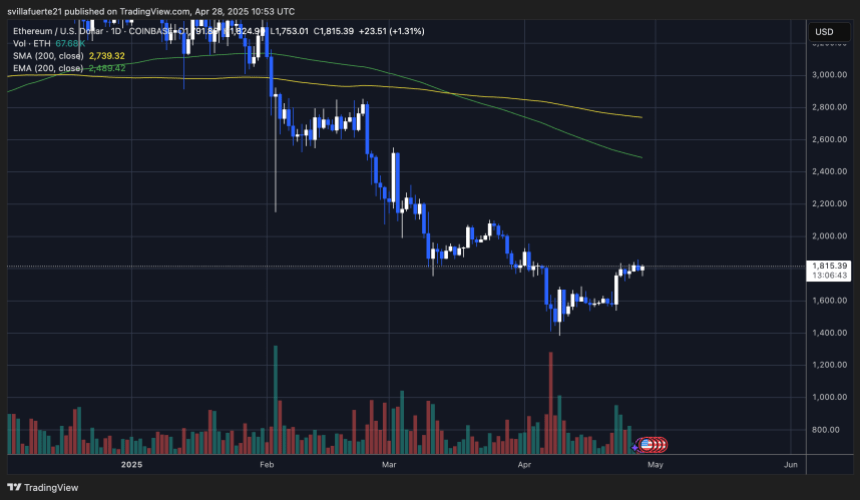

Ether Lee is now facing important tests, trading within the range higher than $ 1,750 than the $ 1,850 resistance. After a strong recovery at a level of $ 1,400 earlier this month, Bulls was able to stabilize price behavior, but the actual challenge is currently being developed. To confirm the sustainable strong structure, Ether Lee Rium must decisively recover $ 2,000 in the future.

As Ethereum is integrated under the resistance, the market feelings are prudent and macroeconomic uncertainty continues to put weight on risky assets. TOP CRYPTO Analyst Big Cheds shared insights to X. Emphasize technical problems. Ethereum indicates 4 hours of bear divergence in a balanced volume (Ambi) indicator with the top shadow structure.

As volatility is expected to rise and traders can closely watch breakouts or failures, the coming sessions can define the trend of Ether Leeum for the next few weeks. The bull must maintain the amount of exercise and act quickly so that the bear does not restore control.

As the bull tries to maintain control, Ether Lee is fighting resistance.

Ether Leeum begins to show the initial signs of the stronger structure in a low time frame, and Bulls hopes to be wider recovery. The ETH pushed at the lowest level of $ 1,400, maintained the main movement average and integrated it within a solid range. However, the market is very prudent and if the bull does not regain higher levels, sales pressure can increase rapidly.

Momentum has been changed to Ether Leeum’s favor for the last few days, and some analysts are demanding potential large -scale escape when they violate key resistance. The identified brake out of $ 1,850 can open the door to move quickly to a psychological level of $ 2,000. Nevertheless, the risk is still higher, and according to the opposite weakness, Ether Lee suggests that if the bull loses control, he can visit the $ 1,300 area again.

Ched’s critical insights point out that Ethereum has a four -hour weak difference in the balance (AMBI) indicator. This is a signal that weakens the purchase pressure by combining with the shape of the top shadow in the local structure. According to Cheds, if Ether Lee loses a $ 1,750 support area, a short position may be triggered, which will confirm the failure of the current integrated pattern.

Technology Details: Main level for changing the structure

Ether Lee is trading for $ 1,815 a few days after strict integration and humble upward exercise. Bulls defended the range of $ 1,750- $ 1,800, but the actual test is ahead. In order to switch a wider weakness to a strong trend, Ether Lee Rium needs to find a $ 2,100 level. Without this escape, the rally can be considered temporary relief within a wider decline.

It is important for the coming days to exceed $ 1,800. The firm foundation on this area can build strong demand and create the requirements for continuous recovery rally. The bulls are getting short -term exercise, but they are still facing the market due to macroeconomic uncertainty and prudent feelings.

If Ether Lee does not maintain support for $ 1,750, the risk of falling will increase quickly. Breaking under this zone can cause a sharp selling, so you can send ETH to $ 1,500. Just as the market shows signs of power, Ether Lee’s next movement will be decisive. It determines whether it can join a greater recovery tendency or whether it can continue to struggle within volatile and uncertain environments.

DALL-E’s main image, TradingView chart