- The recent update has made a speculation on the approval of the XRP ETF.

- Short -term prospects can be positive, but XRP is vulnerable to market risk.

The weekly rebound of XRP of less than $ 0.95 has been triggered with a shocking FUD flush. However, it appears to be a calculated reconualization play rather than a random opportunity trade.

In fact, this movement matched a wide range of emotional rotation according to the main regulatory headline. Specifically, on April 9, Paul Atkins is confirmed as chairman of the US Securities and Exchange Commission (SEC). Needless to say, this has been strengthened In particular, the market speculation of the potential shift of the committee’s location in relation to the long -term SEC vs. Ripple case.

That’s not all because it raises hope for a lot of expectations for the XRP Exchange-Traded Fund (ETF).

Major development that forms XRP news of Q2

The XRP market maintains its buoyancy as optimism over regulatory clarity grows and the potential of XRP -centered ETFs increases.

On April 9, the Senate nominated Trump’s Paul Atkins as the chairman of the SEC. Atkins is widely recognized as encrypted, increasing the likelihood of regulation.

The SEC and RIPPLE, which added fuel to the story, have jointly suspended the ongoing person’s ‘reply’ deadline since April 16.

As a result, market analysts believe that the SEC can delay behavior until Atkins is officially sweared, so that it can open a way for votes of 3-1 to potentially withdraw the appeal.

The market response was immediately. Following the XRP news, Altcoin promoted XRP to more than $ 2 after the pressure of 14.28%a day after the pressure on the three consecutive days.

Source: TradingView (XRP/USDT)

Despite the fact that it is more than 30% more than the maximum $ 3.30 after the election, these recent developments can greatly reconstruct Altcoin’s evaluation prospects for Q2.

Market sentiment and ETF Buzz

Following the XRP news -oriented catalyst system, the Open Interest (OI) surged from $ 28.7 billion to $ 3.22 billion, showing a rapid increase in participation.

In binance, long positions account for almost 70%of the XRP/USDT permanent market, emphasizing the strong direction prejudice that leads to a greater increase.

Meanwhile, short -term holders (STHS <155 days) ended the extended surrender stage entered at $ 1.60 after falling. The cohort seemed to have been in charge of strategically off -road positions to lock his profits in XRP's January rally, which was close to $ 3.30.

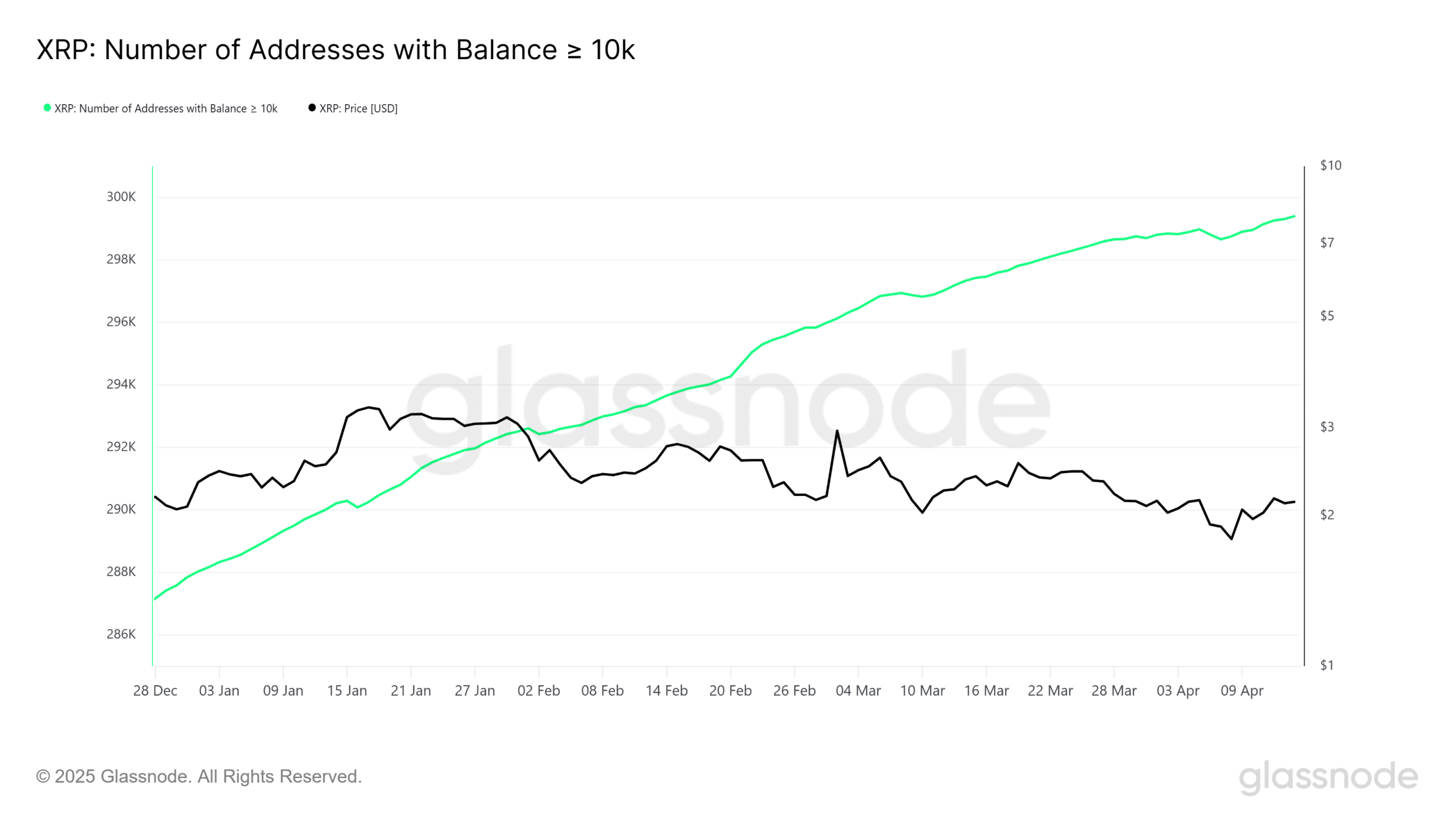

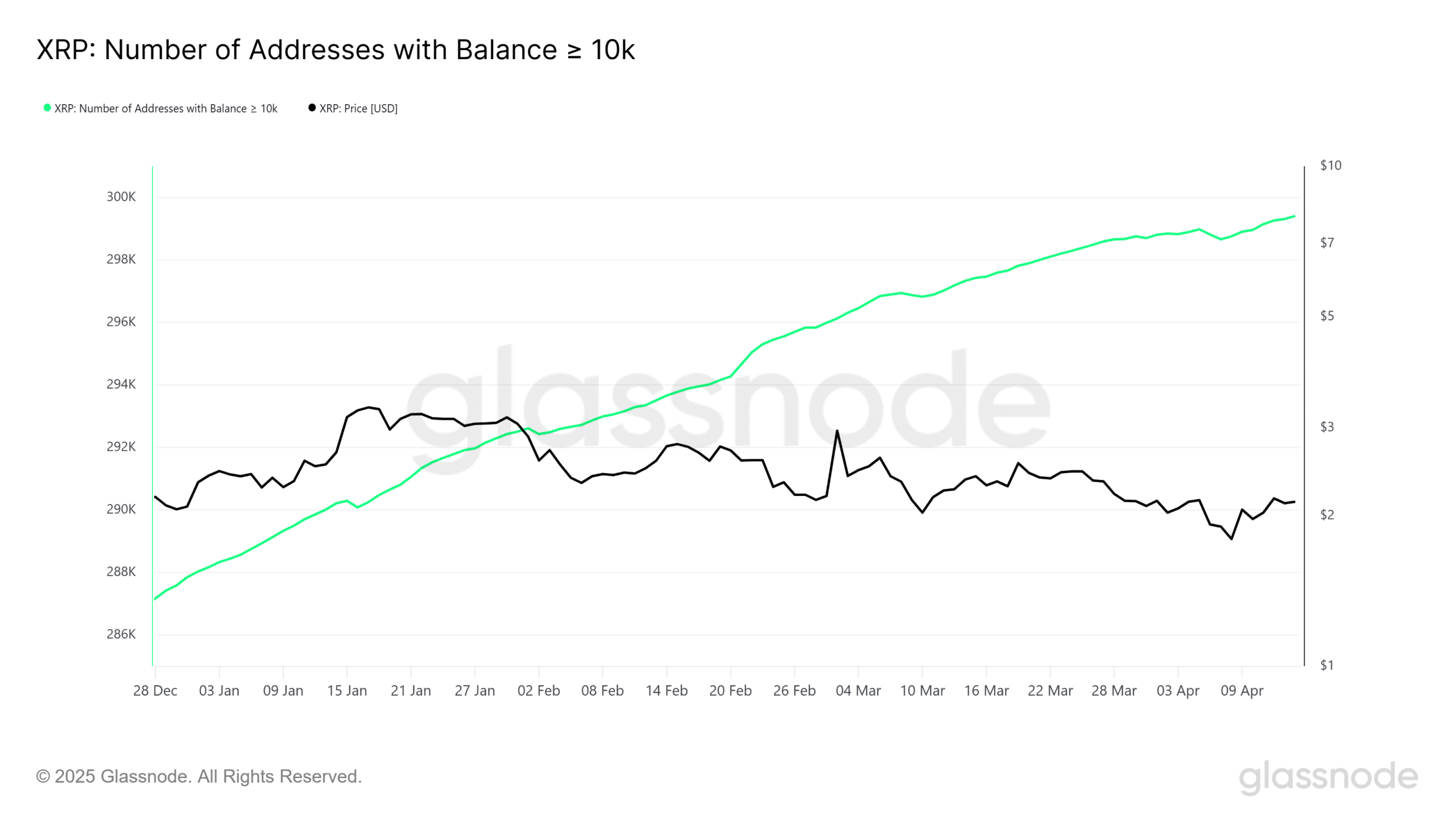

And good news? The number of addresses with more than 10,000 XRPs has soared to an all -time high as it is close to a historic 300K mark.

Source: Glass Node

This cohort now represents about 4.28%of all XRP addresses. This is an increase in the concentration of high steak holders and indicates the institutional trust under the surface.

This is where ETFs (Exchange-Traded Funds) are in conversation.

The XRP -related ETF guess is especially heated when a professional cryptociet occurs in the SEC. The case of the ETF combined with the institutional footprints of XRP seemed to be no more reliable.

Therefore, short -term volatility is expected due to the shake out with a weak hand.

But these basic metrics are key. First, XRP uses the story transition and then leads to the optimistic Q2 trajectory to fuel.