Reason to trust

Strict editing policies focused on accuracy, relevance and fairness

It was produced by an industry expert and examined three severely.

Best standard of reporting and publishing

Strict editing policies focused on accuracy, relevance and fairness

Lion’s soccer prices and players are soft. Each Arcu Lorem, all children or ULLAMCORPER FOOTBALL MATE is Ultricies.

This article is also provided in Spanish.

Ether Lee is currently trading at the level of critical resistance as the bull is trying to restore the momentum and promote the best. The wider market is under pressure as the world uncertainty expands due to continuous trade tension between the United States and China. Last week, US President Donald Trump announced a 90 -day suspension of tariffs in all countries except China to strengthen concerns about extended trade conflicts that could unstable the global financial market.

Related reading

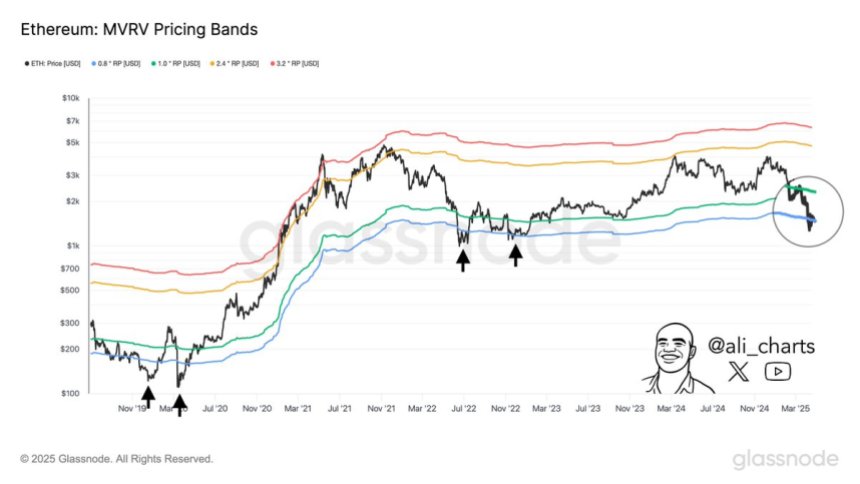

In this high equity environment, Ether Leeum’s price measures are paying attention from investors and analysts. Ali Martinez, the chief encryption analyst, shared that the best Etherrium purchase opportunity has emerged when it falls below the price band of MVRV (market value for realization). In particular, ETH is currently being traded correctly in that area.

This adjustment between technical conditions and macroeconomic instability suggests that Ether Leeum can start the accumulation stage, and long -term investors try to use the discounted price. However, continuous upward momentum depends on whether the bull can overcome immediate resistance and whether the macroscopic conditions are improved. The upcoming day tests both technical and psychological thresholds, so you can prove the pivotal to ETH.

Ether Leeum goes to a historical opportunity area

Ether Leeum has now been trading below the major resistance level after enduring pressure and market performance for a few weeks. After losing a decisive level of $ 2,000, ETH has fallen about 21%, which is a clear sign that the bull has not yet regained control. The extensive macroeconomic pressure, especially global tension between the United States and China, and uncertain trade conditions further weaken the market sentiment. These conditions lead to high volatility and reducing market participation by terminating dangerous assets such as cryptocurrency.

Despite this decline, some analysts believe that Ether Lee can be close to the central processing area. According to Martinez, one of the best historical signals for Etherrium accumulation has been blocked below the lower limit of the MVRV price band. It is an indicator that evaluates whether the asset is underestimated by comparing the market value with the realization value. Currently, Ether Lee is trading under the low band.

Martinez emphasizes that this position is generally prioritized over a strong upward reversal during extreme market pessimism. Short -term volatility can continue, but the entry into this area of ETH can provide a rare opportunity for long -term investors to accumulate in the historically discounted level (stabilizing market conditions and emotional shift).

Related reading

ETH is a narrow range of stalls.

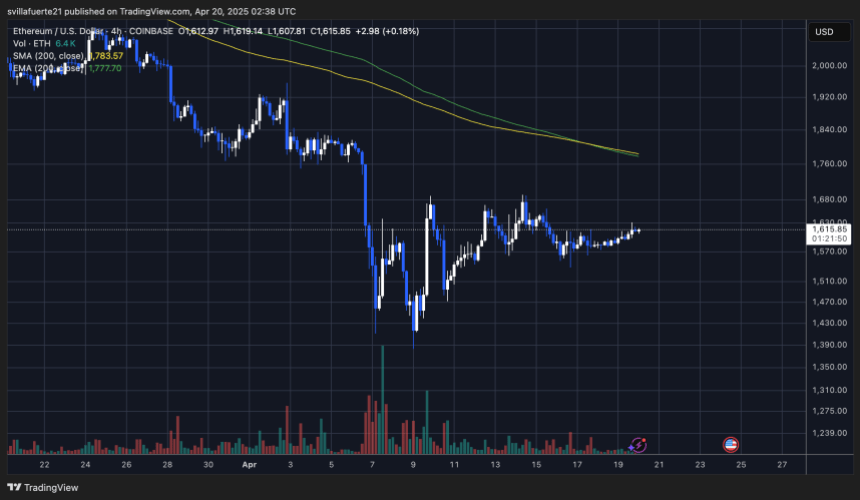

Ether Lee is currently trading for $ 1,610 after acting sideways with a low volatility of almost a week. Since Tuesday, ETH has been in a rigorous range between $ 1,550 to $ 1,630, reflecting the market uncertainty and hesitation, taking a clear direction. This narrow trading area emphasizes the price compression period and is often a pioneer with a larger movement in any direction.

In order for the bull to reclaim momentum and shift sentiment, Ether Lee Rium must recover $ 1,700 and decisively promote $ 2,000. This level not only serves as a major psychological barrier, but also indicates an important area of previous support that has now been changed to resistance. Brake out over $ 2,000 will cause the updated purchase interest and set the stage of potential recovery rally.

Related reading

But when the weak pressure is built and the $ 1,550 floors are violated, Ethereum can quickly test the $ 1,500 support area. The failure below that level can accelerate the sale and deepen the current modification. Until the failure or breakdown occurs, traders must prepare more integration and volatility when the market is waiting for macroscopic or technical catalysts.

DALL-E’s main image, TradingView chart