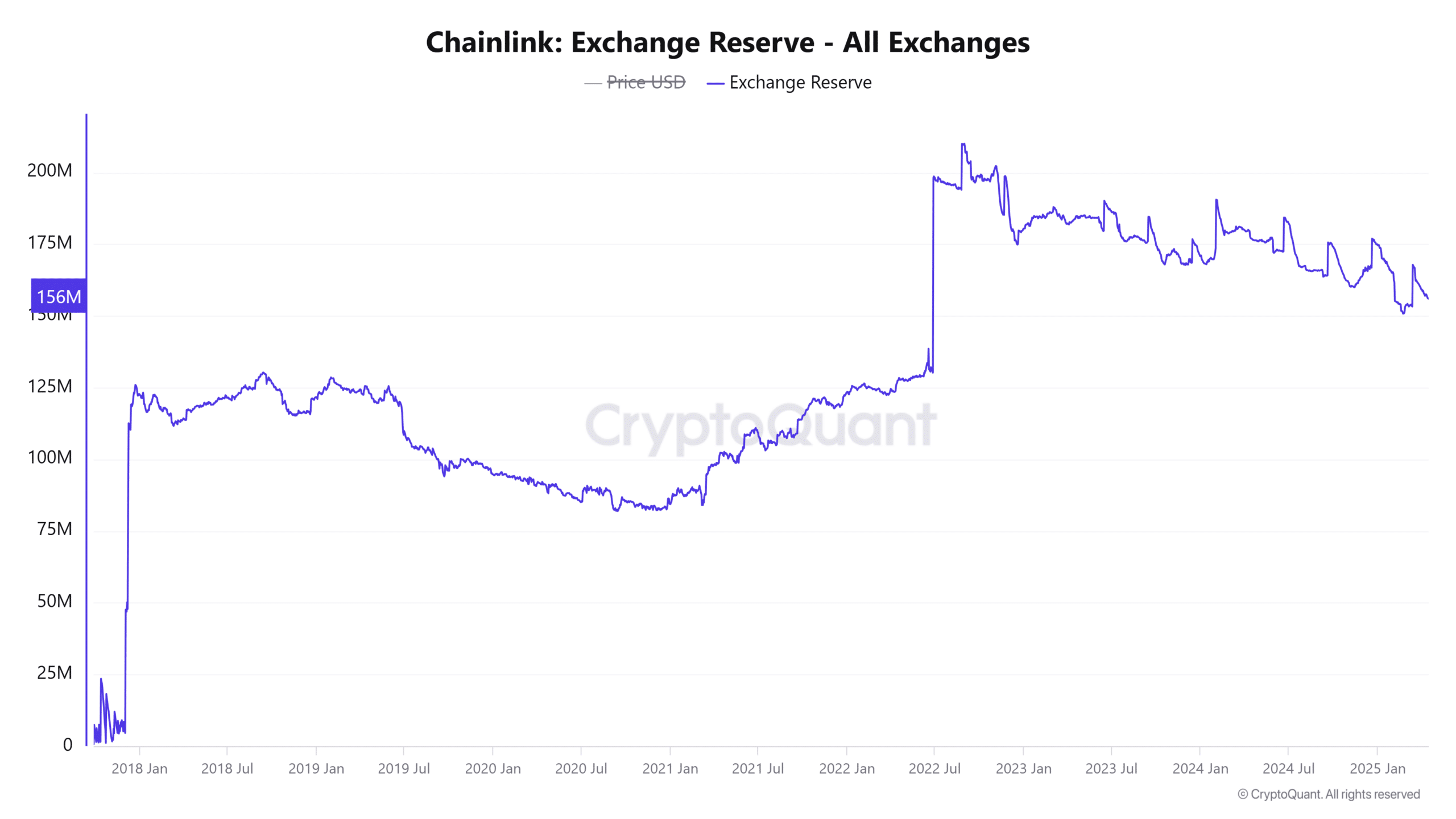

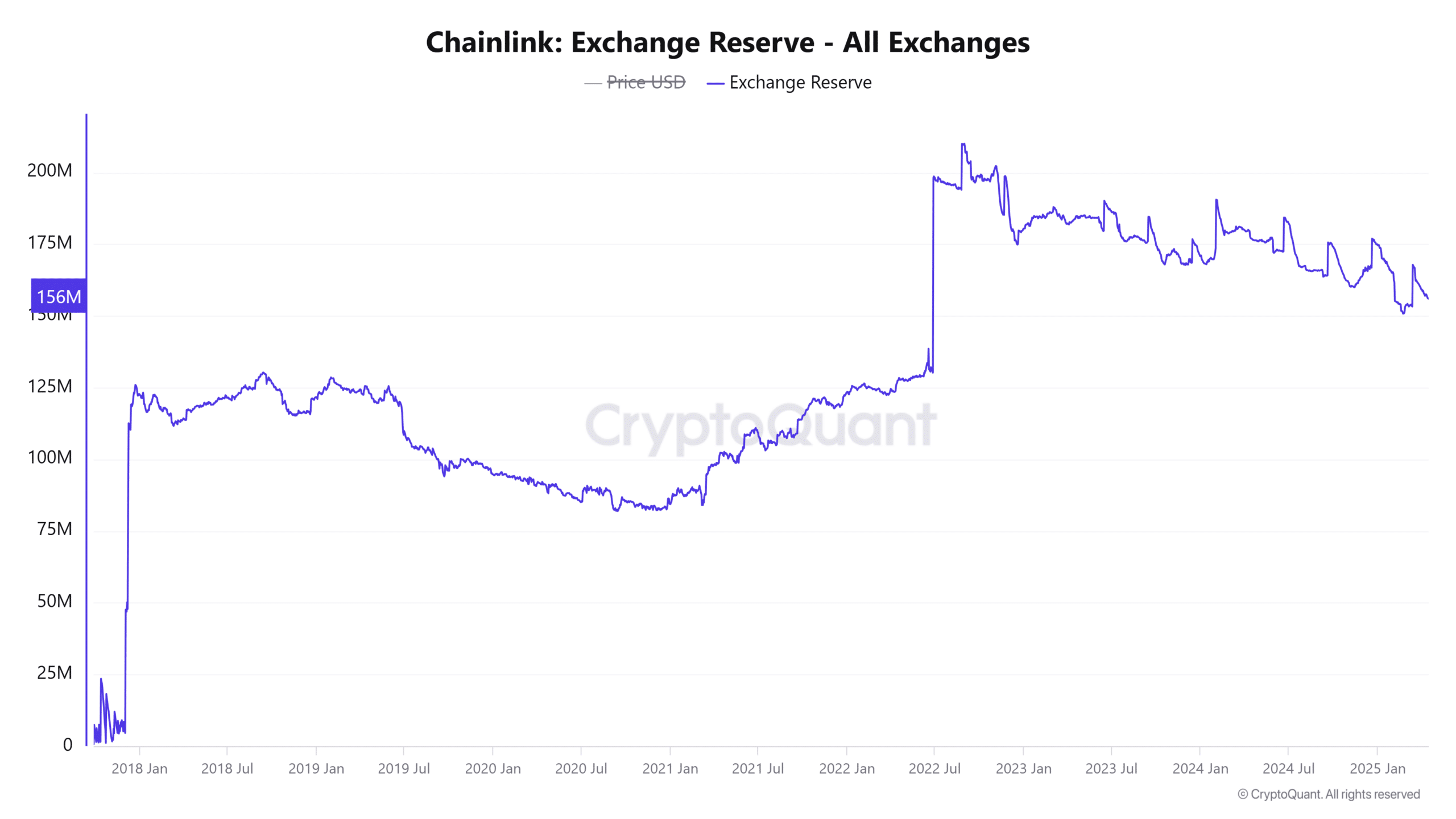

Meanwhile, Exchange Reserve Data has been reduced by 0.2% over the last 24 hours, and now the total link in Exchange is 155 million. This fall exchange supply was often suggested by the decrease in sales pressure, which can be seen at the accumulation stage. If it persists, this trend can support higher prices, especially when demand begins to rise.

Source: cryptoquant

What does investor behavior suggest?

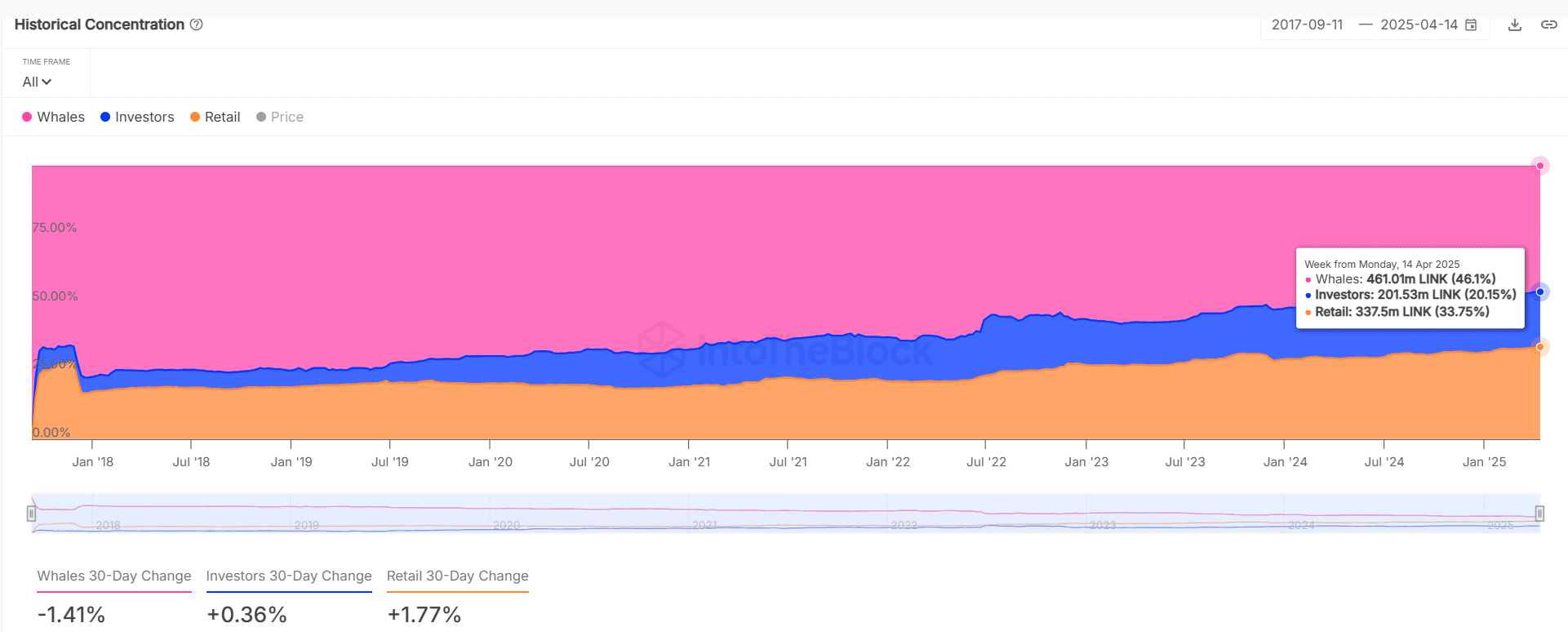

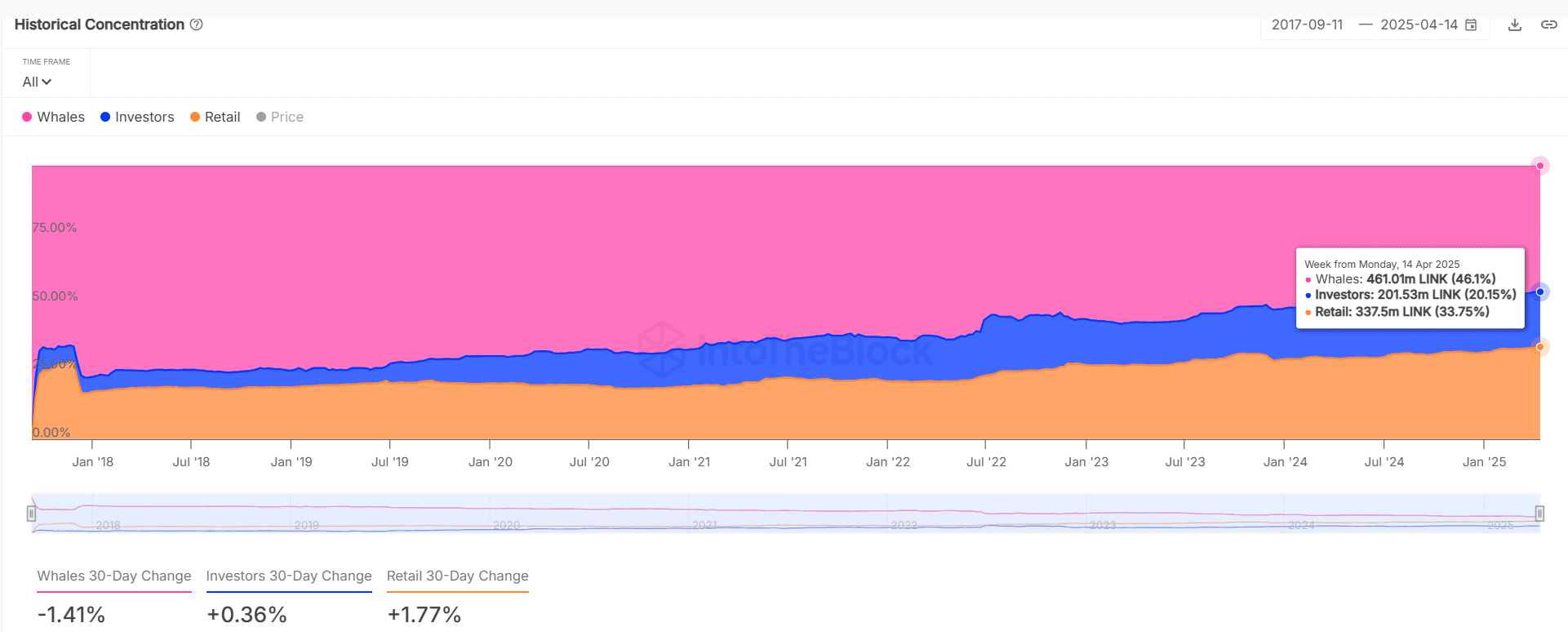

Currently, whales control 46.1%of the link supply. But their stake has decreased 1.41% over the last month.

On the other hand, retail participation increased by 1.77% and investors’ retention increased 0.36%. This redistribution can be pointed out to increase the interest of small market participants despite slight whale leaks.

Source: INTOTHEBLOCK

On the contrary, the address activity suggested that traders are still in a side job. The new addresses have decreased 44.25%, active addresses, 49.5%, and balanced addresses by 56.62%over last week.

The slowing of these network activities can limit the upward potential of links in the short term. Unless the scale and participation are returned throughout the market.

conclusion

Chainlink’s current settings reflect the Limbo Market captured between promising structural changes and a decrease in warm chain. The $ 12.25 level remains the most immediate defense of Bulls and is supported by positive developments such as Exchange Rederve and PI Network Partnership.

However, pay attention if the user activity and whale participation decrease. The decisive bounce of the press time level can cause exercise, but if it is not maintained, the link can turn into a deeper correction area.