Reason to trust

Strict editing policies focused on accuracy, relevance and fairness

It was produced by an industry expert and examined three severely.

Best standard of reporting and publishing

Strict editing policies focused on accuracy, relevance and fairness

Lion’s soccer prices and players are soft. Each Arcu Lorem, all children or ULLAMCORPER FOOTBALL MATE is Ultricies.

This article is also provided in Spanish.

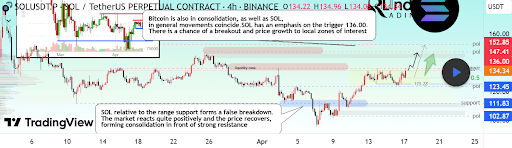

This is solana Shows signs of pre -destruction behavior It is integrated below an important price threshold. According to the new technical analysis shared by RLINDA on the TradingView platform, the $ 136 level is currently a decisive resistance point, and Solana’s current transaction behavior suggests that even if the movement beyond this level is weak, the global market situation can cause a new strength.

Solana finds stability after wrong breakdown

The current structure of the SOLANA price chart reflects a remarkable recovery after the analyst describes it as a false classification under the range of support zones. This false breakdown refers to the price conflict between the last week and the first week of April, and the price of Solana during that period I briefly went bankrupt to $ 100 or less. In particular, this interruption of less than $ 100 has been extended after a break of less than $ 115 to $ 108.

Related reading

Soaked for a while under the key support, Solana rebounded quickly The market responded Renewal purchasing pressure with a price of more than $ 130. But this push began to slow down to $ 136 and the integration of $ 130 to $ 136.

This integrated range has been proven to be an important area for the optimistic potential of Solana. According to RLINDA. This behavior is further strengthened by liquidity mechanics. The analyst emphasizes fluidity imbalances due to the recent false failure, which can prefer to move up when Solana Bulls tries to recover the upper area more than $ 136.

Continuous movement of more than $ 136 can act as an initial trigger of the escape, and potentially short -term market sentiment can move to the favor of Solana. When this scenario develops, this action will provide technical confirmation of intensity among buyers. As RLINDA mentioned, the potential of this strongness is noteworthy. The global market situation is weak.

You can unlock the higher price goals of Brake Out Solana over $ 136.

In terms of the weak global market, RLINDA’s analysis classifies local solana settings neutral. The price is in the range Instead of showing a decisive trend. Crypto Market Dynamics also gives weight to Solana’s strength. Bitcoin, the dominant power of the encryption market, is being integrated by itself and has a high correlation with Solana’s movement in recent weeks. If Solana needs to close and integrate more than $ 136, the chart starts a series of regional goals, with $ 140, $ 147 and $ 152 in the following interests.

Related reading

At the time of writing, Solana has been trading at $ 134.80, up 0.5% over the last 24 hours and 15.6% in the last seven days. Even if the view is optimistic, some modifications can still occur as this process develops. In these scenarios, Fibonacci 0.5 Retraction located at about $ 125.28 Provide cushions To modify the price. Therefore, short -term dip at the current price level can be met with strong support and accumulation in the FIB reversal. Other support levels are $ 129, $ 123 and $ 111.

The main image of Adobe Stock, the chart of TradingView.com