- Solana buyers and sellers in the derivative market pointed out the same amount, pointing out the exhaustion.

- The market activity matched the possibility of optimistic stories and the next movement of Solana.

Recent development has a split feeling due to the loss of Solana (SOL) recorded in the derivative market. In fact, SOL rose 14.56% for a week and 6.50% for a month.

However, AmbCrypto shows that the observed indicators still prefer buyers, and that the next decisive swing can include.

SOL is a stable of $ 13 mln liquidation

In the last 24 hours, the liquidation of the derivatives market has been divided in the same between the long and short location, depending on the CoingLass.

Both sides lost $ 6.5 million, and signaled signal trade fatigue and uncertainty. Of course, this tug of war is often destroyed, which is the result.

SOL’s daily profit reached 0.7%over the same period.

If the liquidation matches evenly, the market tends to be sure of the next movement. However, AMBCRYPTO’s analysis suggests that the bull still has some advantage.

In fact, if the momentum follows, the price may still be in favor of it.

The main activity is the bull preference

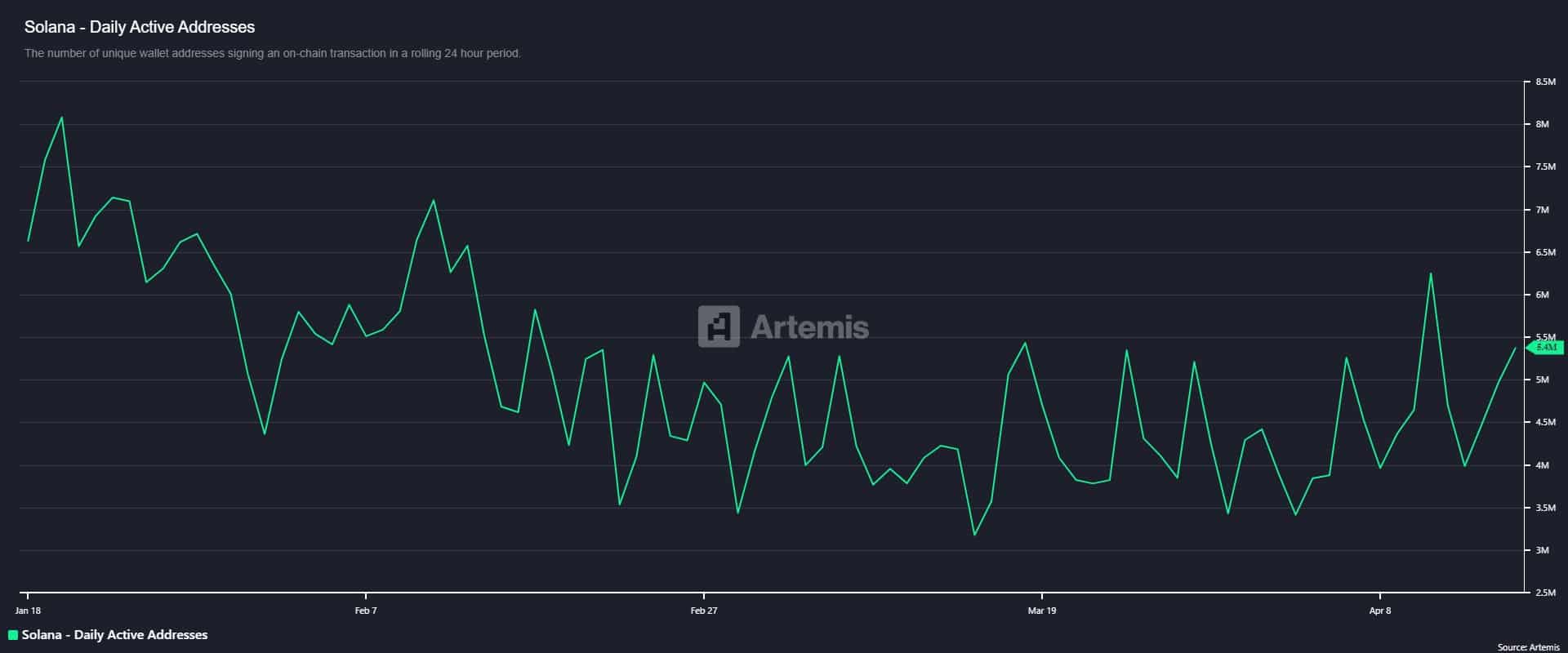

In addition, the chain activity has strengthened its view. According to ARTEMIS, the unique active address has soared 31% in 24 hours, reaching 5.4 million people.

The spike suggested that the sole is fresh, and the expectation of the strong strength is strengthened.

Source: Artemis

This is an increase in the volume of the DEXES (DEXES), and last week, it increased by 15.35% to $ 16.2 billion, and Solana made a chain with the highest DEX trading volume.

The optimistic story also exists in the future market.

The amount of unstable contracts continued to increase with the purchase volume of the derivatives market.

Nevertheless, the public interest, which recorded the amount of unstable derivatives, continued to increase. This contract includes all long and short positions.

The long -term ratio that effectively compares the purchase and sales volume of the derivatives market is less than one reading, which is less than 1 to support the movement of the seller and to propose the dominance of the seller.

In the press time, the long ratio reads 1.0087 and represents more purchases. This suggests that the increase in the increase in interest is dominated by long -term traders, increasing the possibility of price rally.

Source: Defillama

In the last 24 hours, the liquidity of Solana increased by about $ 72 million, and investor trust continued to increase, raising the total value lock (TVL) to $ 71.4 billion.

As TVL rises, it means that more investors are locking the SOL that emphasizes long -term promises to enable more activities, including providing liquidity.

If the market continues to reflect several fall signals, it will be skewed to the bull with the SOL rally.